Under the long-awaited proposed rules adopted by the Securities and Exchange Commission on July 1, 2015, generally, all US publicly listed companies would be required to adopt broad clawback policies and make new clawback-related disclosures. Although these requirements likely will not take effect prior to the 2016 proxy season, all companies should start planning for these changes now.

Background: History of Clawback Regulations

Since 2002, the Securities and Exchange Commission (the SEC) has had the authority under Section 304 of the Sarbanes-Oxley Act (SOX) to recover (or “clawback”) certain compensation from chief executive officers and chief financial officers of public companies over a 12-month period in the event a company restates its financials due to “material noncompliance” with financial reporting requirements, if the noncompliance is the result of misconduct (the SOX 304 Clawback).[1]

In July 2010, Congress enacted Section 954 of The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank),[2] adding a new Section 10D to the Securities Exchange Act of 1934 (the Exchange Act). Section 10D requires US stock exchanges to adopt listing standards which will shift the clawback responsibility to the companies themselves to recover excess incentive-based compensation received by any of their own executive officers in the three-year period preceding the date on which the listed company was required to restate its financials, but without any regard to misconduct (the Dodd-Frank 954 Clawback). A company that fails to comply with the clawback mandate or provide the necessary disclosure would be delisted from the applicable exchange. For a detailed examination of the scope of the Dodd-Frank 954 Clawback and its interplay with the SOX 304 Clawback,[3] please refer to Latham & Watkins, Client Alert: A Tale of Two Clawbacks: The Compensation Consequences of Misstated Financials (August 10, 2010).[4] As discussed in that Client Alert, the statutory language of Dodd-Frank gave rise to important questions that have gone unanswered, leaving issuers in limbo pending SEC guidance.[5]

On July 1, 2015, almost exactly five years after the enactment of Dodd-Frank, a divided SEC voted 3-2 to issue long-awaited proposed rules (the Proposed Rules).[6] These rules direct national securities exchanges and associations (including NYSE and Nasdaq) to establish listing standards that require public companies to adopt, implement and disclose a compensation clawback policy providing for recovery of excess incentive-based compensation from current and former executive officers. The SEC, in issuing the Proposed Rules and accompanying commentary, aims to: (1) prevent executive officers from retaining incentive-based compensation to which they were not entitled under the issuer’s restated results and (2) increase overall accountability and focus on the quality of financial reporting.[7] Although these two underlying goals are both simple and reasonable, the means proposed to achieve these goals in the Proposed Rules are decidedly less so.

As drafted, the Proposed Rules provide bright-line answers to many of the open questions we highlighted five years ago in our commentary regarding the interpretation of the Dodd-Frank 954 Clawback. The Proposed Rules also raise a host of new challenges, risks, costs and unintended consequences for companies, directors and executive officers. The SEC and those submitting formal comments to the SEC within the 60-day comment period, which ends on September 14, 2015,[8] should consider these new issues before the final rules are adopted and required to be implemented.

Because in many instances the Proposed Rules appear to leave room for issuers to mitigate the costs and risks associated with the Proposed Rules through careful planning, we suggest companies consult with legal counsel and consider how best to position themselves to align their long-term compensation policies, strategies and disclosure with the practice pointers and considerations outlined below. Further, compensation committees and audit committees should consider the risks and potential exposure they, their companies and their executive officers will face under the new clawback mandate.

Understanding and Navigating the Clawback Mandate

Below is a discussion of the significant provisions of the proposed clawback mandate, the related issues and the planning opportunities:

- Issuers and Executives Subject to Clawback Policies

“…the issuer will recover from any current or former executive officer of the issuer…”

Which “issuers” are covered? The Proposed Rules generally apply to all issuers which are publicly listed on a national securities exchange or association in the US including smaller reporting companies, emerging growth companies, foreign private issuers, controlled companies and companies with listed debt only, with very limited exemptions for issuers of security futures products and standardized options, certain registered management investment companies and unit investment trusts.[9]

Which “current or former executive officers” are covered? The Proposed Rules would require issuers to adopt recovery policies that apply to any person serving as an executive officer at any time during the performance period relevant to the incentive-based compensation. The SEC has modeled the definition of “executive officer” for these purposes on the definition of “officer” under Section 16 of the Exchange Act.[10] Accordingly, each of the issuer’s president, principal financial officer, principal accounting officer (or controller), any vice president in charge of a principal business unit, division or function and any other person (including executive officers of a parent or subsidiary of the issuer) who performs similar policy-making functions for the issuer would be individually subject to clawback exposure under the Proposed Rules.

