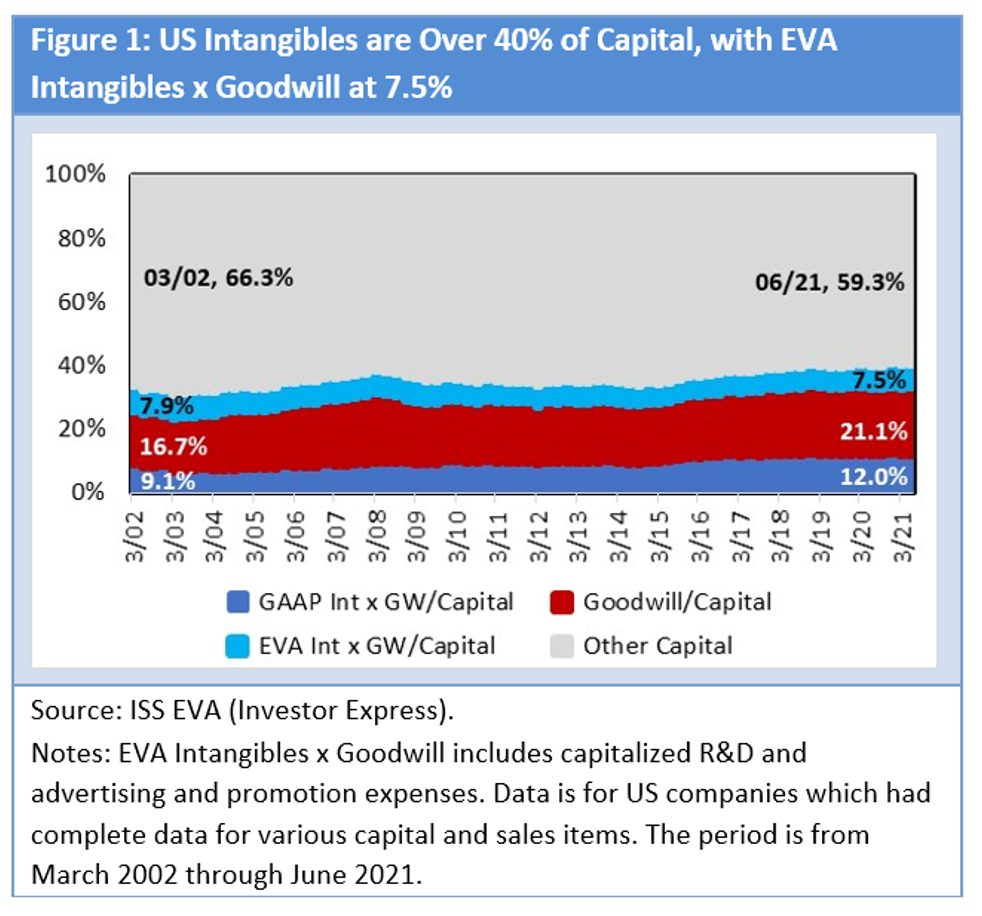

Intangible assets continue to represent a significant portion of the overall Balance Sheet globally. Over 40% of capital in the US today is in the form of intangible assets, as assessed by our ISS EVA (Economic Value Added) methodology. The growth in intangibles has made valuing and evaluating companies more difficult, as disclosure and treatment of intangible assets varies globally. In our most resent ISS EVA & ISS ESG white paper we explore the relationship between intangibles and valuation as well as intangibles and ESG.

EVA stands for economic value added. EVA equals the return on capital, which is net operating profits after tax (NOPAT = EBIT * (1-tax rate)) as a percentage of capital, less the weighted average cost of capital. EVA intangibles x goodwill (EVA intangibles excluding goodwill) are related to research and development, and advertisement and promotion expenses (or ‘all marketing expenses’ if this data is not available). ISS EVA capitalizes these expenses, applies a charge to them, and amortizes them over time (just like property, plant, and equipment). These expenses are made, at least theoretically, to produce an economic benefit in future years, just like capital expenditures for tangibles assets such as equipment in a manufacturing plant. Thus, we believe they should also be capitalized and treated as an asset. Given these intangibles are correlated with various measures of profitability, growth, and returns, the actual results and the market appear to agree with us.

Figure 1 above shows the relative percentage of capital represented by different baskets of assets. EVA intangibles x goodwill (the light blue area above) are those that ISS EVA capitalizes for R&D and advertising and promotions (or ‘all marketing costs’ if this data is not available). It amounts to 7.5% of capital for US companies (10.3% for small US firms) and 4.4% for the world excluding the US. Stocks with higher EVA intangibles x goodwill as a percent of capital are positively correlated with returns.

Not all intangibles are equal, however. Those acquired (goodwill and book intangibles) are generally negatively correlated with returns. Plus, EVA intangibles x goodwill growth is positively correlated with sales growth and negatively with EVA Momentum and ESG. These conclusions have significant implications for corporations and their customers and investors, perhaps most significantly in the health care and information technology sectors where EVA intangibles x goodwill is 32% and 13% of capital, respectively (Figure 2 below).

Expanding on the correlation between the growth in intangibles and ESG, we specifically highlight that governance is positively correlated with level of EVA intangibles x goodwill/capital for most sectors and that EVA intangibles x goodwill/capital is generally positively correlated with future EVA Momentum. Given that these correlations are in the right direction – good governance is positively related to level EVA intangibles x goodwill/capital where it correlates positively with EVA Momentum, and negatively related to level of EVA intangibles x goodwill/capital where it correlates negatively with EVA Momentum – we ran a simple binary backtest to highlight positive outcomes:

As the growth in intangibles has accelerated, we are encouraged to see that when evaluating the performance of firms with growth in intangibles, the market is rewarding those with good governance practices more so than those with poor governance. Figure 3 above highlights this outperformance at +10.5% (1-1’s good governance and high growth in intangibles) vs +5.4% (2-2’s bad governance and low growth in intangibles). This is a strong signal that the market is still valuing capital discipline and also aligns with our findings of a strong relationship that building vs buying intangibles is best.

This post comes to us from Institutional Shareholder Services. It is based on the firm’s recent white paper, “Getting Tangible About Intangibles,” available here.