Central bank law is an unloved part of public law. Maybe that’s because commercial litigators cannot sue central banks, advise the people that sell bonds to them, or argue cases in front of the U.S. Supreme Court to create new doctrines of central bank policy. Yet, new empirical studies may cast light on this unloved sector while pleasing economists eager to put in place something called nominal GDP targeting.

In our recent article, we discuss how to legally authorize central banks to buy private securities like corporate stocks and bonds. We find that the easiest way is to make the central bank responsible for the prices of goods and services in the economy – as well as their amount and value; in other words, to target nominal GDP.

Imagine that central bank purchases of private securities would, at times and under the right circumstances, boost investment. How could we draft laws, particularly in developing countries, to maximize that boost?

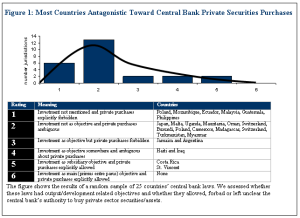

Many policymakers think that central banks have the legal (or at least operational) mandate to buy only government securities. Perceived restrictions on private asset purchases stem from a historical accident – rather than conscious design. Historical tradition led the U.S. Federal Reserve Bank to adopt a “Treasuries only” policy, despite the Federal Reserve Act’s much-debated article 13 (which allows the Fed to buy private assets). Following this conventional wisdom, few countries’ central banking laws provide for private asset purchases. In fact, most such laws remain antagonistic to such purchases. Figure 1 compares central bank laws across countries according to whether they have output-investment related objectives and provide for central banks to buy private sector securities. Only about 25 percent of jurisdictions in our random sample of 25 countries had central banking laws which included economic growth or development as a goal. The same percentage remain completely hostile to such purchases – completely ignoring output growth as an objective and explicitly forbidding private securities purchases. Developing countries’ central banking laws in general prohibit non-conventional private sector asset purchases either during crises or in normal times.

Since the global economic crisis, many countries have considered using central bank purchases of private assets to prop up asset values – in effect making central banks funders (rather than lenders) of last resort in places like Russia. In the UK and elsewhere, central bank rules increasingly allow central banks to hold private securities as collateral against bank loans – making the central bank still the final funder. Skeptics pejoratively refer to these purchases as get rich quick schemes. Yet, if our evidence is correct, such central bank purchases can help boost investment, and thus growth.

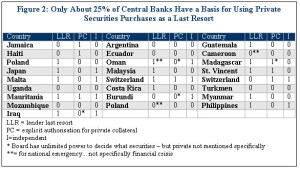

Even if true, few countries have the de jure legal provisions in place to address crises using central bank purchases of private securities – making their de facto use both risky and unpredictable. Figure 2 shows the countries from our random sample whose central bank laws cover their banks’ conduct during a crisis (or as a lender of last resort) as well as having clear rules for engaging in private asset purchases and the independence needed to act when government cannot. Burundi’s law (at article 10), for example, allows its central bank to purchase assets of any kind (and indeed hold collateral from banks for their loans). Poland’s central bank law (at article 30) forbids the bank from holding private securities and has no special section dealing with either financial emergencies (and thus a lender of last resort function) or its independence.

How to endow central banks with a simple mandate to buy private assets and otherwise promote stabilization and growth? Despite calls for nominal GDP targeting among economists, legal scholars have paid almost no attention to central bank rules as an important area of public law. Economists have recently generally favored nominal GDP targets, which provide both discipline and flexibility. Authors like Hoelle and Peiris find that such rules would ensure a Pareto efficient outcome only if all countries adopted them rules simultaneously and all economic actors wanted the same things.

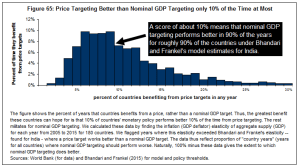

The very limited data available suggest that nominal GDP targeting would perform better than the current approach to targeting prices. Bhandari and Frankel in particular look at a social loss function similar to the Taylor monetary rule – one which penalizes deviations from optimal output and low inflation rates. They find, in the Indian context, that a nominal GDP target would have raised welfare more than would have price targets. In particular, they identify the level of price elasticity of output that would make central banks prefer a price target (roughly 2.14).] Building on their work, we calculate the price elasticity of GDP for all the jurisdictions for which the World Bank have data – repeating the same procedures used by Bhandari and Frankel. Figure 3 shows the percentage of countries and the percentage of years (from 2005 to 2015) where price elasticities of output rose high enough to make price targets worthwhile. As shown, their model would only choose a price target in about 10 percent of the cases. Authors like Beckworth and Hendrickson generalize these results – showing that, under reasonable assumptions, such nominal GDP targets generally outperform other types of monetary policy rules.

