In a new essay, available here, I discuss the essential but insufficient role of regulation to promote more effective stewardship by institutional investors. My essay offers a frame for specific policy recommendations that align the responsibilities of institutional investors with the best interests of their human investors in sustainable wealth creation, environmental responsibility, the respectful treatment of stakeholders, and, in particular, the fair pay and treatment of workers. In doing so, the essay: 1) explains how the corporate governance system we now have is fundamentally different from the system we had when the regulatory structures governing institutional investors were put in place; 2) identifies the suboptimal results that have ensued by increasing the power of institutional investors, and thus the stock market, over public companies, while diminishing the protections for other stakeholders and society generally; 3) discusses why leaving needed change to the industry itself is not an adequate answer; and 4) sets forth a series of specific, measured public-policy changes for mutual funds, pension funds, and hedge funds.

In sum, the essay explains and addresses the reality that companies that make products and deliver services cannot focus more on sustainable profitability, respectful treatment of stakeholders, and social responsibility than the powerful investors that control them permit. Like any powerful economic interest, institutional investors should be expected to be responsible citizens and faithful fiduciaries.

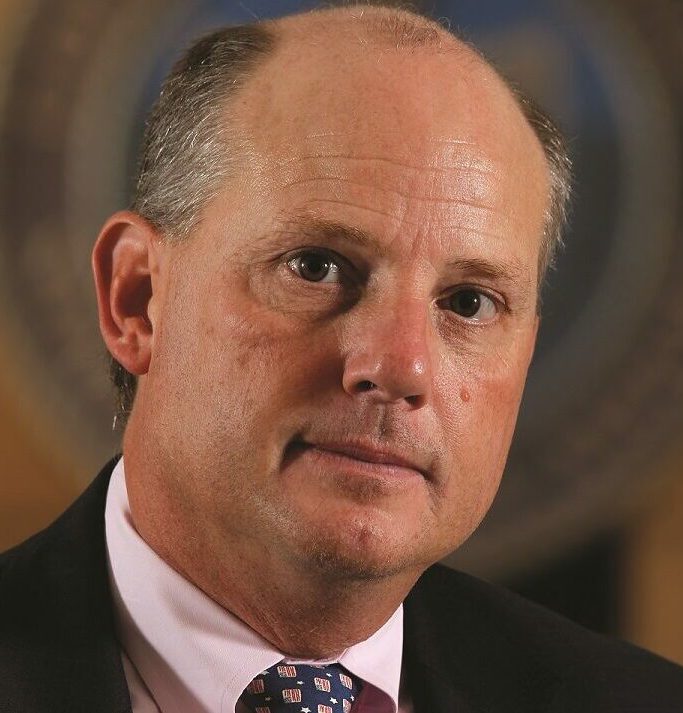

Leo E. Strine, Jr., is the Ira M. Millstein Distinguished Senior Fellow at the Ira M. Millstein Center for Global Markets and Corporate Governance at Columbia Law School; Michael L. Wachter Distinguished Fellow in Law and Policy at the University of Pennsylvania Carey Law School; senior fellow, Harvard Program on Corporate Governance; Henry Crown Fellow, Aspen Institute; of counsel, Wachtell Lipton Rosen & Katz; and former chief justice and chancellor of the State of Delaware. The essay was the basis for his luncheon keynote speech at the Rethinking Stewardship online conference presented on October 23, 2020, by the Ira M. Millstein Center for Global Markets and Corporate Ownership at Columbia Law School and ECGI, the European Corporate Governance Institute.