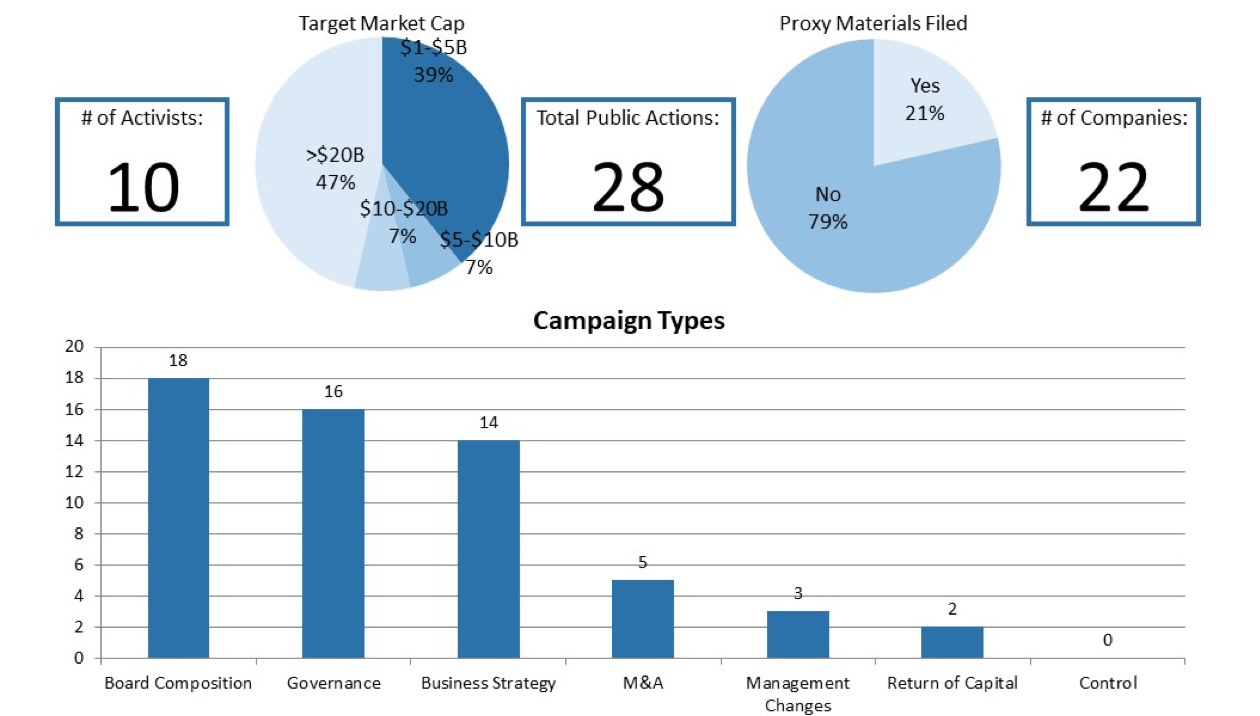

This Client Alert provides an update on shareholder activism activity involving NYSE- and Nasdaq-listed companies with equity market capitalizations in excess of $1 billion and below $100 billion (as of the close of trading on June 30, 2020) during the first half of 2020. As the markets weathered the dislocation caused by the novel coronavirus (COVID-19) pandemic, shareholder activist activity decreased dramatically. Relative to the first half of 2019, the number of public activist actions declined from 51 to 28, the number of activist investors taking actions declined from 33 to 10 and the number of companies targeted by such actions declined from 46 to 22.

The decline in shareholder activism activity brought concentration among those investors engaged in activist activity during the first half of 2020. For example, during the first half of 2020, NorthStar Asset Management launched six campaigns and Starboard Value LP launched four campaigns. Three activists represented half of the total public activist actions that began during the first half of 2020.

In addition, as compared to the first half of 2019, activists turned their focus away from agitating for particular transactions as the animating rationale for the campaigns they launched. While changes in board composition remained the leading rationale for campaigns initiated in the first half of 2019 and the first half of 2020, M&A (which includes advocacy for or against spin-offs, acquisitions and sales) and acquisitions of control, which served as the rationale for 24% and 8%, respectively, of activist campaigns in the first half of 2019, declined to 9% and 0%, respectively, in the first half of 2020. By contrast, advocacy for changes in governance, which emerged in 6% of campaigns in the first half of 2019, became the principal rationale for 28% of campaigns in the first half of 2020. Business strategy also remained a high-priority area of focus for shareholder activists, representing the rationale for 22% of campaigns begun in the first half of 2019 and 24% of campaigns begun in the first half of 2020. The rate at which activists engaged in proxy solicitation remained consistent at 24% in the first half of 2019 and 21% in the first half of 2020. (Note that the percentages for campaign rationales described in this paragraph sum to over 100%, as certain activist campaigns had multiple rationales.)

