Family does matter in the United States. Census data indicate that more than 20 percent of men have worked for the same employers as their fathers, while a recent New York Times article suggests that the sons of senators have a 8,500 times higher chance of becoming senators than the average American male. A large body of empirical research in economics and finance has been devoted to the study of family firms and their role in the economy. Yet little is known about the implications of widespread family ties outside family-owned firms.

In an attempt to measure how widespread family connections actually are, we gather information on family ties from firms’ proxy statements. The U.S. Securities and Exchange Commission requires each company to disclose in those statements the presence of any family relationship (by blood, marriage or adoption, not more remote than first cousin) among individuals holding an important role in the company. Such ties involve both business relationships (two family members are employed by the same firm) and financial relationships (a family member is employed while the other is a shareholder with voting power).

We track the family ties disclosed by 7,336 public U.S. firms for the period from 1994 through 2014. We use a crawling algorithm to search in each filing for key words identifying family relationships among people with interests in the firm. As an example, consider Standard Motor Products, a manufacturer and distributor of automotive parts headquartered in Long Island City, New York and listed on the New York Stock Exchange. Standard Motor filed a proxy statement on April 4, 2003, prior to the annual meeting in which 11 directors were to be elected. The 11 nominees presented included, Lawrence Sills (grandson of the founder), Arthur Sills (Lawrence’s brother), Peter Sills (brother of Arthur and Lawrence), Arthur Davis, Susan Davis (Arthur’s wife) and Marilyn Cragin (sister of Susan).

We find family ties to be pervasive in our sample, which covers most of the publicly traded firms in the United States. More than half of the firms disclose at least one family connection. Some firms disclose more than 40. Overall, the most common ties are those among the key executives of the firm and their wives and sons. Disclosed family members also include fathers, mothers, uncles, cousins, ex-wives, nephews and a grandfather. Additionally, family ties are widespread across several industries. Classifying the firms in our sample into 48 main sectors, only the tobacco industry discloses less than one family tie per firm on average.

