The global sustainable finance industry has been described as an ‘industry in transition’, according to the recently-released Global Sustainable Investment Review 2020. This is reflective not only of the growth of the industry, but also the steps taken by many regional markets in implementing industry best practice standards. The Review marks the 5th iteration of a biyearly study published by the Global Sustainable Investment Alliance (GSIA), a group of the world’s leading sustainable finance industry bodies, that reports on the size, growth and dynamics of the world’s responsible investment market.

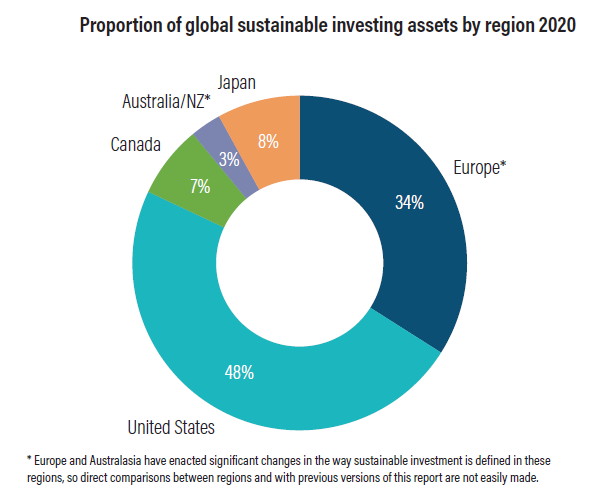

The report found that sustainable investments account for a total of 36% of total assets under management (AUM) globally. The US and Europe comprised more than 80% of this number, followed by Japan, Canada and Australasia.

Source: GSIR 2020

The report notes significant increases in sustainable investments, with a growth of 15% since the last report in 2018 to a total of $35.3 trillion. This figure is based on the 5 major GSIA member contributors to the study, namely Canada, the United States, Japan, Australasia (Australia and New Zealand), and Europe, all of which are detailed in the report. There are also brief insights on China, Latin America, Africa, United Kingdom, and areas of Asia, to form a holistic view of the industry.

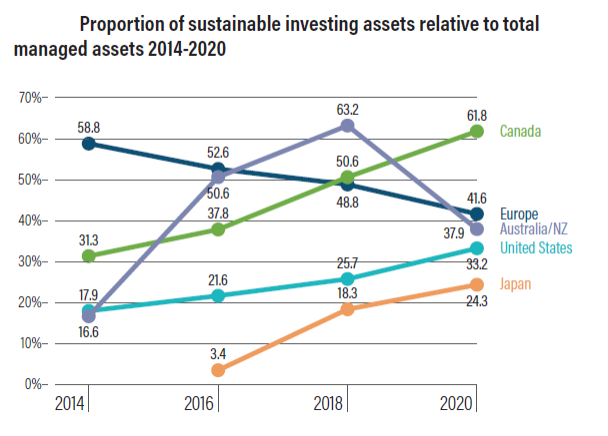

Canada was reported as the national market with the highest proportion of sustainable investment assets at 62%, followed by Europe with 42%, Australasia 38%, the United States with 33%, and Japan 24%.

Source: GSIR 2020

As the responsible investment market becomes more mainstream, refinements of sustainable investment definitions have occurred either by law or through industry standards in the European and Australasian markets. The decrease in the figures for Europe (see table above) are a result of a tightening of regulatory frameworks such as the Sustainable Finance Disclosure Regulation (SFDR), which aims to define what constitutes a sustainable investment and embed this definition into European finance legislation. Similarly, the reduction in total AUM for Australia and New Zealand is due to a revision of sustainable investment definitions driven by stricter industry standards in order to ensure alignment with global standards and consumer expectations.

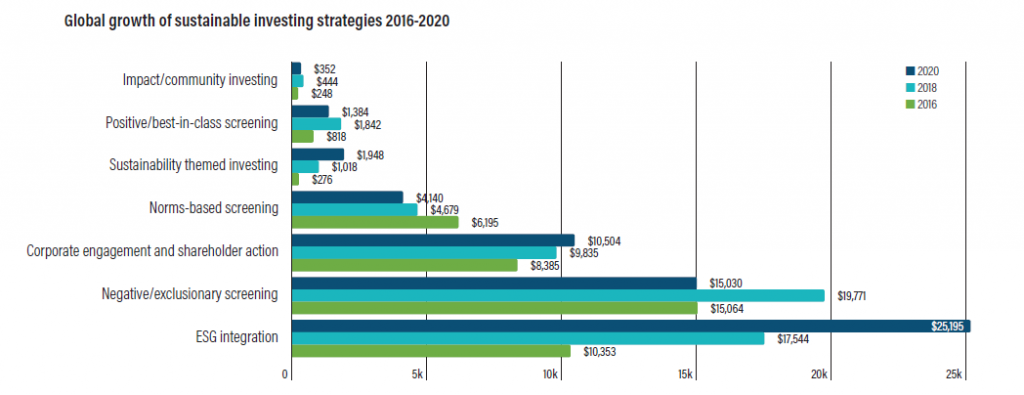

A variety of global initiatives have had a significant impact on the growth of the sustainable investment industry. These include the Paris Agreement on climate change, the UN-backed Sustainable Development Goals, and the Task Force on Climate-related Financial Disclosures. The GSIR 2020 documents growth in the use of sustainable investing strategies over time, with the most common being ESG integration, followed by negative screening, Corporate Engagement & Shareholder Action, norms-based screening, and sustainability themed investing – all areas where solutions are offered by ISS ESG.

Source: GSIR 2020

Given the variety of instruments and investment strategies available, there is a growing need for transparency and verifiable evidence that these investments are delivering real-world outcomes. The report states:

“Increasingly, there are expectations that sustainable investment is defined not just by the strategies involved, but by the short- and long-term impacts that investors are having from their sustainable investment approach.”

All regional markets are likely to face increased levels of scrutiny as the proportion of sustainable investments continue to grow globally. It is key that the quality of these investments is maintained to ensure the advancement of sustainability related goals.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the F in ESGF using the ISS EVA solution.

- Use ISS ESG Sector-Based Screening to assess companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

- Develop engagement strategies, define achievable engagement objectives and manage your engagement process with the ISS ESG Engagement Service.

- Make active ownership a key plank of your responsible investment implementation with ISS Proxy Voting Services.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

This post comes to us from Institutional Shareholder Services. It is based on the firm’s article, “Quality and Quantity: Both are Key to Maximizing Positive Outcomes from the Global Sustainable Investment Industry,” dated August 4, 2021.

Sky Blog

Sky Blog