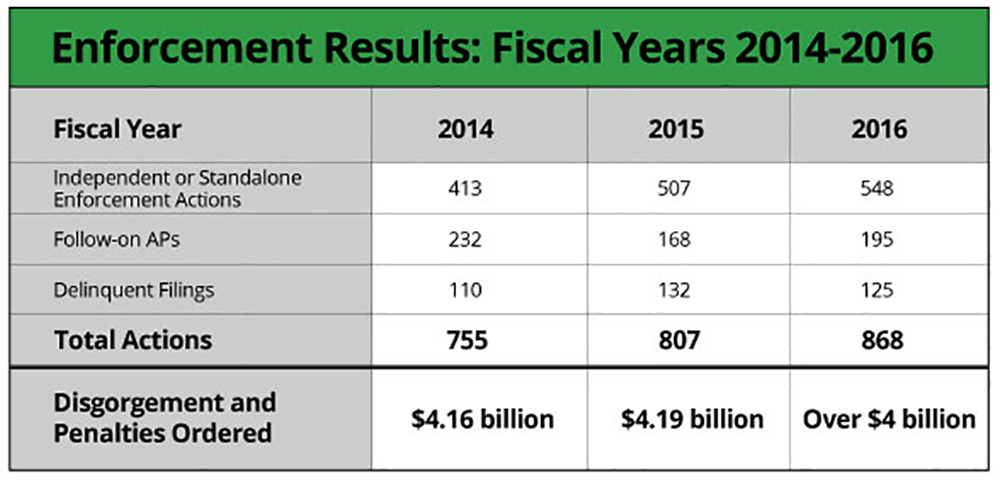

The Securities and Exchange Commission announced on October 11 that, in fiscal year 2016, it filed 868 enforcement actions exposing financial reporting-related misconduct by companies and their executives and misconduct by registrants and gatekeepers, as the agency continued to enhance its use of data to detect illegal conduct and expedite investigations.

The new single year high for SEC enforcement actions for the fiscal year that ended September 30 included the most-ever cases involving investment advisers or investment companies (160) and the most-ever independent or standalone cases involving investment advisers or investment companies (98). The agency also reached new highs for Foreign Corrupt Practices Act-related enforcement actions (21) and money distributed to whistleblowers ($57 million) in a single year.

The agency also brought a record 548 standalone or independent enforcement actions and obtained judgments and orders totaling more than $4 billion in disgorgement and penalties.

“By every measure the enforcement program continues to be a resounding success holding executives, companies and market participants accountable for their illegal actions,” said SEC Chair Mary Jo White. “Over the last three years, we have changed the way we do business on the enforcement front by using new data analytics to uncover fraud, enhancing our ability to litigate tough cases, and expanding the playbook bringing novel and significant actions to better protect investors and our markets.”

The SEC’s most significant enforcement actions in fiscal year 2016 include:

- Insider trading and beneficial ownership reporting-related charges against Leon G. Cooperman and his firm Omega Advisors.

- Insider trading charges against William “Billy” Walters and his source Thomas C. Davis, a former Dean Foods Company board member.

- A $415 million enforcement action against Merrill Lynch for violating customer protection rules by misusing customer cash and putting customer securities at risk. The firm also admitted wrongdoing.

- A $267 million enforcement action against J.P. Morgan wealth management subsidiaries, for failing to disclose conflicts of interest to clients. The firms also admitted wrongdoing.

- FCPA cases against the Och-Ziff hedge fund and its CEO and CFO and against VimpelCom Ltd. in which the companies paid hundreds of millions of dollars to settle the charges.

“This has been a strong year for the Enforcement Division, with groundbreaking insider trading and FCPA cases and other important actions across the full spectrum of the securities laws,” added Andrew J. Ceresney, Director of the SEC’s Enforcement Division. “Through their hard work and steadfast dedication to our mission, the Division’s committed staff have helped protect investors and made our markets fairer and more reliable.”

The agency also brought impactful first-of-their-kind actions in fiscal year 2016, including charges against: a firm solely for failing to file Suspicious Activity Reports when appropriate; an audit firm for auditor independence failures predicated on close personal relationships with audit clients; municipal advisors for violating the fiduciary duty for municipal advisors created by the 2010 Dodd-Frank Act and the municipal advisor antifraud provisions of the Dodd-Frank Act; a private equity adviser for acting as an unregistered broker; and an issuer of retail structured notes for misstatements and omissions. In addition, fiscal year 2016 included a first-of-its-kind trial victory: the first federal jury trial by the SEC against a municipality and one of its officers for violations of the federal securities laws. The SEC brought many other impactful actions in fiscal year 2016 spanning the entire spectrum of the marketplace, examples of which are discussed below.

