My remarks today come a little over a year after Stephanie Avakian and I were appointed Co-Directors of the SEC’s Division of Enforcement and just a few days after the close of the first full fiscal year in which we have held our positions. So this is a fitting time to look back on the work of the Division of Enforcement over the past year and to discuss the Division’s priorities over the next year. Before I begin, I am required to give a standard disclaimer that the views I express here today are my own, and do not necessarily represent the views of the Commission or its staff.[1]

Many of those who closely follow the work of the Enforcement Division tend to evaluate its effectiveness based on metrics such as the number of enforcement actions the Commission brings each year and the total amount of penalties and disgorgement ordered by the Commission or federal district courts. These quantitative metrics are of some value in assessing the work of the Division; they certainly provide a rough measure of our overall activity level. But statistics such as these do not provide a full and meaningful picture of the quality, nature, and effectiveness of our efforts. Indeed, in my view, when numbers are the primary lens through which our work is viewed, that perspective can be counterproductive.

So to assess whether the Division’s work is effective in accomplishing the Commission’s mission, Stephanie and I have been moving the conversation to a different set of questions, namely the following:

- Are our efforts protecting retail investors?

- To what extent is the Commission holding individuals accountable for violations of the law?

- Are we keeping pace with technological change?

- Do the remedies we recommend effectively further enforcement goals?

- And, are we efficiently allocating the Division’s resources?

This morning, I’d like to focus my remarks on how we think about one of these questions – that is, how particular remedies and relief that the Division of Enforcement recommends to the Commission advance our goals. In thinking about the effectiveness of the remedies and relief available to the Commission, it is tempting to focus solely on the Commission’s ability to obtain significant financial penalties in enforcement actions. Large dollar figures attract headlines and some view them as a proxy for how tough we are, and, relatedly, the effectiveness of our enforcement efforts.

Penalties are important to an effective enforcement regime because they punish wrongdoers and send a message of general deterrence – ensuring that others know that violating the federal securities laws is a losing proposition. And our activity over just this past year reflects our view that in many instances, to be effective, such penalties need to be substantial. In fact, just last week, the Commission assessed eight-figure penalties against Walgreens and Tesla, which I’ll address in more detail later this morning.

While we do seek and obtain some form of monetary relief – whether disgorgement, penalties or both – in most of our actions, non-monetary relief can be highly important to achieving the Commission’s overall goals as well. For that reason, a case-specific approach to remedies and relief is important, and is exemplified by a number of Commission actions that I will describe during my remarks today.

Non-Monetary Relief

When we think about what overall relief makes the most sense in a given case, we’re guided by these questions: Does the relief punish bad actors and restore money to harmed investors? Does it advance the goals of specific and general deterrence? And does it put into place meaningful protections for investors going forward? If we have secured a good set of remedies, we can answer each of those questions affirmatively, and to do so often requires looking not just to penalties and disgorgement, but to forms of equitable or remedial relief that are available to us.

First off, what do I mean by non-monetary, equitable relief? To me, that term includes the full range of remedies the Commission has at its disposal, beyond the ability to seek penalties and disgorgement. When thoughtfully deployed, non-monetary remedies give the Commission latitude to craft an outcome that best matches the facts and circumstances of a given case.

So what are the non-monetary remedies that are critical to our enforcement efforts? Today, I’ll highlight a few forms of non-monetary relief that are of particular significance – undertakings and conduct-based injunctions, and bars and suspensions.

Undertakings and Conduct-Based Injunctions

In civil injunctive actions, the federal securities laws permit the Commission to seek – and federal courts to grant – any equitable relief that may be appropriate or necessary for the benefit of investors.[2] In practice, two of the most effective forms of equitable relief in Commission enforcement actions are undertakings, which require a defendant to take affirmative steps – either in conjunction with entry of the order or in the future – in order to come into and remain in compliance with the specific terms of the court’s order, and conduct-based injunctions, which prohibit a defendant from engaging in conduct that, while otherwise legal, poses risk of harm to investors in the future. The Commission also has authority to impose similar obligations in administrative and cease-and-desist proceedings.[3]

