The Wall Street Journal recently reported that federal prosecutors are pursuing criminal cases against bank executives for allegedly selling flawed mortgage securities. The crux of the cases? That the bankers ignored warnings they were packaging too many shaky mortgages into investment securities and failed to disclose the risks to others. The result, they claim, was fraud.

In a recent paper, The Nonprime Mortgage Crisis and Positive Feedback Lending, we collected evidence that the risk of a nonprime housing bubble (not the certainty, but a meaningful risk) should have been obvious to the originators, securitizers, rating agencies, money managers, and institutional investors who participated in the markets for nonprime lending and related mortgage-backed securities (nonprime MBS). Those who did not see the risk, we argue, were willfully blind.

If there was, say, a one percent risk that we were in a nonprime bubble, then the AAA ratings given to a large percentage of nonprime MBS (ratings which implied an annual default rate under 0.1%) were unjustified, and the AAA ratings given to nonprime collateralized debt obligations (nonprime CDOs and, together with nonprime MBS, nonprime MBSall), which were based heavily on BBB-rated nonprime MBS, were a fantasy.

We also describe the strong positive feedback nature of typical nonprime mortgages. This positive feedback made it highly likely that, if nonprime housing prices flattened—let alone fell, as they did—the dynamics of many nonprime loans ensured strong positive feedback in prices and default rates. This should have been obvious to anyone who bothered to look. The feedback would predictably lead to a crash in nonprime housing prices, nonprime MBS, and nonprime CDOs. The positive feedback would be (and, in fact, was) rapid and vicious. A drop (or even a non-rise) in house prices would spark loan defaults, which would drive forced sales by owners and foreclosures by lenders, followed by distressed sales. Those sales would drive housing prices down further, sparking more defaults, further forced sales, and additional foreclosures. Falling prices and higher default rates would trigger tighter lending and securitization standards, which would further limit purchases and refinancings of houses and reinforce the downward cycle. The whole nonprime securitization process might (and, in fact, did) shut down, as it had in the 1990s.

We argue that these risks were gross and obvious. Yet, most market participants assumed away the risk of a housing bubble and paid little attention to the many other risks, such as the fraud risk posed by loans with low or no documentation of a job, income, or assets (“lo-doc” loans), and widely-reported claims that loan amounts were often based on artificially high appraisals. Moreover, so far as we can tell, participants ignored the positive feedback that would result from a drop (or non-rise) in housing prices. As a result, they significantly underestimated how poorly nonprime MBSall could perform.

Failure to recognize the risks, we argue, cannot be explained simply as reasonable decisions made by smart investors that turned out badly in hindsight. Prior analyses have made nonprime MBSall seem complicated, which they were. But that too easily makes it appear that the participants’ mistakes were reasonable. They were not. Instead, market participants were willfully blind, and that blindness requires an explanation.

We argue that willful blindness arose because, at every stage of the lending, structuring, and purchase chain, the key actors had incentives to understate and under-investigate MBSall risks:

- Originators profited from originating loans that they then resold to banks, which would securitize the loans. So long as they could sell the loans, the originators were largely insulated from the risk of poor loan performance.

- Bankers are often seen as “reputational intermediaries” who engage in a “due diligence” investigation of issuers and securities and then vouch for the securities they underwrite. Instead, as the nonprime boom gathered steam, bankers limited their diligence, maintaining the pretense of doing so but conducting little real investigation or disregarding the results of that investigation. Many banks bought loan originators in order to gain greater access to the assets needed to create nonprime MBSall. They were unlikely to reject loans from their own affiliates.

- Rating agencies are also held out as reputational intermediaries, but the profits from casting an uncritical eye on nonprime MBSall were large enough to override their concern with reputation. The agencies made incredible modeling assumptions, and when that was not enough to justify their high ratings, they added large, unexplained “out-of-model” adjustments in order to do so.

- Money managers failed to press the rating agencies on their assumptions. Key modeling assumptions remained entirely hidden until the financial crisis. Nonprime MBSall had a limited history, which counseled caution; instead, many money managers bought them aggressively to gain a bit of extra yield. The managers were competing in a tournament for investor funds and could tell investors they were beating their peers without taking too much risk—after all, they could reason, they were investing in highly-rated securities.

- Given the limited track record of nonprime MBSall, investors had no way to assess the true risk level of those securities. This short track record gave them reason to act with caution, but many chose not to do so. In part, investors who placed funds with money managers did not want to underperform their peers. In part, they were lulled by high ratings. Top-rated assets are often viewed as “informationally insensitive” and properly so if the ratings were justified since substantial investor diligence would not be cost-effective.

Banks, rating agencies, money managers, and investors also found safety in being part of a crowd—if they were wrong, they would not be alone. All three major rating agencies blessed nonprime MBSall with unjustified ratings; all the major banks peddled those securities; many money managers bought them; and investors happily pocketed the extra returns.

Distorted incentives also existed within banks and rating agencies. The bonuses and careers of MBSall bankers depended on riding the securitization wave, not sitting it out or raising warnings within their institutions. So too at the rating agencies—the more offerings they rated, the more the nonprime MBSall raters would prosper, and this required that they provide high ratings. For them, the reputational and financial risk to their employers was an externality.

To diagnose a disease is not to offer a cure. We have no full cure to offer. Our paper discusses the regulatory responses to date, which do far too little to prevent a recurrence, and sketches reforms that would strengthen the due diligence obligations of bankers, money managers, and rating agencies, as well as the rating agencies’ disclosure obligations. Those reforms could limit the size and frequency of future bubbles. Willful blindness is hard to prevent. But explicit due diligence requirements, with the need to disclose what you find, and liability for not disclosing or not conducting diligence, can help.

The systemic risk posed by positive feedback lending is a separate problem that may require direct regulation. Positive feedback lending is also hard to prevent. It may seem privately rational to individual lenders, who fail to see (or see, but ignore) the broader, system-wide consequences of many lenders behaving similarly. Due diligence and disclosure requirements can help. They may prove not to be enough, but they are an important step in the right direction, and perhaps a sufficient one.

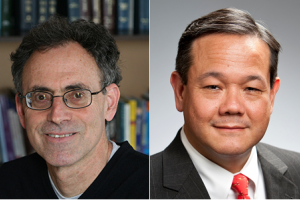

The preceding post comes to us from Bernard Black, the Nicholas D. Chabraja Professor at the Pritzker School of Law at Northwestern University and Charles K. Whitehead, the Myron C. Taylor Alumni Professor of Business Law at Cornell Law School. The post is based on an article they wrote with Jennifer M. Coupland, a graduate of the Pritzker School of Law at Northwestern University, which is entitled “The Nonprime Mortgage Crisis and Positive Feedback Lending” and available here.

Sky Blog

Sky Blog

Bernie, Charlie,

I look forward to reading this paper. The entire world knew of “liar loans,” “no-doc loans” and funny paper.

Conscious disregard of these facts was at least willful blindness.

Bruce