- L&W Practice Pointer: Because the clawback mandate applies to all executive officers, issuers may want to review and reconsider the duties of their executive officers to limit the number of officers subject to these rules. For executive officers who have little or no responsibility for accounting and finance matters, issuers may want to base their incentive awards on non-financial performance metrics so as to eliminate the exposure of those executives to clawbacks under the Proposed Rules.

- L&W Practice Pointer: Applying mandated clawbacks against former executive officers may represent the biggest administrative burden for issuers. While a substantial number of issuers have existing voluntary clawback policies in place,[11] only a scant 3%[12] cover former executive officers. For long-term administrative ease, companies may be well served to (a) develop a database devoted to tracking incentive-based compensation received by current and former executive officers and (b) discuss, on the date of an executive’s termination, what forms of compensation received[13] would be exposed to recovery under the clawback policy.

- L&W Commentary: As currently drafted, the Proposed Rules could require recovery of incentive-based compensation that an executive officer earned in his or her capacity as a non-executive officer. Because the standard requires only that the individual served as an executive officer at any point in time during the award’s applicable performance period, all of the officer’s incentive-based compensation would be subject to recovery for any excess received during the three-year lookback period described below. By way of example, consider a non-executive employee who was awarded incentive-based compensation in 2016 that vests based on financial reporting metrics over the 2016-2018 three-year period. To the extent such individual is promoted to serve as an executive officer in 2018 during the final year of the award’s performance period and to the extent the company is required to restate its financials in 2019, the three fiscal-year lookback period would look to recover from his or her full compensation award — including the amounts earned as a non-executive. While the Dodd-Frank 954 Clawback was designed and enacted as a “no-fault” policy, the practical effect ensnares compensation of non-executive personnel who later serve as executive officers at some point during the lookback period.

- Clawback Trigger Event: A Correction of Errors

“In the event that the issuer is required to prepare an accounting restatement due to the material noncompliance of the issuer with any financial reporting requirement under the securities laws…”

What type of “accounting restatement” triggers the mandated clawback policy? The Proposed Rules would require recovery after any accounting restatement to correct an error deemed “material” to the previously issued financial statements, based on a facts and circumstances analysis. The SEC also notes that issuers should consider whether a series of immaterial error corrections could be considered a material error when viewed in the aggregate — whether or not the individual corrections resulted in amendments to previously filed financial statements.

- L&W Practice Pointer: The type of error-correction restatements that would trigger a compensation clawback would typically coincide with restatements where the issuer would be required to file an Item 4.02 current report on Form 8-K disclosing that previously issued financial statements can no longer be relied upon.

- L&W Commentary: The statement in the Proposed Rules that “issuers should consider whether a series of immaterial error corrections could be considered a material error when viewed in the aggregate,” raises practical questions from an issuer’s perspective. The issuer would need to monitor, on an on-going basis, immaterial errors and out-of-period adjustments and assess their materiality in the aggregate. In the cases where a series of errors is considered material in the aggregate, the clawback trigger date (e., at what point should the issuer “have reasonably concluded” that its prior financial statements included a material error) could be unclear, as further discussed below.

Does the role the executive had in the “noncompliant” accounting matter? No. The mandated clawback policy is required to be a “no-fault” policy under which misconduct (by the executive or anyone else) is irrelevant.

- L&W Commentary: A “no-fault” clawback policy triggered only by accounting errors puts increased pressure on directors and officers who are responsible for reviewing company financials and the scope of any errors. Audit committees (and compensation committees which are held responsible for implementing clawbacks) would be tasked with intensified responsibility to actively monitor for noncompliance. Both committees would likely rely disproportionately on outside auditor determinations on this point. Members of management whose compensation is subject to clawback are likely to spend more time and resources to more closely monitor the company’s financials.

