There were more than $1 trillion worth of cross-border mergers and acquisitions in 2016, according to the United Nations Conference on Trade and Development, making them a prominent form of foreign direct investment and an important way for multinational entities (MNEs) to invest and restructure. When MNEs from various countries bid for a foreign target, each country’s system for taxing foreign dividends and capital gains affects deal prices and may determine who wins the bid.

A big question in the theoretical tax literature on capital ownership neutrality (CON) has been how to neutrally tax M&A (e.g., Desai and Hines (2003), Becker and Fuest (2010), Becker and Fuest (2011), Ruf (2012), Devereux et al. (2015)). To achieve CON, all countries need to apply the same taxation system and thereby avoid inefficient ownership structures.

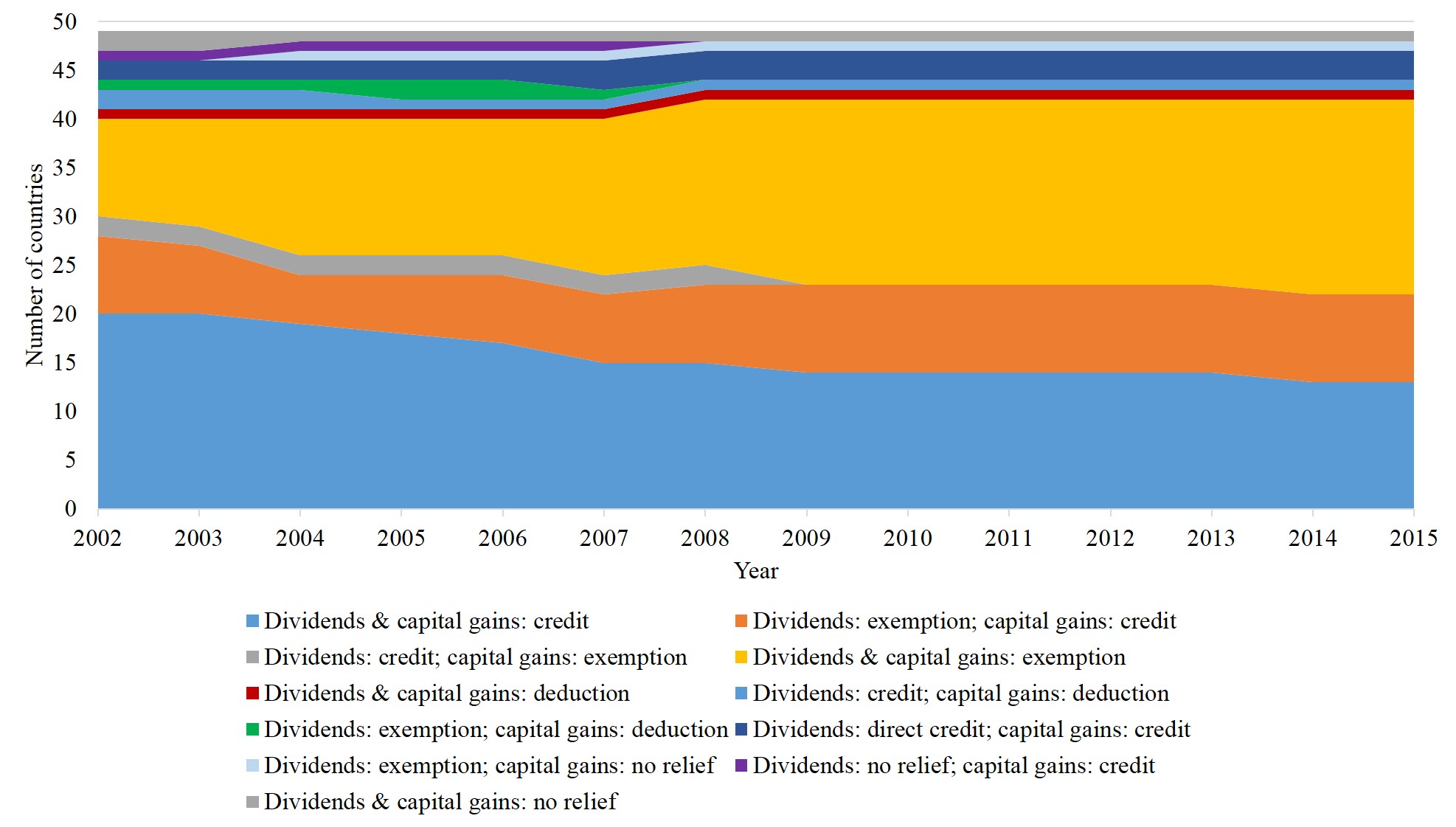

However, as shown in Figure 1, we find substantial variation among taxation systems across the 49 countries studied. We observe that the most common taxation system is the exemption method (in place in 20 countries in 2015), i.e., not taxing foreign dividends (upon dividend repatriation from a foreign subsidiary) and capital gains (upon liquidating or selling a foreign subsidiary) at the parent level. Further, the credit method (13 countries) for both foreign dividends and capital gains is also common, i.e., taxing foreign dividends and capital gains at the parent level while crediting underlying foreign taxes. While the exemption method has become more popular in recent years, the credit method has become less so. The split taxation system of exempting foreign dividends and crediting foreign capital gains is also common (9 countries). We observe 18 countries that have changed their taxation systems over time. Twenty-one countries tax foreign dividends and capital gains differently. Further, the 49 countries have a substantial number of bilateral double taxation conventions (DTCs) among each other; the median number of DTCs is 44. As favorable taxation methods in a DTC overrule the “usual” taxation method according to national tax law, additional variation on a bilateral (i.e., country-by-country level) is present.

This substantial variation in taxation systems suggests that CON is far from a reality, prompting the question of how tax policymakers can put their home countries’ MNEs in a better position to acquire foreign targets – and create for those countries the beneficial spillover effects of cross-border M&A as demonstrated by empirical literature (e.g., Manne (1965), Scharfstein (1988), Bresman et al. (1999), Devos et al. (2009), Wang and Xie (2009), Bena and Li (2014), Sapra et al. (2014), Stiebale (2016)). What’s more, the number of possible cross-border targets may be limited due to operational reasons (e.g., specific intellectual property that can be acquired), giving policymakers even more incentive to ensure that their domestically based MNEs are in a strong position as buyers.

Figure 1. Changes in corporate taxation systems for the 49 countries (OECD, G20 and EU member states) for 2002–2015.

Source: Author data collection.