Combating Financial Fraud and Enhancing Issuer Disclosure

- The SEC continued to prioritize issuer reporting and disclosure matters in fiscal year 2016 and brought a number of significant matters, including actions against companies and executives. These actions included: Weatherford International plc and two of its employees; Monsanto Company and three of its accounting and sales executives; First Mortgage Corporation and six senior executives; Navistar International Corporation and its former CEO; Logitech International and three of its former executives and a former director of accounting; 11 former executives and board members at Superior Bank and its holding company; RPM International Inc. and its General Counsel; IEC Electronics Corp. and two former executives; Uni-Pixel, Inc. and its former CEO and CFO; Martin Shkreli; and The St. Joe Company and five of its former top executives.

Holding Gatekeepers Accountable

- Held attorneys, accountants and other gatekeepers accountable for failures to comply with professional standards.

- In the second non-independence case against a major audit firm since 2009, charged Grant Thornton LLP, which admitted wrongdoing, and two of its partners, with ignoring red flags and fraud risks while conducting deficient audits of two publicly traded companies that the SEC had separately charged with improper accounting and other violations.

- Brought important actions against auditing firms for violating auditor independence rules, including two Grant Thornton firms and Ernst & Young LLP.

- Charged a private fund administrator with missing or ignoring clear indications of fraud while it was contracted to keep records and prepare financial statements and investor account statements for two client funds that the SEC charged with fraud.

- Sanctioned a consultant to a Texas-based oil company based on charges that he improperly evaluated the severity of the company’s internal control deficiencies (in addition to charges against the company, senior executives, and an outside auditor).

- Charged lawyers with allegedly offering EB-5 investments while not registered to act as brokers.

- Sanctioned Barclays Capital Inc. and Credit Suisse Securities (USA) LLC for violating the federal securities laws while operating alternative trading systems (ATSs); Barclays admitted wrongdoing and agreed to pay a $35 million penalty – the largest penalty ever assessed against a dark pool – and Credit Suisse agreed to pay over $54 million in monetary sanctions, representing the largest overall settlement against an ATS.

- Sanctioned Merrill Lynch for violations of the Market Access Rule, which requires firms to have adequate risk controls in place before providing customers with access to the market and imposed the largest penalty ever assessed in a Market Access Rule case ($12.5 million).

- Imposed a $1 million penalty on Morgan Stanley Smith Barney LLC for the firm’s failure to adopt written policies and procedures reasonably designed to protect customer records and information.

- Charged 78 parties in cases involving trading on the basis of inside information. A number of these cases involved complex insider trading rings which were cracked by Enforcement’s innovative uses of data and analytics to spot suspicious trading.

- For example, brought insider trading cases against: two hedge fund managers and their source, who was a former employee of the U.S. Food and Drug Administration; a former Goldman Sachs employee; and a former senior employee at Puma Biotechnology Inc.

- Brought eight enforcement actions related to private equity advisers, including cases against: three private equity fund advisers within The Blackstone Group; Fenway Partners, LLC and four of its employees; Cherokee Investment Partners, LLC and Cherokee Advisers, LLC; JH Partners, LLC; Blackstreet Capital Management, LLC and its managing member and principal owner; WL Ross & Co. LLC; four private equity fund advisers affiliated with Apollo Global Management; and First Reserve Management, L.P. Including these actions, the SEC has now brought eleven private equity-related actions in the last two years.

- Charged Aequitas Management LLC, four affiliates, and three of the firm’s top executives, with allegedly hiding the rapidly deteriorating financial condition of its enterprise while raising more than $350 million from more than 1,500 investors.

- Sanctioned three AIG affiliates for steering mutual fund clients toward more expensive share classes so the firms could collect more fees.

- Charged Morgan Stanley Investment Management based on unlawful prearranged trades known as “parking” that favored certain clients over others made by one of its portfolio managers. Also charged the portfolio manager, SG Americas, and a trader at SG Americas who assisted the schemes.

- Sanctioned 13 investment advisory firms found to have violated securities laws by repeating the false claims made by investment management firm F-Squared Investments about its flagship product without obtaining sufficient documentation supporting these claims.

- Suspended trading in the securities of 199 issuers in order to combat market manipulation and microcap fraud threats to investors, including 19 issuers arising from a microcap fraud-fighting initiative known as Operation Shell-Expel.

- Obtained a court order freezing the profits of a foreign trader who allegedly manipulated the stock of a Silicon Valley technology firm through a false EDGAR filing traced to a computer in Pakistan.

- Obtained an emergency court order to freeze the assets of a United Kingdom resident charged with allegedly intruding into the online brokerage accounts of U.S. investors to make unauthorized stock trades that allowed him to profit on trades in his own account.