- Clawback Trigger Date and Lookback Period

“…[issuer will recover compensation] received…during the 3-year period preceding the date on which the issuer is required to prepare an accounting restatement…”

On what date is the issuer “required” to prepare the restatement? The Proposed Rules identify the “required” date as the date the issuer’s board of directors, committee thereof or authorized officer concludes, or reasonably should have concluded, that previous financial statements contain a material error or, if earlier, the date a court or regulator directs the company to restate its financial statements to correct a material error. The clawback trigger date therefore is not the date of the filing of the restatement itself, but instead, either (a) the date of the issuer’s decision to restate its financials in response to advice or notices received from its independent accountant or (b) if no decision to restate was made, the date the issuer should have made a decision based on receipt of independent accountant advice or notification.

- L&W Commentary: In light of the “reasonableness” standard and the lack of a clear benchmark for the standard, potential shareholder derivative litigation could arise based on allegations that an issuer reasonably should have concluded that previous financial statements contained a material error at an earlier date.

- L&W Practice Pointer: In practice, to mitigate risks of derivative lawsuits in an area ripe for shareholder litigation, issuers would be well advised to document the board’s and/or applicable committee’s decision not to restate.

How far back does the clawback reach? The Proposed Rules would require recovery policies to capture excess compensation received during the three completed fiscal years (not necessarily calendar years) that immediately precede the clawback trigger date, including a transition period (for a total of four fiscal periods) for those issuers that change their fiscal year during the lookback period.

When is compensation deemed “received”? Compensation is deemed received by an executive officer under the Proposed Rules in the fiscal period in which the financial reporting measure is attained, regardless of the actual payment date and even if the compensation remains subject to additional vesting conditions based on service or non-financial reporting metrics after the lookback period ends.

- Form and Amount of Compensation Recoverable

“…[will recover] incentive-based compensation (including stock options awarded as compensation)… in excess of what would have been paid to the executive officer under the accounting restatement.”

What form of “incentive-based compensation” is subject to clawback? As proposed, the SEC identifies “incentive-based compensation” as any compensation that is granted, earned or vested based wholly or in part upon the attainment of any financial reporting measure. The Proposed Rules deem “financial reporting measure” to include measures that are determined and presented in the issuer’s financial statements, any measures derived wholly or in part from such financial information, and stock price and total shareholder return (TSR). Salaries, discretionary bonuses, time-based equity awards and bonuses or equity awards based on non-financial reporting measures, including strategic or operational metrics, are explicitly excluded. The financial reporting metric need not be presented in the actual financial statements (i.e., the metric can be addressed in a management discussion & analysis section or performance graph) and a specific metric need not be filed with the SEC if it is affected by an accounting restatement for revenue recognition (e.g., same store sales or regional sales volume).

- L&W Practice Pointer: The Proposed Rules explicitly exclude from recovery time-based equity awards and equity awards based on non-financial reporting measures. Most stock option grants and grants of restricted stock and stock appreciation rights (SARs) will fall into this exception because the grant of such equity awards is generally tied to a specific service period.

- L&W Practice Pointer: As non-financial reporting measures — including strategic or operational metrics — were excluded from the definition of “financial reporting measure,” we are likely to see incentive compensation programs move away from financial measures toward objective performance metrics and targets that are non-financial, strategic or operational. Such non-financial metrics could incentivize performance and should still achieve the objective metrics requirements under Section 162(m) of the Internal Revenue Code.

- L&W Practice Pointer: The Proposed Rules would not grandfather existing compensation arrangements and therefore may require recovery of incentive-based compensation that was earned before the clawback mandate takes effect. As noted below in connection with the SEC’s proposed clawback implementation timeline, recovery would be required of any incentive-based compensation received by a current or former executive officer that is granted, earned or vested based in any part on financial reporting measures that are filed on or after the date final SEC rules are published in the Federal Register. Meaning, in practice, any financial information the issuer reports on or after this date (which may be a year before the exchange listing standards are effective and more than a year before each company is required to implement its own clawback policy) can establish a basis for potential clawback. Further, all relevant incentive-based compensation where performance is based on such information would be subject to recovery regardless of whether the compensation is awarded pursuant to a pre-existing employment contract or award agreement. Issuers should consider revising forms of incentive-based compensation plans and agreements to include a general provision that any compensation granted thereunder is subject to any clawback policy the issuer adopts in the future to comply with Dodd-Frank or stock exchange rules.

