In a recent paper, we argue that outside investors are cautious about financing start-ups because such companies often lack a track record and tend to be managed in a less-than professional manner, with founders sometimes putting their own interests above the company’s. We posit that investors can alleviate their fears by identifying early stage firms that have effective corporate governance already in place.

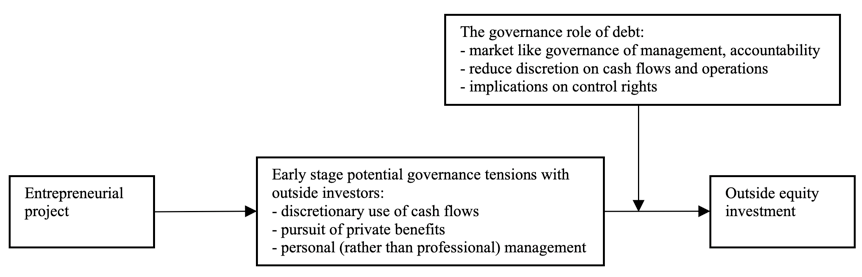

We propose that debtholders can provide a valuable signal that a company has good governance by demanding that the company be accountable to external constituents. Debt has a magnified impact on governance at entrepreneurial firms. It requires them to have professional management practices rather than practices that favor discretionary management; it ties control rights to cash-flow monitoring by lenders, and it enforces penalties that can go as far as shifting control of the firm. Figure 1 summarizes these arguments.

Figure 1. The governance role of debt in early stage firms (Epure and Guasch 2020)

Figure 1. The governance role of debt in early stage firms (Epure and Guasch 2020)

In our paper, we show that the governance role of debt is stronger in the case of business debt, which is subject to more rigorous screening and monitoring of firm activity, while personal debt acts mostly as a signal of the entrepreneur’s commitment. There are specialization advantages in these signaling rationales: Banks can specialize in using soft information on entrepreneurial firms and impose more effective governance by actively monitoring credit lines. While the analysis is general, it shows that the governance role of debt can send a stronger signal in capital intensive industries with business models that are more difficult to scale up (see here).

Our study uses the Kauffman Firm Survey (KFS), and confirms these predictions. Creating a debt signal at firm inception can matter more in times of economic distress, when capital providers are constrained. Importantly, there are economic effects: Start-ups with higher levels of debt, but with otherwise similar characteristics, display higher growth in revenues and market share, especially in capital intensive industries. In short, the presence of lenders can help investors assess arm’s length equity transactions by providing informational advantages based on firms’ existing screening and governance.

Our work reconciles some of the contrasting perspectives of lenders with those of investors forced to interpret limited information. Lenders tend to focus on governance mechanisms that minimize downside risk, while investors look for firms with high growth potential. By using early stage soft information, lenders can guide young firms away from idiosyncratic, sometimes self-serving governance towards market-oriented governance that investors see as promoting growth.

Finally, our findings have managerial and policy implications. Entrepreneurs could rely on the governance role of debt to signal that they are accountable to external constituents through channels such as early stage bank-firm relationships. Also, private equity markets may function better with fewer interventions in capital intensive industries, which feature a higher signaling value of debt. Conversely, public financing grants could complement market debt signals in emerging and less capital intensive industries.

This post comes to us from professors Mircea Epure at Pompeu Fabra University in Barcelona, Spain, and Martí Guasch at Tilburg University. It is based on their recent paper, “Debt Signaling and Outside Investors in Early Stage Firms,” available here.

Sky Blog

Sky Blog