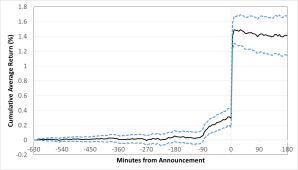

Security prices contain information. Private information is reflected in prices through trading. Public information is generally believed to be incorporated in prices before anyone can trade on it. In a recent study, we examine whether some traders are able to make profitable trades by using public information. Specifically, we analyze futures returns and trading activity around releases of the Weekly Natural Gas Storage Report. This report is issued by the U.S Energy Information Administration (EIA) and contains information about U.S. inventory of natural gas. It is widely followed by traders because its release often triggers large price moves. The report is posted on the EIA website every Thursday at 10:30 a.m. ET. Therefore, it is public information. However, we find evidence of informed trading before the release of the report. The figure below shows that natural gas futures prices begin to drift in the “correct” direction about 90 minutes prior to the announcement. The pre-announcement returns and order flow in natural gas futures are significantly correlated with inventory surprises based on the consensus analyst forecast, suggesting that informed traders correctly anticipate inventory news.

Evidence of Pre-announcement Informed Trading

This figure shows the average cumulative returns of the nearby natural gas futures contract around the release of the Weekly Natural Gas Inventory Report. We invert the sign of returns for positive inventory surprises. Inventory surprises are computed as the difference between the actual change in inventory and the Bloomberg consensus forecast. The dashed lines represent 90 percent confidence interval. The sample period is from July 2008 through January 2016 and contains 334 announcements.

This figure shows the average cumulative returns of the nearby natural gas futures contract around the release of the Weekly Natural Gas Inventory Report. We invert the sign of returns for positive inventory surprises. Inventory surprises are computed as the difference between the actual change in inventory and the Bloomberg consensus forecast. The dashed lines represent 90 percent confidence interval. The sample period is from July 2008 through January 2016 and contains 334 announcements.

The pre-announcement drift begins about 90 minutes before the announcement, which coincides with the beginning of the regular trading hours in the natural gas futures market at 9:00 a.m. ET. The sharp increase in trading activity around that time makes it easier for informed traders to hide their trading. Minimizing risk is another possible reason for delaying trading until shortly before the announcement. Establishing a position long before the announcement would expose the trader to potential losses driven by other news.

Similar evidence of pre-announcement informed trading has been reported in recent studies of macroeconomic announcements. For example, Bernile, Hu and Tang (2016) show evidence of informed trading during the news embargoes before policy announcements of the Federal Open Market Committee (FOMC). Kurov, Sancetta, Strasser and Wolfe (2016) find strong evidence of price drift in equity index and Treasury futures prior to the official release of seven major U.S. macroeconomic announcements. Our evidence for the natural gas inventory announcements shows that the pre-announcement informed trading is not limited to macroeconomic news.

One can think of several channels through which informed traders might obtain informational advantage before the release of the official data. In the first channel, some traders might get advance access to the news due to information leakage. Bernile et al. (2016) show that informed trading before FOMC announcements is associated with the FOMC’s news embargo, suggesting that information about monetary policy decisions may be leaked by those who have early access to FOMC statements. This raises the possibility that access to leaked information gives some traders an unfair advantage.

In the second channel, traders may become informed about upcoming announcements by collecting proprietary information. For example, institutional traders may conduct informal surveys of natural gas storage operators and use the collected data to forecast inventory surprises. Finally, traders might be able to predict announcement surprises through the skillful processing of public information. Kurov et al. (2016) examine this possibility for macroeconomic announcements but are unable to produce clear evidence that the pre-announcement drift is explained by smart reprocessing of publicly available data.

We offer evidence on the public information channel of the pre-announcement informed trading by looking at whether such trading is related to inventory forecasts of analysts with superior historical forecasting ability. Bloomberg assigns ranks to the three best analysts based on their past forecasting accuracy. We use the median of the ranked analyst forecasts as a proxy for the “informed” forecast. We then compute a simple predictor of the inventory surprise as the difference between the “informed” forecast and the regular Bloomberg consensus forecast. Individual analyst forecasts and ranks are available to Bloomberg subscribers before the announcement. Thus, our predictor is based on what effectively is public information.

We show that our simple predictor has explanatory power for the natural gas inventory surprises and for the pre-announcement futures returns. Therefore, we provide evidence that some traders use public information to make well-timed trades before the announcement. A simple trading strategy based on the predictor would have generated a high reward-to-risk ratio. Traders may use public information from a variety of sources and employ sophisticated forecasting models or forecast combinations. Such market participants may be able to predict announcement surprises more accurately, which should translate into even better trading performance.

It is possible that the pre-announcement informed trading is driven in part by information leakage or by proprietary data collection. However, our results show that informed trading due to superior processing of public information is a plausible explanation for the pre-announcement price drift.

Our results have two important implications. First, our predictor is based on information that is common knowledge before the announcement, suggesting that careful analysis of public information can lead to informational advantage. This finding may alleviate concerns of traders and regulators that pre-announcement informed trading is necessarily driven by information leakage. Second, we relate the pre-announcement returns to superior forecasting, suggesting that trading based on such superior forecasts facilitates price discovery in financial markets.

REFERENCES

Bernile, Gennaro, Jianfeng Hu, and Yuehua Tang, 2016. Can information be locked-up? Informed trading ahead of macro-news announcements. Journal of Financial Economics, 121, 496-520.

Kurov, Alexander, Alessio Sancetta, Georg, Strasser, and Marketa H. Wolfe, 2016. Price drift before U.S. macroeconomic news: Private information about public announcements? ECB Working Paper No. 1901. http://ssrn.com/abstract=2778549.

This post comes to us from Chen Gu and Alexander Kurov, who are respectively a doctoral student and an Associate Professor of Finance at West Virginia University – College of Business and Economics. The post is based on their paper, “What Drives Informed Trading Before Public Releases? Evidence from Natural Gas Inventory Announcements,” available here.

Sky Blog

Sky Blog