For example, the Commission recently secured a conduct-based injunction in its settlement with Billy McFarland, who, according to the SEC’s complaint, fraudulently induced more than 100 investors to put over $27 million into his companies, including Fyre Festival LLC. In addition to ordering that McFarland and his companies were liable for full disgorgement, the final judgment in the SEC’s matter against McFarland included a conduct-based injunction, enjoining McFarland from directly or indirectly participating in the issuance, purchase, offer, or sale of any security, except for his own personal account.[4]

With respect to undertakings, many require the settling party to retain a compliance consultant or monitor to make recommendations to the issuer and report to the Commission on terms specifically defined in the settlement papers.[5] Such undertakings make it possible for an SEC action to seed change in a corporation’s processes in a way that serves the long-term interests of investors. Undertakings are a forward-looking remedy; they are specifically designed with an eye toward what happens after the settlement. So when they are well-crafted, they unquestionably provide unique benefits to investors in the long term.

In addition to undertakings requiring the retention of compliance consultants or monitors, we have also tailored other types of undertakings to accomplish remedial objectives that were specific to the wrongful conduct at issue.

In March, the Commission charged Theranos, Inc., a private company, and its founder and CEO Elizabeth Holmes with raising more than $700 million from investors in an elaborate, years-long scheme involving exaggerated claims about the company’s technology, business, and financial performance.[6]

Aspects of the Theranos matter have been covered extensively in other forums. But for today’s purposes, one of the most important elements of the Commission’s settlement with Holmes were undertakings that (1) required her to relinquish her voting control over Theranos by converting her supermajority shares to common shares, and (2) guaranteed that in a liquidation event, Holmes would not profit from her ownership stake in the company until $750 million had been returned to other Theranos investors. In Theranos, the Commission confronted a situation where, because of the capital structure of the company, Holmes had nearly complete control of the company. And given what we alleged had occurred, it was appropriate to seek relief that protected investors from potential misuse of that controlling position going forward. The undertakings were designed to do exactly that.

In another example, late last week, the Commission charged Elon Musk, the Chairman and CEO of Tesla, with fraud for Tweeting a series of false and misleading statements about his plan to take Tesla private.[7] The Commission also charged Tesla with failing to maintain disclosure controls and procedures with respect to Musk’s communications. To settle the SEC actions, Musk and Tesla agreed not only to pay significant penalties, but also to a set of comprehensive undertakings. If approved by the court, the undertakings will require, among other things, (1) Musk to resign as Chairman and be replaced by an independent Chairman, (2) Tesla to add two independent directors to its board, (3) Tesla to establish a committee of independent directors and adopt mandatory controls and procedures to oversee and Musk’s public communications about the company, and (4) Tesla to employ within its legal department an experienced securities counsel.[8]

These undertakings specifically target and attempt to address specific risks – in this case, the potential harm to investors caused by Musk’s communication practices and a lack of sufficient oversight and control of those communications. The undertakings were specifically targeted to put in place stronger corporate governance by increasing the independence of the Tesla board and imposing closer oversight and control of Musk’s communications. I believe these carefully tailored undertakings serve the Commission’s investor protection mission by specifically addressing the misconduct at issue.

In these examples, the overall package of remedies also included monetary penalties aimed at punishing misconduct, and the benefit of such penalties for deterring misconduct should not be understated. But the equitable relief the Commission obtained was both forward-looking and precisely tailored to the facts and circumstances of the case, and for that reason, it stands to benefit investors over the long run.

Bars and Suspensions

In addition to undertakings, the Commission can also seek or impose other forms of forward-looking or remedial relief, such as officer and director bars and associational bars and suspensions. Like undertakings, bars and suspensions are not a punishment. Rather, they serve a critical prophylactic function – preserving the integrity of our markets and protecting investors by limiting the activity of known bad actors by removing them from the industry or preventing them from serving as officers or directors at public companies.