- Charged several alleged perpetrators behind a $78 million pump-and-dump scheme involving the stock of Jammin’ Java, a company that operates as Marley Coffee.

- Charged proprietary trading firm Briargate Trading LLP and one of its co-founders with engaging in a manipulative trading strategy known as “spoofing.”

- Sanctioned three traders for two fraudulent trading schemes involving the mismarking of option orders to obtain execution priority and avoid transaction fees charged by options exchanges and “spoofing” to generate liquidity rebates from an options exchange.

- Charged and obtained asset freezes against the operator of a worldwide pyramid scheme that allegedly falsely promised investors would profit from a venture purportedly backed by the company’s massive amber holdings.

- Charged Vu H. Le a/k/a Vinh H. Le and his company, TeamVinh.com LLC, in connection with their alleged fraudulent raising of more than $3 million from over 5,600 investors throughout the United States and in various foreign countries through a multi-level marketing scheme.

- Charged entities and individuals with schemes targeting seniors and the elderly, including:

- Charges against a Los Angeles-based litigation marketing company and its co-founders for allegedly defrauding retirees and other investors who were told they would earn hefty investment returns from settlement proceeds.

- Charges against two brothers, and a company that they founded purportedly to develop and sell real estate for allegedly engaging in a $2.7 million Ponzi scheme that targeted approximately 30, largely elderly and unsophisticated investors over a six-year period.

- Announced enforcement actions against 14 municipal underwriting firms and 71 municipal issuers and other obligated persons for violations in municipal bond offerings as part of the Municipalities Continuing Disclosure Cooperation (MCDC) Initiative.

- Charged State Street Bank and Trust Company, a former State Street senior vice president, and a lobbyist with conducting a pay-to-play scheme to win contracts to service Ohio pension funds.

- Charged Ramapo, N.Y., its local development corporation, and four town officials who allegedly hid a deteriorating financial situation from their municipal bond investors.

- Charged California’s largest agricultural water district, its general manager and former assistant general manager with misleading investors about its financial condition as it issued a $77 million bond offering.

- Charged a municipal advisor, its CEO, and two employees for breaching their fiduciary duty by failing to disclose a conflict of interest to a municipal client.

- Charged UBS AG, Merrill Lynch, and UBS Financial Services with violations related to structured notes.

- Sanctioned credit rating agency DBRS Inc. for misrepresenting its surveillance methodology for ratings of certain complex instruments.

- Filed significant FCPA actions against PTC Inc. and two of its Chinese subsidiaries; LAN Airlines and its CEO; Anheuser-Busch InBev; Qualcomm Incorporated; Las Vegas Sands Corp.; AstraZeneca PLC; and GlaxoSmithKline plc.

- Announced non-prosecution agreements with two unrelated companies who both self-reported misconduct and cooperated extensively with the SEC.

- The whistleblower program awarded over $57 million to 13 whistleblowers in fiscal year 2016, which is more than in all previous years combined.

- Brought the first stand-alone action for retaliation against a whistleblower.

- Charged Anheuser-Busch, Merrill Lynch, BlueLinx Holdings Inc., and Health Net Inc. for violating Exchange Act Rule 21F-17, which prohibits the use of confidentiality agreements or other actions to impede a whistleblower from communicating with the SEC.

- Demanded and obtained acknowledgements of wrongdoing under the admissions policy. Cases from this fiscal year involved an audit firm that issued false and misleading unqualified audit opinions, a failure to disclose conflicts of interest to clients, violating federal securities laws while operating an ATS, an unregistered securities offering by Ethiopia’s electric utility, violations of the SEC’s Customer Protection Rule, a computer coding error that caused incomplete blue sheet data to be provided to the SEC, among other actions.

- Nan Huang was found liable for illegally insider trading on information he obtained while working as a data analyst for credit card issuer Capital One.

- Former stock brokers Daryl Payton and Benjamin Durant were found liable for insider trading ahead of a $1.2 billion acquisition of SPSS Inc. by IBM Corporation.

- Stephen Ferrone, the former CEO of biopharmaceutical company Immunosyn Corp., was found liable for fraudulently misleading investors about regulatory approval of the company’s sole product, and for signing and filing false certifications included with Immunosyn’s annual and quarterly reports.

- The City of Miami and its former budget director Michael Boudreaux were found liable for multiple counts of antifraud violations of the federal securities laws in connection with the city’s disclosures concerning the deteriorating financial condition of the city during 2007 and 2008 and in three separate offerings of municipal securities in 2009.

This post comes to us from the Securities and Exchange Commission. It is based on the regulator’s press release, “SEC Announces Enforcement Results for FY 2016,” dated October 11, 2016, and available here.

Sky Blog

Sky Blog