To aid policymakers in maximizing their MNEs’ buying power, we model the joint impact of foreign dividends and capital gains taxation at the corporate level on the acquiring MNE’s reservation price for a specific target in a multi-period design. For dividends taxation, we analyze whether (non-)taxation of repatriated profits affects the reservation price. In determining profit taxation, we take into account statutory corporate tax rates, withholding tax rates, and profit shifting opportunities. For capital gains taxation, we analyze whether the reservation price is affected by a potential tax treatment of participation losses or gains arising from liquidating or selling the target in the future.

In an empirical application on a large cross-border M&A data set, we show that our model works. In particular, we conclude that taxing foreign dividends plays a decisive role in determining the reservation price of an acquirer, whereas taxing capital gains seems irrelevant. Additionally, we investigate the role of profit shifting and profit retention in cross-border M&A activity. Our empirical results show that profit shifting opportunities result in higher M&A prices.

Our results have important implications for tax policy and are relevant in light of current U.S. tax proposals that would replace the credit method with the exemption method for foreign dividends. We find that such a change has a positive effect on acquirers’ M&A prices and improves the ability of U.S. MNEs to bid for foreign targets.

REFERENCES

Becker, J., and C. Fuest. 2010. Taxing foreign profits with international mergers and acquisitions. International Economic Review 51: 171–186.

Becker, J., and C. Fuest. 2011. Source versus residence based taxation with international mergers and acquisitions. Journal of Public Economics 95: 28–40.

Bena, J., and K. Li. 2014. Corporate innovations and mergers and acquisitions. The Journal of Finance 69: 1923–1960.

Bresman, H., J. Birkinshaw, and R. Nobel. 1999. Knowledge transfer in international acquisitions. Journal of International Business Studies 30: 439–462.

Desai, M., and J. Hines. 2003. Evaluating international tax reform. National Tax Journal 56: 463–485.

Devereux, M., C. Fuest, and B. Lockwood. 2015. The taxation of foreign profits: A unified view. Journal of Public Economics 125: 83–97.

Devos, E., P.-R. Kadapakkam, and S. Krishnamurthy. 2009. How do mergers create value? A comparison of taxes, market power, and efficiency improvements as explanations for synergies. Review of Financial Studies 22: 1179–1211.

Manne, H. 1965. Mergers and the market for corporate control. Journal of Political Economy 73: 110–120.

Ruf, M. 2012. Optimal taxation of international mergers & acquisitions. Working Paper (SSRN).

Sapra, H., A. Subramanian, and K. Subramanian. 2014. Corporate governance and innovation: Theory and evidence. Journal of Financial and Quantitative Analysis 49: 957–1003.

Scharfstein, D. 1988. The disciplinary role of takeovers. Review of Economic Studies 55: 185–199.

Stiebale, J. 2016. Cross-border M&As and innovative activity of acquiring and target firms. Journal of International Economics 99: 1–15.

Wang, C., and F. Xie. 2009. Corporate governance transfer and synergistic gains from mergers and acquisitions. Review of Financial Studies 22: 829–858.

This post comes to us from Dominik von Hagen and Fabian Nicolas Pönnighaus, PhD candidates in business administration at the Business School of Mannheim University (Germany). It is based on their recent article “International Taxation and M&A Prices” available here.

Sky Blog

Sky Blog