Our new academic study examines the long-term effects of interventions by activist hedge funds. Prior studies document positive equal-weighted long-term returns and operating performance improvements following activist interventions, and typically conclude that activism is beneficial to shareholders. We challenge and extend prior literature in two ways. First, we find that equal-weighted long-term returns are driven by the smallest 20 percent of firms with an average market value of $22 million. The largest 80 percent of firms experience insignificant negative long-term returns. On a value-weighted basis, which likely best gauges effects on shareholder wealth and the economy, we find that pre- to post-activism long-term returns are insignificantly different from zero. For operating performance, we find that prior results are a manifestation of abnormal trends in pre-activism performance. Using an appropriately matched sample, we find no evidence of abnormal post-activism performance improvements. Overall, our results do not strongly support the hypothesis that activist interventions drive long-term benefits for the typical shareholder. However, we also do not find evidence of shareholder harm.

* * * * * *

The economic consequences of activist hedge fund interventions are widely debated. Proponents assert that companies with engaged shareholders are more likely to succeed because attentive shareholders mitigate natural agency problems. They also claim that shareholder activists are an important component of the disciplining role played by the market for corporate control. Opponents allege that hedge fund activism is either an uninformed distraction or a mechansim for some investors to take the money and run. In its extreme form, activism is claimed to weaken companies by imposing a short-term perspective on managers.

Our study, “Long-Term Economic Consequences of Hedge Fund Activist Interventions,” investigates two shortcomings in the existing literature on hedge fund activism. First, the existing literature measures long-term effects based on equal-weighted mean abnormal stock returns. However, positive equal-weighted mean returns do not necessarily indicate activist interventions enhance the wealth of the average investor. Because the largest 20 percent of U.S. public firms make up 91 percent of the total market value, an activist intervention for a large firm likely has a far bigger impact on investors than an intervention for a small firm. Thus, for regulators evaluating the impact of activist interventions on shareholder wealth and the market at large, meaningful analysis should examine the distribution of returns across firms and, in particular, value-weighted average long-term stock returns. A second shortcoming in existing activism literature is that tests of post-activism changes in operating performance typically do not adequately control for natural trends accounting metrics.

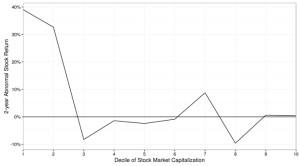

Our first analyses examine stock returns. Similar to prior research, we find that short-term equal-weighted average returns around activist intervention announcements are significantly positive at 5.4 percent, and the cumulative two-year long-term returns are significantly positive at 5.9 percent. However, as shown in Figure 1, the positive long-term returns are concentrated in the smallest 20 percent of targets with an average market value of just $22 million.

Figure 1: Average two-year abnormal stock returns for activism targets, by market cap decile

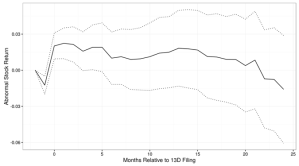

Figure 2 shows that equal-weighted average long-term returns for the largest 80 percent of targets are initially positive but become insignificant within three months of activism and become an insignificantly negative -1.6 percent at the end of two years.

Figure 2: Path of two-year abnormal returns excluding the smallest 20% of firms

Looking at returns on a value-weighted basis, short-term returns for the pooled sample are significantly positive but less than half the size of the equal-weighted returns. Long-term returns are insignificantly differently from zero, and fewer than half of all activist targets experience positive long-term returns. Clearly, a minority of small firms drives the positive equal-weighted long-term returns found in prior academic studies. From a value-weighted perspective, our returns tests provide minimal support for the hypothesis that activist interventions drive long-term increases in wealth for the typical shareholder. However, they also do not show evidence of shareholder harm.

Our second set of analyses focus on long-term operating performance for the targets that survive as public companies for at least two years following an activist intervention. We show that hedge fund activism targets experience unusual declines in operating performance prior to the activist intervention. After controlling for this unusual decline, we find no evidence of improvements in accounting-based measures of operating performance and efficiency in the years following activist interventions. Further tests fail to find consistent operating improvements in subsets of firms with large asset sales, a CEO change, high board turnover, or high shareholder payouts. Overall, we find little evidence that commonly discussed strategy and governance motivations for activist interventions drive improvements in shareholder wealth. In sum, across a large battery of tests, we fail to find consistent evidence that activists drive changes in accounting-based operating performance.

Our final analyses examine the 26 percent of targets that delist and are not included in our operating-performance tests. Of these, 19 percent are acquired by another firm and experience significantly positive long-term returns. The remaining 7 percent delist for other reasons and experience significantly negative returns. These results indicate nearly all the positive long-term returns to activist interventions are concentrated in firms that are subsequently acquired.

In sum, our study provides two new insights to the academic literature. First, we confirm prior findings of significantly positive equal-weighted mean short- and long-term returns to activist interventions, but find these positive returns are primarily driven by the smallest 20 percent of targets. Value-weighted short-term returns are less than half the size of the EW returns, and cumulative pre- to post-activism long-term returns are insignificantly different from zero. Nearly all of the positive long-term returns to activist interventions are concentrated in firms that are acquired. Second, using an appropriately matched sample, we find no evidence that activist interventions induce long-term improvements in a broad set of accounting-performance variables.

Our findings contribute significantly to the debate on the costs and benefits of hedge fund activism. Public discourse frequently cites academic findings that activist interventions produce improvements in long-term value and operating performance, and these findings have likely influenced investors and regulators. Our findings do not strongly support arguments that activist interventions drive long-term wealth for the average investor. At the same time, we find no evidence that activist interventions destroy value, so our findings also fail to support critics’ proposals to restrict activism. However, like most studies of hedge fund activism, our results speak solely to the first-order effects of activist interventions on the shareholders of target firms. Broad policy analyses should also consider a comprehensive set of costs and benefits, including whether hedge fund activism has externalities for peer firms or a disciplining effect on managers in general.

This post comes to us from Professor Ed deHaan at the University of Washington’s Michael G. Foster School of Business, Professor David. F. Larcker at Stanford University’s Graduate School of Business, and Professor Charles McClure at the University of Chicago’s Booth School of Business. It is based on their recent paper, “Long-Term Economic Consequences of Hedge Fund Activist Interventions,” available here.

Sky Blog

Sky Blog