The rationale behind a number of recent EU legislation changes focusing on corporate governance has been to prioritise a long-term focus on governance through various transparency measures as well as some concrete requirements for action, and on allowing shareholders and other stakeholders to be well informed. This is evident in the revised Shareholder Rights Directive adopted in 2017, and also in the most recent legislative initiatives discussed in this review. The Corporate Sustainability Reporting Directive and the proposed directive on Corporate Sustainability Due Diligence revise current obligations and introduce new ones under EU law regarding company disclosure and corporate governance practices. Additionally, the new November 2022 Directive on gender balance on company boards seeks to harmonise and improve Member State practices regarding gender representation on company boards.

This review takes a look at the recent legislative initiatives noted and discusses their possible impacts on the Annual General Meeting (AGM) agendas of European companies in the upcoming years. Drawing conclusions from these multiple initiatives rather than examining each individually can help us to better understand the general direction of corporate governance and EU legislation in the European context.

The first half of this review discusses the selection of EU legislative initiatives that will have impact on shareholder meetings, and the status of these legislative procedures. The second half highlights some notable themes and potential impacts of AGMs across these legislative pieces.

Corporate Sustainability Reporting Directive

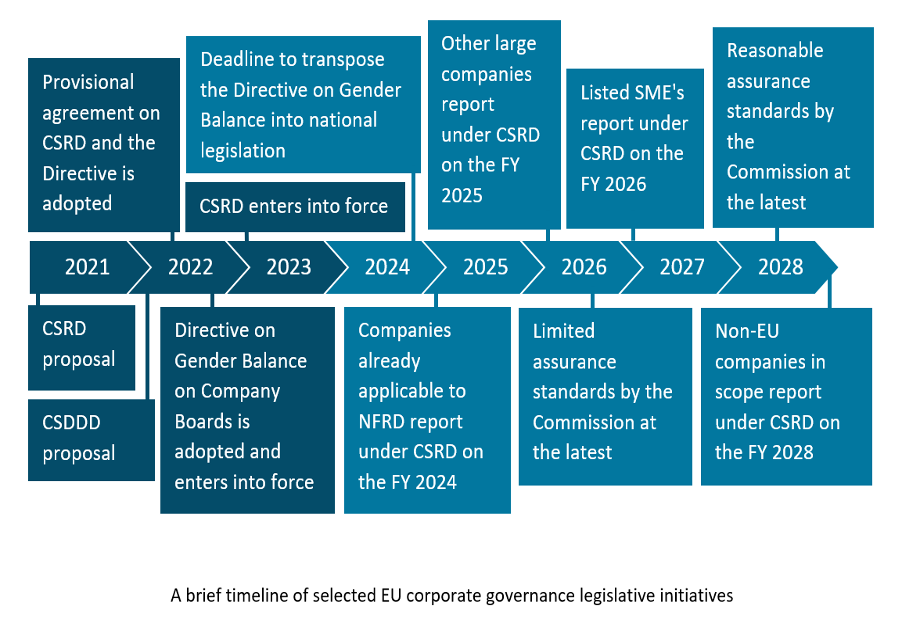

In 2021, the European Commission adopted a Sustainable Finance Package to help the flow of money towards sustainable activities across the European Union and considered by the European Commission as instrumental in making Europe climate neutral by 2050. Part of this package is a proposal for a Directive on Corporate Sustainability Reporting (CSRD, CSR Directive). In June, 2022, the EU Parliament and Council announced that they had reached a provisional political agreement on the proposed CSR Directive and on January 5, 2023, it (CSR Directive (EU) 2022/2464) entered into force.

The CSR Directive revises and extends the scope of the Non-Financial Reporting Directive (NFRD). The NFRD entered into force in 2014 and requires the companies that fall under its scope to disclose information regarding environmental and social matters. Additionally, the CSRD is not a stand-alone directive, but is intended to amend four existing pieces of EU legislation: the Accounting Directive, the Transparency Directive, the Audit Directive, and the Audit Regulation.

The principal new provisions of the CSR Directive:

- Extend the scope of application to include all large companies and all companies listed on regulated markets, with the exception of listed micro-companies.

- Require assurance (audit) of the reported sustainability information.

- Require reporting to be in line with mandatory European Sustainability Reporting Standards (ESRS).

- Require the reported information, including targets and a climate transition plan, to be published in a dedicated section of company management reports as well as disclose in a digital, machine-readable format.

Under the NFRD, companies were not required to report non-financial information in line with any harmonised standards. However, the CSR Directive brings an obligation for companies to report in line with mandatory EU sustainability reporting standards. The European Commission aims to adopt its first set of sustainability reporting standards by mid-2023 based on submission from EFRAG (the European Financial Reporting Advisory Group).

The CSR Directive balances between two assurance (or audit) levels, namely the limited assurance requirement and the more demanding reasonable assurance requirement. Ultimately, the objective is to have a similar level of assurance for both financial and sustainability reporting, namely the higher standard of reasonable assurance. The gradual approach from limited to reasonable assurance allows for the progressive development of company reporting practices. The Directive includes a provision requiring the Commission to adopt specific standards for limited assurance requirement by mid-2026 and for reasonable assurance by mid-2028.

