Much recent work in finance and economics aims to understand the role that chief executive officers and other top managers play in the firms they run. Traditional theories about firm decisions on matters such as capital structure or investments don’t consider the role of CEOs or they assume that rational managers will behave identically if faced with the same problem. However, the more recent literature suggests that CEOs behave in very different ways that matter to the firms that they run. Several papers have shown substantial changes in a firm’s stock price and accounting performance when its top management changes. To tie these results to individual differences, Bertrand and Schoar (2003) show that top executives’ management styles vary widely, and there is growing evidence that CEOs’ personal traits play a role in their management approaches.

However, much less is known about how these management styles are formed. Are they affected by conditions outside a manager’s control, such as early career experiences? Or do managers deliberately choose to invest in the skill set most likely to enhance their success over their careers, given their personal characteristics? Alternatively, do different economic environments lead different types of people to become managers? If early work environment is indeed important to managerial style, it’s reasonable to believe that at least some of a manager’s style is fixed long before the manager becomes CEO. As a result, over the long run, macroeconomic factors might shape the available talent pool in the CEO labor market.

In our recent article, “Shaped by Booms and Busts: How the Economy Impacts CEO Careers and Management Styles,” available here, we seek to shed light on these questions by looking at labor market conditions at the beginning of a manager’s career, i.e., recessions versus non-recessions. Since labor market conditions are outside a person’s control, they allow us to test whether CEOs who begin their careers during a recession have a different career trajectory and ultimately a different management style as CEO. In particular, we want to understand the channel through which these different outcomes are formed. Embarking on a career during a recession might teach young managers different skills or attitudes, regardless of the type of firm where their careers begin. They may be exposed, for example, to managerial techniques aimed at preserving resources or cutting costs. We call this the general recession channel. Under this scenario, we would expect a general recession cohort effect independent of where a manager’s career begins.

On the other hand, a tight labor market during a recession might force young managers to start their careers at smaller or private firms, or managers in these non-traditional firms might find it easier to get promoted during a recession. Under this scenario, the recession cohort effect would be predominantly driven by the type of the firm at which managers begin their careers. So once we control for the characteristics of the firms where recession CEOs begin their careers, the general recession cohort effect would become much smaller. We call this the firm specific channel. We show that this firm specific effect explains an important fraction of the general cohort effect.

We begin by documenting that CEOs who start their career during a recession tend to have different career trajectories than those who start in economically prosperous periods. We refer to the former as recession CEOs. Recession CEOs tend to start in smaller or private firms. They on average hold fewer jobs and become CEOs more quickly, but ultimately end up heading smaller firms and receiving lower compensation (by about 20 percent, in both cases) than their non-recession peers. This lower pay persists even after we control for firm size and performance. These outcomes are an indication that the careers of recession CEOs are significantly affected by the economic environment at the beginning of their careers. This lends support to the general recession effect, as described above.

The data suggest a particular channel that affects recession CEOs: When we include the characteristics of the CEO’s first job in the regression, we find that the general recession effect is significantly reduced. This is evidence for the firm-specific effect of recessions. For example, as discussed above, recession CEOs lead firms that are about 20 percent smaller than those headed by non-recession CEOs. However, half of this effect is explained by the characteristics of the first job. These results suggest that one of the important channels through which recessions affect managerial careers is that they change the types of jobs people initially take. As a result, different kinds of people with differing management styles end up as CEOs.

Second, we document that, compared with non-recession peers in the same firm, recession CEOs have a more conservative management style. Recession CEOs display a tendency to make fewer capital expenditures, invest less in research and development and spend less on sales and administrative expenses. On the financing side, they incur significantly less debt and need less working capital. They also display lower sales growth. However, they pay higher effective tax rates. In addition, a company’s stock returns are generally more stable under a recession CEO. We do not find evidence that recession CEOs have different rates of return on assets.

We note that recession CEOs don’t randomly end up heading companies. Firms with a need for a certain type of management style might opt for a CEO who has this style. As a result, the policy differences observed between recession and other CEOs are likely a combination of the true causal effects of recession CEOs and unobserved differences in firms. However, we do not find significant evidence of those policy differences in the year before the recession CEO is appointed. This shows that even if the board selects a CEO for his or her management style, the CEO’s presence is needed to implement the intended change. There appears to be something special about these CEOs’ abilities. In sum, our findings imply that the pool of managerial talent in each cohort of new executives is significantly shaped by the overall economic conditions at the time they entered the labor market.

Our findings can have broad implications for the managerial labor market. Whether recessions affect the formation of CEOs through imprinting or selection, we find that these cohort effects seem to change management styles in the future. For instance, after extended periods of high growth, a large number of managers may have learned how to manage growing companies, but there could be a limited supply of managers who know how to run firms in distress or in turn-around situations. While the CEO labor market might efficiently allocate managers to firms with the highest need for a specific style at a given time, the persistence of these managerial styles might have long-run effects on the optimal skill mix in the economy. For example, in our recent article, “Does the Market Value CEO Styles?,” available here, we show that the announcement returns around the appointment of a recession CEO are economically and statistically significant and positive. If markets on average are rational in predicting the type of CEO a firm might select, the good news around the selection of recession CEOs suggests that there is a limited supply of these types of CEOs in the market.

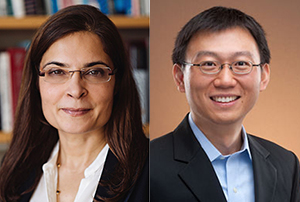

This post comes to us from Professor Antoinette Schoar at MIT’s Sloan School of Management and Professor Luo Zuo at Cornell University’s Samuel Curtis Johnson Graduate School of Management. It is based on their articles, “Shaped by Booms and Busts: How the Economy Impacts CEO Careers and Management Styles,” available here, and “Does the Market Value CEO Styles?,” available here.

Sky Blog

Sky Blog