The U.S. high-yield and investment-grade debt markets saw significant increases in 2017 over 2016 in dollar volume and number of issuances.[1] The U.S. equity indices reached new highs throughout the year, with the Standard & Poor’s 500 index ending the year up 19.4 percent.

The slow, steady expansion of the economy (one of the longest expansion cycles on record) and the current favorable market conditions, along with the recently enacted reduction in corporate taxes — which could drive earnings expansion — have fueled optimism for robust capital markets activity in 2018. Questions linger, however, about the sustainability of the bull run and whether volatility can remain at historically low levels.

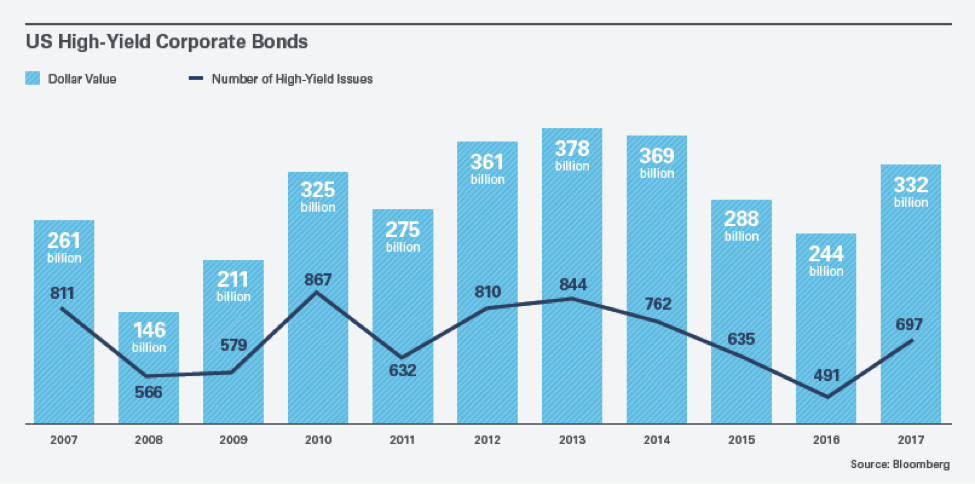

Debt Markets. The U.S. high-yield debt market ended 2017 approximately 36 percent higher by volume and 42 percent higher by number of issuances than 2016, ending three consecutive years of decline but falling short of the record highs in 2012-14. U.S. high-yield bond issuances totaled $332 billion (697 issuances) in 2017 compared to $244 billion (491 issuances) in 2016.

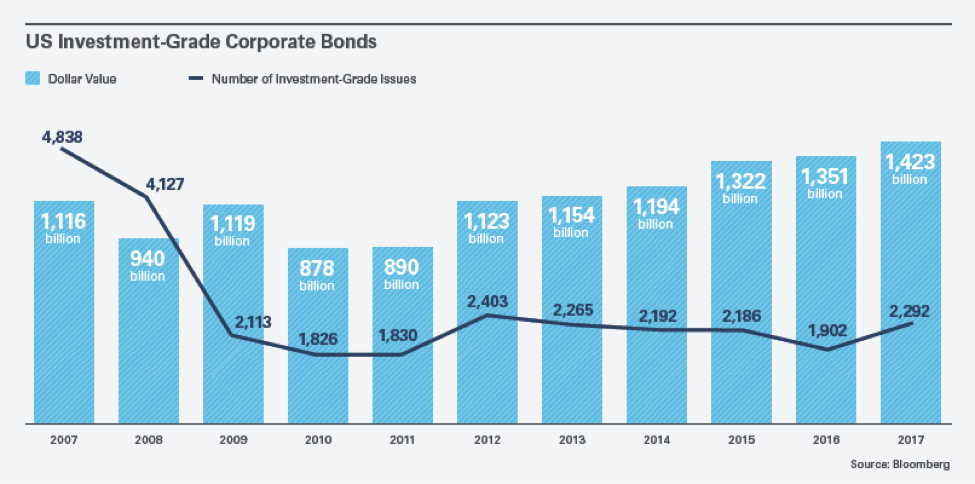

The U.S. investment-grade debt market had record volume of $1.42 trillion (2,292 issuances) in 2017, exceeding the previous record of $1.35 trillion (1,902 issuances) set in 2016 and marking the seventh consecutive year of dollar volume increase. AT&T was the largest issuer by volume, totaling $36 billion in 16 issuances, and in July 2017 also had the largest investment-grade transaction of the year at $22.5 billion in connection with its proposed acquisition of Time Warner. Refinancing activity continued to drive both high-yield and investment-grade volume, with M&A a distant second.