In actions authorized this fiscal year alone, the Commission is seeking in litigation, or has obtained in settlements, multi-year officer and director bars or industry bars and suspensions against hundreds of individuals. Some illustrations of the bars sought or obtained include:

- Bars we are seeking in ongoing litigation against the former CEO and CFO of one of the largest mining interests in the world, who allegedly misled investors about the rapid deterioration in the value of a business the company had recently acquired for $3.7 billion.[9]

- Bars sought against CEO and COO who allegedly misrepresented their company as a first-of-its-kind decentralized bank offering its own cryptocurrency to be used for a broad range of customer products and services.[10]

- Bars secured in settlement with the former CEO of a NASDAQ-listed oil and gas company who received over $1 million of undisclosed perks and compensation in a variety of forms, including lavish social events, first class travel, and an office bar stocked with high-end liquor and cigars.[11]

- Bars secured against the former CEO of LendingClub Asset Management LLC, who was charged with using the fund’s money to benefit LendingClub Corporation.[12]

- And of course, we secured a ten-year officer and director bar against Elizabeth Holmes, and are seeking an officer and director bar in our ongoing litigation against Theranos’ former President, Sunni Balwani.[13]

It may not come as a surprise that many individuals as to whom we seek bars choose to litigate rather than settle with the Commission. As such, bars can be a resource-intensive remedy for the agency. But the flip side of the resources coin is a remedy that, like undertakings, can have direct, far-reaching, and positive effects for investors. As such, obtaining bars and suspensions, when warranted by the facts and circumstances, are a high priority for the Division.

Civil Penalties and Disgorgement

Penalties

I’d like to turn now to monetary relief. Since 1990, when the SEC’s current penalty regime came into effect, the Commission has often levied large penalties against regulated entities.[14] That was true again this year, when multiple Wall Street banks,[15] asset managers,[16] and other market gatekeepers, including a regulated exchange,[17] were assessed large money penalties.

The rationale behind assessing money penalties in actions involving regulated entities is relatively straightforward. To preserve the integrity of our markets and protect investors, the Commission is charged with promulgating and enforcing rules governing certain of the business practices of the entities we regulate – including broker-dealers, investment advisers, asset managers, credit rating agencies, and exchanges. Penalties are one of the primary enforcement tools we have to incentivize regulated entities to remain in compliance with the rules that protect investors. Stephanie and I embrace this rationale, and you can expect us to apply it throughout our tenure as Co-Directors.

But the analysis with respect to corporate issuers with a class of securities registered with the SEC often involves additional considerations that don’t uniformly apply in matters involving regulated entities. Such issuers are required by statute and regulation to file public periodic and annual reports and financials, and to have policies, procedures, and controls in place to enable them to satisfy their obligations concerning the accuracy, completeness, and timeliness of such filings. Using enforcement to promote the integrity of issuers’ public filings – which are central to the sound functioning of our capital markets – is a critical part of our mandate. So in matters involving corporate issuer misconduct, decisions about whether to recommend the assessment of penalties require careful and thoughtful balancing of many factors including, of course, the nature of the misconduct.

We also consider whether application of the Seaboard factors is appropriate. This includes evaluation of the nature of remedial steps taken by the company, its own self-reporting and self-policing efforts, and the extent of its cooperation with the Commission and other law enforcement agencies.[18]

Over the last year, the balance of factors has led the Division to recommend substantial penalties against a variety of corporate issuers. I’ll touch briefly on four examples:

- In September, the Commission obtained a $20 million penalty from a publicly-traded biopharmaceutical company and two of its senior officers to settle charges that they misled investors about the company’s developmental lung cancer drug. The Commission alleged that the company’s investor presentations, press releases, and SEC filings stated that the drug was effective 60 percent of the time, far higher than suggested by actual results available internally.[19]

- The Commission obtained a $34 million penalty against Walgreens Boots Alliance, Inc., in an action against the company and two former executives for allegedly misleading investors over multiple reporting periods about increased risk that the company would miss an important financial projection that it had announced simultaneously with the announcement of its merger with Boots.[20]

- Altaba, the company formerly known as Yahoo!, paid $35 million to settle charges that it misled investors by failing to disclose one of the world’s largest data breaches, in which hackers stole personal data relating to hundreds of millions of user accounts. The Commission alleged that Yahoo!’s senior management was aware of the cyber intrusion, but failed adequately to investigate the breach or disclose it for a period of almost two years.[21]

- And of course, the Commission secured a $20 million penalty against Tesla, whose governance failures allegedly enabled Musk’s fraudulent tweets. As we alleged in our complaint, for years, Tesla had relied on Musk’s Twitter feed – with its 22 million followers – to market the company and disseminate corporate news and information. But the company had no controls in place to ensure that his Tesla-related tweets were accurate and otherwise complied with the federal securities laws.

