The topic of human rights is of major concern among many stakeholder groups, spanning the public, private, and social sectors (e.g., companies, investors, consumers, NGOs, governments, intergovernmental organizations, etc.). Human rights issues present material risks to not only companies, but also to institutional investors, as reputational as well as regulatory and litigation risks, can impact both companies and their investors. Reputational costs stemming from, say, damaging viral news stories could negatively impact consumer loyalty, brand perception, and ultimately share price. As many institutional investors engage with companies to increase alignment on ESG performance and reporting, the ‘S’ in ESG (Environmental, Social, and Governance) has come under increasing scrutiny in recent years.

Additionally, there have been significant legal and regulatory developments regarding human rights-related issues, such as the recent enforcement of the Uyghur Forced Labor Prevention Act (UFLPA) which came into effect in June 2022 and the EU’s September 2022 proposed ban on goods made with forced labor – and accompanying social compliance-related reassessments of supply chain human rights due diligence (mostly limited to tier 1 finished goods facilities), upstream materials traceability protocols (e.g., cotton and polysilicon), and associated reporting and disclosure requirements. As such, due also in part to NGO engagement and consumer segment expectations, best practices have emerged among corporate leaders with regards to transparent and comprehensive end-to-end supply chain disclosures.

Human rights-related risks, however, have not correlated with significant majority support for human rights-related shareholder proposals. In 2022, the only human rights-related shareholder proposal to receive majority support was for the firearms manufacturer Sturm, Ruger & Company, Inc. (RGR) – this might have corresponded closely with the societal response to the recent torrent of mass shootings in America. The Ruger proposal received 69 percent support, which was an outlier in the data set.

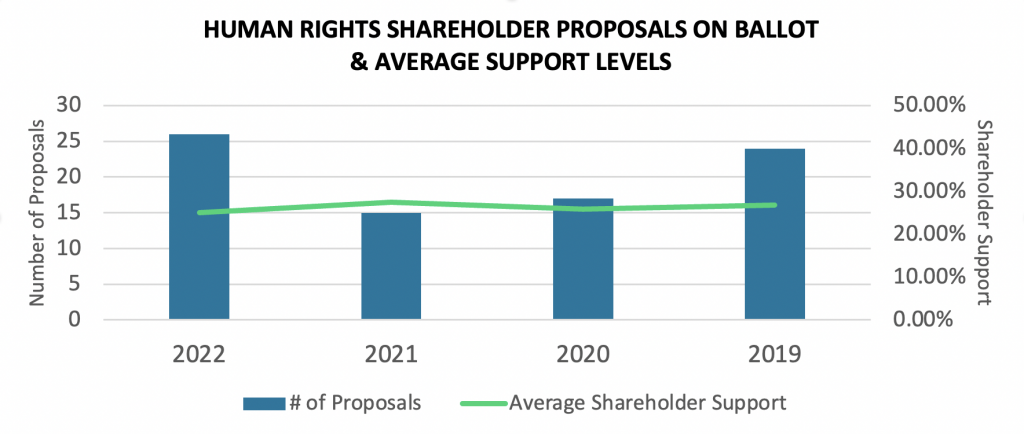

During the 2022 U.S. proxy season, there were 26 human rights-related shareholder proposals on ballot (around 9 percent of total shareholder proposals on ballot), which garnered an average of 25 percent of shareholder support.

Source: ISS Governance Research & Voting

While the number of human rights-related shareholder proposals on ballot have varied over the years, the mean level of support for these proposals has remained more-or-less constant.

