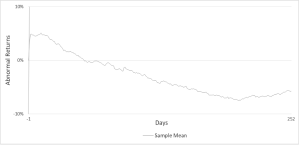

Seeking “strategic alternatives” is a euphemism for a company trying to sell itself, which typically results in an acquisition premium for shareholders, and many announcements of strategic alternatives explicitly state that the goal is maximizing shareholder value. Upon a company’s announcement that it is evaluating strategic alternatives, its stock price on average jumps more than 5 percent. Yet, over the next six months, the price drops 9 percent, more than erasing the initial gain. In a new article, we explain how the market misprices the news so severely.

Questioning the Status Quo

The traditional theory of financial markets is the efficient market hypothesis (EMH), which holds that all news is factored into stock prices immediately and correctly, on average. This also means that any news should not systematically predict future stock gains or losses. However, academic researchers and investment professionals have documented instances where news does predict future stock returns, providing an opportunity to understand investors’ actual behavior, which is not always rational and efficient. In our setting, the news that a company is evaluating strategic alternatives seems to trigger an irrational response marked by inefficient stock price movement.

We propose that the psychological root of the inefficient market reaction is the “availability heuristic” (Tversky and Kahneman, 1973), which is based on the notion that humans have limited knowledge and processing power and must rely on simplifying heuristics to assess complicated questions. When assessing uncertain outcomes, such as the expected future value of the firm after it announces a strategic review, investors cannot accurately compute all future outcomes and weight them by their probabilities. Instead, potential outcomes that are more easily recalled and “available” are judged as being more frequent. Concurrently, unfamiliar outcomes are underweighted.

The most salient potential outcome, by far, is a business combination where the firm that announced strategic alternatives becomes the acquisition target, and its shareholders receive an acquisition premium. In contrast, a less salient fact is that firms seeking strategic alternatives are on the decline and generally continue declining in terms of their fundamentals and accounting performance. Of the two signals, the more-salient, value-creating possibility may be over-emphasized by investors. This would explain the positive initial reaction. Then, as declining fundamental performance occurs and is reported in future earnings announcements, stock prices slide.

Stock returns reacting to the announcement and future stock returns over the subsequent 252 trading days. Returns are adjusted for firm size and book-to-market of equity.

Investors’ Overly Optimistic Expectations

While the stock return pattern suggests market mispricing, we document a set of empirical facts to corroborate that the availability heuristic causes systematically over-optimistic expectations upon investors learning about the company’s strategic alternatives evaluation. Essentially, investors overweight the expectation of value creation, as they recall salient cases of successful strategic alternatives and believe the announcement’s statement to maximize shareholder value, and correspondingly underweight the negative signal of the announcement for firm fundamentals.

We find the following results:

- Future earnings disappointments significantly explain the future abnormal returns. Returns that cluster around future earnings news indicate that earnings are mispriced. In our setting, the announcement provides a negative signal of the firm’s future earnings that is not fully incorporated by investors.

- Analysts’ earnings forecasts and target prices are systematically too high compared with actual future earnings and prices, and these errors explain future returns. Analyst reports, containing analysts’ expectations, are a proxy for market participants’ expectations. Furthermore, we find that analysts’ forecasting and price target errors explain the cross section of future returns.

- Upon observing the strategic alternatives announcement, analysts revise target prices upward yet, in contrast, revise earnings forecasts downward. This is direct evidence that the announcement causes expectations of firm value to be biased upward.

- The subsamples with higher announcement returns, which reflect greater market expectations, experience negative future returns. More specifically, when we sort our sample based on announcement returns, all subsamples experience negative future returns.

- The strategic alternatives announcement return is negatively associated with the merger announcement return. This suggests that investors both over-anticipate and prematurely anticipate the acquisition premium at the time of the announcement of strategic alternatives. If a takeover is subsequently announced, the merger announcement premium is already priced in.

- The firms that announce strategic alternatives but do not receive a subsequent takeover offer drive the stock underperformance result.

Alternative Explanations

There are other potential reasons why future stock returns might be negative following the strategic alternatives announcement, reasons which are unrelated to investors’ over-optimism. We address each of these alternative reasons in our study and conclude that they cannot sufficiently explain the negative future returns.

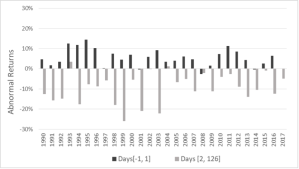

- The negative future returns may be statistically spurious, driven by a few outliers, or an artifact of a particular return measure or methodology. To explore this possibility, we divide our sample by industry, by year, by market capitalization, by analyst following, and by trading volume. We also use several different abnormal return methodologies: controlling for market-wide movements, controlling for firm size and book-to-market, and equal-weighting and value-weighting portfolio returns. We find no evidence for this possibility.

Announcement returns and future returns, broken up by year. Announcement returns are measured from trading day -1 to 1, and future returns are measured from trading day two to 126, relative to the announcement date. Returns are adjusted for firm size and book-to-market of equity.

- Firms seeking strategic alternatives may have confounding characteristics or experience other corporate events that also lead to low future returns. We confirm our findings by checking that the negative return predictability of the strategic alternatives announcement is incremental to these other predictive signals.

- The abnormal returns may be rational compensation for risk. Therefore, we include commonly used risk proxies and traditional and contemporary risk factor models in our analyses. We find a negative and statistically significant alpha from our risk factor regressions, confirming our findings.

- High transaction costs and prohibitive limits to arbitrage may cause the initial over-pricing, and prices may gradually correct. We address this possibility by sorting and dividing our sample based on the magnitude of transaction costs and find that the return pattern persists across the subsamples.

Conclusion

The abnormally negative stock returns following companies’ announcements of strategic alternatives occur because investors appear to over-emphasize the possibility of value-enhancing outcomes, causing a positive market reaction. Investors also appear to misconstrue the announcement’s predictive signal for declining firm fundamentals such that when future fundamental underperformance is reported in future earnings announcements, investors are disappointed and share prices slide. Cognitive reliance on the availability heuristic is a reasonable explanation for this seemingly inefficient stock return pattern.

REFERENCE

A. Tversky and D. Kahneman. 1973. Availability: A Heuristic for Judging Frequency and Probability. Cognitive Psychology 5 (2), pp. 207-232.

This post comes to us from Professor Jenny Zha Giedt at George Washington University and Hyun Jung Rim, a doctoral candidate at the university. It is based on their recent article, “Mistaking Bad News for Good News: Mispricing of a Voluntary Disclosure,” available here.

Sky Blog

Sky Blog

There’s a lot of underlying theory supporting these findings. Thank you for the hard work!