The penalties in these cases served a strong deterrent purpose.

That said, not every case warrants a penalty. As a counterpoint, last December the Commission issued an order finding that the CEO and CFO of an exchange-listed biopharmaceutical company received millions of dollars in undisclosed perks.[22] The company undertook to fully remediate material weaknesses in its accounting controls – and undertook to retain an independent compliance consultant should its remediation efforts fail. The SEC’s order expressly acknowledged the extensive remediation efforts taken by the company, which included the institution of legal proceedings the collect repayments from its former CEO and CFO and replacing the firms that had provided or assisted with bookkeeping. In light of these extensive remedial efforts, combined with the undertaking agreed to by the company, we determined that it was appropriate not to recommend a penalty to the Commission.

We made a similar judgment call with our recommendation in a case announced last week, which involved conduct by a publicly-traded pharmaceutical company that otherwise weighed in favor of a penalty recommendation. We credited new management’s significant cooperation – including its self-reporting of the misconduct – with the Commission’s investigation and its proactive remediation efforts in deciding against recommending a corporate penalty.[23]

Disgorgement

While there is a careful weighing of factors with respect to penalties, the other primary form of monetary relief – disgorgement – is handled quite differently. Even where a defendant or respondent cooperates and agrees to meaningful undertakings, it should not be entitled to keep its ill-gotten gains, which we are often in a position to restore to harmed investors.

The Commission has obtained disgorgement in a wide variety of matters, including offering frauds, and most all FCPA resolutions.[24] The Commission also obtained significant disgorgement in settlements with regulated entities that profited by their failures to adhere to the Commission’s rules and regulations. Earlier this year, for example, Deutsche Bank was required to disgorge more than $44 million of ill-gotten gains associated with its improper handling of pre-release American Depositary Receipts. The Commission secured similar relief in matters against a number of large broker-dealers this year.

And of course, in offering frauds, where individuals obtain money directly from investors through fraudulent representations, disgorgement is a central component of meaningful relief and often the surest way to restore at least a portion of investors’ losses.[25]

As you probably know, the Supreme Court ruled last term in Kokesh v. SEC that disgorgement was to be considered a penalty for statute of limitations periods, and therefore the proceeds of misconduct obtained by a wrongdoer outside the statute of limitations were insulated from disgorgement. The impact of the ruling has been very significant and will continue to be. Take Kokesh, itself. That case involved an investment adviser who misappropriated from investors $34.9 million through a long running scheme that spanned 14 years. Of that amount, $29.9 million was misappropriated as a result of violations that occurred more than five years before the Commission brought its action. In the end, Kokesh kept the vast majority of his ill-gotten gains, at the expense of innocent investors.[26]

The impact of Kokesh has been felt across our enforcement program. A few months ago, we calculated that Kokesh led us to forego seeking approximately $800 million in potential disgorgement in filed and settled cases. That number continues to rise.

Conclusion

So what is the takeaway of all of this? I think as you can see the Commission has at its disposal a wide variety of remedies and relief. And in the Division of Enforcement we think carefully about what of those tools to recommend to the Commission in every case. What we do not do is assess large penalties simply for the sake of counting them up at the end of the year For that reason, the effectiveness of our program cannot be measured with resort to any one quantitative measure, but instead requires a nuanced and qualitative evaluation of our overall impact on achieving our investor and market integrity protection mission.

ENDNOTES

[1] The Securities and Exchange Commission, as a matter of policy, disclaims responsibility for any private publication or statement by any of its employees. The views expressed herein are those of the author and do not necessarily reflect the views of the Commission or of the author’s colleagues on the staff of the Commission.

[2] See Section 21(d)(5) of the Securities Exchange Act of 1934, 15 U.S.C. §78u(d)(5).

[3] See Sections 15(b)(4), 15(b)(6), and 21C(a) of the Securities Exchange Act of 1934, 15 U.S.C. §§ 78o(b)(4), (6), and 78u-3(a).

[4] See Final Judgment as to Defendants William Z. (“Billy”) McFarland, Fyre Media, Inc., and Magnises, Inc., SEC v. William Z. (“Billy”) McFarland, No. 1:18-CV-6634-JGK (S.D.N.Y. Aug. 1, 2018).

