Scholars agree that crowdfunding regulations in Title III of the Jumpstart Our Business Startups (JOBS) Act are broken. My latest article addresses their concerns and proposes a solution for crowdfunding based on a deeper understanding of the startup fundraising market—a solution called “bridgefunding” for its ability to provide capital to startups at a particular time when they need it most. The broader theme is that a new exemption from securities regulation should consider how a new entrant will fit into an existing market. A narrower point is that startup funding may have a persistent market failure that regulations could solve. This post focuses on that narrower point and raises for discussion some reasons that the startup funding market might not be functioning as efficiently as one might hope.

Virtually all startups raise money from outside investors. This fundraising usually occurs in discrete stages, called “series.” The first is “Series Seed,” when angel investors—professionals who invest their own money in startups—invest on average an aggregate of $350,000.[1] The second is “Series A,” when venture capitalists—fund managers who invest other people’s money in startups—invest an average of $4.9 million.[2] Venture capitalists continue to invest larger amounts throughout the startup’s lifecycle, until the startup fails, is acquired or goes public. In fact, venture capitalists prefer to invest large amounts in a startup: their average investment across all the series is $7.3 million.[3]

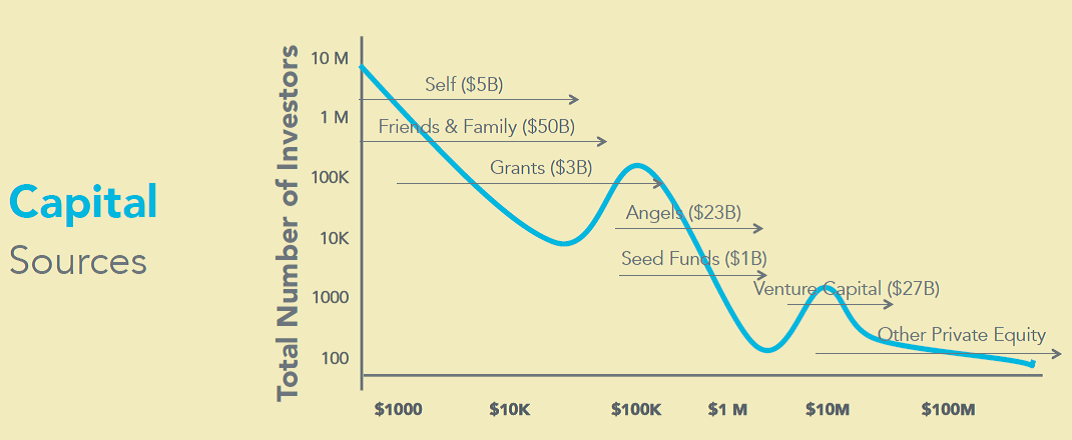

My article gets into specifics about why angels invest so much less in each company than venture capitalists do, but the primary upshot is that although entrepreneurs have ready access to initial “seed” investment, they have to find a new source of capital to continue growing. Moreover, venture funds generally supply capital only after a startup reaches a funding level that is difficult to attain using only angel investors because there is very little capital available in the US for rounds of $1 to $5 million.[4] It is virtually impossible to find investors who want to fund $3.5 million.[5] This lack of funding is illustrated below in Figure A. The challenge to get funding in the range between $1 and $5 million has become somewhat infamously known as the “Series A Crunch,” where funding is especially scarce.[6] I refer to this lack of funding as the Series A Gap.

FIGURE A: Capital availability based on level of current investments © 2011 Bill Payne

A common reaction of economists to the gap is, “so what?” At a glance, startup financing appears to occur in a free, deep and well-functioning market. Perhaps the gap merely reflects that there are too many (low quality) startups. A closer look, I argue in Bridgefunding, reveals several reasons why the Series A Gap may evidence a market failure.

First, angel group dynamics can lead to underinvestment. Although data on individual angel investment behavior is scarce, estimates suggest that each angel invests about $25,000 per startup.[7] It costs about $25,000 to sell Series Seed Preferred Stock.[8] Transaction costs thus force angels to invest collectively in groups called syndicates.[9] This group dynamic leads to three potential source of market failure: (1) regulations limit angel groups to 100 members,[10] which limits the investment power of syndicates; (2) angels sometimes can secretly observe other angel’s investment decisions, which allows them to free ride on other’s efforts, but without the ability to communicate about who expends the cost of diligence and negotiations, this can lead to a prisoner’s dilemma and underinvestment in the initial period; and (3) angel groups have a holdout problem when it is time to reinvest because an angel can benefit from the rest of the group’s reinvestment without putting any more capital at risk.