Equity Markets. The Dow Jones industrial average reached four 1,000-point milestones in 2017 — the most in any one year — topping out at over 24,000 in December 2017. The S&P 500 and Nasdaq composite also set all-time highs. The gains were driven largely by strong corporate earnings and a favorable macroeconomic backdrop of moderate but steady gross domestic product growth, low unemployment, a strong housing market, high consumer confidence, and the expected pro-business and anti-regulation agenda of the new administration, including the promise of tax reform.

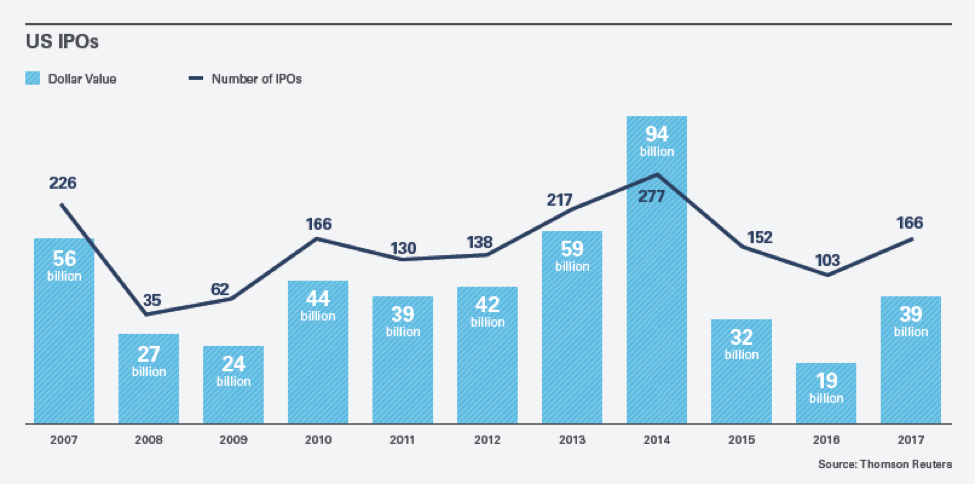

Despite a favorable backdrop of rising equity markets and historically low volatility, the initial public offerings (IPO) market fell short of some expectations going into the year. Many companies chose to take advantage of the robust private markets that have developed in recent years to satisfy their capital-raising and secondary liquidity needs or to pursue an M&A exit (with secondary buyouts by private equity sponsors continuing to make up a large share of M&A activity). With 167 IPOs raising approximately $39 billion, it was a significant improvement over 2016 but still below post-financial crisis highs.

The leading sector for IPOs by volume and number of deals in 2017 was financial services, followed by health care and technology. The two largest IPOs of the year were Snapchat owner Snap Inc. and cable operator Altice USA Inc., which raised $3.91 billion and $2.15 billion, respectively. Despite a solid year, with 27 deals raising $9.1 billion, technology IPOs failed to materialize in the way that some had anticipated. Two of the largest tech IPOs — Snap and Blue Apron — fell short of investor expectations, although a number of subsequent deals — including Roku and Stitch Fix — performed well. Blank check, or special purpose acquisition company (SPAC), issuances increased sharply in 2017, with 29 SPAC IPOs raising a record $8.6 billion (up from 14 SPAC IPOs raising $1.7 billion in 2016).