How is “excess” compensation measured? Excess compensation, or “erroneously awarded compensation,” is the amount of incentive-based compensation that the executive officer receives, based on erroneous data, over and above what would have been paid to the executive officer under the accounting restatement. For incentive-based compensation where the applicable performance targets are based on objective, publicly filed financial reporting metrics, the calculations should be straightforward. For the other forms of incentive-based compensation identified below, the calculations will be much more challenging and complex. In all cases, the recoverable amount is calculated on a pre-tax basis and issuers generally have no discretion to settle for less than the recoverable amount.[14]

Stock price and/or TSR. Under the Proposed Rules, the SEC admits that calculations necessary to assess excess compensation based on stock price and TSR will require the engagement of complex analyses, significant technical expertise and specialized knowledge.[15] The SEC, therefore, would permit the use of “reasonable estimates” when determining the impact of a restatement on stock price and TSR. Issuers would be required to disclose to the SEC their underlying methodology and file documentation relating to the estimates.

- L&W Commentary: Ambiguity remains as to (1) what forms of “reasonable estimates” will be deemed adequate without the engagement of valuation experts and other third-party advisors and (2) the extent to which, in practice, the SEC and the investor market would ultimately demand issuers engage outside experts to calculate proper recovery amounts based on stock price and TSR metrics. Companies would be well advised to document all decisions and analyses, both internal and external, and monitor disclosure in connection with recoveries made by peer group members. Otherwise an issuer risks the rejection of its independent estimate as “unreasonable” if its peer group conceded the estimate was too complex for internal assessment.

- L&W Commentary: Due to the ambiguity as to what forms of “reasonable estimates” will be deemed adequate, potential shareholder derivative litigation could arise over whether the analyses and calculations used to determine the impact of a restatement on stock price and TSR were “reasonable estimates.”

Stock options and other equity awards. For equity awards still held and unexercised at the time of the recovery, the “excess” recoverable amount would be the number received in excess of the number that should have been received under the restated financial reporting measure. For equity awards already exercised, but where the underlying shares have not yet been sold, the recoverable amount would equal the number of shares underlying the excess options or SARs applying the restated financial measure. For shares already sold, the recoverable amount would be the sale proceeds the executive officer received with respect to the excess number of shares. For any shares obtained by payment of an exercise price, the recoverable amount would be reduced by the applicable price paid.

Retirement plans. The Proposed Rules would require the issuer to reduce the account balance or recover distributions under a nonqualified deferred compensation plan by the amount attributable to the erroneously awarded compensation. To the extent erroneously awarded compensation formed the basis for calculating an executive’s accrued benefit under a pension plan, such accrued benefit could be reduced or distributions recovered.

- L&W Commentary: The Proposed Rules fail to address the potential for exposure under either Section 409A of the Internal Revenue Code or ERISA in connection with the recovery of nonqualified deferred compensation and/or pension plan accruals.[16] The SEC should consider such concerns in connection with its final rules and issuers should refrain from amending their nonqualified deferred compensation and retirement plans to comply with the new rules without first consulting tax and ERISA counsel to avoid unintended and adverse tax consequences.

Bonus pools. For incentive-based compensation earned under a bonus pool funded on achievement of financial reporting measures, but where individual bonuses are allocated from the pool in the company’s discretion, the Proposed Rules require a two-step calculation process. First, the size of the bonus pool should be reduced based on the restated financial reporting measure. Second, the issuer must review whether the reduced pool is sufficient to fund the aggregate amount of individual bonuses received. If the fund is less than the aggregate amount, the issuer must recover from each individual bonus an amount that would reflect a pro rata portion of the total deficiency. As noted below, boards would be prohibited from discretionary disproportionate recovery from individual awards that were granted under a bonus pool, even if the board used its discretion to determine the award amounts at the time of the original grant.

Interplay with SOX 304 Clawback. Any amount recoverable from the chief executive officer or chief financial officer under a SOX 304 Clawback would be credited against any amount recoverable from the same executive officers under the Dodd-Frank 954 Clawback.

- Discretion: (How) to Recover or Not to Recover?