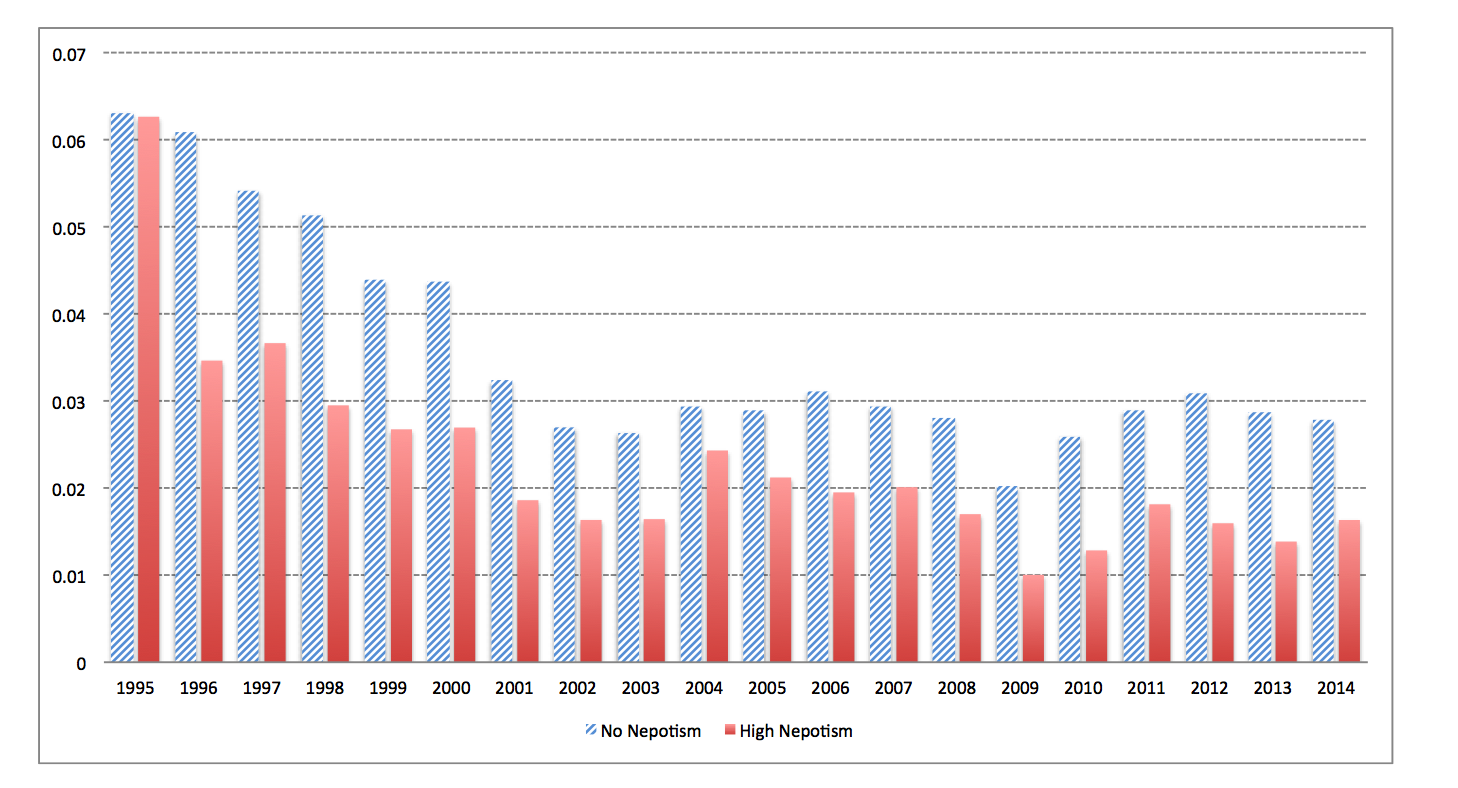

Widespread family ties in American companies suggest pervasive nepotism – defined as the practice, among those with power or influence, of promoting relatives to key positions. To assess the implications of nepotism, we compare the firms having the highest percentage of related employees in our sample with the remaining companies. We find that firms in the top 10 percent of those with related employees invest roughly 12 percent less than the average amount that all of the companies in our sample invest, controlling for known determinants of investment decisions. Additionally, we show that such firms are more likely to pass up valuable investment opportunities.

Year-by-year average investment computed as capital expenditures over book assets for firms in the top decile of our Nepotism measure (in red) and firms that do not disclose any family ties (in blue).

Year-by-year average investment computed as capital expenditures over book assets for firms in the top decile of our Nepotism measure (in red) and firms that do not disclose any family ties (in blue).

Why does high nepotism lead to underinvestment? We try to answer this question by “following the money.’’ If nepotistic firms invest less than other firms, the resources that are not spent on new equipment and projects must go somewhere else. Our results clearly indicate that executives in nepotistic firms tend to pay key employees more than other companies do and approve higher payouts to their shareholders. The payouts and salaries roughly account for the difference in investment with respect to other firms in the same industry. We conjecture that the presence of relatives among the shareholders and the main employees weakens the governance mechanisms of the firm. Relatives placed into important positions may exercise undue influence on key corporate decisions such as payouts and salaries. We rule out the possibility that our findings are driven by higher cost of accessing financial resources or by family infighting, while we find mixed evidence for the hypothesis that family related employees are less skilled.

Overall, the pattern that we uncover is likely to seriously compromise value creation in the long run. Our findings may have important welfare implications as a systematic reduction of investment in favor of short-term compensation can have severe consequences for the whole U.S. economy. Furthermore, we argue that non-family investors and job seekers should consider how widespread family ties are before buying shares of public firms or applying for jobs, as their interests are likely to be seriously compromised in favor of those of related shareholders and employees. From a macroeconomic perspective, the prevalence of nepotism in some economies might help explain why some countries systematically invest less than others.

This post comes to us from Fabrizio Leone of UBS and the Swiss Finance Institute, Gianpaolo Parise of the Bank for International Settlements and Carlo Sommavilla of the University of Lugano and the Swiss Finance Institute. It is based on their article, “Nepotism Everywhere: The Real Effects of Widespread Family Ties,” available here, and does not necessarily reflect the views of the institutions with which they are affiliated.

Sky Blog

Sky Blog