Imagine a world in which your employer showers you with lavish perks like free gourmet meals, smartphones, massages, yoga classes, dance lessons, and all-expenses-paid vacations, including plane fares, hotels, and rental car use. Now imagine an even better world, one in which you aren’t subject to tax on any of these perks. Believe it or not, such a world does exist, at least for a privileged class of workers comprised of business owners, those well situated on the corporate ladder, and other professionals.

What is confounding is why the general public is not up in arms rallying against this inequity.

Consider the fact that the vast majority of taxpayers are subject to income and payroll taxes on their wages, which dramatically reduce their take-home pay and make it a challenge for them to meet their daily living expenses. And employee wages are generally subject to the same amount of tax whether they are paid in hard cash or in kind (e.g., a sixty-inch plasma TV).

In certain cases, though, Congress has provided that conventional job perks, commonly known as fringe benefits, are exempt from tax. These exemptions were instituted a quarter of a century ago for reasons of administrative ease.

But in recent years, a new breed of fringe benefits has emerged that goes well beyond coffee and doughnuts in the break room. The evolution of these modern fringe benefits reflects a fundamental transformation of the workplace. As technology and globalization have blurred the line between employees’ work lives and personal lives, employers have responded by creating work atmospheres that feel like home (or, in many cases, better than home). Nowhere has this trend been more prominent than in Silicon Valley, where lavish perks at companies like Google and Facebook are pervasive. The employees who enjoy such perks can relish the fact that not only can they enjoy epicurean dining and dance a better pas de deux, they also don’t have to worry about paying a penny of tax for these corporal rejuvenations.

To policy makers, the receipt of valuable benefits that go unreported for tax purposes should be extraordinarily troubling. Aside from the associated loss in tax revenue, employers use fringe benefit distributions as a strategic tool to minimize their payroll tax obligations, resulting in wasteful spending and their overprovision. Furthermore, this practice perpetuates a corrosive myth that all noncash benefits are free of tax—a notion that the tax law squarely rejects.

Comprehensive reform is thus in order, with an emphasis on administrative ease. While the most accurate approach would be to tax employees on the fair market value of these perks, in many cases this would be both politically unsavory and unduly burdensome. As a second-best approach, Congress should tax workplace lifestyle perks in much the same way that business gifts and entertainment expenditures are currently treated under the tax code, by denying employers a business deduction for all or a portion of the expense. For example, if the benefit involved were primarily personal in nature (e.g., free dance lessons), the concomitant expense would be entirely nondeductible; however, if the benefit involved were truly a mixture between business and personal (e.g., free high-speed home Internet access), only one-half of the concomitant expense would be nondeductible.

The IRS has recently announced that it is taking a closer look at the receipt of free employee meals and their taxation. But due to twenty-first century workplace transformations, Congress should acknowledge that the new breed of fringe benefits is a far broader problem, a problem that is only growing more acute and currently costing the country billions of dollars of lost tax revenue. While institution of these proposed reforms would admittedly not solve the nation’s deficit problem, it would help to inject efficiency and equity into the tax code and arrest tax base erosion. This would hopefully bode well for other tax reform measures that place a premium on administrative simplicity and fairness.

Simply put, whether an employer wants to offer lavish perks to its employees is its decision. But the tax code should not make this option more attractive than the payment of cash wages unless deeper deficits, inequity, and wasteful spending are high priorities on Congress’s agenda.

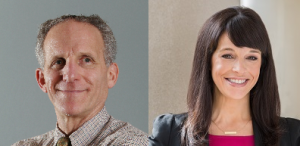

This post comes to us from Jay A. Soled, Professor and Director of Master of Accountancy in Taxation at Rutgers Business School and Kathleen DeLaney Thomas, Assistant Professor of Law at the University of North Carolina School of Law. The post is based on their article, which is entitled Revisiting the Taxation of Fringe Benefits and will appear shortly in a forthcoming issue of the Washington University Law Review.

Sky Blog

Sky Blog