[5] See Press Release 2018-184, SEC Obtains Relief to Fully Reimburse Retail Investors Sold Unsuitable Product (Sept. 11 2018), available at https://www.sec.gov/news/press-release/2018-184; Press Release 2018-222, SEC Charges Stryker A Second Time for FCPA Violations (Sept. 28, 2018), available at https://www.sec.gov/news/press-release/2018-222.

[6] See Press Release 2018-41, Theranos, CEO Holmes, and Former President Balwani Charged With Massive Fraud (March 14, 2018), available at https://www.sec.gov/news/press-release/2018-41.

[7] See Press Release 2018-219, Elon Musk Charged With Securities Fraud for Misleading Tweets (Sept. 27, 2018), available at https://www.sec.gov/news/press-release/2018-219.

[8] See Press Release 2018-226, Elon Musk Settles SEC Fraud Charges; Tesla Charged With and Resolves Securities Law Charge (Sept. 29, 2018), available at https://www.sec.gov/news/press-release/2018-226.

[9] See Press Release 2017-196, Rio Tinto, Former Top Executives Charged With Fraud (Oct. 17, 2017), available at https://www.sec.gov/news/press-release/2017-196.

[10] See Press Release 2018-8, SEC Halts Alleged Initial Coin Offering Scam (Jan. 30, 2018), available at https://www.sec.gov/news/press-release/2018-8.

[11] See Press Release 2018-13, SEC Charges Oil Company CEO, Board Member With Hiding Personal Loans (July 16, 2018), available at https://www.sec.gov/news/press-release/2018-133.

[12] See Press Release 2018-223, SEC Charges LendingClub Asset Management and Former Executives With Misleading Investors and Breaching Fiduciary Duty (Sept. 28, 2018), available at https://www.sec.gov/news/press-release/2018-223.

[13] See Press Release 2018-41.

[14] See Press Release 2010-123, Goldman Sachs to Pay Record $550 Million to Settle SEC Charges Related to Subprime Mortgage CDO (July 15, 2010), available at https://www.sec.gov/news/press/2010/2010-123.htm; Press Release 2016-128, Merrill Lynch to Pay $415 Million for Misusing Customer Cash and Putting Customer Securities at Risk (June 23, 2016), available at https://www.sec.gov/news/pressrelease/2016-128.html.

[15] See Press Release 2018-155, Citigroup to Pay More Than $10 Million for Books and Records Violations and Inadequate Controls (Aug. 16, 2018), available at https://www.sec.gov/news/press-release/2018-155-0; Press Release 2018-108, Merrill Lynch Admits to Misleading Customers about Trading Venues (June 19, 2018), available at https://www.sec.gov/news/press-release/2018-108; Press Release 2018-138, Deutsche Bank to Pay Nearly $75 Million for Improper Handling of ADRs (July 20, 2018), available at https://www.sec.gov/news/press-release/2018-138.

[16] See Press Release 2018-167, Transamerica Entities to Pay $97 Million to Investors Relating to Errors in Quantitative Investment Models (Aug. 27, 2018), available at https://www.sec.gov/news/press-release/2018-167.

[17] See Press Release 2018-31, NYSE to Pay $14 Million Penalty for Multiple Violations (March 6, 2018), available at https://www.sec.gov/news/press-release/2018-31; Press Release 2018-169, SEC Charges Moody’s With Internal Controls Failures and Ratings Symbols Deficiencies (Aug. 28, 2018), available at https://www.sec.gov/news/press-release/2018-169.

[18] Report of Investigation Pursuant to Section 21(a) of the Securities Exchange Act of 1934 and Commission Statement on the Relationship of Cooperation to Agency Enforcement Decisions, Securities Exchange Act Release No. 44969 (Oct. 23, 2001) (available at: http://www.sec.gov/litigation/investreport/34-44969.htm).

[19] See Press Release 2018-199, Biopharmaceutical Company, Executives Charged With Misleading Investors About Cancer Drug (Sept. 18, 2018), available at https://www.sec.gov/news/press-release/2018-199.

[20] See Press Release 2018-220, SEC Charges Walgreens and Two Former Executives With Misleading Investors About Forecasted Earnings Goal (Sept. 28, 2018), available at https://www.sec.gov/news/press-release/2018-220.

