What a long, strange trip it’s been for Twitter shareholders since the company’s November 7, 2013 Initial Public Offering on the New York Stock Exchange.

- Defendants concealed adverse facts they knew or deliberately discarded, including that by early 2015, daily active users had replaced the timeline views metric as the primary user engagement metric tracked internally by Twitter management and that the trend in user engagement growth was flat or declining.

- Defendants concealed that new product initiatives were not having a meaningful impact on Monthly Active Users (MAUs) or user engagement and that acceleration in MAU growth was the result of low-quality MAU growth (in which new users were not as engaged as existing users).

- Defendants lacked a basis for their previously issued projections of approximately 20% MAU growth and 550 million MAUs in the immediate term.

- As a result of defendant’s false statements and / or omissions, Twitter stock traded at significantly inflated prices during the Class Period, reaching a high of $52.87 per share.

The initial announcement of a tentative settlement occurred on September 20, 2021, minutes prior to jury selection in the scheduled securities class action trial. Settling defendants include the company and two former executives:

- Richard Costolo – Chief Executive Officer of Twitter from August 2009 to July 2015

- Anthony Noto – Chief Financial Officer of Twitter from July 2014 to August 2017

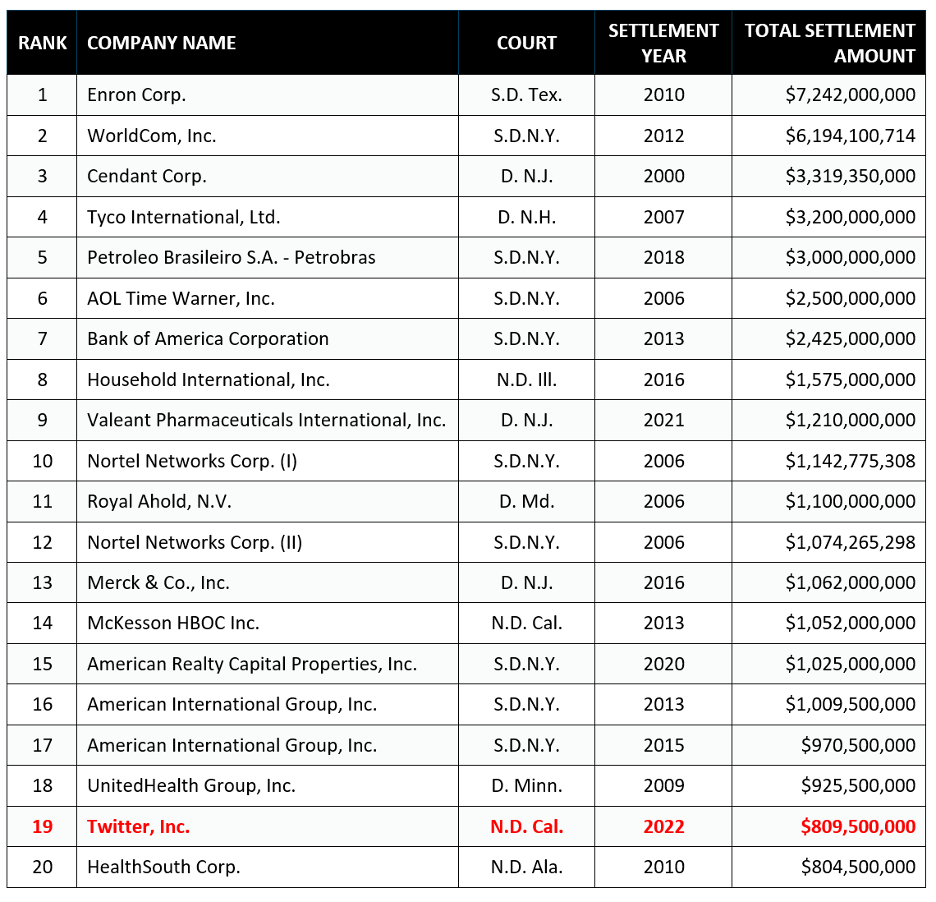

According to ISS Securities Class Action Services, this will become the 19th largest U.S. shareholder class action settlement of all-time, surpassing the 2010 settlement with HealthSouth Corp. valued at $804,500,000. Co-lead counsel Robbins Geller Rudman & Dowd LLP stated this Twitter settlement represents the largest securities fraud class action recovery opportunity in the last 20 years in the Ninth Circuit.

