For chief executive officers, communication is essential. It allows them to help stakeholders understand a company’s strategies and form opinions about the company’s prospects as well as the CEO’s ability to create value. While effective communication is important at every stage of a CEO’s career, it is most salient at times of increased uncertainty around CEO transitions. A new CEO does not get a second chance to make a good first impression on employees, customers and investors, and because a CEO is in the spotlight as the company’s leader, a CEO’s every statement and move are scrutinized for what he or she is planning to do. For example, Marissa Mayer, appointed Yahoo CEO in July 2012, started her first earnings conference call with analysts and investors with a discussion of “the vision and direction for Yahoo moving forward…Our goals are simple: execute faster, return value to our shareholders, attract the best talent and make Yahoo the absolute best place to work.”

New CEOs’ disclosures about their firms’ prospects can allay stakeholder uncertainty about their management’s ability: No one likes uncertainty – neither outside stakeholders such as investors and creditors, nor insiders like employees. Investors, creditors, and employees all expect a new leader to show them a credible and promising path even if it is too early for the leader to possess precise information about the outcomes of their strategic plans. A CEO’s message, optimism and confidence can alleviate stakeholders’ concerns by reducing uncertainty about management’s ability and their company’s future. This is especially true for CEOs appointed when their company is performing poorly and for CEOs that lack a history of publicly observable executive experience.

In contrast, CEOs’ future-oriented information disclosures and their optimism potentially increase with their job experience. As they gain on-the-job knowledge, CEOs enhance their expertise so that stakeholders perceive information that they disclose as more credible. The increasing credibility leads investors and creditors to demand that their CEOs enhance their disclosures about their firms’ prospects. Further, a CEO’s job and career security increase over their tenure as they demonstrate superior performance. Consequently, CEOs are increasingly confident and optimistic about their firms’ future.

To test these competing predictions, we analyze the communication styles in quarterly earnings conference calls of 670 newly appointed CEOs who begin their career as CEOs at publicly listed U.S. firms after 2005. Earnings calls connect a company’s top management with participating analysts and investors. Typically, a call starts with a brief introduction of the management team present on the call and a legal disclaimer about forward-looking statements. Then company executives (CEO, CFO, etc.) give an overview of the operating performance for the quarter just ended and provide information on future plans and operations. After the introductory statements by managers, the call is opened to questions from analysts and investors. Since conference calls are periodic events that contain managers’ prepared statements and spontaneous responses to participants’ questions, they provide an ideal setting for examining CEOs’ communication styles.

Using textual analysis techniques on a large sample of quarterly earnings conference calls, we are able to identify CEO-specific statements in earnings conference calls and determine the degree of future-orientation and optimism in CEO disclosures. CEOs who disclose more information about the future and use more positive language in their communications are deemed more open and optimistic about their strategies and plans. We measure executives’ future-oriented language as the number of sentences in a conference call that include future-oriented phrases scaled by the total number of spoken sentences, and their optimism by the relative difference between positive and negative words in their sentences, scaled by the total number of spoken words.

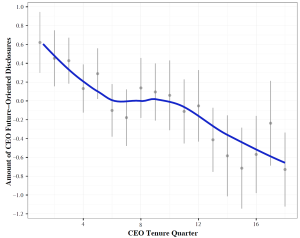

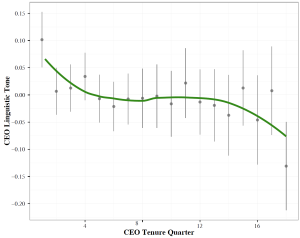

We find that the amount of CEOs’ future-oriented disclosures and their optimism decrease over their tenure – CEOs are more forthcoming and optimistic in their communications with investors and analysts at the beginning of their appointment but both measures decline over time. The average decline in forward-looking information and relative optimism is substantial, 13 percent year over year. Further, we find that the number of positive spoken words by a CEO declines while the number of negative words increases over their tenure. In addition to our primary sample of CEOs who start their appointment after 2005, we find that our identified negative relation between CEOs’ communication styles and their tenure maintains in a sample of successful CEOs – those who maintained their position for at least 18 quarters.

To examine whether our observed relation between CEO tenure and disclosure style is truly CEO driven rather than affected by other changes in company characteristics around executive transitions, we also study the future-orientation and optimism in statements made by firm officers other than the CEOs (e.g., CFO or COO) in each quarterly earnings conference call, over their CEOs’ tenure. We find that the future-oriented disclosures and optimism of non-CEO officers does not change over their CEO’s tenure. That leads us to conclude that the empirically observed relation between CEO disclosure style and CEO tenure is essentially CEO-specific and a result of the temporal decline in the perceived uncertainty about executive ability that alleviates their career concerns.

Since uncertainty surrounding CEO appointments is heightened for CEOs facing greater career concerns and those who are not well known to investors, we separately analyze communication styles of CEOs who are hired following poor company performance, CEOs who are hired from outside the firm, CEOs who are younger and CEOs lacking prior executive experience. We find that externally hired CEOs, those lacking prior executive experience and those appointed following poor firm performance are more forthcoming in disclosing their strategies and prospects. Younger and inexperienced CEOs are more optimistic in their conference call communications. These results further demonstrate that CEOs use their communication styles to mitigate increased corporate uncertainty following their appointment, and that their communication styles are affected by their concerns regarding the executive labor market’s beliefs about their managerial ability.

Overall, our empirical analysis demonstrates the dynamically changing communication styles of CEOs over their tenures in response to the uncertainty about their ability perceived by their firms’ stakeholders. To alleviate stakeholder concerns about firm prospects and to favorably impress outsiders, CEOs disclose more about the future and are more optimistic about their plans in early years of their career. Given that CEOs’ information dissemination attracts a great deal of attention from their firms’ investors, creditors, customers and employees, our study provides important evidence about executives’ motives that affect their disclosing behavior.

This post comes to us from assistant professors Khrystyna Bochkay and Roman Chychyla and Professor Dhananjay Nanda of the University of Miami School of Business Administration. It is based on their paper, “CEO Ability Uncertainty, Career Concerns and Voluntary Disclosure,” available here.

Sky Blog

Sky Blog