Recently, there has been concern among investors, preparers, regulators, and standard setters that corporate disclosure (in particular the annual report, Form 10-K) is becoming increasingly lengthy, redundant, complex, and onerous. In December 2013, the SEC began a comprehensive review of current disclosure regulation with the intent of identifying the extent of excessive, unduly complex, and redundant disclosure. Similarly, the FASB has an ongoing agenda project, the Disclosure Framework, evaluating the effectiveness of firm disclosure. A variety of explanations have been offered for the apparent increase in the quantity and complexity of disclosure including the effects of litigation, increases in business complexity, globalization, financial instruments, regulation, and new mandatory disclosure.[1] However, there has been very little evidence on why firm disclosures are becoming so long and complex or what implications this has for investors and other financial statement users. Motivated by these concerns from regulators and consumers of financial information, we analyzed corporate annual reports over the last two decades and found evidence that the largest drivers of 10-K length are additional disclosures created in response to new disclosure requirements, specifically those relating to internal controls, risk factors, and fair value accounting.

In our analysis of annual reports, we documented striking increases in the length of annual report text with the median 10-K more than doubling from a little more than 23,000 words in 1996 to over 49,000 in 2013. While there is evidence of a sharper increase following Sarbanes-Oxley, for the most part increases in length occur relatively smoothly over our 18-year sample period. These increases are pervasive; the length of every section of the 10-K increased substantially, even when accounting for changes in firm characteristics and economic environment. Moreover, while the 10-K has been getting longer, it has also become more redundant and complex.

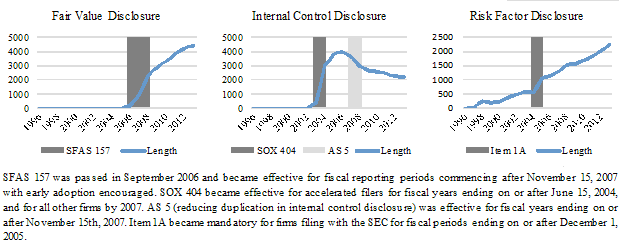

In order to delve deeper into the specific types of disclosures that are contributing the most to the overall increases in length, we performed automated analysis of the content of corporate disclosures using a linguistic technique called Latent Dirichlet Allocation which is able to estimate the proportions of a document related to a specific topic (e.g. executive compensation). Of the 150 major topics that our analysis revealed within 10-K filings, three topics account for virtually all of the increase in length: (1) fair value and impairment disclosure associated with SFAS 157; (2) discussion of internal controls over financial reporting associated with Sarbanes-Oxley Section 404; and (3) forward-looking disclosure associated with risk factors which was made mandatory as part of Item 1A. As can be seen in the figure below, all three of these disclosure topics experienced stark increases in the years in which their associated standards were implemented. Being able to link the overall increases in 10-K length to a few specific disclosures is good news for standard setters and firms because it implies a different solution than if all disclosures were increasing substantially in length. In this case it is possible to focus efforts on a few disclosures as opposed to trying to combat the more difficult and pervasive problem of increases in every disclosure.

Not only did increases in these three different types of disclosures increase overall length, they also made 10-Ks more redundant and complex. As of 2013, the median 10-K contains about 3,300 words repeated verbatim in other sections of the 10-K and requires a reader to have 21.6 years of formal education to fully comprehend. All three of these topics tend to be unusually complex and redundant relative to other disclosure in the 10-K, and increases in the proportion of these topics have contributed substantially to the increases in overall complexity and redundancy that we observe over time.

Finally, our evidence suggests that of these three topics only disclosure related to risk factors appears to provide new information to market participants. Risk factor disclosures are associated with increases in stock liquidity and trading and with market returns in the three days surrounding the 10-K filing and can predict future market beta (systematic risk). In contrast, internal control and fair value disclosures do not appear to provide new information to the market at the time of the 10-K filing and cannot be used to predict future fundamentals.