Top 20 U.S. Securities Class Action Settlements

The Twitter settlement ranks number two in 2022 in terms of the largest worldwide settlement (trailing only the €1.4 billion Steinhoff International case that resolved concurrently in the Netherlands and South Africa), however it significantly exceeds the other top U.S. settlements of 2022, which are:

- Teva Pharmaceutical Industries Ltd. – $420 Million

- Luckin Coffee, Inc. – $175 Million

- BlackBerry, Inc. – $165 Million

- NovaStar Mortgage Funding – $165 Million

- Granite Construction – $129 Million

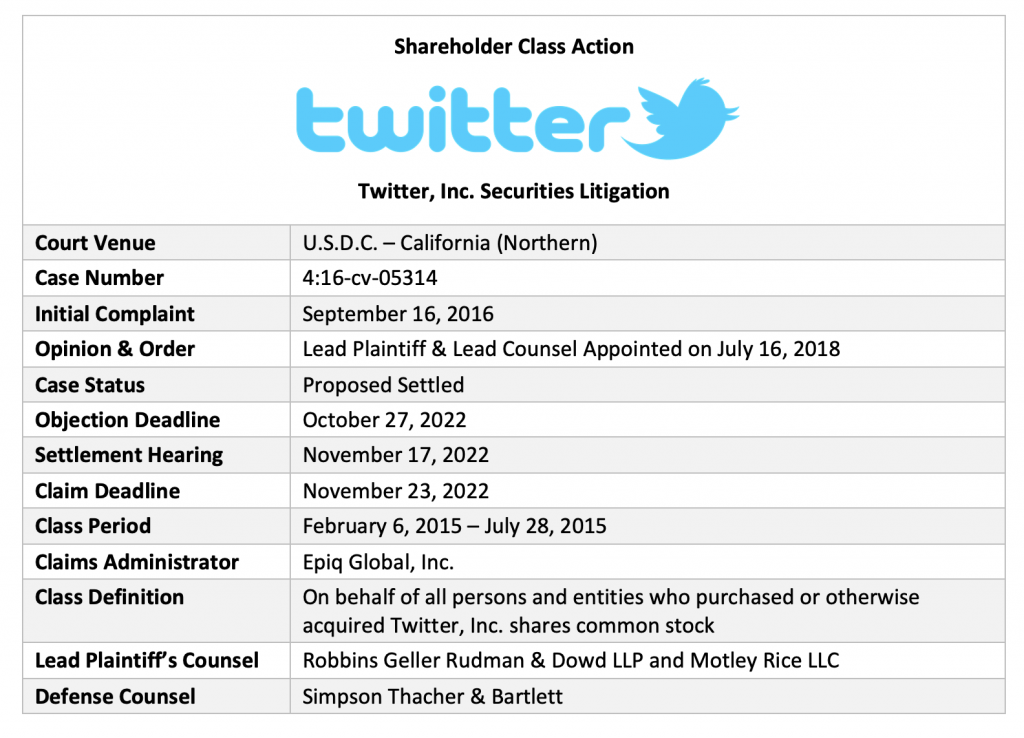

The claims filing process will be managed by the court-appointed administrator, Epiq Global Inc. For institutional investors not serviced by ISS Securities Class Action Services, the In re Twitter Inc. Settlement Notice and official Claim Form can be found here.

The full life cycle of this specific action will likely approach eight years:

As previously reported by ISS Securities Class Action Services, eligible claimants to shareholder class actions typically wait, on average, 18 months between the claim deadline date and disbursement date to be paid.ISS Securities Class Action Services will continue to closely monitor the final stages of this case, including the upcoming Settlement Hearing in November. ISS SCAS will share updates to its clients and the investment community, as developments occur.With an incredibly large $809.5 million settlement, the longer-than-typical life cycle of this action will have been worth the wait.

ENDNOTE

[1] Assumes 18 months from the claim deadline date (the average length of time for a U.S. shareholder class action to disburse).

This post comes to us from Institutional Shareholder Services. It is based on the firm’s memorandum, “Twitter’s $809.5 Million Settlement Close to the Goal Line,” dated September 6, 2022, and available here.

Sky Blog

Sky Blog

The upcoming fairness hearing and claim deadline is positive news for Twitter shareholders as it’s been almost six years since the initial complaint was filed against Twitter on September 16, 2016. (On average, shareholder class actions,

The upcoming fairness hearing and claim deadline is positive news for Twitter shareholders as it’s been almost six years since the initial complaint was filed against Twitter on September 16, 2016. (On average, shareholder class actions,