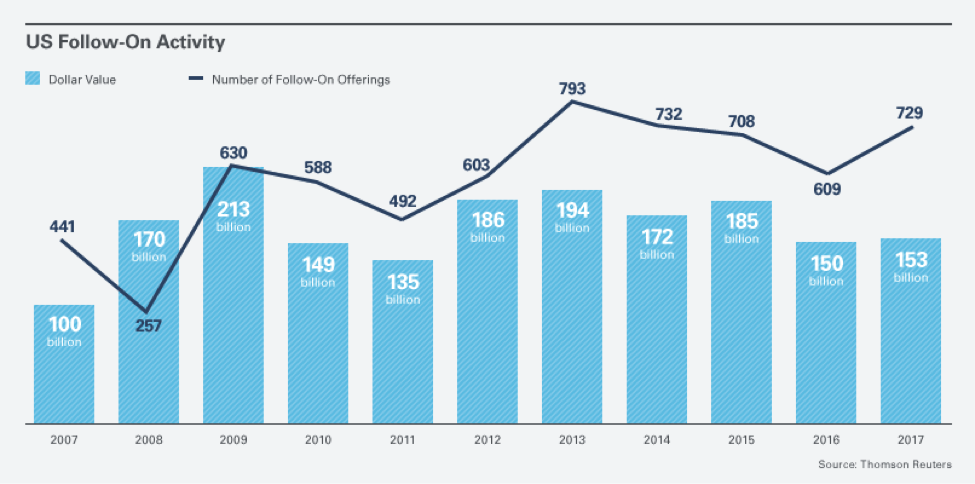

Follow-on activity was relatively flat, with the number of deals up nearly 20 percent — from 609 in 2016 to 730 in 2017 — but the aggregate volume up only 3 percent — from $150.2 billion in 2016 to $154.3 billion in 2017 — reflecting a smaller average deal size. M&A activity continued to drive follow-on activity, as 18 percent of all follow-on volume raised in 2017 was used to fund M&A. Block trades declined as a proportion of overall follow-on activity, representing 30 percent of total follow-on offerings in 2017, more in line with recent years and down from a record high of 49 percent in 2016.

Looking Ahead

A number of factors will impact the strength and mix of capital markets activity in 2018.

Corporate Tax Reform. While it is too early to assess the ultimate impact of the corporate tax overhaul on the U.S. capital markets, a few themes have emerged. In general, the new tax law reduces the value of debt by both (1) lowering the corporate tax rate from 35 to 21 percent, which reduces the value of the tax shield provided by interest deductions, and (2) imposing a cap on interest deductibility to 30 percent of EBITDA. (See “US Tax Reform Enacts the Most Comprehensive Changes in Three Decades.”) As a result, companies will need to re-evaluate the cost of their debt, and some issuers could gravitate toward equity or equity-linked securities, where the new interest deductibility rules and a rising interest rate environment could make pricing more attractive for companies’ capital-raising strategies.

Companies also may find themselves with significant additional cash on hand due to the lower tax rate and the one-time mandatory deemed repatriation of money held overseas at discounted rates. Potential uses for this additional cash include M&A activity, share buybacks and dividend recapitalizations, all of which could bring about higher stock prices and promote additional equity market activity. On the other hand, tax reform could quell some secondary follow-on market activity, particularly block trades, if private equity sponsors choose to hold their positions longer to capture additional gains from potential stock appreciation as a result of potential increases in earnings.

Alternative Financing. The average age of all venture capital-backed companies going public has risen from 5.1 years in 2006 to 7.6 in 2016, demonstrating the continuation of a multiyear trend of companies choosing to stay private longer. This trend is the result not only of the JOBS Act increasing the number of shareholders private companies can have before they are required to go public, but also of the wealth of private capital and secondary financing strategies available. As a result, companies have been able to raise substantial primary capital and provide liquidity to existing shareholders and employees outside the public markets and at valuations often significantly exceeding what public investors are willing to pay. The seeding of the SoftBank Vision Fund in 2017, which to date has raised nearly $100 billion to invest in technology companies (including a notable investment in WeWork), may only prolong this trend.

A number of private companies also may be contemplating strategies to become public outside the traditional IPO process, including (1) by being acquired by publicly traded SPACs, effectively allowing a company to avoid the associated time and expense of Securities and Exchange Commission registration and minimizing market risk, and (2) through direct listings of shares without an accompanying capital raise, providing immediate liquidity for shareholders (who would otherwise be subject to IPO lockups) with no dilution. The success of Spotify’s proposed direct listing could set a new precedent for companies with significant scale and a large investor base.

Increased financial leverage also has led some companies to look for alternative financing. Average leverage ratios, as measured by net debt relative to EBITDA, are near their highest since before the financial crisis for nonfinancial firms in the S&P 500. Some highly leveraged companies have issued mezzanine-style preferred securities to raise capital without increasing their leverage. Typically, these hybrid instruments are carefully structured to be treated as equity by rating agencies to avoid increasing a company’s leverage for ratings purposes.

Federal Reserve Activity. The monetary policy of the Federal Reserve may significantly impact the U.S. capital markets throughout 2018. The Fed has begun the process of reversing several years of quantitative easing and has continued to gradually increase interest rates, resulting in higher borrowing costs. Further rate hikes are anticipated in 2018, which will particularly benefit companies that are operated primarily in the United States (as a stronger U.S. dollar will increase the value of domestic products). On the debt side, many companies are issuing longer-term bonds to extend the maturities of their debt and lock in a lower interest rate as a hedge against higher borrowing costs in the future. Approximately 20 percent of the investment-grade debt issued in 2017 was 30-year notes.

