Where jurisdictions differ in how they regulate an activity, migration allows private parties to choose between regulatory regimes. In the context of financial regulation, scholars assert that harmonization of regulation across jurisdictions is necessary to prevent institutions from opting into the laxest regulatory regime through relocation.[1] This assertion relies on two assumptions: (1) financial institutions indeed move in response to burdensome regulations, and (2) unilateral regulation is insufficient to achieve regulatory objectives with respect to offshore institutions. My recent project provides the first empirical evidence supporting that financial institutions relocate activities in response to derivatives regulation. Charges that unilateral financial regulation is inadequate for achieving legitimate policy goals, however, are generally overstated.

The Dodd-Frank Act initiated the regulation of swap markets. Swaps are contracts that allow parties to shift risk, such as the risk of interest rates, currency exchange rates, or other economic variables fluctuating; the risk of a borrower defaulting on its debt obligations; or the risk of variations in harvests or mortality due to weather or pandemics. When a party seeks to shift risk through a swap, it contacts one or more “swap dealers.” A swap dealer responds with the price and other terms for entering into the trade, and if the parties reach agreement on terms, the swap is executed. As a matter of business practice and—subsequent to the imposition of the Volcker Rule on banks and their affiliates[2]–regulatory requirements, swap dealers generally do not retain market risk assumed in swap transactions (e.g., the risk that the level of the relevant index will fluctuate). Instead, after assuming this risk from a counterparty, a swap dealer seeks to offload it through one or more reciprocal transactions. These transactions transfer risk between swap dealers until customers are identified with inverse demands to the customer transferring the risk into the network of swap dealers.

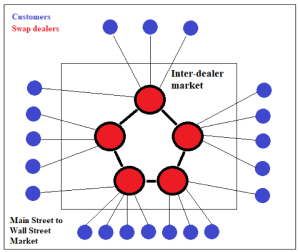

The following simplified example helps to illustrate swap market structure. Consider a soft drink producer that uses corn syrup in its manufacturing. The producer may want to reduce the risk that corn prices fluctuate and enters into a swap with a dealer pursuant to which the producer periodically receives the floating price of a quantity of corn (called the notional) while paying a fixed price for that quantity. The dealer taking on the risk of corn price fluctuation (i.e., going short) then has to find one or more counterparties to enter into an offsetting trade with (i.e., enter into a long position). After a chain of transactions, the dealer community may eventually find, for example, a major corn farmer that wants to lock in the price at which she can sell her inventory. The farmer would enter into the inverse of the trade by the soft drink producer, asking a dealer to make payments for a quantity of corn at a fixed price in return for the farmer paying the dealer the market price of the corn periodically over the term of the swap. As a result of this chain of transactions, the soft drink producer periodically receives enough cash under the swap to cover prevailing costs of ingredients, while the farmer periodically receives a fixed amount of cash for selling its inventory. There are many other contexts in which customers reach out to dealers to shift risk through a swap, but the example illustrates the interdependent function of two distinct markets: (1) a market between users of swaps and the dealers that provide swaps to them, and (2) an inter-dealer market where swaps are traded wholesale. Figure 1 depicts these two markets, calling the first a market between Main Street and Wall Street, and the second market consisting of the few dozen major swap dealing firms, an intra-Wall Street Market.

Figure 1

Although much of the focus in congressional autopsies of the financial crisis and scholarship calling for swap regulation was on credit default swaps, Title VII of the Dodd-Frank Act imposed substantially similar requirements with respect to all swaps—a diverse and massive market, a small fraction of which consists of credit default swaps. The regulatory requirements are substantial and costly[3], including central clearing and platform execution of some swaps, mandatory minimum margin for uncleared swaps, and customer protection rules meant to address information asymmetries between dealers and their customers. One of the many requirements is the initiation of swap reporting, enabling the weekly production of aggregated data on swap market activity by the Commodity Futures Trading Commission (CFTC).[4]

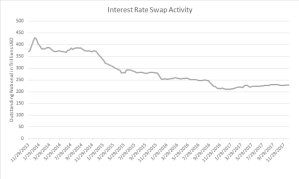

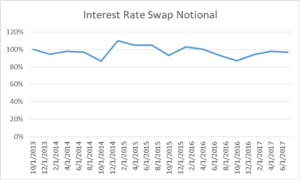

Standardized, public CFTC data begins to track swap activity in late 2013. The largest U.S. swap market is the interest rate swap market, which is valued at approximately $15 trillion.[5] Economists believe the size of the interest rate swap market is comparable to the size of the U.S. treasuries market ($16 trillion), corporate bond market ($12 trillion), mortgage market ($15 trillion), and municipal securities market ($4 trillion).[6] At first glance, CFTC data on the U.S. interest rate swap market shows a massive financial implosion, as illustrated in Figure 2.

