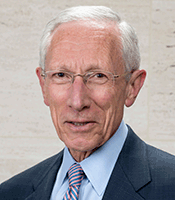

Fed Vice-Chair Fischer Discusses Committee Decisions and Monetary Policy Rules

It is a pleasure to be at the Hoover Institution again. I was privileged to be a Visiting Scholar here from 1981 to 1982. In addition, many of the researchers and practitioners with whom I have discussed monetary policy over …

Sky Blog

Sky Blog