I am very happy to be with you in Manhattan. You may have heard that I have been kind of busy in Washington.

After I speak with you this morning, I need to head across Times Square to participate in the annual conference about the Foreign Corrupt Practices Act.

I did not intend to deliver two speeches about white collar crime today. When I received the invitations a few months ago, I hoped to delegate one of them to a Senate-confirmed Assistant Attorney General for the Justice Department’s Criminal Division.

The President nominated a highly qualified lawyer named Brian Benczkowski to serve in that position almost one year ago. But Brian is still awaiting a confirmation vote, as are Jeffrey Clark, our nominee for the Environmental Division; Eric Dreiband for the Civil Rights Division; and Jody Hunt for the Civil Division.

Each nominee meets or exceeds the qualifications normally required for those important jobs. President Trump deserves great credit for nominating champions of the rule of law to serve in the Department of Justice.

There are seven litigating components in Main Justice. Only two of them have Senate-confirmed leaders.

When the founders drafted the Constitution in 1787, this is probably not what they had in mind.

It used to take only a few days to secure the Senate’s advice and consent for presidential nominations.

Fortunately, under the leadership of Attorney General Jeff Sessions, we assembled a superb team to serve as acting heads of the Justice Department’s key components, and we will keep moving forward.

We are aggressively pursuing the crimes that pose imminent danger to the American people. They include terrorism, gang violence, drug trafficking, child exploitation, elder abuse and human smuggling.

Fortunately, we have sufficient resources to enhance our commitment to our new enforcement priorities without detracting from our commitment to prosecute other violations, including white collar crime.

White collar crime undermines the rule of law, defrauds victims, and disrupts the marketplace. Our goal is to deter crime, and we can only do that by holding accountable the perpetrators who cheat in an effort to gain a competitive advantage.

Effective crime prevention requires strong relationships among enforcement authorities and law-abiding businesses. Our Department is committed to reinforcing its relationships with good corporate citizens.

That is reflected in a series of concrete policies announced by the Department over the past year. You will continue to see it in the faithful execution of those policies by our agents and lawyers.

One of my favorite management parables is about a child who watches her mother prepare a roast beef. The mother cuts the ends off the roast before she puts it in the oven. The child asks why. The mother says that she learned it from her mother. So the child asks her grandmother. The grandmother explains, “When your mother was a child, I cut the ends off because my pan was too small to fit the whole roast beef.”

The moral is that the solutions of the past are not necessarily the right solutions today. Circumstances change. We should be willing to reconsider our assumptions.

Whenever we mention that an existing policy is under review, defenders of the status quo proclaim that the current version of the policy is exactly right. Maybe so. Maybe some Department policies are exactly right. But sometimes we need to review whether an existing policy accomplishes its goals and best meets our current needs.

I hope that our attorneys continue to share their experiences, to accept input from stakeholders, and to make suggestions about policy changes.

Let me discuss a few recent policy changes.

In June of 2017, Attorney General Sessions announced that the Department would end the practice of directing third-party settlement payments to non-governmental entities that were not harmed by a defendant’s conduct.

Last November, the Attorney General announced a Department policy to prohibit improper use of and reliance on agency guidance documents.

Also in November, we announced the Department’s new Foreign Corrupt Practices Act Corporate Enforcement Policy. It promotes greater clarity and consistency in FCPA enforcement efforts, and provides stronger incentives for companies to voluntarily disclose misconduct, fully cooperate, and remediate any harm.

Today, we are announcing a new Department policy that encourages coordination among Department components and other enforcement agencies when imposing multiple penalties for the same conduct.

The aim is to enhance relationships with our law enforcement partners in the United States and abroad, while avoiding unfair duplicative penalties.

It is important for us to be aggressive in pursuing wrongdoers. But we should discourage disproportionate enforcement of laws by multiple authorities. In football, the term “piling on” refers to a player jumping on a pile of other players after the opponent is already tackled.

Our new policy discourages “piling on” by instructing Department components to appropriately coordinate with one another and with other enforcement agencies in imposing multiple penalties on a company in relation to investigations of the same misconduct.

In highly regulated industries, a company may be accountable to multiple regulatory bodies. That creates a risk of repeated punishments that may exceed what is necessary to rectify the harm and deter future violations.