Figure 2

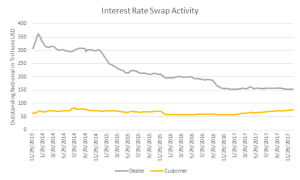

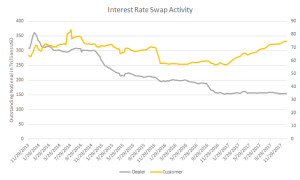

U.S. interest rate swap activity appears to have declined by approximately 40 percent between the end of 2013 and the end of 2017. CFTC data, however, breaks out swap activity involving a customer from inter-dealer activity. As shown in Figure 3A (using the same Y axis for customer and inter-dealer data) and Figure 3B (using distinct Y axes for customer and inter-dealer data), U.S. customers’ usage of swaps did not decline during this period, in fact, it increased approximately 10 percent. The two figures are used to illustrate the distinct trends in the customer and inter-dealer market, while also presenting the relative size of the two markets (the inter-dealer market is much larger than the customer market due to the number of intermediating transactions that occur before risk is transferred between customers desiring to go long and customers desiring to go short).

Figure 3A

Figure 3B

The massive decline in the U.S. interest rate swap market is not due to fewer swaps being supplied to customers. Rather, the decline represents an approximately 50 percent reduction in the U.S. wholesale market. Examining CFTC data alone, it appears that dealers may have become more efficient in intermediating risk, and fewer links are required in the inter-dealer chain to connect customers with inverse demands. CFTC data, however, are not the only source of information on swap transactions involving U.S. financial institutions.

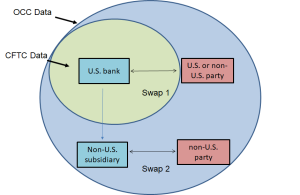

The Office of the Comptroller of the Currency presents aggregated information on the swap activities of U.S. banks and their subsidiaries on a global basis.[7] Figure 4 shows swaps covered in OCC but not CFTC data.

Figure 4

U.S. banks and their subsidiaries represent a substantial portion of the swap dealers supplying interest rate swaps to U.S. customers.[8] The approximately 50 percent decline seen in U.S. inter-dealer activity is difficult to explain absent changes in interest rate swap dealing activity of U.S. banks and their subsidiaries. Yet OCC data shown in Figure 5 reflects nothing close to a 50 percent decline in the relevant period.

Figure 5

Figure 5 charts the interest rate swap activity of U.S. banks during the relevant period relative to an end of 2013 baseline. When the activity of their global subsidiaries is included, U.S. banks’ participation in inter-dealer markets does not appear to have declined substantially. What can explain leading swap dealers going into hibernation within the U.S. while remaining about as active as they have been on a global level and U.S. customer use of swaps increasing? Perhaps U.S. swaps dealers have become more efficient at intermediation within the U.S. while (a) those efficiencies did not translate outside of the U.S., and (b) foreign customer demand for swaps grew substantially? But that is a complicated story, requiring several unrelated coincidences to occur in the late fall of 2013, when the extraterritorial reach of U.S. swap regulations was finalized. A simpler story is that U.S. swap dealers shifted inter-dealer trading into offshore subsidiaries. News reports support this simpler narrative. [9]

What does this evidence of migration in swap markets teach about the risks of regulatory arbitrage and the potential for unilateral regulation? Observation of swap markets after the implementation of Title VII cautions against categorical statements regarding the need for international harmonization. The risk migration poses to regulatory goals depends on the financial service at issue and the policy objective.

There is no evidence that swap customers collaborated with swap dealers to escape U.S. regulatory ambit. The volume of transactions between customers and dealers that is subject to CFTC regulation did not decline in the relevant period; in fact it grew. These observations are consistent with priors on the relative costs and benefits of migration. From the customer’s perspective, migration is only desirable if (a) the customer’s share of private surplus from lower regulatory burdens achieved through relocation to a laxer regime outweighs (b) the costs of relocation. Because the swap regime is territorial[10] like many other financial regulatory regimes, more than reincorporation in the foreign jurisdiction is needed, and the costs of (b) include the costs of relocating personnel and other operations needed to receive the financial services at issue (and where the service involves longstanding liabilities such as a swap or loan, independently capitalizing the foreign subsidiary).[11] Many factors will influence this calculus, including the extent to which the regulatory regime benefits the customer (as at least some customer protection and other market integrity rules are expected to do), the frequency and size of the customer’s transactions, the value of the transactions to the customer’s business, and the costs of relocation. A related question is whether regulatory protections may be waived by their intended beneficiaries (and if so, whether waiver should require migration or should be less costly to effectuate)? Satisfying these inquiries should be a case-by-case exercise with some empirical component.