Second, good startups may go unfunded merely because there is a liquidity crunch. Just because limited venture capital has better alternatives, unfunded startups are not necessarily undeserving. VCs invested almost $30 billion in 2013. That may seem like a lot, but in comparison, mutual funds invested $15 trillion—500 times more—that year (of course, mutual funds invest in a range of assets besides startup companies, but the comparison provides a sense of financial markets’ scale).[11] Limited venture capital is increasingly deployed in later-stage companies. In fact, the average VC investment has increased consistently from $1.7 million in 1985 to $4.9 million in 2013. This is probably because venture firms are growing in terms of money under management, but not in terms of number of managers: there are basically the same number of managers today as in 1993, but they manage over six-and-a-half times as much money.[12] Later-stage investments make sense for VCs who can afford to write eight-figure checks because pre-IPO companies are more likely to get liquid sooner—and less likely to fail first.

Third, there may be an emerging communication or signaling problems between angels and venture capitalists because there are so many new angel investors online.[13] This creates a vast new pool of angel investors, but it diminishes the reputation effects that can discipline angels and syndicates. There used to be just a handful of angel investors. Getting funding from such an angel provided a strong signal of quality to venture capitalists. As thousands of new, inexperienced angels join the startup investment market each year, the signal to noise ratio diminishes. Angels need venture capitalists to invest in the startups that angels fund because angels lack the resources to sufficiently capitalize such companies, but angel investment is no longer a self-fulfilling prophecy. Knowing that their investment in the first period no longer stimulates venture capital investment in the second period might reduce angel investment in the first period as well.

Bridgefunding offers to solve this problem by interposing a new set of investors between the angel and venture capital stages—between Series Seed and Series A—to bridge the Series A Gap. Clearly this provides a source of capital where it is currently lacking, but it also resolves some of the potential market failures described above. First, bridgefunding introduces a new type of market participant, crowds, which have the potential to disrupt the equilibrium (in which there is a large and growing gap)[14]. Moreover, crowds have proven willing to invest in the gap. They funded a number of projects on Kickstarter and other pre-purchase crowdfunding platforms in that range and above.[15] Peer-to-peer lending has also taken off, with over $1 billion loans issued on the crowdlending platform Lending Club in 2014.[16] Crowds also perform a valuable signaling function to venture capitalists about what projects will attract consumers.

For these and other reasons more fully explained in my article, bridgefunding suggests a new mechanism for crowds to join the startup investment market in mutually beneficial ways. First, bridgefunding inverts crowdfunding’s current $1 million ceiling, turning it into a $1 million floor. Second, bridgefunding requires a professional, accredited, substantial, independent investor to make the initial investment, before startups can solicit crowdfunding. This prevents crowds from competing with angel investors, and instead requires crowds to benefit from angels’ efforts. Angels are in a better position than crowds to perform the initial diligence and negotiate the initial seed financing agreements because crowds may suffer from rational apathy. Each angel invests tens of thousands of dollars, whereas each member of a crowd may invest as little as $25, so crowd members may not have sufficient incentives to perform the extensive diligence required of an initial investment, whereas angels do.

Bridgefunding thus solves many problems of crowdfunding and the Series A Gap. Angels benefit from a new type of investor who helps keep Series Seed investments solvent and makes them more attractive targets for Series A investment. Crowds benefit from the involvement of professional investors who have the skill and motivation to diligence, oversee and influence the startup. Startups get access to a new and much needed source of capital. And the economy continues to receive the capital required to fuel rapid growth and innovation.

ENDNOTES

[1] Jeffrey Sohl, The Angel Investor Market in 2013: A Return to Seed Investing, UNIVERSITY OF NEW HAMPSHIRE CENTER FOR VENTURE RESEARCH (Apr. 30, 2014) (“Total investments in 2013 were $24.8 billion…A total of 70,730 entrepreneurial ventures received angel funding in 2013…The average angel deal size in 2013 was $350,830.”).

