Corporate expatriations – transactions that lead a U.S. company to become the subsidiary of a foreign parent – present two problems for the U.S. Internal Revenue Service (I.R.S.). First, they give expatriated companies the opportunity to use tax minimization strategies to avoid taxes; second, they erode the U.S. corporate tax base. Though both actions are driven by idiosyncrasies in U.S. tax treatment of foreign income, they spring from different motivations, and lead to different kinds of harm. Tax minimization involves exploiting differences in national tax laws to shield income from arguably legitimate U.S. tax obligations, while tax base erosion involves legitimately placing income beyond the reach of the I.R.S. While it has been argued that tax minimization is a kind of cheating, it has also been argued that tax base erosion is a response to government overreach.

The government’s attempts to limit corporate expatriation have focused on eliminating so-called “tax inversion” transactions, or transactions without “sufficient non-tax effect and purpose (S. Rep. No. 107-188, at 4 (2002) (legislative history of the Reversing the Expatriation of Profits Offshore Act)).” The tests Congress adopted (codified in section 7874 of the Internal Revenue Code (26 U.S.C. § 7874 (2012), 7874) attempt to draw a line between “inversions” and what the I.R.S. calls “legitimate” expatriations (U.S. Department of the Treasury, Fact Sheet: Treasury Actions to Rein in Corporate Tax Inversions (Sept. 22, 2014)) by testing ownership continuity between the former shareholders of the U.S. entity and the shareholders of the U.S. entity’s new foreign parent, and by requiring the new parent conduct “substantial” business activity in the parent’s home jurisdiction. Under these tests, some inversions are treated as if they did not occur and others are segregated for further scrutiny. Essentially, 7874 sets conditions on when and how companies may (for tax purposes) leave the country – an enforcement mechanism apparently directed at slowing tax base erosion rather than addressing tax minimization.

Recent rules and legislation suggest the administration is abandoning 7874’s focus on identifying “bad” expatriations (inversions) in favor of a new, inversion-indifferent focus on tax minimization tactics employed by U.S. companies with foreign parents. This change may result from the realization that the old approach isn’t working. Our analysis suggests that while 7874 has, in fact, reduced the number of inversions it has not reduced the number of expatriations.

On April 8, 2016 the I.R.S. issued regulations elevating previously released anti-inversion guidance to temporary rule status (Inversions and Related Transactions, 81 Fed. Reg. 20,858-01 (Apr. 8, 2016), Inversion Rules), and enacting new rules designed to eliminate the tax minimization tactic known as earnings stripping. Soon after, Sander Levin introduced the Protecting the U.S. Corporate Tax Base Act of 2016 (H.R. 5261, 114th Cong. (2016), H.R. 5261), which aims to stop two other tax minimization tactics, hop-scotching and de-controlling, used by U.S. companies with foreign parents to access the untaxed overseas income of controlled foreign subsidiaries. Both H.R. 5261 and the Inversion Rules are inversion-indifferent, meaning that they operate against any U.S. company with a foreign parent.

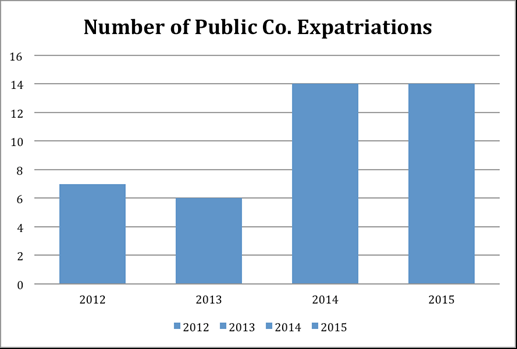

In recent months, we’ve noted a decrease in the number of inversions, and a corresponding uptick in expatriations that are not inversions (under 7874). Thus, while the number of inversions decreased, the number of public company expatriations, and the erosion of the U.S. tax base, continued at the same rate.

In 2014 there were 14 announced expatriations of U.S. public companies; all 14 were inversions. 2015 also saw 14 announced expatriations, but only nine were inversions.

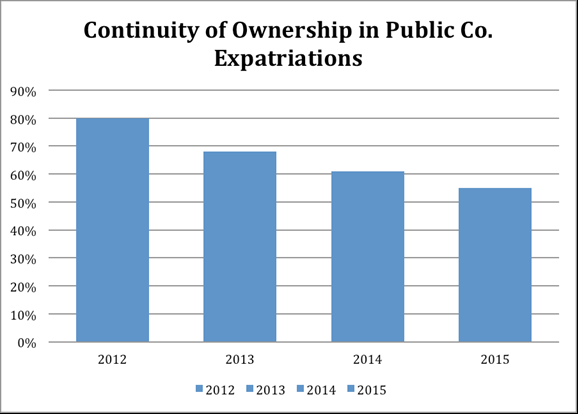

Our analysis shows a consistent decline in continuity of ownership in public company expatriations. In 2015, many expatriations fell below the ownership level that would have qualified them as 7874 inversions. In ten transactions in 2014, the former owners of the U.S. entity received 50% or more of the shares of the new foreign parent. In 2015, that number declined to seven.

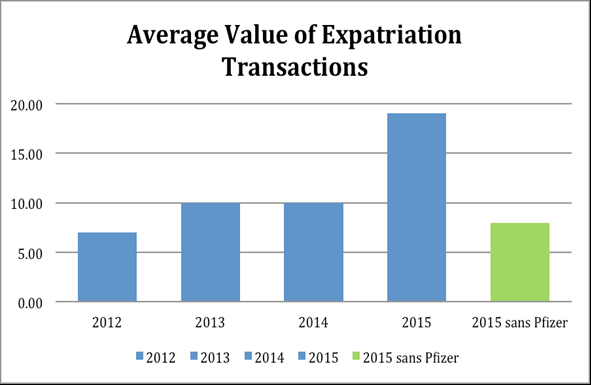

While the number of expatriations in 2015 was the same as in 2014, the average value of expatriation transactions (not including Pfizer / Allergan) decreased from $10 billion in 2014 to $8 billion in 2015.

The Protecting the U.S. Corporate Tax Base Act of 2016 probably won’t become law, but it seems likely that it is only the opening salvo along a new front in the battle on corporate expatriation.

The preceding post is based on analysis authored by Craig Eastland, Business Law Expert on-Call at Thomson Reuters. The analysis was published on June 6, 2016 and is available here.

Sky Blog

Sky Blog