The consequences for companies and individuals directly involved in corporate accounting misconduct are severe. Research has documented that after such misconduct is revealed, the market value of corporations declines, executives are terminated, and auditors are often dismissed. While the implications for those directly involved in the misconduct are well documented, the broader spillover impacts are less clear. Our study examines one such effect by investigating whether the revelation of a major corporate accounting misconduct in a community leads to an increase in neighborhood financial crime.

Our prediction that it does stems from social psychology literature that suggests groups of people establish informal norms that govern the behavior of members of society. While these norms often promote socially beneficial behavior, they can also encourage behavior that runs counter to what society desires. Previous studies on social norms find that when signs of disorder are present in society (e.g., graffiti or littering), individuals are more likely to commit more serious crimes (e.g., stealing).

While visible crimes by any individual are likely to spill over, sociologists suggest that white-collar crimes can be particularly harmful to society because they are by definition committed by people in power. Moreover, anecdotal evidence suggests that large scale accounting misconduct committed by corporate executives is highly visible within the community. For example, the reporting of the revelation of the 2002 HealthSouth fraud, primarily perpetrated by the firm’s CEO Richard Scrushy, reflects the psychological impact that the accounting misconduct had on the citizens of its hometown of Birmingham, AL:

“The accusations against HealthSouth and Mr. Scrushy are a setback, both real and psychological, for Birmingham, Ms. Matlock said. (Romero and Berenson 2003)

“In a grating public embarrassment, the statue outside the institute was defaced in April: Someone spray-painted the word “thief” on the figure of Scrushy. When it happened again a few weeks later, Andrews decided to take the statue down.” (Burke 2003)

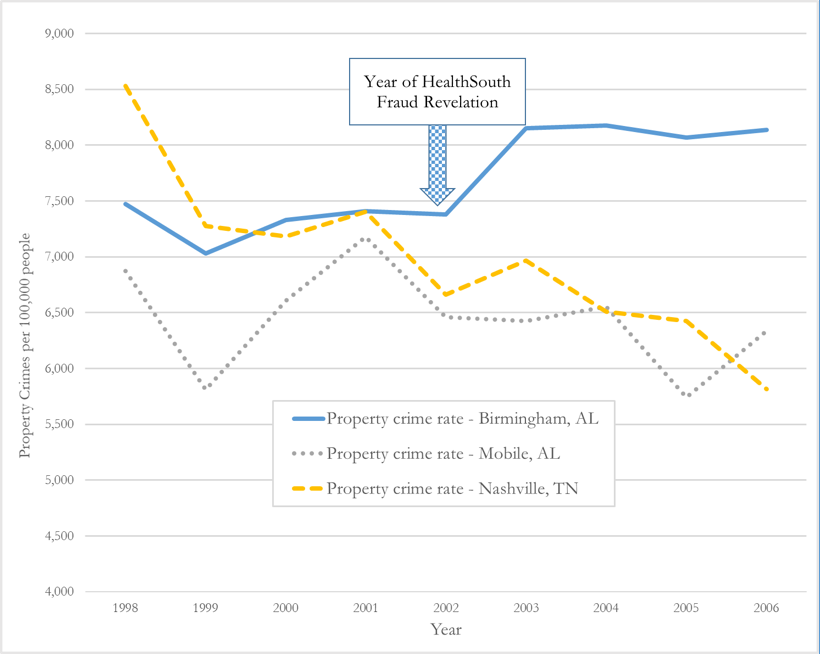

Consistent with a rise in neighborhood financial crime after the revelation of the HealthSouth accounting misconduct, Figure 1 below shows the annual rate of property crime in Birmingham, AL visibly increasing in the post-revelation period (i.e., 2003 to 2006). At the same time, similarly sized and geographically proximate cities (i.e., Mobile, AL and Nashville, TN) did not experience a comparable rise in property crime during this time.

To study whether instances of high-profile accounting fraud influence the ethical decision-making of other local people, we collect data on a sample of several hundred instances of large-scale accounting misconduct identified by the Securities and Exchange Commission (“AAERs”). We then examine whether the initial reporting of this misconduct in a city is associated with an increase in neighborhood crime in that city. To measure local crime, we obtain city-year level data on crime rates from the Federal Bureau of Investigation’s (FBI) Unified Crime Reporting Program (UCR) and scale the number of crimes committed in a given year by the population of the city. We focus specifically on local financially motivated crimes (i.e., thefts, burglaries, robberies, and motor vehicle thefts). These crimes are most similar to those perpetrated by the corporate executives and most likely to be imitated by individuals in that community. Using a regression framework, we compare crime rates across city-years that do and do not experience the revelation of a major accounting misconduct in a certain city. Our results suggest that the revelation of corporate accounting misconduct in a city is associated with an increase in future neighborhood financial crime rates in that city.

The increase in observed crime rates after an AAER could stem from factors other than spillover of immoral behavior through social norms. As such, we include multiple economic factors that could directly influence crime. In particular, we perform a series of tests that include controls for other factors that may influence crime, including unemployment, per capita income level, whether the city has an economic downturn, and the amount of crime in the period before the misconduct becomes known. We also include local fixed effects and time trends to mitigate potential concerns that geographic or time specific factors drive our results. We estimate that the local crime rate is approximately 3.3 percent higher after the revelation of corporate accounting misconduct and that these elevated crime levels persist for up to three or four years. We also perform a series of tests to help mitigate concerns that our results are driven by other factors or local trends. These tests include an analysis where we match AAER city-years to non-AAER city-years based on city size, pre-existing crime rate levels, and the recent trend in local crime rates and continue to document consistent results.

Finally, we provide a series of tests to illustrate further when the relationship between accounting misconduct and local crime is the strongest. We show that the impact of the revelation of an AAER is more pronounced in smaller cities, as the awareness of the corporate malfeasance should spread more quickly through smaller communities. Consistent with this notion, we document that the local crime rate in these smaller cities is approximately 7.3 percent higher after the revelation of corporate accounting misconduct than in other small cities. We also find a stronger relationship between the revelation of accounting misconduct and future crime in locations with higher income inequality. Finally, we find evidence that in communities where the residents have a strong commitment to civic responsibilities (e.g., relatively large number of civic and non-governmental organizations, a high percentage of individuals voting, etc.), neighborhood crime is less likely to be affected by the revelation of corporate accounting misconduct.

Our study contributes to literature examining the impact of social norms on crime. Further, while prior research on accounting fraud has chiefly focused on the direct implications of the fraud for top executives or board members, our evidence suggests that accounting misconduct may have broader implications for society. These findings should help inform academics, enforcement agencies, and policymakers about the costs associated with financial reporting failures.

This post comes to us from professors Eric Holzman at Ohio State University and Brian P. Miller and Brian Williams at Indiana University’s Kelley School of Business. It is based on their recent article, “The Local Spillover Effect of Corporate Accounting Misconduct: Evidence from City Crime Rates,” available here.

Sky Blog

Sky Blog