Source: ISS Governance Research & Voting

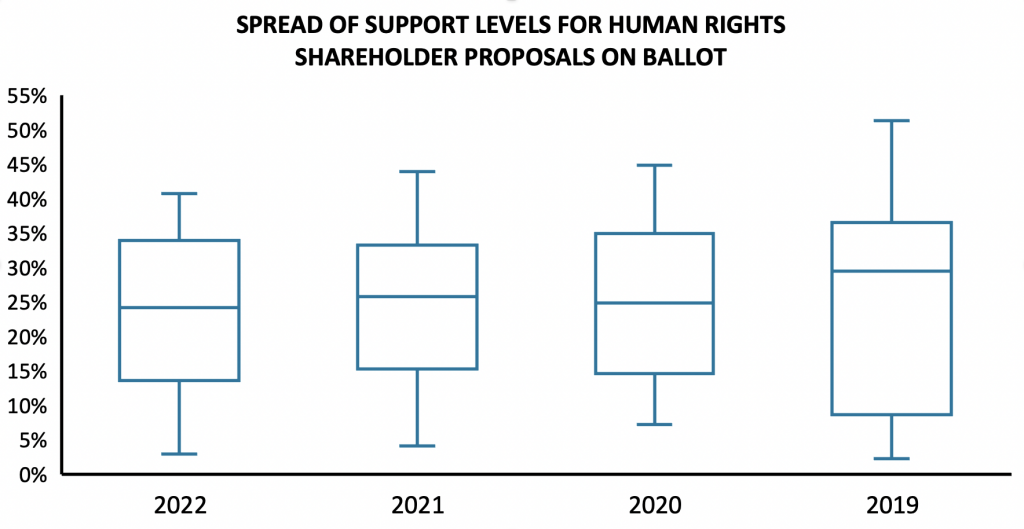

The median level of support for human rights-related shareholder proposals on ballot has also not varied significantly year-over-year.

Source: ISS Governance Research & Voting

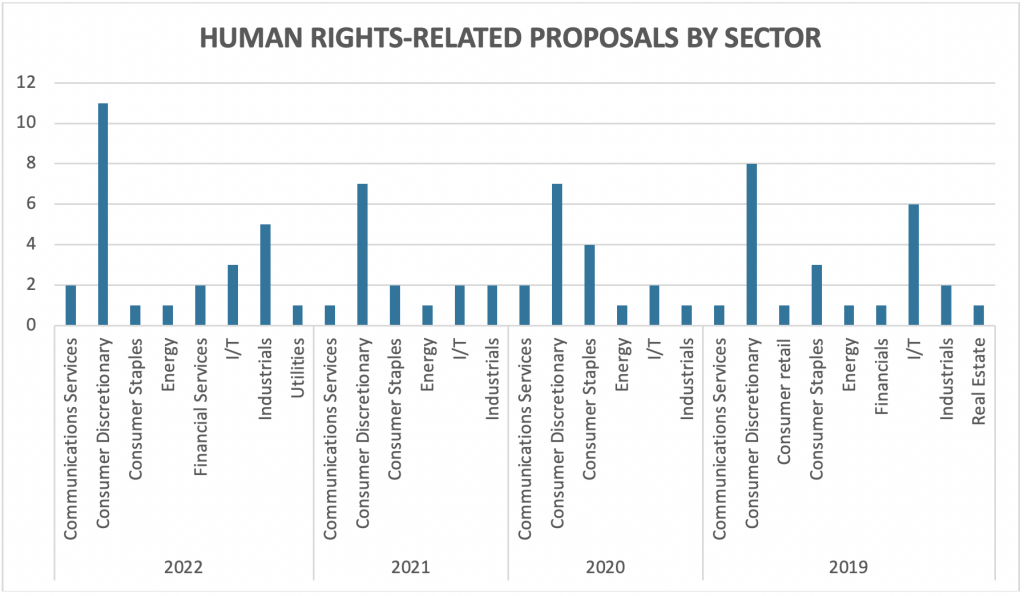

The numbers of human rights-related shareholder proposals by sector since 2019 are shown above. The consumer discretionary and I/T sectors in particular have faced increased scrutiny with regards to responsible sourcing standards in supply chains, due in part to significant controversies driven by media reporting and NGO attention.

Many of the human rights-related shareholder proposals over the period have focused on increased disclosure regarding supply chain human rights due diligence, or on whether company leadership is effectively managing forced labor and child labor sourcing risks, and business operations and end-use due diligence in high-risk regions. Other proposal topics have included customer and end-use due diligence (e.g., privacy and law enforcement), domestic labor rights, and other issues. See table below for a list of targeted companies, sector, proposal type, main filer and vote support level.

The wider picture is that the average vote of support for human rights-related proposals has held approximately at 26 percent per season over recent years. With 26 human rights-related proposals, the 2022 proxy season had the most human rights-related proposals in recent years, up from 15 in 2021, 17 in 2020, and 24 in 2019.