Sometimes government authorities coordinate well. They are force multipliers in their respective efforts to punish and deter fraud. They achieve efficiencies and limit unnecessary regulatory burdens.

Other times, joint or parallel investigations by multiple agencies sound less like singing in harmony, and more like competing attempts to sing a solo.

Modern business operations regularly span jurisdictions and borders. Whistleblowers routinely report allegations to multiple enforcement authorities, which may investigate the claims jointly or through their own separate and independent proceedings.

By working with other agencies, including the SEC, CFTC, Federal Reserve, FDIC, OCC, OFAC, and others, our Department is better able to detect sophisticated financial fraud schemes and deploy adequate penalties and remedies to ensure market integrity.

But we have heard concerns about “piling on” from our own Department personnel. Our prosecutors and civil enforcement attorneys prize the Department’s reputation for fairness.

They understand the importance of protecting our brand. They asked for support in coordinating internally and with other agencies to achieve reasonable and proportionate outcomes in major corporate investigations.

And I know many federal, state, local and foreign authorities that work with us are interested in joining our efforts to show leadership in this area.

“Piling on” can deprive a company of the benefits of certainty and finality ordinarily available through a full and final settlement. We need to consider the impact on innocent employees, customers, and investors who seek to resolve problems and move on. We need to think about whether devoting resources to additional enforcement against an old scheme is more valuable than fighting a new one.

Our new policy provides no private right of action and is not enforceable in court, but it will be incorporated into the U.S. Attorneys’ Manual, and it will guide the Department’s decisions.

This is another step towards greater transparency and consistency in corporate enforcement. To reduce white collar crime, we need to encourage companies to report suspected wrongdoing to law enforcement and to resolve liability expeditiously.

There are four key features of the new policy.

First, the policy affirms that the federal government’s criminal enforcement authority should not be used against a company for purposes unrelated to the investigation and prosecution of a possible crime. We should not employ the threat of criminal prosecution solely to persuade a company to pay a larger settlement in a civil case.

That is not a policy change. It is a reminder of and commitment to principles of fairness and the rule of law.

Second, the policy addresses situations in which Department attorneys in different components and offices may be seeking to resolve a corporate case based on the same misconduct.

The new policy directs Department components to coordinate with one another, and achieve an overall equitable result. The coordination may include crediting and apportionment of financial penalties, fines, and forfeitures, and other means of avoiding disproportionate punishment.

Third, the policy encourages Department attorneys, when possible, to coordinate with other federal, state, local, and foreign enforcement authorities seeking to resolve a case with a company for the same misconduct.

Finally, the new policy sets forth some factors that Department attorneys may evaluate in determining whether multiple penalties serve the interests of justice in a particular case.

Sometimes, penalties that may appear duplicative really are essential to achieve justice and protect the public. In those cases, we will not hesitate to pursue complete remedies, and to assist our law enforcement partners in doing the same.

Factors identified in the policy that may guide this determination include the egregiousness of the wrongdoing; statutory mandates regarding penalties; the risk of delay in finalizing a resolution; and the adequacy and timeliness of a company’s disclosures and cooperation with the Department.

Cooperating with a different agency or a foreign government is not a substitute for cooperating with the Department of Justice. And we will not look kindly on companies that come to the Department of Justice only after making inadequate disclosures to secure lenient penalties with other agencies or foreign governments. In those instances, the Department will act without hesitation to fully vindicate the interests of the United States.

The Department’s ability to coordinate outcomes in joint and parallel proceedings is also constrained by more practical concerns. The timing of other agency actions, limits on information sharing across borders, and diplomatic relations between countries are some of the challenges we confront that do not always lend themselves to easy solutions.

The idea of coordination is not new. The Criminal Division’s Fraud Section and many of our U.S. Attorney’s Offices routinely coordinate with the SEC, CFTC, Federal Reserve, and other financial regulators, as well as a wide variety of foreign partners. The FCPA Unit announced its first coordinated resolution with the country of Singapore this past December.

The Antitrust Division has cooperated with 21 international agencies through 58 different merger investigations during the past four years.