Would the issuer have discretion whether to clawback? No. The Proposed Rules interpret Dodd-Frank’s clawback mandate to require recovery of erroneously awarded compensation “except to the extent that pursuit of recovery would be impracticable because it would impose undue costs on the issuer or its shareholders or would violate home country law and certain conditions are met.”[17] The Proposed Rules would provide for a committee of independent directors responsible for executive compensation decisions (i.e., the compensation committee) to be the sole body permitted to apply these exceptions. The only criteria the committee would be permitted to consider are (a) whether the direct costs of enforcing recovery (namely, direct legal costs and financial expenditures, excluding indirect costs for reputation and recruitment concerns) would exceed the recoverable amounts or (b) whether recovery would violate home country law for foreign private issuers. In both instances, however, a “reasonable attempt” to recover the applicable compensation would be required, and documentation of any such attempt would be submitted as proof of impracticability along with disclosure of such efforts and determination. As a separate matter, the SEC explicitly notes that discrepancies between the Proposed Rules and any existing compensation contract will not suffice for a finding of impracticable recovery, because, the SEC says, the existing contract can be amended as appropriate to comply with the policy.

- L&W Commentary: In practice, issuers would have no discretion whether to clawback. For both recovery exemptions noted above, the issuer would be required to demonstrate a “reasonable attempt” to recover the excess incentive-based compensation. With respect to the first exemption, in order to show that direct costs of recovery exceeded the recoverable amounts, the issuer would still have to navigate the normal recovery process, run the calculations necessary to identify the recoverable amounts against which the enforcement costs would be measured and ultimately attempt to enforce the recovery policy, monitoring and documenting the associated costs along the way to prove the recovery was a futile effort. Given the absence of a de minimis threshold for clawbacks, in some circumstances companies would be required to retain costly experts to calculate amounts subject to clawback even where those amounts ultimately prove smaller than the cost of recovery. Although recovery would not be required in that circumstance, the company would be able to reach that determination only after significant expenditure of time, effort and professional advisory fees. The same approach would hold true to obtain an exemption for home country law violation — the second recovery exemption described above — with the added burden of obtaining an opinion of home country counsel.

- L&W Commentary: The SEC discounts the existence of legally binding contracts (where such contracts provide for incentive-based compensation but do not condition receipt of such compensation on clawback rights under the new rules) as an insufficient basis for an impracticability exception, noting that such contracts can be amended to comply with the clawback mandate. The amendment of legally binding contracts, however, is not as simple as the SEC suggests. Recipients of incentive-based compensation not already subject to clawback restrictions would likely be averse to amending an existing agreement to permit recovery of such compensation without any consideration for doing so. In practice, companies should weigh the value of additional consideration required to amend an existing contract against the administrative burden and expense of potential litigation for subsequent recovery and the potential for delisting. Going forward, the analysis for any company would likely turn on the way the SEC chooses to enforce the mandate. Nonetheless, the Proposed Rules are not self-effecting and companies would be well advised to make all new incentive-based bonuses, equity and long-term incentive awards expressly subject to clawback to allow the company to enforce the clawback mandate.

Can the issuer control the manner of recovery? Yes, boards would have general discretion over the method of recovery (that is, the process of recovery but not the amount recovered), but only to the extent such discretion is exercised “reasonably promptly” and “in a manner that effectuates the purpose of the statute” (namely, preventing executive officers from retaining compensation to which they were not entitled under the restated results). While noting that “undue delay would constitute non-compliance with an issuer’s policy” and thus subject the issuer to delisting, the SEC commentary also solicits feedback on the merits of a bright-line mandatory time window.

- L&W Commentary: Companies still face uncertainty as to how this process would play out in practice. Specifically, we question whether exchanges would monitor the actual recoveries and the speed at which funds have been recovered to identify whether issuers were effectuating the purpose of the statute.

- L&W Commentary: Due to the potential enforcement costs (both direct and indirect) to recover excess incentive compensation, we may see more issuers subject incentive compensation payable to executive officers to holdback policies that defer payment of incentive compensation until the expiration of the lookback period. The lost compensation associated with the time value of money of those deferred payments may ultimately be absorbed into other forms of compensation, such as base salaries.