The combined results from our analyses suggest that disclosure related to enhanced regulation and disclosure requirements largely explains increases in the quantity, complexity, and redundancy of disclosure over time. However, the evidence on whether or not the additional disclosure is actually informative is mixed, with only risk factor disclosures appearing to provide information to financial statement users not available through other channels. Furthermore, our analysis does not consider the additional cost to firms of preparing these disclosures, although anecdotal evidence suggests that they can be substantial.[2] While we cannot make any conclusions about the net benefits of these new requirements, our results suggest that the costs to financial statement users in the form of unnecessarily long and complex disclosures are larger than perhaps anticipated, with only limited benefits in the form of additional information.

It is important to point out that while increases in corporate disclosure are undoubtedly tied to the three standard changes that we identify, the regulations themselves may not be entirely to blame for the bloated filings that we observe. Many of the across-the-board increases in length, complexity, and redundancy of these disclosures may reflect implementation decisions by firms that are not in line with the intent of standard setters. For example, some blame the suboptimal disclosure choices of firms on corporate attorneys, who counsel firms to disclose all related details, regardless of materiality, in order to safeguard against litigation. However, there are many reasons why unnecessary disclosure can actually be detrimental to firms and may in some cases increase the potential for future litigation by increasing the amount of information for which firms may later be held accountable.[3] If this is the case, firms may identify and eliminate specific complex and redundant text and improve clarity without sacrificing overall information content while still complying with relevant standards. Part of this effort will need to involve more coordination and informed discussion between firms and their legal counsel about the pros and cons of additional disclosures. On the other hand, firms argue that much of the redundancy and complexity is inherent in the way that the standards are currently written. For example, in a recent letter to the SEC, the Business Roundtable, an association of chief executive officers of U.S. companies, pointed to a lack of coordination between the SEC and FASB as a major contributor to redundancy in the 10-K, with this duplication exacerbated by requirements to disclose items that are irrelevant to investors or immaterial for the majority of firms. We believe that the effects that we document are attributable to implementation choices, inefficient regulations, and poor coordination between standard setters and we encourage the business community and regulatory bodies to work together to come to an optimal solution.

ENDNOTES

[1] See, for example, KPMG, 2011. Disclosure overload and complexity: hidden in plain sight. Available at: http://www.kpmg.com/US/en/IssuesAndInsights/ArticlesPublications/Documents/disclosure-overload-complexity.pdf; Securities and Exchange Commission (SEC), 2013. Report on Review of Disclosure Requirements in Regulation S-K. Available at: http://www.sec.gov/news/studies/2013/reg-sk-disclosure-requirements-review.pdf. SEC Offices, Washington D.C.; Monga, V., Chasan, E., 2015. The 109,894-word annual report; as regulators require more disclosures, 10-Ks reach epic lengths; how much is too much? Wall Street Journal (Online), Jun 2, 2015.

[2] The SEC’s estimates of the total annual costs to prepare just internal controls disclosures is approximately $500 million. See https://www.sec.gov/rules/final/33-8238.htm#iv, Section IV.D.

[3] See, for example, Ellis, J. A., Fee, C. E. and Thomas, S. E. (2012), Proprietary Costs and the Disclosure of Information About Customers. Journal of Accounting Research, 50: 685–727 and Rogers, J.L., and Van Buskirk, A. (2009), Shareholder litigation and changes in disclosure behavior. Journal of Accounting and Economics, 47: 136-156.

The preceding post comes to us from Travis Dyer, PhD candidate in accounting at the University of North Carolina at Chapel Hill, Mark Lang, the Thomas W. Hudson, Jr./ Deloitte and Touche Distinguished Professor of Accounting at the University of North Carolina at Chapel Hill, and Lorien Stice-Lawrence, PhD candidate in accounting at the University of North Carolina at Chapel Hill. The post is based on their paper, which is entitled “The Ever-Expanding 10-K: Why are 10-Ks Getting so Much Longer (and Does it Matter)?” and available here.

Sky Blog

Sky Blog