And the National Security Division works with the Treasury Department’s Office of Foreign Assets Control, among others, to coordinate and secure resolutions of sanctions and export control violations in which OFAC deems its penalties satisfied by a company’s payments to the Department of Justice.

Coordination also will help us to identify culpable individuals and hold them accountable. We will seek appropriate corporate penalties when justified by the facts and the law. But the primary question should be, “Who made the decision to set the company on a course of criminal conduct?” Our investigations should focus on those individuals.

Our commitment to enhancing international coordination and promoting individual accountability is demonstrated by our increased cross-border enforcement. The Attorney General assigned additional attorneys and paralegals to the Department’s Office of International Affairs to achieve those goals.

The additional resources help us promptly and efficiently obtain necessary evidence from abroad through Mutual Legal Assistance Treaties and other mechanisms of foreign assistance. They also strengthen efforts to return fugitives from abroad for prosecutions here in the United States.

At the same time, we will improve our ability to support our foreign counterparts by more expeditiously responding to their requests for assistance in securing evidence and fugitives located within our borders.

In 2017, our Office of International Affairs successfully returned more than 70 individuals to the United States to face fraud-related charges.

That trend continues. In March, the Office of International Affairs successfully concluded a 10-year long extradition process that led to the criminal conviction of a Canadian fraudster. The defendant orchestrated a telemarketing scheme that cheated at least 60,000 victims of more than $18 million.

We often talk about deterrence as a goal of law enforcement, but what causes deterrence?

For twelve years, I commuted 40 miles each way from Bethesda to Baltimore, mostly on Interstate 95. The speed limit is 65 miles per hour. Some people take that as a suggestion. They know the enforcement strategy.

During those long drives, I sometimes thought about how well traffic laws illustrate the mission of law enforcement.

Speed limit signs deter law-abiding people. If the rules are clear, most people obey them out of a sense of duty and honor.

But some people are not deterred by rules. If we announce a speed limit, but we do not enforce it, then law-breakers always get ahead of law-abiding people.

What if we post a speed camera? A speed camera deters many law-breakers. They slow down as they approach the camera. Then they speed up again. It is not a complete solution. Nonetheless, it does illustrate deterrence.

But some people do not bother to slow down at all. Those people are thinking one of two things. Either they do not believe the government will enforce the penalty, or they calculate that the likely benefit of breaking the rule outweighs the potential penalty.

The lesson is that deterrence requires enforcement. The rules that matter most are the ones that carry expected penalties that decision-makers are unwilling to pay.

Focusing on deterrence requires us to think carefully about what we can achieve in our enforcement actions. Corporate settlements do not necessarily directly deter individual wrongdoers. They may do so indirectly, by incentivizing companies to develop and enforce internal compliance programs. But at the level of each individual decision-maker, the deterrent effect of a potential corporate penalty is muted and diffused. Our goal in every case should be to make the next violation less likely to occur by punishing individual wrongdoers.

In order to promote consistency in our white collar efforts, we established a new Working Group on Corporate Enforcement and Accountability within the Justice Department. The working group includes Department leaders and senior officials from the FBI, the Criminal Division, the Civil Division, other litigating divisions involved in significant corporate investigations, and the U.S. Attorney’s Offices.

The working group will make internal recommendations about white collar crime, corporate compliance, and related issues.

We look forward to collaborating with other agencies and regulators in implementing the new coordination policy. And we welcome input from stakeholders who share our commitment to reduce crime and uphold the rule of law.

Most American companies are serious about engaging in lawful business practices. They want to do the right thing. They need and deserve our support to help protect them from criminals who seek unfair advantages.

Corporate America should regard law enforcement as an ally. In turn, the government should provide incentives for companies to engage in ethical corporate behavior and to assist in federal investigations.

Companies can help protect themselves by using caution when choosing business associates and by ensuring appropriate oversight of their activities.

By effectively combating white collar crime and prosecuting individuals when appropriate, we can protect Americans from fraud, and reduce the risk of another corporate-fraud epidemic.

That will require us to get the policies right, articulate the policies clearly, train our agents and attorneys properly, and provide appropriate supervision.

The Department’s rhetoric gets a lot of attention – the policy memos and speeches. But performance matters most.