Can the issuer protect executives from the clawback? No, the Proposed Rules would prohibit companies from indemnifying an executive officer for the loss of erroneously awarded compensation that the officer would be obligated to repay under the clawback policy, either directly through indemnification agreements or indirectly through payment of insurance premiums on third-party indemnification insurance.

- L&W Practice Pointer: The additional risk and costs associated with the mandated clawback under the Proposed Rules raise concerns that publicly listed issuers would be at a disadvantage in competing for top executive talent against private companies where no comparable clawback risks exists.

- L&W Commentary: The SEC recognizes that active insurance markets would emerge to provide public executives with the opportunity to protect themselves against the loss of incentive-based compensation when they are not responsible for material accounting errors. While the Proposed Rules explicitly prohibit issuers from reimbursing an executive for the cost of clawback-related insurance policies, the SEC also admits that the individual costs associated with such hedging policies would ultimately be borne by market-determined compensation packages and absorbed into base salaries.

- Clawback Policy Disclosure Compliance

(1) Supplement Proxy Disclosure. Newly proposed Item 402(w) of Regulation S-K[18] would require the issuer’s proxy statement to include disclosure of (a) any restatements completed in the past fiscal year that required recovery under the clawback policy or (b) the existence of any outstanding balance of excess compensation that remains due under the clawback policy for a prior restatement. As proposed, the specific disclosure may be included in the compensation discussion & analysis section (CD&A) in tandem with disclosure already required under Item 402(b)(2)(viii) of Regulation S-K (which requires a discussion of recovery policies and decisions relating to named executive officers) or outside the CD&A in its own section (as the scope of the Proposed Rules, encompassing any current or former executive officer, is broader than the named executive officers whose compensation is subject to discussion in the CD&A). Further, issuers otherwise exempt from CD&A disclosure (i.e., smaller reporting companies, emerging growth companies and foreign private issuers) would still be required to provide disclosure under Item 402(w). The specific disclosure would include the following:

- Restatements Completed in the Past Fiscal Year:

- The date the restatement was required to be prepared

- The amount of erroneously awarded compensation, in the aggregate, recoverable under the policy with respect to the restatement

- Any estimates used in calculating the erroneously awarded compensation (e., for compensation based on stock price or TSR)

- The amount of unrecovered compensation, in the aggregate, as of the end of the fiscal year

- Information if Board Used Discretion to Forgo Recovery:

- The names of all executive officers and amounts of incentive-based compensation erroneously awarded to each such executive officer which the company decided not to recover, along with the reasons why such recovery was not sought

- Aggregate Past-Due Recovery Balances:

- The names of all executive officers and the respective amounts of recoverable excess incentive-based compensation that have remained outstanding for more than six months as of the end of the last completed fiscal year

(2) Update Summary Compensation Table. Any recovered amount would be reflected as a reduction to the amount reported in the applicable column of the summary compensation table for the fiscal year in which the recovered amount was initially reported, with a corresponding footnote to the summary compensation table providing an explanation and the relevant amounts recovered.

(3) File Additional Exhibits. The Proposed Rules would require the submission of two new exhibits:

- Clawback Policy The compliant clawback policy (whether new or revised) would need to be filed as an exhibit to an issuer’s Annual Report on Form 10-K or Form 20-F, as applicable.

- XBRL Interactive Data Formatting All Item 402(w) disclosure would need to be provided in XBRL format as an exhibit to the issuer’s proxy statement or information statement and annual report on Form 10-K. Issuers would need to convert their disclosure into interactive data format using XBRL block-text tagging based on a specified list of tags the SEC provides. Any supporting files required by EDGAR would also be submitted with the exhibit.

Timeline for Compliance

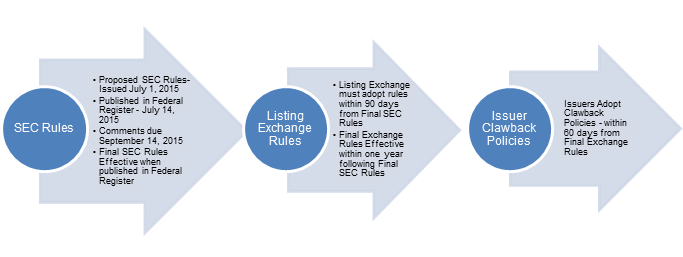

- Issuer Clawback Policy Adoption. As outlined in the chronology below, the Proposed Rules would require issuers to adopt a compliant clawback policy no later than 60 days following the effective date of the applicable exchange adopting final listing rules (the Exchange Effective Date).

