Multiforum shareholder litigation has increased sharply in recent years. In our working paper, The Private Ordering Solution to Multiforum Shareholder Litigation, we empirically analyze what has quickly proven to be the most popular and robust response to this trend: exclusive forum provisions in corporate charters and bylaws. These provisions require that corporate law-related suits be filed in a single forum, usually a court in the corporation’s statutory domicile. We identify 746 U.S. public corporations that have adopted the provision (as of August 2014); the bulk of these (93 percent) are incorporated in Delaware. Using hand-collected data on these firms, we examine what drives the growth in the provisions and whether, as some critics contend, their adoption reflects managerial opportunism. We separately analyze companies that adopt an exclusive forum provision at the IPO stage and those that adopt one “midstream.” We draw this distinction because post-IPO charter and bylaw amendments can potentially result in a wealth transfer from public shareholders to management. In contrast, when a provision is already included in a corporation’s documents at the time of its IPO, any potential wealth effect can be impounded into the stock price before public investors purchase their shares.

We find that nearly all new Delaware corporations go public with an exclusive forum provision in their charters, and further that the transition from zero to near-universal IPO adoption rates over the last several years is driven by law firms. The characteristics of individual companies appear to play little or no role in adoption decisions, and the effect of investment bankers is swamped by that of law firms. Moreover, the pattern of adoption follows what can be described as a light switch model, in which once a law firm includes a provision in one IPO, it does so for all subsequent IPOs that they advise. This light switch pattern contrasts with the inclusion of staggered board takeover defenses in IPO charters. That law firms are now advising their IPO clients to adopt the provision unconditionally, rather than on a case-by-case basis, suggests that law firms have come to perceive these provisions as universally value-increasing.

For midstream adoptions, we compare corporate governance features of midstream bylaw adopters to a matched sample of non-adopters in order to test the hypothesis that midstream bylaw adoption reflects managerial opportunism. If the hypothesis were correct, then we would expect to find midstream adopters to exhibit poor corporate governance compared to non-adopters (using the metrics of good governance practices as identified by critics of the exclusive forum provisions – proxy advisory service provider Institutional Shareholder Services and the Council of Institutional Investors – rather than our own assessment of governance practices). We find, however, that there are either no significant differences in governance or that it is actually adopters that have higher quality governance features. We also find no significant differences in governance and ownership structures between firms whose boards adopt the provisions as bylaws and those who obtain shareholder approval. The absence of significant differences across firms using disparate adoption procedures suggests that the method of adopting an exclusive forum provision – whether with or without shareholder approval – should not be a matter of import for investors.

The Delaware legislature has recently enacted legislation validating exclusive forum provisions, codifying earlier decisions by the Chancery Court that, as documented in our study, precipitated the rapid diffusion of the provisions. This legislative action is consistent with our analysis of the provisions as not adverse to shareholder interests. However, our data suggest that the legislature’s concomitant prescription against Delaware corporations’ specifying another state’s court as its exclusive forum was unnecessary. Only two of the nearly 700 Delaware firms with exclusive forum provisions, or less than one half of one percent, did not select Delaware. (A higher but still similarly small number of the smaller number of non-Delaware firms with exclusive forum provisions – three of fifty-two such firms –selected a court not in their domicile state.) The extreme rarity of a Delaware corporation not selecting Delaware for its exclusive forum both throws into question any concern that may have motivated the legislation regarding the potential for other state courts to make Delaware law and suggests that the rare firm that does select a different (non-domicile) state may very well have a good reason.

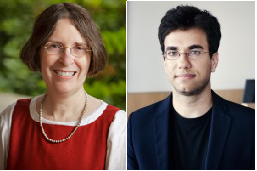

The preceding post comes to us from Roberta Romano and Sarath Sanga. The post is based on their recent article, which is entitled “The Private Ordering Solution to Multiforum Shareholder Litigation” and is available here.

Sky Blog

Sky Blog