Equity Markets in 2018Based on the views of equity capital markets and syndicate bankers across Wall Street, 2018 holds the promise of a strong year for equity issuances across many sectors. Technology will continue to be viewed as a key bellwether for the IPO market. While a number of the tech unicorns, including Airbnb, Dropbox and Lyft, are possible 2018 IPO candidates, others may continue to sit on the sidelines, rather than accept a potential “down round” relative to lofty valuations achieved in the private markets, not to mention hefty discounts investors demand to compensate for the risk of an IPO investment. Another indicator for the IPO market is the extent to which private equity sponsor-backed issuers will come to market. Sponsors have used strong cash positions to continue replenishing their pipeline, and sustained favorable market conditions combined with attractive public market valuations may entice them to begin monetizing these assets through the public markets in 2018. • Technology. Many experts anticipate smaller to medium-sized issuers to dominate the tech IPO calendar, although several deals by unicorns are also likely. Much of the activity is expected to come from high-growth software companies and internet and e-commerce businesses, with possible issuances by a number of technology services companies. Chinese and other offshore issuers continue to make up a significant portion of the potential IPO backlog, but some equity capital markets professionals question whether the mixed performance by the 2017 IPO class will impact such issuances. Follow-on activity is expected to be robust, as venture capitalists look to exit positions. • Health Care. Driven largely by life sciences, health care issuances were up over 55 percent in 2017 by proceeds raised, and all signs point to the sector once again being active in 2018. Life sciences issuers are expected to continue accessing equity capital to fund research and development and pipeline growth, while pharmaceuticals, services and facilities issuers are expected to benefit from the new tax law. The biotech IPO pipeline remains strong, with a number of issuances on the near-term deal calendar. • Industrials. The new tax law could have a particularly catalyzing impact in this sector, as many issuers carrying heavy tax burdens will see meaningful tax savings and benefit from the provision allowing immediate expensing of capital purchases. Areas to watch include companies sitting at the intersection of the technology and industrial sectors (particularly those that serve the automotive industry) and companies in the building products space, depending on the pace of interest rate rises and any impact of the new tax law on home construction and sales. • Financial Institutions. Equity issuance in the sector was up in 2017, and with interest rates rising and regulations being relaxed, conditions appear favorable for the year ahead, with a number of insurance and business development company IPOs in the nearer-term pipeline. All eyes will be on Fed activity, with two to four rate hikes expected in 2018. • Consumer. Despite a few notable IPOs (Canada Goose and Laureate Education), 2017 was a fairly quiet year in the consumer space. Although Apollo-backed home security company ADT recently launched its highly anticipated $2 billion IPO, 2018 may continue to see relatively few issuances. Amazon’s continued disruption of the way consumers shop makes it a challenging environment for traditional brick-and-mortar retailers, with possible bright spots for discount retailers and companies tied to the home improvement space. • Real Estate. The real estate equity capital markets are expected to see another active year in 2018 and subsectors with continued strong fundamental tailwinds (data centers, industrial real estate investment trusts (REITs), gaming, and single- and multi-family REITs) are likely to be strong. A number of sizable IPOs are expected in the early part of the year, while emerging small and midcap REITs may be appealing to institutional investors. At-the-market offerings, which reached record levels in 2017, are expected to continue to be a popular funding tool. • Energy. Industry observers expect much of the capital markets activity in the energy space to come in the form of financing M&A activity, as a crowded exploration and production (E&P) field appears ripe for consolidation. Despite a recent proposal from the Trump administration to open up offshore drilling around U.S. waters, market experts are skeptical that this will translate into renewed investor appetite for E&P IPOs, as offshore drilling ventures remain costly and largely dependent on crude oil prices. On the other hand, a substantial backlog in the oilfield services space could come to market, particularly if issuers are willing to accept valuation discounts. (As of the date of this publication, two oilfield services IPOs have priced in January 2018). • SPACs. SPAC issuance hit an all-time high in 2017, and a great deal of attention was paid to the Social Capital Hedosophia offering, a vehicle designed for the purpose of acquiring a technology unicorn. However, while SPAC issuance is expected to remain strong in 2018, many question whether the 2017 pace is sustainable, given the glut of recent issuance and a desire for issuers to demonstrate an ability to complete the back end of the process — that is, successfully acquire an operating company. |

ENDNOTES

[1] Sources for the data in this article are: Bloomberg, Dealogic, Deloitte, Moody’s, PitchBook, PwC, Seeking Alpha and Thomson Reuters.

This post comes to us from Skadden, Arps, Slate, Meagher & Flom LLP. It is based on the firm’s memorandum, “US Capital Markets Expected to Remain Robust in 2018,” dated January 23, 2018, and available here.

Sky Blog

Sky Blog