- Required Disclosures under Item 402(w). As outlined below, the Proposed Rules require issuer compliance with all clawback-related disclosure required under Item 402(w) (including any required recoveries, estimates and methodologies used and amounts ultimately recovered or still outstanding from executive officers) as of the Exchange Effective Date. In practice, certain issuers may be required to make certain public disclosures before their internal clawback policy has been adopted.

- Recovery of Executive Officer Incentive-Based Compensation. As proposed, reasonably prompt recovery would be required of any incentive-based compensation received by a current or former executive officer that is granted, earned or vested based in any part on financial reporting metrics filed on or after the date final SEC rules are published in the Federal Register. In practice, this means that any financial information the issuer reported on or after this date can form the foundation for a potential clawback. Further, all relevant incentive-based compensation based on such information would be subject to recovery regardless of whether the compensation was awarded pursuant to a pre-existing employment contract or arrangement or one entered after the Exchange Effective Date.

Conclusion

We recommend all issuers subject to the Proposed Rules consider the following specific action items:

- Study the Proposed Rules. In an effort to be prepared before the final rules, company boards and management should study the Proposed Rules and begin to discuss the various issues and how they might affect the company’s incentive compensation.

- Consult with Legal Counsel. Engage counsel to assess the compliance of existing clawback policies with the mandate of the Proposed Rules.

- Revise Employment Agreements and Other Incentive Plans and Agreements. Review and consider revising existing incentive-based compensation plans and programs, and the forms of award agreements and employee communication relating thereto, to include a general condition that the compensation awards (such as bonuses, equity awards and long-term cash compensation) are granted subject to any clawback policy that the company may adopt in the future to comply with Dodd-Frank or stock exchange rules.

- Review Corporate Governance Documentation. Review bylaws, indemnification policies and committee charters in light of the Proposed Rules.

- XBRL Administration. Prepare for interactive data electronic filing system.

- Submit Comment Letters. We encourage all affected issuers to submit comment letters to the SEC to influence the final design of these rules in light of the areas of concern in our commentaries above.

ENDNOTES

[1] Sarbanes-Oxley Act of 2002, Pub. L. No. 107-204, § 304, 116 Stat. 745. Even before SOX, the SEC’s Division of Enforcement frequently sought disgorgement of performance-based compensation in enforcement actions charging fraudulently misstated financial statements pursuant to theories of equitable disgorgement. See, e.g., SEC v. Albert J. Dunlap, Russell A. Kersh, Robert J. Gluck, Donald R. Uzzi, Lee B. Griffith, and Phillip E. Harlow, 01-8437-CIV-DIMITROULEAS (S.D. Fla., May 15, 2001), Litigation Release No. 17001 (May 15, 2001) (obtaining disgorgement of performance-based bonuses following restatement due to fraudulent conduct).

[2] Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Pub. L. No. 111-203, § 954, 124 Stat. 1376.

[3] In addition, issuers that are Troubled Asset Relief Program (TARP) recipients are subject to a third clawback provision. A TARP recipient must ensure that any bonus payment made to a senior executive officer (SEO) or the next 20 most highly compensated employees during the TARP period is subject to clawback if the bonus payment was based on materially inaccurate financial statements or any other materially inaccurate performance metric criteria. Similar to the requirements under the Proposed Rules, the TARP recipient must exercise its clawback rights except to the extent it demonstrates that it is unreasonable to do so, such as, for example, if the expense of enforcing the rights would exceed the amount recovered. See 31 CFR § 30.8.

[4] A Tale of Two Clawbacks: The Compensation Consequences of Misstated Financials, Latham & Watkins LLP (August 10, 2010), available at http://www.lw.com/upload/pubContent/_pdf/pub3662_1.pdf.

[5] Id.

[6] Listing Standards for Recovery of Erroneously Awarded Compensation, Securities Act Release 33-9861; Exchange Act Release No. 34-75342 (July 1, 2015), available at http://www.sec.gov/rules/proposed/2015/33-9861.pdf.

