Accredited investors are eligible to participate in unregistered securities offerings such as private equity, venture capital and hedge fund private placements under the SEC’s Regulation D. Based on current SEC Rule 501, an individual investor is qualified as an accredited investor if he has an annual income over $200,000 ($300,000 for a married couple) or a net worth over $1 million excluding primary residence.

The purpose of SEC Regulation D is to preserve a balance between investor protection and capital formation. Exempting some securities issuers from registration and disclosure requirements provides easier access to outside capital by reducing transaction costs for small businesses. Limiting Regulation D offerings to accredited investors is intended to restrict purchases to investors who are sophisticated enough to evaluate the investments and who can bear the possible risks. SEC Commissioner Daniel Gallagher recently noted that “Millionaires can fend for themselves.”

Since unregistered securities are not subject to traditional investor protections and are illiquid and opaque, unsophisticated accredited investors may be particularly vulnerable to sales of unsuitable securities. Individuals with whom a brokerage firm has had pre-existing substantive relationships may receive frequent offers to participate in exempt transactions. If wealth and income thresholds are not good indicators of the financial sophistication needed to evaluate these complex securities, then wealthy unsophisticated investors may be attractive targets for the sale of lower quality securities that they are unable to evaluate effectively.

Households saving for retirement over their life cycle will theoretically see their financial wealth peak in early retirement. Many retirees who have reached the accredited investor threshold during the defined contribution era may not have been considered accredited investors in the defined benefit era of previous generations. For example, $1 million in savings can purchase roughly $60,000 a year in annuitized income at the age of 65. In the future, there will be more retirees who meet accredited investor thresholds through sheltered retirement saving, and many who sell a business, save carefully, or receive an inheritance will also meet the threshold.

Older accredited investors may be less able to “…fend for themselves” for two important reasons. The first is that they did not necessarily accumulate wealth through active investment in complex financial securities. Many workers invest in default investments that do not require a great amount of involvement or expertise. In general, the basic financial literacy of average Americans is low and nowhere near the level of specialized knowledge that would be required to assess the quality of a complex private equity or hedge fund investment.

The second reason that older accredited investors may be vulnerable is age-related decline in cognitive abilities. A number of large-sample cross-sectional studies in the field of cognitive aging show a consistent decline in cognitive performance after age 60. Studies in financial performance also show a consistent decline in old age, and a recent study shows that scores on a financial literacy test fall at a steady, constant rate in old age. This decline results in significantly lower financial knowledge scores for older investors. There is also evidence that there is no decline in financial decision making confidence in old age, making older investors particularly vulnerable to financial mistakes.

Financial literacy assessment instruments measure basic financial knowledge. Questions may include topics such as the value of diversification which is closely related to the ability to recognize the risk of investing in undiversified and illiquid unregistered securities.

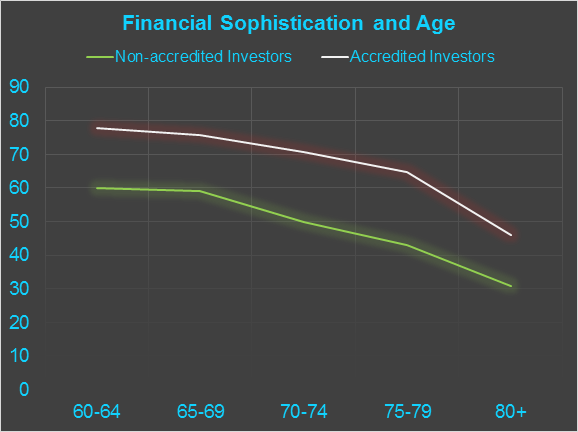

Using two large nationally-representative data sets that include financial literacy tests, we find that financial literacy scores decline in old age consistently among both accredited and non-accredited investors in both data sets. Average scores for accredited investors age 80 and older are significantly lower (45.7% in one data set and 57.1% in the other) than average scores for respondents age 60-64 (60.4% and 63.8%) who do not meet the accredited investor income and wealth thresholds.

Despite being less financially literate, older respondents are much more likely to meet the accredited investor thresholds. In a multivariate analysis, we find that respondents age 80 and older are 213% more likely to be an accredited investor. Among all other age groups, being more financially literate increased the likelihood of meeting the accredited investor thresholds (consistent with the use of these thresholds as a proxy for sophistication), but there was no relation between literacy and meeting the accredited threshold among those age 80 and above.

Non-accredited and accredited investors see their financial literacy fall consistently in old age. The predicted percentage literacy score is 19.4 percentage points lower for accredited investors age 80 and older than non-accredited respondents age 60-64. In fact, the impact on financial literacy score was nearly twice that of having less than a high school degree (10.1%). Even accredited respondents age 75-79 had a predicted financial literacy score that was significantly lower (7 percentage points) than non-accredited investors age 60-64.

The SEC’s Investor Advisor Committee recommended amending the accredited investor definition using more accurate ways of assessing financial knowledge that can allow investors to evaluate the quality of unregistered securities. This study provides strong empirical support for the need to modify the accredited investor definition to protect older investors who meet the financial asset threshold but are clearly less able to discern whether a complex and opaque security recommended by an advisor is appropriate.

The preceding post comes to us from Tao Guo, PhD candidate in Personal Financial Planning at Texas Tech University, Michael Finke, Professor of Personal Financial Planning at Texas Tech University, and Chris Browning, Assistant Professor of Personal Financial Planning at Texas Tech University. The post is based on their article, which is entitled “The Unsophisticated Sophisticated: Old Age and the Accredited Investors Definition” and available here.

Sky Blog

Sky Blog