[21] See Press 2018-71, Altaba, Formerly Known as Yahoo!, Charged With Failing to Disclose Massive Cybersecurity Breach; Agrees To Pay $35 Million (April 24, 2018), available at https://www.sec.gov/news/press-release/2018-71.

[22] See Press Release 2017-229, SEC Charges Biopharmaceutical Company With Failing to Properly Disclose Perks for Executives (Dec. 12, 2017), available at https://www.sec.gov/news/press-release/2017-229

[23] See Press Release 2018-221, SEC Charges Salix Pharmaceuticals and Former CFO With Lying About Distribution Channel (Sept. 28, 2018), available at https://www.sec.gov/news/press-release/2018-221.

[24] See Press Release 2018-215, Petrobras Reaches Settlement With SEC for Misleading Investors (Sept. 27, 2018), available at https://www.sec.gov/news/press-release/2018-215; See Press Release 2018-188, United Technologies Charged With Violating FCPA (Sept. 12, 2018), available at https://www.sec.gov/news/press-release/2018-188; Press Release 2018-174, Sanofi Charged With FCPA Violations (Sept. 4, 2018), available at https://www.sec.gov/news/press-release/2018-174

[25] See Press Release 2018-141, SEC Charges Failed Fyre Festival Founder and Others With $27.4 Million Offering Fraud (July 24, 2018), available at https://www.sec.gov/news/press-release/2018-141; Litigation Release No. 24076, SEC Charges Operators of Private Real Estate Fund with Scheme to Defraud Retail Investors (March 22, 2018), available at https://www.sec.gov/litigation/litreleases/2018/lr24076.htm; Litigation Release No. 24241, SEC Charges Nevada Microcap Issuer and Individuals with Unregistered, Fraudulent Offering (Aug. 21, 2018), available at https://www.sec.gov/litigation/litreleases/2018/lr24241.htm.

[26] Kokesh v. SEC, 137 S. Ct. 1635 (2017) (Sotomayor, J.).

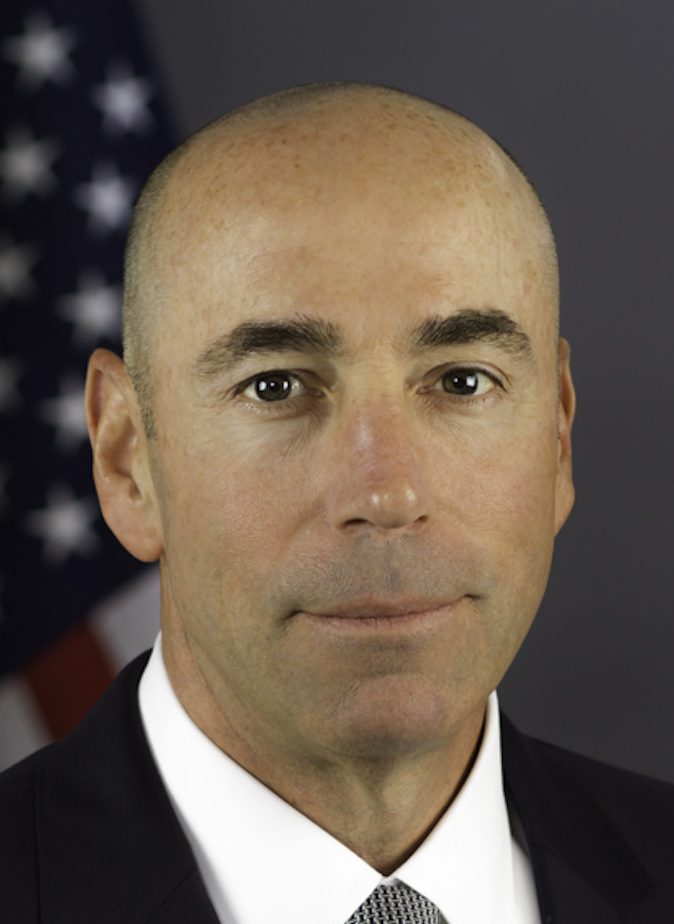

These remarks were delivered by Steven R. Peikin, co-director of the division of enforcement at the U.S. Securities and Exchange Commission, on October 3, 2018, at the PLI conference on White Collar Crime 2018: Prosecutors and Regulators Speak, in New York, New York. A copy of the original remarks are available here.