The increasing use of financial technologies (FinTech) by market participants has fostered a discussion among public authorities on the use of similar technologies for regulatory (RegTech) and supervisory (SupTech) purposes. Innovative technologies could also be applied to crisis resolution: the use of one or more resolution tools by a public authority to manage the failure of banks and financial firms in an orderly way. However, the features and market dynamics of resolution differ from those of RegTech and SupTech: There is little market incentive for the private sector to foster innovation in the area of crisis resolution. That is mainly due to two reasons: First, crisis management is the duty of public authorities, and second, financial firms have little incentive to plan for crisis.

Our paper “ResTech: Innovative Technologies for Crisis Resolution,”defines the concept and the scope of resolution technology (ResTech). ResTech is the application of innovative technologies: i) to support the work of resolution authorities in developing resolution plans and in resolving banks and financial firms and ii) to allow financial firms to achieve regulatory compliance and better risk management in an effective and automated manner.

There is a case for ResTech. Supervisors generally lag behind innovations developed by market participants. Internal ratings-based models are one tangible example of this phenomenon applied to credit risk management. Counterparties’ creditworthiness assessment is an evergreen challenge in banking. Thus, market participants developed sophisticated credit-scoring internal models, which have subsequently been endorsed by regulators.

We argue that the drivers for developing innovations for supervisory purposes are distinct from those of crisis resolution. The lack of private sector incentives to invest in R&D on how to resolve a firm’s crisis leaves the task to resolution authorities. One example from early 2010s was the introduction of bail-in, which, as opposed to public bailouts, limited banks’ moral hazard by ensuring that losses are first borne by their shareholders and creditors.

We identify four main areas of ResTech:

- Technology supporting resolution planning activities;

- Technology supporting the execution of resolution actions;

- Technology supporting the cross-border exchange of information to coordinate global resolution actions;

- Technology supporting financial firms’ cooperation with resolution authorities, which enhances compliance with resolution regulation, policies, and decisions.

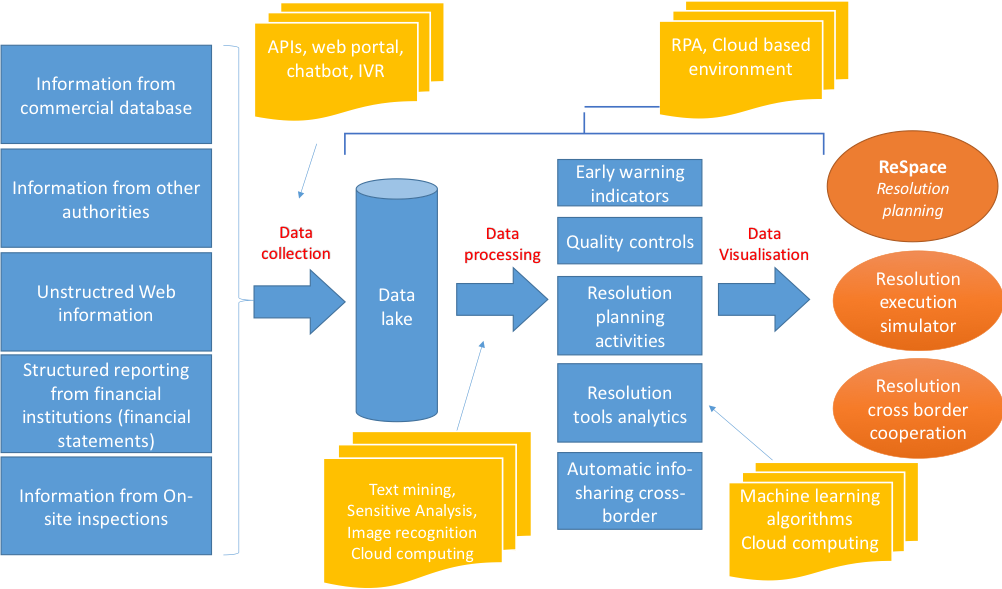

The ResTech toolbox relies on state-of-the-art Big Data architecture and technologies. Resolution authorities may move from data warehouses to data lakes, which enable the collection of structured reporting and unstructured web-based information. Collected data are processed in cloud computing environments and robotic process automation systems. Machine learning algorithms support the analytical work underpinning the definition of early warning indicators and the calibration of the resolution strategy that best minimizes the negative externalities of a crisis at any given time.

ResTech uses a virtual resolution space (ReSpace) and a resolution simulator (ReSimulator). In ReSpace, the resolution plan becomes a cloud-based work environment. Data regularly flow from authorities and from firms to the resolution authority’s data lakes and are consolidated in ReSpace, with automated quality checks. For each planning activity, users can view the underlying input data and any applicable law provisions and policies. In ReSimulator, machine-learning algorithms would define the optimal uses of resolution tools at any given time, for example by tailoring bail-in execution to the firm’s balance sheet features.

Financial firms may ultimately benefit from the use of ResTech applications for compliance purposes. Machine-readable solutions, such as regulatory radars, automatically scan the legislation, official communications, and authorities’ websites to capture publicly available regulatory developments.

ResTech achieves better results in a technologically neutral environment. Technology may enhance domestic and cross-border cooperation between authorities. For instance, the drawing up of resolution plans for cross-border financial groups and the execution of coordinated resolution actions across jurisdictions could use algorithms that process information on the financial firms concerned and on the legal frameworks in which the global resolution strategy would be executed.

Notwithstanding the promising aspects of ResTech, its adoption by resolution authorities might not be a sufficient answer to all existing challenges. In a digitalized environment, resolution authorities would need to set up IT infrastructures and e-governance processes that prevent increased operational, cyber, reputational, and legal risks. Further multidisciplinary research is necessary to assess the benefits of ResTech against its risks. One avenue to start addressing these challenges could be to gather relevant actors and stakeholders together to work on a common taxonomy for ResTech. The following step could be to work on international standards on RegTech and SupTech, but also shaping ResTech tools along the specificities of financial firms’ crisis resolution. In this regard, policy makers and resolution authorities are the best placed to foster innovation.

The ResTech Framework

This post comes to us from Giuseppe Loiacono at SciencesPo Paris, Alessandro Mazzullo at University Paris Diderot, Sorbonne Paris Cité – Institute of Physics of the Globe of Paris, and Edoardo Rulli at the University of Rome Tor Vergata. It is based on their recent paper, “ResTech: Innovative Technologies for Crisis Resolution,” available here. A version of this post first appeared on Oxford Business Law Blog, here. The views expressed in the post are the authors’ own and not necessarily those of their employers.

Sky Blog

Sky Blog