Crowdfunding has emerged in recent years as an alternative financing channel in which entrepreneurs can directly solicit contributions from a large number of investors. In return for their contributions, investors receive non-pecuniary rewards, private benefits, or most recently, monetary payoffs. In the realm of rewards-based crowdfunding, it is reported that the funding portal Kickstarter has received more than $2.6 billion in pledges from 11.7 million backers and successfully funded 112,897 creative projects since its launch on April 28, 2009.[1] In May 2016, against the backdrop of Title III and Title IV of the Jumpstart Our Business Startups (JOBS) Act, the SEC approved a new type of crowdfunding, in which investors receive monetary payoffs under a contract agreed to at the time of investment. Contracts currently used in this new form of security-based crowdfunding offer returns in the form of equity, debt, or a mixture of both. It remains an open question, however, as to what the optimal contract and form of return should look like.

On a separate note, one of the many claimed benefits of crowdfunding is that it can harness the wisdom of crowds. This argument has been extensively made from the entrepreneur’s perspective: By aggregating the investment decisions of a large number of investors, the idiosyncratic noises associated with each individual’s judgment tend to be diversified. Because of this diversification, the aggregate investment amount provides crucially useful information to the entrepreneur. There are few studies, however, on how the wisdom of crowds could similarly benefit investors.

My recent paper, available here, fills the above two gaps by studying the optimal contract design in security-based crowdfunding that most benefits investors through the wisdom of crowds (apparently such contracts would also indirectly benefit entrepreneurs with promising projects). A general take-away is that the optimal contract (meaning how the investor is paid in relation to the project’s performance) that harnesses the wisdom of crowds is similar to but still different from common stock. Indeed, it is more like a typical equity stake in a partnership.

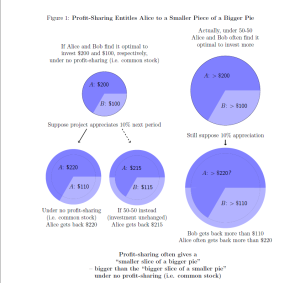

To see the difference, consider a simple example in which only two investors, Alice and Bob, participate in funding a risky project. Assume both investors have their own assessment of the return-per-dollar-invested in the project with some idiosyncratic errors, and the only difference between Alice and Bob is in their assessment. Alice and Bob independently decide on how much money to put into the project, based on their optimal return-risk trade-off. In this case, I show that the optimal contract would be to equally divide the total payoff in excess of the two investors’ initial investments (while each still gets back the exact amount of initial investment). Numerically, if Alice invests $200, Bob invests $100, and the project value appreciates 10 percent (i.e. the total (net) return is ($200+$100) * 10 percent = $30), then Alice gets back $200 + $30/2 =$215, and Bob gets $100 + $30/2 =$115. In comparison, if Alice and Bob are holding common stock, which delivers payment in proportion to their initial investment, then assuming the same investment decisions and project performance, Alice gets back $200 * (1+10 percent) = $220, and Bob $100 * (1+10 percent) = $110.

At first sight profit-sharing might look like a bad deal for Alice. She could get $220 under a common stock arrangement, all else being equal, and why would she prefer profit-sharing to common stock? The answer lies in the fact that profit-sharing changes investors’ risk-taking incentives, as it provides insurance against investors’ idiosyncratic errors in their own assessments. In other words, profit-sharing effectively enhances investors’ ability to bear risk, and the improved risk-sharing among investors allows them to give more weight to their own assessment of the project return when deciding on the optimal investment amount. On average, compared with common stocks, profit-sharing increases the aggregate amount committed from all investors. Thus even if Alice equally divides net profits with Bob, under profit-sharing, she will actually be entitled to a smaller slice of a larger pie (Figure 1 illustrates this further).

My paper goes on to discuss the optimal sharing contract under more general scenarios, in which the number of investors may be large and investors may have different risk tolerances. Overall, the optimal contract that features profit-sharing has three advantages. First, it often achieves the best outcome in terms of harnessing the collective wisdom of all investors. The paper shows that with an optimal profit-sharing contract, under assumptions that perfectly fit the setting of investing in security-based crowdfunding, all investors’ investment decisions as predicted by a Nash equilibrium (a concept in game theory) gives each investor a monetary payoff that is exactly equal to what she could have achieved had she known all other investors’ assessments of the project return, even though she only knows her own assessment.

Second, the optimal profit-sharing contract is simple. It only requires information about an investor’s risk tolerance, and does not depend on how well-informed each individual is, which is private information and often hard to discover. Such simplicity makes implementing the optimal profit-sharing contract particularly easy. For example, on a crowdfunding platform, all information required to determine the optimal sharing rule can be gauged by standard questionnaire items on income, wealth, investment experience, investment objectives, etc. that are readily available at the time someone opens an account. I also show that under an optimal profit-sharing contract, investors do not have incentives to misreport on such questionnaires.

Third, the contract is cost-effective. Because profit-sharing does not involve the direct exchange of private information, there is no need for sophisticated communication technology, no need to offer incentives for providing information, and no need to fear individuals won’t tell the truth.

The paper discusses at length the results’ practical relevance. In this age of information, a contract design that exploits the wisdom of crowds can improve resource allocation, investment performance, and growth of the crowdfunding market. What’s more, it provides valuable insights for developers of crowdfunding platforms, crowdfunding investors and issuers, and the many regulators and lawyers involved in the industry.

ENDNOTE

[1] See https://www.kickstarter.com/help/stats.

This post comes to us from Professor Jiasun Li of George Mason University. It is based on his recent article, “Profit-Sharing: A Contracting Solution to Harness Wisdom of the Crowd,” available here.

Sky Blog

Sky Blog