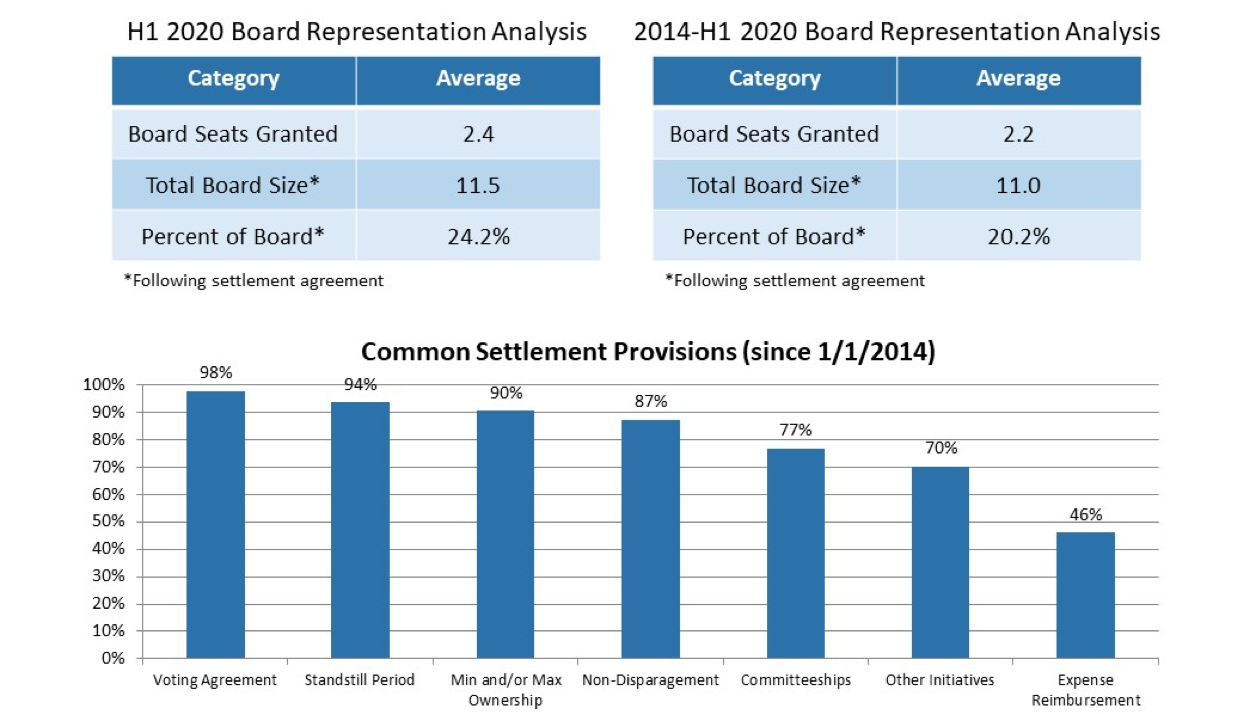

Publicly filed settlement agreements declined alongside the decrease in shareholder activism activity. Nine settlement agreements were filed during the first half of 2020, as compared to 17 such agreements during the first half of 2019. Nonetheless, the settlement agreements into which activists and companies entered contained many of the same features noted in prior reviews, including voting agreements and standstill periods as well as non-disparagement covenants and minimum and/or maximum share ownership covenants. Expense reimbursement provisions appeared in two thirds of the settlement agreements reviewed, which represented an increase relative to historical trends. We delve further into the data and the details in the latter half of the Client Alert, the full version of which is available here.

By the Numbers – H1 2020 Public Activism Trends

By the Numbers – Trends in Settlement Agreements (2014 to H1 2020)

This post comes to us from Gibson, Dunn & Crutcher LLP. It is based on the firm’s memorandum, “2020 Mid-Year Activism Update,” dated October 9, 2020, and available here.

This post comes to us from Gibson, Dunn & Crutcher LLP. It is based on the firm’s memorandum, “2020 Mid-Year Activism Update,” dated October 9, 2020, and available here.

Sky Blog

Sky Blog