Existing central bank law reveals the benefits of targeting nominal GDP. The Russian Central Bank law shows why a similar nominal GDP targeting rule provides far more transparency and accountability than a piecemeal approach. In our article, we identify the various provisions in the 86 page law (the longest in our sample). Article 2 of the law vesting federal ownership in any property owned by the Bank of Russia could exert a potentially market chilling effect on any private sector securities purchase program. Numerous provisions allow for such provisions – under relatively ill-defined conditions and usually as a way of funding government entities. As we show in our previous review of central bank laws, both authorizations and prohibitions on buying private sector assets exist – usually leaving the decision up to the central bank’s governing board. Such ad hoc authorizations to buy private sector securities are a far worse basis for central bank policymaking than simply requiring the central bank to achieve a certain inflation and output mix.

Adding a nominal GDP target as a primary objective of a central bank law would also prevent much of the legal contortions central banks currently use to effect such transactions. The U.S. Fed, for example, would not need to register a legal entity like “NGDP Targeting LLC” to engage in such purchases. Such an objective is far more specific than, say, the one in Haiti’s law, which calls for “promoting the development of the national economy.” Why leave such nominal GDP targets abstract and diffuse when central bank laws can incorporate them directly?

We describe in our paper six approaches for incorporating such a legal requirement in the different systems we reviewed. The simplest is to modify existing objectives to focus on a nominal GDP target. Poland’s law, for example, could change to read, in section 3,, “The basic objective of the activity of NBP shall be to promote the growth of nominal GDP, namely growth in the real economy while maintaining price stability, while supporting the economic policy of the Government…” As previously seen, lawmakers could consign output-based targets to subsidiary tasks and objectives. In Poland’s case, such an objective might read “ensure the equitable, sustainable growth of nominal GDP, investing as necessary in productive assets while guaranteeing the stability of prices and foreign exchange.” Nothing forbids the central bank from carrying out the other objectives enshrined in its central bank law.

Lawmakers might consider the following legal drafting strategies:

- Direct application. Adding nominal GDP growth as a primary or, if that’s not possible, secondary objective during an economic crisis for the purposes of stabilization. The legislature can decide whether to set up a limited account from which the central bank can conduct purchases.

- Through government policy. For central bank laws requiring that government rules be followed, an executive decree could simply establish the nominal GDP target and provide the authorization to purchase private securities on an independent basis.

- Definition of already existing objectives. When a central bank law already refers to economic objectives, add the purchase of non-inflationary, GDP growth enhancing portfolio holdings in the short or long run – rather than leaving it to a monetary policy committee to decide.

- Lender of last resort and stabilization rules. When the central bank law includes sections on the bank’s role as lender of last resort or in stabilizing the economy, explicitly allow for the purchase and holding of private securities directly.

- Distribution rules for monetary unions. When a crisis affects several members of an economic union, either a separate treaty or negotiated regulation could define the level of private asset purchases from each country and what shares the bank could buy from which jurisdiction.

- Relations with national development banks. The law would define conditions under which the bank would transfer securities to the development bank (if existing) or operate a department as a developmental arm.

Why would a nominal GDP target authorize a central bank to participate more directly in private securities markets? The Bahamas central bank law provides an obvious example. The Bank’s objectives at article 5 require the Bank to “a) promote and maintain monetary stability and credit and balance of payments conditions conducive to the orderly development of the economy, b) in collaboration with the financial institutions, to promote and maintain adequate banking services and high standards of conduct and management therein, and c) to advise the Minister.” Almost as an after-thought, the law allows the bank to buy corporate bonds or securities, or to lend in general. One could hardly imagine a situation where such purchases or loans aimed primarily at maintaining monetary stability (as required by the bank’s objectives).

At the very least, the explicit mandate to maximize nominal long-term, risk-adjusted, nominal GDP would simplify central bank laws. In our study, we reviewed the numerous cases where central bank laws repeated authorizations to buy securities. In a developing or emerging market context, central bank asset purchases should probably focus less on public debt and securities and more on private sector securities. Putting authorization for buying private securities in a subsequent section only diverts attention from the central bank’s dual role in maximizing real output (with optimal inflation). If such measures were enacted, central bank law would be at least a step closer to the rest of public law.

This post comes to us from Professor Bryane Michael of Oxford University. It is based on a recent article he wrote with Professor Viktoria Dalko of Hult International Business School, “Funders-of-Last-Resort: Legal Issues Involved in Using Central Bank Balance Sheets to Bolster Economic Growth,” available here.

Sky Blog

Sky Blog