When we are serious about wanting people to follow the law, it does no good merely to post a sign. We need to make clear our intent to enforce the law, with sufficient vigor that people fear the consequences of violating it.

That is the lesson I learned on I-95. I appreciate the opportunity to share it with you today.

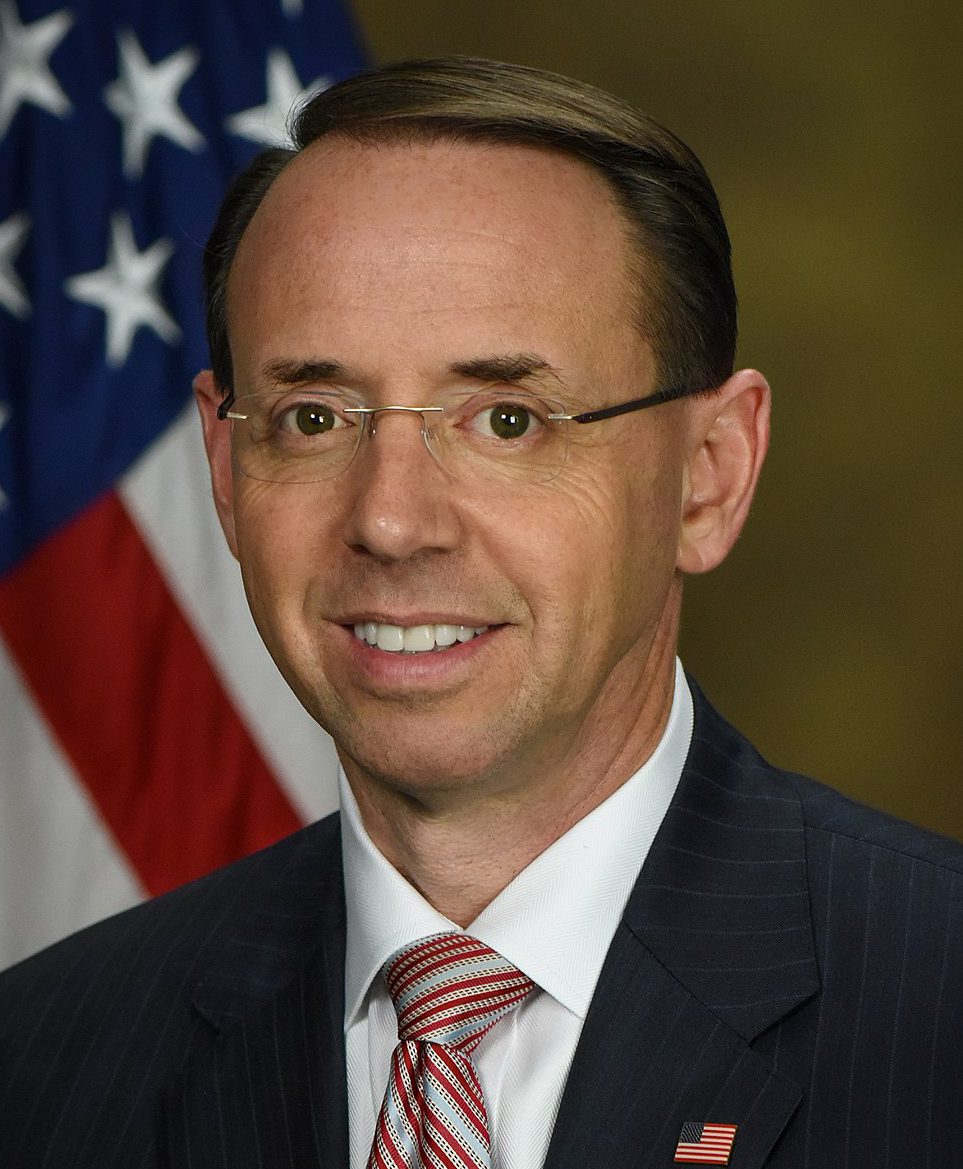

This post is based on remarks delivered on May 9, 2018, by Rod Rosenstein, the U.S. deputy attorney general, at the New York City Bar White Collar Crime Institute in New York, New York. A copy of the remarks is available here.

Sky Blog

Sky Blog