[2] National Venture Capital Association, Yearbook 2014, THOMSON REUTERS (Mar. 2014) at 38, Figure 3.10, Venture Capital Investments in 1985-2013 by Stage (In 2013, VCs made $9.896 billion in early stage investments and 29.5452 billion in total investments) and at Figure 3.11, Venture Capital Investments in 1985-2013 by Stage (Number of Deals) (In 2013, VCs made 2,031 early stage deals and 4,041 total deals). Data thus show that VCs invested an average of $4.872 million per early stage deal and $7.311 million per deal generally in 2013.

[3] Id.

[4] Bill Payne, The Funding Gap, Part 1, Enabling Entrepreneurs (Nov. 16, 2010).

[5] Bill Payne, The Funding Gap, Part 2, Enabling Entrepreneurs (Jan. 20, 2011).

[6] See, e.g., Ross S. Weinstein, Crowdfunding in the U.S. and Abroad: What to Expect When You’re Expecting, 46 Cornell Int’l L.J. 427, 453 (2013) (“Lately, though, a so-called ‘Series A crunch’ has begun to emerge as a glut of seed financing and has met stagnating availability of next-step funding. This crunch is projected to leave many startups scrambling for funds and many current seed-stage investors without anything to show for their early faith.”).

[7] See ANGELLIST, How are funds different from Maiden Lane? (Approximate investment per deal on AngelList funds is $25,000); compare Judd Hollas, A Comparison on Angel Investors and Venture Capitalists, EQUITYNET (Sep. 12, 2011) (“The average angel investor…invests $37,000 per venture) with ANGEL CAPITAL ASSOCIATION, FAQs About Angel Groups (“The average ACA member angel group had 42 member angels and invested a total of $1.94 million in 7.3 deals per year in 2007.” This equates to an average investment of $6,327 per member angel per deal.)

[8] The standard form of Series Seed Term Sheet specifies that company will reimburse purchaser’s counsel a flat fee of $10,000. It is generally understood that company’s counsel usually bills about 1.5x what purchaser’s counsel does. See Term Sheet, www.SeriesSeed.com.

[9] ANGELLIST, What Is a Syndicate?, (“A syndicate allows investors to co-invest with other notable investors. People who back a notable investor’s syndicate commit to invest in their future deals, and agree to pay them carry.”).

[10] See Investment Company Act of 1940 § 3(c)(1).

[11] INVESTMENT COMPANY INSTITUTE, 2014 Investment Company Fact Book, at 160, Table 1.

[12] NVCA Yearbook at 10, Figure 1.0, Venture Capital Under Management Summary Statistics (Number of VC professionals increased slightly from 5,217 in 1993 to 5,891 in 2013, while VC capital under management increased dramatically from $29.3 million in 1993 to $192.9 billion in 2013).

[13] See Tomie Geron, AngelList Takes Angel Investing to Warp Speed, FORBES (Jun. 20, 2011) (“AngelList cuts through the “old boys’ network” where you need to know an insider to get a meeting with a top angel investor.”).

[14] See Ryan Caldbeck, Crowdfunding Won’t Solve the Venture Capital Series A Crunch, FORBES (Jan. 23, 2013) (“In 2008, the ratio of seed financings to Series A financings was 1.9:1. In 2012, that ratio stood at 3.3:1.”).

[15] For example, Nomad raised several million dollars via several campaigns for three novel UBS accessories. The Dash raised $3.4 million to produce a wireless in ear headphone and fitness tracker. Pono Music (founded by Neil Young) raised almost $6.3 million to create a high fidelity portable music player. OUYA raised $8.5 million to create an open-source video game console that is powered by Android OS and plays on a television. Pebble raised over $10 million to create a smart watch with an eInk display. See http://www.kickstarter.com.

[16] Bloomberg Business, Lending Club Issued $1 Billion in Loans, CEO Says (Nov. 5).

The preceding post came to us from Seth C. Oranburg, Visiting Assistant Professor at Florida State University College of Law. It is based on his paper “Bridgefunding Is Crowdfunding for Startups across the Private Equity Gap” available here.

Sky Blog

Sky Blog