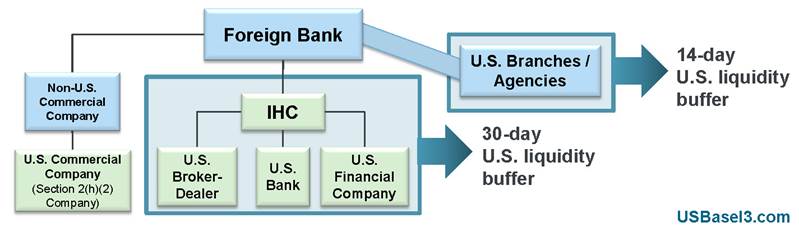

The Federal Reserve’s recent Dodd-Frank enhanced prudential standards final rule subjects foreign banking organizations with ≥ $50 billion in U.S. assets (“Foreign Bank”) to a qualitative liquidity framework. Among other things, the qualitative liquidity framework requires a Foreign Bank to maintain separate U.S. liquidity buffers (based on results of internal liquidity stress tests) for its: (1) U.S. branches/agencies; and (2) U.S. intermediate holding company (“IHC”).

The U.S. branches/agencies must maintain a U.S. liquidity buffer consisting of unencumbered highly liquid assets that are sufficient to meet projected net stressed cash flow need for the first 14 days of an internal liquidity stress test with a 30-day planning horizon. The IHC must maintain a U.S. liquidity buffer consisting of unencumbered highly liquid assets that are sufficient to meet projected net stressed cash flow need for the entire 30 days of an internal liquidity stress test with a 30-day planning horizon. This is illustrated by the diagram below.

The Federal Reserve’s enhanced prudential standards final rule prescribes a specific method for calculating the U.S. liquidity buffers for a Foreign Bank’s U.S. branches/agencies and IHC. We have prepared a visual memorandum that uses diagrams, flowcharts, examples and an interactive calculator to illustrate the U.S. liquidity buffer requirement and related calculations. The interactive calculator allows you to enter various internal and external cash flow amounts to assess the potential impact of the final rule’s prescribed method for calculating net stressed cash flow need. The visual memorandum and interactive calculator are available here.

Sky Blog

Sky Blog