Valuation, solvency, and adequate capitalization analyses play a crucial role in the process of reorganizing U.S. companies in bankruptcy. They are central to allowance of claims, adequate protection, avoidance actions such as fraudulent transfer and preference, rejection of collective bargaining agreements, plan confirmation, and 363 sales. Solvency opinions may also be sought prospectively in anticipation of transactions such as leveraged buyouts, spin-offs, or dividend recapitalizations.

Courts and bankruptcy professionals have often complained about the expense, delay, subjectivity, and unpredictability inherent in traditional approaches to valuation. Financial analyses can consume tens of millions of dollars in a single large case and delay plan confirmation while producing outcomes that are at odds with investors’ expectations.

To ameliorate these problems, the Supreme Court, the Court of Appeals for the Third Circuit, and the District Court for the Southern District of New York have all encouraged bankruptcy courts to shift from expert-driven analyses toward more objective market-based indicators. Traditional methods of analysis include discounted cash flow (DCF) and multiples approaches. DCF largely depends on subjective judgments about future earnings and discount rates, while multiples approaches depend on subjective judgments about the right group of comparable companies or transactions.

However, newer methods based on market prices for equity, debt, or options and derivatives are supplementing, and in some cases supplanting, more established approaches. Bankruptcy courts have considered equity prices, unsecured bond prices relative to par, and the ability to raise equity or unsecured debt as evidence that is relevant to valuation and solvency and adequate capitalization analysis. When important information was not known to investors, courts have back-dated market valuations to the date when such information was publicly disclosed.

These cases leave important questions unanswered. How should courts decide close cases such as when a debtor’s equity price is declining but still positive, when bonds are trading slightly below par, or when the debtor has access to credit but on unfavorable terms? What about cases in which equity prices may reflect volatility and option value instead of adequate capitalization?

One proposal is for courts to look to credit spreads between corporate and treasury bonds rather than to bond or equity prices. Because investors could eliminate almost all credit risk by selling a corporate bond and purchasing a treasury bond, the difference in yield between a corporate bond and a treasury bond must compensate investors for the additional risks of non-payment of corporate bonds.

Credit spreads are widely used in financial services to price floating rate debt, to monitor credit risk and required collateral, and by financial regulators to inform capitalization requirements. Credit spreads offer a clear indicator of market actors’ expectations about the likelihood of default and the likely losses given default. With a single assumption about recovery rates—which can be grounded in historic data or sometimes backed out from contemporaneous market data—one can reconstruct a daily market estimate of a debtor’s probability of default. (Credit spreads can also be adjusted to take into account liquidity and risk premiums—otherwise they will tend to overpredict default).

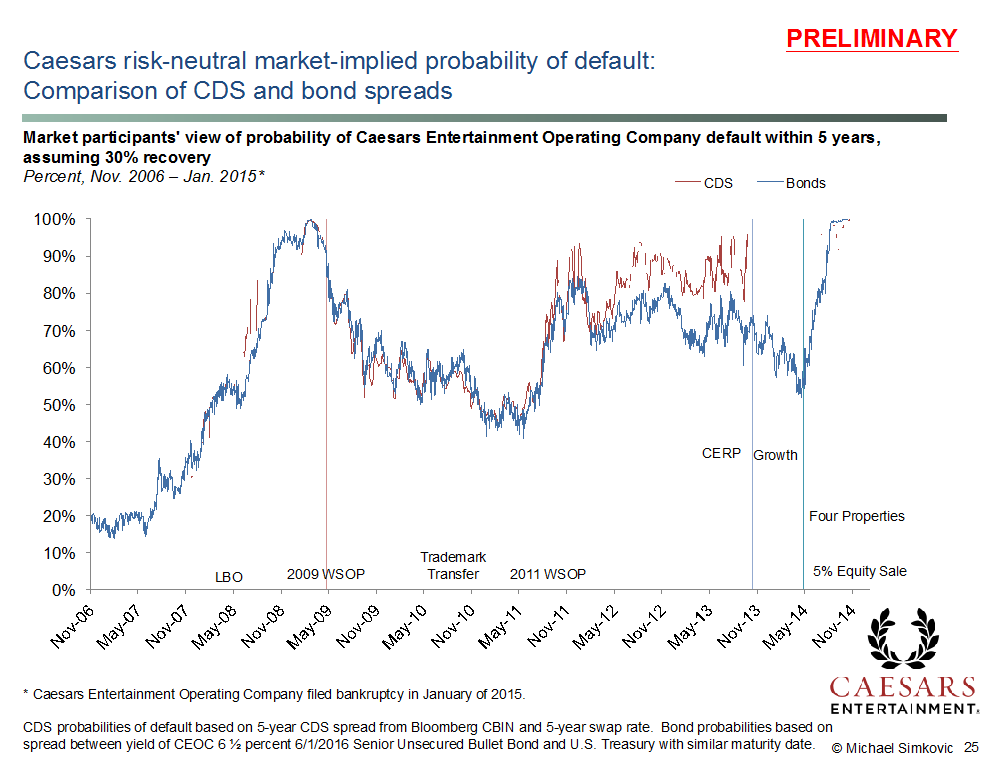

Credit-spread based approaches are faster, less expensive, and more objective than current approaches. An example is provided below using data for Caesar’s Entertainment Operating Company:

Figure 1. Caesars risk-neutral market-implied probability of default from CDS and bond spreads (preliminary analysis)

The traditional solvency and adequate capitalization analysis performed by the bankruptcy examiner in the Caesars case took months and cost the estate millions of dollars. The preliminary market-based analysis above was completed by a law professor and a handful of research assistants in a few days using data that can be purchased for a few thousand dollars.

The traditional analysis performed by the examiner only calculated solvency on a few specific dates, filling in gaps by assuming deterioration in financial condition as the bankruptcy date approached. The market-based analysis above indicates daily capital adequacy based on objective market indicators. It shows capital adequacy at times improving and at times deteriorating rather than continuously decreasing as the bankruptcy date approached.

A more thorough market-based analysis to inform adjudication would likely continue to be faster, more predictable, and much more cost-effective than the traditional approach. If market-based approaches to solvency analysis could be used with confidence in many large corporate bankruptcy cases, the collective savings to debtors’ estates over a decade could easily be in the tens of millions of dollars.

This post comes to us from Professor Michael Simkovic of Seton Hall Law School. It is based on his recent book chapter, “Making Fraudulent Transfer Law More Predictable,” and his article, “The Evolution of Valuation in Bankruptcy,” which is available here.

Sky Blog

Sky Blog