While in corporate law, reincorporation can unilaterally change legal obligations vis-à-vis shareholders pursuant to the internal affairs doctrine, and anti-pollution laws may be based on the location of a plant, financial regulation is not the regulation of financial institutions per se. Rather, financial regulation is the regulation of financial services, and financial services necessarily involve at least two parties. Unless customers partner with financial services providers in relocation, regulatory goals concerned with the market between financial institutions and their customers can typically be achieved on a unilateral basis.

Relocation may be a greater risk to policy goals concerned with the intra-Wall Street market, such as the containment of systemic risk. However, even the offshoring of operations into foreign subsidiaries discussed above is not immune to unilateral regulation. Presumably, the primary interest of the United States is in preventing the inflow of risk through the dependence of U.S. parents on their foreign subsidiaries. This interest may be achieved through regulation at the parent level, notwithstanding that the activities of the foreign subsidiary may be beyond reach. For example, to limit exposure of U.S. banking groups to the activities of unregulated foreign subsidiaries, the Federal Reserve may be authorized to restrict interdependence between foreign subsidiaries of U.S. bank holding companies, on the one hand, and their domestic parents and other affiliates, on the other hand. Restrictions could involve limitations on cross-defaults, business dependencies (such as cross-branding), and contributions to foreign subsidiaries (whether in any given period or in times of market turmoil). Where capital rules apply to a U.S. entity, haircuts may be imposed on its equity in foreign subsidiaries to recognize the greater risk they may pose due to their unregulated conduct. In short, the same basis that legitimizes the regulatory goal—the interest of a sovereign in protecting the stability of its domestic financial institutions—also provides the hook for unilateral regulation at the parent level.

To say that unilateral regulation is generally sufficient to achieve policy goals is not to say that harmonization would not ease the regulatory project. Regulating at the parent level as suggested above to deal with risks from foreign subsidiaries would generally require action by the Federal Reserve (and other banking agencies), whereas domestic swap regulations are primarily implemented by the CFTC and SEC.[12] Overcoming barriers to coordination between agencies (and congressional committees) is no easy task. Furthermore, in times of market stress, there may be political pressure to relax restrictions on U.S. parents privately bailing out their foreign subsidiaries. Harmonization reduces the challenges of solving for interactions between regulated domestic activity and non- (or differently-) regulated foreign activity. Harmonization reduces the engineering challenges in regulatory design.

Harmonization also has benefits beyond serving policy goals typically associated with U.S. financial regulators. Through harmonization, jurisdictions can prevent the distributive consequences of migration as business activity departs to countries with laxer regimes. Although these departures may not threaten financial stability, market integrity, or any of the other legitimate concerns of financial regulators, they may represent political and economic losses to the regulating jurisdiction. Migration also imposes deadweight loss, in the form of first-best geographic alternatives being abandoned in favor of regulatory cost minimization. It remains for further scholarship to explore these alternative explanations for calls to harmonize financial regulation.

ENDNOTES

[1] See, e.g., Chis Brummer, How International Financial Law Works (and How It Doesn’t), 99 Geo. L.J. 257 (2011); Pierre-Hugues Verdier, The Political Economy of International Financial Regulation, 88 Ind. L.J. 1405 (2013); David Zaring, Financial Reform’s Internationalism, 64 Emory L.J. 1255 (2016).

[2] The Volcker Rule does not apply to all swap providers in theory as some swap providers may not be affiliated with banks, however, in practice, the great majority of swap dealing activity is from banks and bank affiliates (although this varies by asset class, with non-bank affiliates having a greater role in physical commodity markets such as energy, metals and agriculture). The Volcker Rule is not the only regulatory lever pushing financial institutions to offload rather than warehouse risks. Hedging also provides relief from capital requirements.

