While unequal voting structures in the U.S. are commonly associated with technology and media companies, there is no such industry specific tendency in Europe – with its tradition of so-called “loyalty shares” and government ownership. This paper surveying dual class share structures in Europe follows an earlier piece looking at similar structures in the U.S.

Key Findings

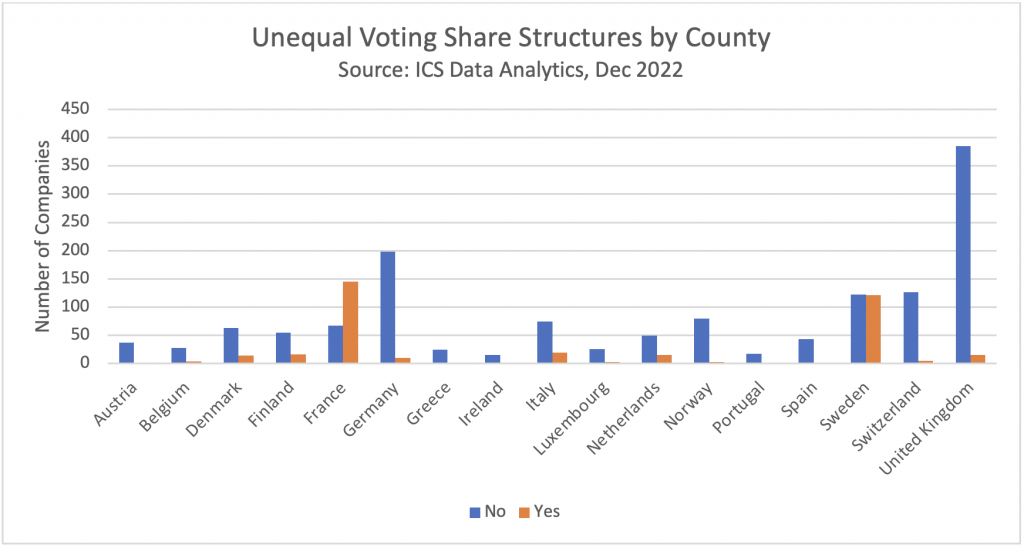

- More than twice as many companies in France have unequal voting rights than those that don’t have them

- The split in Sweden is around 50:50

- Greece and Portugal have no companies with unequal voting rights

- Loyalty shares as well as other unequal voting arrangements are allowed in Finland, Italy, Sweden, Switzerland, Belgium, France and the U.K.

- In addition, while loyalty shares are not allowed, other unequal voting practices are allowed in Denmark, Germany, Netherlands and Spain

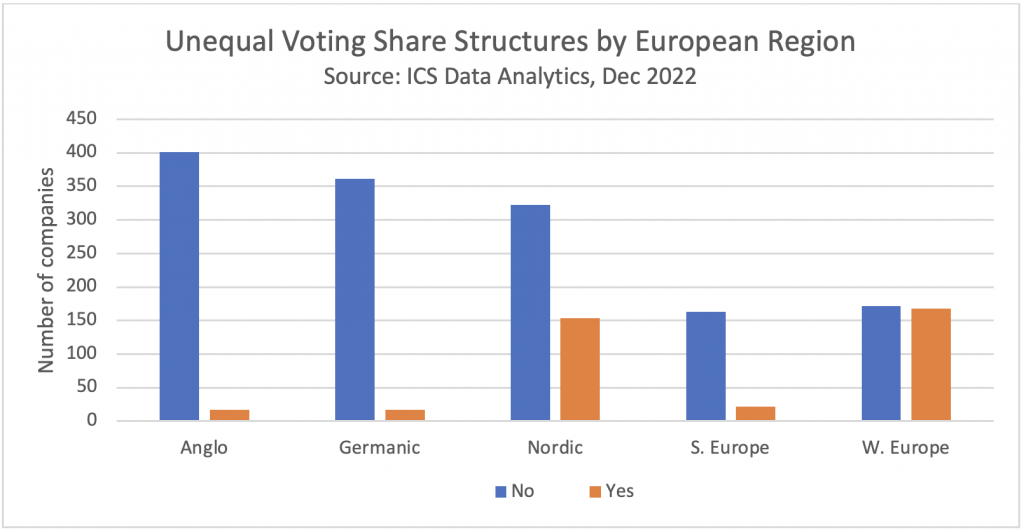

As can be seen from the graph below, unequal voting share structures are largely concentrated in Western Europe (France, Belgium, Luxembourg, Netherlands) and the Nordic countries (Denmark, Sweden, Norway, Finland).

