U.S. public company audits all include a simple step to determine whether an amount is large or significant for their clients, otherwise known as materiality. This decision influences the planning and procedures of the other facets of the audit as well as many judgments by both the auditor and manager about how to interpret misstatements and discrepancies in financial reporting and auditing. In essence, it is the backbone of financial reporting and auditing but kept confidential from investors and often managers (i.e. not publicly disclosed) in the U.S., unlike the UK. We access proprietary data from the Public Company Accounting Oversight Board (PCAOB) to describe and evaluate materiality judgments by auditors at the eight largest public accounting firms (EY, Deloitte, PWC, KPMG, GT, BDO, Crowe, and RSM) across engagements inspected by the PCAOB between 2004 and 2015.

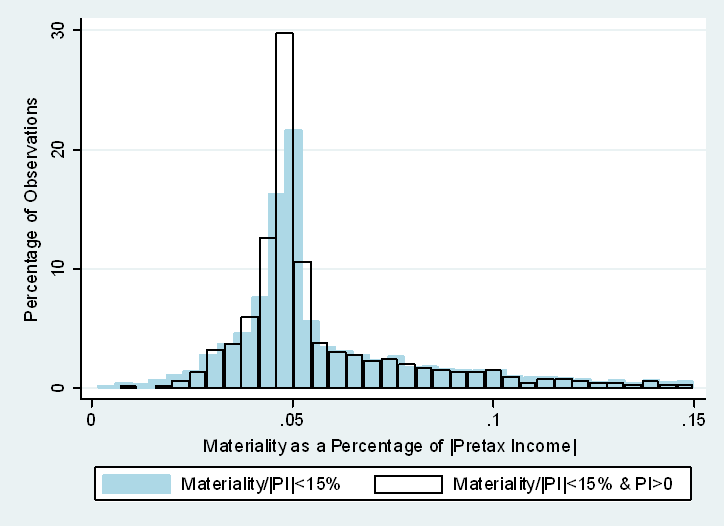

The figure below illustrates that, although the most common benchmark used by auditors is 5 percent of pretax income (which is mentioned in SAB 99), we find substantial variation in judgments made by auditors. This variation stems from using different financial-statement line items as benchmarks to calculate materiality (e.g. revenue or assets), applying a variety of percentages to those bases (e.g. percentages other than 5 percent), as well as adjusting the bases chosen for various reasons (e.g. excluding items the auditor may judge as nonrecurring). Such variation in auditor materiality judgment occurs even when looking only at profitable public companies, which is represented by the bold outline (unshaded) part of the graph.

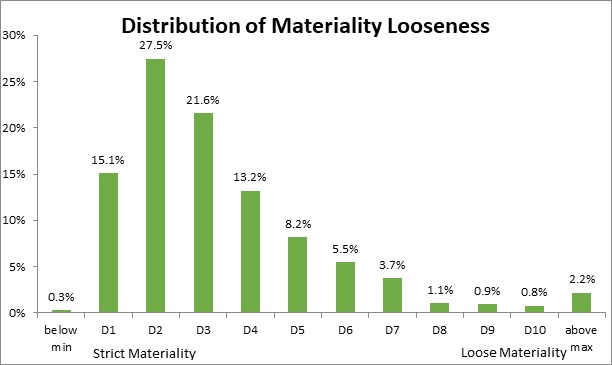

We transform the materiality dollar amount selected by the auditor to a measure that captures the looseness or strictness of materiality decisions by forecasting various possible materiality amounts the auditor could have chosen based on common conventions. As shown in the figure below, we find that, while most auditors select values on the conservative or strict end of possible materiality values (strict choices that correspond to lower dollar values), some choose values on the looser end of the spectrum.

These choices influence both the auditor’s amount of work and fees, such that looser choices result in less of both. Importantly, for audit committees and investors, these materiality choices have implications for the reliability of financial statements. We find that when auditors choose loose materiality values, they identify fewer misstatements in the audit, and among the loosest choices, the propensity to restate is nearly 6 percentage points higher (our sample’s restatement rate is 3 percent) . Our research highlights how much variation there is in auditors’ materiality decisions and how such decisions at the start of the audit are important elements that influence financial reporting reliability.

This post comes to us from professors Preeti Choudhary at the University of Arizona, Kenneth Merkley at Indiana University, and Katherine Schipper at Duke University. It is based on their recent article, forthcoming at the Journal of Accounting Research, “Auditors’ Quantitative Materiality Judgments: Properties and Implications for Financial Reporting Reliability,” available here.

Sky Blog

Sky Blog