[7] SEC Proposes Rules Requiring Companies to Adopt Clawback Policies on Executive Compensation, Press Release 2015-136 (July 1, 2015), available at http://www.sec.gov/news/pressrelease/2015-136.html.

[8] The comment period began once the Proposed Rules were published in the Federal Register. Listing Standards for Recovery of Erroneously Awarded Compensation, Securities Act Release 33-9861; Exchange Act Release No. 34-75342, 80 Fed. Reg. 41144 (July 14, 2015), available at http://www.gpo.gov/fdsys/pkg/FR-2015-07-14/pdf/2015-16613.pdf (SEC Proposed Rules).

[9] See Section II.A.3 of SEC Proposed Rules, suggesting the exemption of “any security issued by a registered management investment company if such management company has not awarded incentive-based compensation to any executive officer of the registered management investment company in any of the last three fiscal years or, in the case of a company listed for less than three fiscal years, since the initial listing.”

[10] Section 16 of the Securities Exchange Act of 1934.

[11] Ninety percent (90%) of large issuers have developed and implemented some form of clawback policy. See PricewaterhouseCoopers, Executive Compensation Clawbacks: 2014 Proxy Disclosure Study (2015), available at http://www.pwc.com/en_US/us/hr-management/publications/assets/pwc-executive-compensation-clawbacks-2014.pdf (reporting that of 100 large public companies, approximately 90 had clawback policies in place in 2014). See also Equilar, Clawback Policy Report (2013), available at http://info.equilar.com/rs/equilar/images/equilar-2013-clawbacks-policy-report.pdf.

[12] Based on its sampling of 104 issuers with publicly disclosed clawback policies, the SEC identifies only three issuers (or approximately 2.9%) that sought clawback from former executives.

[13] This is an individualized assessment based on the executive officer’s date of termination (or demotion) and the applicable performance period associated with that executive’s incentive-based compensation. By way of example, assume an individual served as an executive officer from 2016-2018, received incentive-based compensation during each such year and resigned at some point in 2019 without receiving any additional incentive-based compensation during 2019. The issuer should communicate to the executive on the applicable 2019 resignation date that if the issuer were to conclude at some point during 2019, 2020 and 2021 that a restatement were necessary, the lookback period would require recovering from this executive any excess incentive-based compensation received (within the meaning of the Proposed Rules) during the applicable three completed fiscal year periods.

[14] While this Client Alert is not intended to address all possible tax consequences associated with the clawback mandate, note that executives required to repay pre-tax amounts will bear the burden of recovering any personal income tax previously paid on the receipt of such amounts.

[15] See Section III of SEC Proposed Rules, analyzing the estimated cost of an outside specialist to assist in running such calculations.

[16] Commentators have noted that the Proposed Rules, as drafted, impose an obligation to clawback erroneously awarded compensation under nonqualified deferred compensation plans by deducting the excess amount from the executive’s account, and that such deduction would be deemed an impermissible “acceleration” of the deferred amount under Section 409A of the Code, subjecting the executive to corresponding 409A tax liability. See Groom Law Group, SEC’s Proposed “Clawback” Rule Raises Section 409A and Other Tax Issues (July 6, 2015), available at http://www.groom.com/media/publication/1599_SEC_Proposed_Clawback_Rule_Raises_Section_409A_and_Other_Tax_Issues.pdf.

[17] In recent years, because of the refusal of the Financial Accounting Standards Board to write additional guidance on share-based payment arrangements marked by certain types of clawback features and discretionary provisions, some accounting firms have taken the position that any discretion to enforce a clawback policy vitiates fixed, measurement date accounting for any equity awards subject to such clawbacks. In light of the non-discretionary nature of the Proposed Rules to require recovery of erroneously awarded compensation, issuers should be alleviated of this burgeoning accounting issue.

[18] The Proposed Rules also amend Item 402(a)(1) to add proposed Item 6.F of Form 20-F to the list of mandatorily required executive compensation disclosures for foreign private issuers. Item 6.F would mirror the disclosure requirements of Item 402(w).

The preceding post comes to us from Latham & Watkins LLP, and is based on their recent white paper that was published on August 4, 2015 and is available here.

Sky Blog

Sky Blog