Loyalty shares are those that have been held for a longer period, usually two years, but sometimes longer. They bring with them additional voting rights and, in some cases, a higher dividend.

Unequal voting practices are rare in Anglo (U.K., Ireland) countries and in Germanic (Germany, Austria, Switzerland) countries, with only 4.1% and 4.5% of companies respectively operating them. In Southern Europe, only 11.9% of businesses have such structures, which are allowed in Italy and Spain but not Greece and Portugal. By contrast, almost half of all companies in Western Europe have some form of unequal voting rights, while in the Nordic region, almost a third of companies have them.

Unequal voting practices are rare in Anglo (U.K., Ireland) countries and in Germanic (Germany, Austria, Switzerland) countries, with only 4.1% and 4.5% of companies respectively operating them. In Southern Europe, only 11.9% of businesses have such structures, which are allowed in Italy and Spain but not Greece and Portugal. By contrast, almost half of all companies in Western Europe have some form of unequal voting rights, while in the Nordic region, almost a third of companies have them.

Country by Country Analysis

In France, most of the unequal structures involve loyalty shares. In Sweden, half of companies have unequal voting structures. Austria, Belgium (where legislation allowing loyalty shares is very recent), Ireland, Norway, Spain, Luxembourg and Switzerland have only a handful of companies with unequal voting rights.

In Denmark, 18.2% of companies have unequal voting rights, while in Finland the figure is 23.6%, 21% in Italy and 24.2% in the Netherlands.

In Denmark, 18.2% of companies have unequal voting rights, while in Finland the figure is 23.6%, 21% in Italy and 24.2% in the Netherlands.

How Loyalty Shares Work

In France, loyalty voting rights are granted by default, unless opposed by a two-thirds majority. By contrast, a two-thirds majority of shareholders is required to introduce loyalty shares in Italy and Belgium. In most European countries, it is much easier to introduce such a structure than other unequal arrangements. This is based on the idea that any shareholder, in theory, can take advantage of the greater voting rights – double those of ordinary shareholders – by simply retaining the securities for long enough. In many cases, however, loyalty voting rights benefit controlling shareholders the most; in France, that often means the government. Loyalty shares – as with dual class share structures in the U.S. – are also often used by family firms in Europe.

Loyalty Shares vs. Other Dual Class Structures

Loyalty shares are allowed to trade on indexes that prohibit other types of dual class structures because they are potentially open to all investors. Another difference from other unequal arrangements is that the extra voting power depends on how long the securities are held and it disappears when the shares are sold. By contrast, the extra rights in a “founder style” structure, including their duration, depend on the terms set when they are granted. Often the extra rights granted to founders are permanent.

One criticism of loyalty shares, however, is that they can be less transparent than founder style preferred shares /voting rights. While companies disclose the number and ownership of shares in the founder style structure, they often do not when it comes to loyalty shares.

Institutional Shareholder Services (ISS) has recently changed its approach to board approval in continental Europe where there is an unequal voting rights arrangement. It recognizes that companies in Europe take a variety of approaches to governance, such as golden share structures, multiple share classes, and an increasing numbers of countries allow loyalty share arrangements. However, some of these structures have been designed with positive governance intentions, such as encouraging long-termism by both management and investors, and may not be universally seen as treating shareholders unequally. In addition, a current board may not be accountable for the continued existence of such policies, for example when the holders of the special class of shares have to approve any change to the voting rights structure.

“Nevertheless, equal treatment of shareholders is a key tenet of good governance” ISS said in announcing its change of approach. That aligns with the ICGN’s Global Governance Principle number nine.

The new ISS policy, which goes into effect on February 1, 2024, “will generally hold boards accountable for the existence of arrangements that allow for unequal voting rights through recommendations against specific directors or against the discharge of (non-executive) directors.”

This post comes to us from Institutional Shareholder Services. It is based on the firm’s article, “Dual Class Share Structures: The European Experience,” dated February 6, 2023, and available here.

Sky Blog

Sky Blog