[3] As a sample, swap dealers are estimated to now commit over $1.4 trillion in margin for cleared and uncleared trades. Hayley McDowell, Over $1.4 Trillion in Collateral Posted by Top Swaps Dealers, Global Custodian (Sept. 18, 2017). See Basel Committee on Banking Supervision & Board of the International Organization of Securities Commissions, Margin Requirements for Non-centrally Cleared Derivatives (Feb. 2013); Basel Committee on Banking Supervision & Board of the International Organization of Securities Commissions, Margin Requirements for Non-centrally Cleared Derivatives (Sept. 2013). This figure reflects mandatory purchases of liquid, high-grade assets that have lower returns than alternative investments swap dealers may make. Kevin McPartland, Total Cost Analysis of Interest-Rate Swaps vs. Futures, Greenwich Associates (March 9, 2015). Including service costs charged by clearinghouses and their members for clearing a swap, the costs of a $1 trillion interest rate swap position with a 10 year duration held for two years is over $400 million. Annual costs of clearing for a market exceeding $100 trillion in notional amount to tens of billions of dollars. Because these amounts represent the costs of risk management, which would occur in an unregulated world to some extent, the measure is an over-estimate of costs. But mandatory clearing comes with some extra costs, and the costs of entering into uncleared swaps are by regulatory design even higher. In addition, the potential for end-user participation in dealer-to-dealer markets through SEFs and DCMs risks compromising the profits swap dealers receive through preferential wholesale rates in the dealer to dealer market. Although collateral costs and erosion of oligopolistic pricing in inter-dealer markets may represent the greatest private costs motivating relocation, direct compliance costs are also present. For the 15 largest swap dealers in the U.S., the costs of building compliance technology were estimated at approximately $5 billion. Capgemeni, Impact of Title VII of the Dodd Frank Act (2011). The annual cost of swap regulation in the European Union was estimated at €15.5 billion. Deloitte, OTC Derivatives: The New Cost of Trading (2014). Lawyers, compliance professionals, and back office enhancements represent additional costs.

[4] Title VII divides regulation of swap markets between the CFTC and the Securities and Exchange Commission (SEC). The CFTC regulates the great majority of the swaps markets, with the SEC regulating “security-based swaps” which are generally speaking swaps that base cash flows on the financial performance of one issuer or a narrow basket of issuers. See https://www.sec.gov/swaps-chart/swaps-chart.pdf.

[5] Richard Haynes, John Roberts, Rajiv Sharma & Bruce Tuckman, Introducing ENNs: A Measure of the Size of Interest Rate Swap Markets (Jan. 2018) available at http://www.cftc.gov/idc/groups/public/@economicanalysis/documents/file/oce_enns0118.pdf.

[6] Id.

[7] See, e.g., OCC, Quarterly Report on Bank Trading and Derivatives Activity (2017 Q4).

[8] At least 95 five percent of all interest rate swap dealing originates from banks or bank affiliates. The extent of dealing within the U.S. by non-U.S. banking institutions is uncertain, but reports estimate that non-U.S. banks represent approximately 20 percent of banking assets in the U.S. Within U.S. bank holding companies, 60 percent is a low end estimate of the interest rate swap dealing taking place in banks and their subsidiaries. Although there is uncertainty about the estimate, OCC data is expected to cover approximately 40 percent of U.S. swap dealing.

[9] Charles Levinson, U.S. Banks Moved Billions of Dollars in Trades-Beyond Washington’s Reach, Reuters (Aug. 21, 2015) online at https://www.reuters.com/investigates/special-report/usa-swaps/ (“Major banks had tweaked a few key words in swaps contracts and shifted some other trades to affiliates in London, where regulations are far more lenient. Those affiliates remain largely outside the jurisdiction of U.S. regulators, thanks to a loophole in swaps rules that banks successfully won from the Commodity Futures Trading Commission in 2013.”).

[10] Interpretive Guidance and Policy Statement Regarding Compliance with Certain Swap Regulations, 78 Fed. Reg. 45292, 45309 (July 26, 2013).

[11] Guarantees are generally inadequate for providing credit support in this context, because transactions guaranteed by a U.S. entity will be within the regulatory ambit of the CFTC and SEC.

[12] Capital and margin requirements for banking institutions were written by the banking agencies, however, the applicability of those requirements among many others turns on whether an entity is a swap dealer. That threshold determination is made under regulations the CFTC and SEC co-authored, which pursuant to subsequent guidance by the CFTC, exempts foreign non-guaranteed subsidiaries engaging in dealing transactions with other foreign non-guaranteed entities.

This post comes from Ilya Beylin, an acting assistant professor at NYU Law School. The post is based on his article “The Real but Exaggerated Threat of Regulatory Arbitrage to International Financial Regulation,” which is available here.

Sky Blog

Sky Blog