2022 U.S. Proxy Season Human Rights-Related Proposals (by AGM DATE)

| Company | Sector | Proposal Topic | Main Filer | Support Level (%) |

| Apple Inc. (AAPL) | I/T | Forced Labor (Item 7) | Jane M. Saks et al | 33.70% |

| The Walt Disney Company (DIS) | Communications Services | Human Rights Due Diligence (Item 6) | National Legal and Policy Center | 36.80% |

| Lockheed Martin Corporation (LMT) | Industrials | Human Rights Impact Assessment – End Use (Item 5) | Sisters of Charity of St. Elizabeth et al | 20.20% |

| Citigroup Inc. (C) | Financial Services | Human Rights Due Diligence – Indigenous People (Item 7) | Sisters of St. Joseph, Brentwood | 34.00% |

| Wells Fargo & Company (WFC) | Financial Services | Human Rights Due Diligence – Indigenous People (Item 8) | American Baptist Home Mission Societies | 25.91% |

| General Dynamics Corporation (GD) | Industrials | Human Rights Impact Assessment – End Use (Item 5) | Franciscan Sisters of Allegany, NY | 25.24% |

| 3M Company (MMM) | Industrials | Business in “Communist China” (Item 5) | Steven Milloy | 3.30% |

| FirstEnergy Corp. (FE) | Utilities | Child Labor (Item 4) | Steven Milloy | 2.90% |

| The Hershey Company (HSY) | Consumer Discretionary | Child Labor (Item 4) | American Baptist Home Mission Society | 7.81% |

| Amazon.com, Inc. (AMZN) | Consumer Discretionary | Customer Due Diligence (Item 6) | Sisters of St. Joseph, Brentwood | 40.25% |

| Amazon.com, Inc. (AMZN) | Consumer Discretionary | Freedom of Association (Item 13) | SHARE | 38.91% |

| Amazon.com, Inc. (AMZN) | Consumer Discretionary | Human Rights Impact Assessment – End Use (Item 19) | Harrington Investments | 40.69% |

| Chevron Corporation (CVX) | Energy | Human Rights Due Diligence (Item 8) | International Brotherhood of Teamsters | 12.39% |

| Meta Platforms, Inc. (META) | Communications services | Human Rights Impact Assessment (Item 10) | Mercy Investment Services | 23.76% |

| Lowes Companies, Inc. (LOW) | Consumer Discretionary | Independent Contractor Misclassification (Item 9) | International Brotherhood of Teamsters | 35.71% |

| Alphabet Inc. (GOOGL) | I/T | Human Rights Due Diligence (Item 13) | SumOfUs | 16.99% |

| Alphabet Inc. (GOOGL) | I/T | Human Rights Impact Assessment (Item 16) | The Sustainability Group of Loring, Wolcott & Coolidge | 23.00% |

| Sturm, Ruger & Company, Inc. (RGR) | Consumer Discretionary | Human Rights Impact Assessment (Item 4) | CommonSpirit Health | 68.52% |

| The TJX Companies, Inc. (TJX) | Consumer Discretionary | Human Rights Due Diligence (Item 5) | NorthStar Asset Management | 24.60% |

| The TJX Companies, Inc. (TJX) | Consumer Discretionary | Independent Contractor Misclassification (Item 6) | International Brotherhood of Teamsters | 31.80% |

| Caterpillar Inc. (CAT) | Industrials | Human Rights Due Diligence (Item 6) | Wespath Benefits and Investments | 10.60% |

| General Motors Company (GM) | Industrials | Child Labor (Item 6) | National Legal and Policy Center | 22.36% |

| The Kroger Co. (KR) | Consumer Staples | Human Rights Due Diligence (Item 6) | Domini Impact Investments | 20.85% |

| Tesla, Inc. (TSLA) | Consumer Discretionary | Freedom of Association (Item 11) | N/A | 33.35% |

| Tesla, Inc. (TSLA) | Consumer Discretionary | Child Labor (Item 12) | N/A | 10.54% |

| NIKE, Inc. (NKE) | Consumer Discretionary | Forced Labor (Item 5) | Domini Impact Equity Fund | 6.35% |

Source: ISS Governance Research & Voting

This post comes to us from Institutional Shareholder Services. It is based on the firm’s article, “In Focus: Human Rights-Related Shareholder Proposals in the 2022 U.S. Proxy Season,” dated November 28, 2022, and available here.

Sky Blog

Sky Blog