Corporate Sustainability Due Diligence Directive

In February 2022, the European Commission published its proposal for a Directive on Corporate Sustainability Due Diligence (CSDDD proposal, CSDD Directive). At the time of writing, the proposal is at the European Parliament and the Council for approval. On November 7, 2022, the Parliament’s Committee on Legal Affairs published a Draft Report and on December 1, 2022, the Council published its negotiating position. Depending on the timeliness of the legislative procedure, the CSDD Directive is expected to be transposed by Member States into their national legislation by 2026 due to the two-year implementation period of EU directives.

Companies falling within the scope of the Directive are:

- Large EU limited liability companies, with more than 500 employees and a net EUR 150 million turnover worldwide (Group 1).

- Other EU limited liability companies operating in defined high impact sectors with more than 250 employees and net EUR 40 million turnover worldwide (Group 2). For these companies the rules will start applying 2 years later.

- Non-EU companies active in the EU that have turnover generated in the EU falling within the above-mentioned turnover thresholds.

The Directive aims to improve corporate governance practices and foster sustainable and responsible corporate behaviour by mandating certain corporate due diligence measures and duties. The proposal establishes a corporate sustainability due diligence duty to address negative human rights and environmental impacts. The Commission considers that corporate sustainability due diligence should include the integration of due diligence into relevant policies and measures, directors’ duties and remuneration. Thus, all these three aspects can be found in the proposal.

Due diligence. The Directive includes a list of requirements relating to due diligence and how those requirements need to be implemented in all corporate practices. The requirements apply to the company’s own operations, their subsidiaries and all established relationships within their value chains. For example, companies must take appropriate measures to identify actual or adverse impacts of their operations on human rights, and Group 1 companies need to have a plan to ensure their business strategy is compatible with limiting global warming to 1.5°C in line with the Paris Agreement.

Civil liability and director’s duties. Certain provisions of the Directive incorporate due diligence into directors’ fiduciary duties and establish civil liability of companies in respect of harm to human rights and/or the environment caused by due diligence failures. Additionally, companies would have to comply with the rights and prohibitions included in the list of international treaties annexed to the Directive.

Remuneration. As noted above, Group 1 companies falling within the scope of the Directive are also required to adopt climate mitigation plans to ensure their business model and company strategy are compatible with the transition to a sustainable economy and limiting global warming to 1.5°C. Also, if for example variable remuneration is linked to the contribution of a director or senior manager to the company’s business strategy, long-term interests and sustainability, the director or senior manager’s variable remuneration will need to be set with the company’s climate mitigation plan in mind.

The CSDD (Due Diligence) Directive is intended to supplement the CSR (Reporting) Directive whereby the CSRD requires setting up disclosure procedures regarding sustainability information and the CSDD will hold companies accountable for due diligence failures.

Gender Balance On Company Boards

The Commission’s proposal for a Directive on Gender Balance on Company Boards was presented back in 2012. The proposal gained momentum in 2022 and in June, the Parliament and Council reached a provisional agreement on the Directive, and the final Directive (EU) 2022/2381 was adopted on November 22, 2022..

This Directive aims to improve gender balance among both executive and non-executive directors. Under the Directive, listed companies are expected to have either at least 40 percent of their non-executive directors or at least 33 percent of all director positions (including both executive and non-executive directors) from “members of the underrepresented sex” by June 2026. The Directive also lays out obligations to prioritise the underrepresented sex among equally qualified candidates. Companies that fail to reach the target will need to adjust their selection process.

Upcoming Annual General Meetings Agendas

Executive Compensation

The adopted CSR Directive was amended from the original proposal by the Parliament and the Council to require further information on company incentive schemes in the management report. Each company is required to state whether or not it has a policy whereby terms of incentive schemes offered to members of administrative, management and supervisory bodies are linked to sustainability matters. The management report should also include performance indicators relevant to the disclosure of such information.

The Commission’s proposal on the CSDD Directive includes a provision that climate mitigation plans should be properly implemented and embedded in the financial incentives of directors. Under the proposal, the plan should be duly taken into account when setting directors’ variable remuneration, if variable remuneration is linked to the contribution of a director to the company’s business strategy, long-term interests and sustainability. However, both the Parliament’s draft report and the Council’s negotiating position have amended the provision. The Parliament’s draft report considers that a significant portion of directors’ variable remuneration should be linked to the achievement of sustainability goals and in particular greenhouse gas emission reduction targets but makes no mention of the emission reduction plans. On the contrary, the Council’s position refers to the strong concerns raised by Member States and states that “the form and structure of directors’ remuneration are matters primarily falling within the competence of the company and its relevant bodies or shareholders”.

Whereas the provisions in the CSR Directive refer to disclosure obligations, the Commission’s vision of the CSDD Directive goes a step further and requires that measures are taken to include sustainability matters into the compensation practices for directors at both executive and non-executive levels. Many believe the obligation may help further align shareholder and company management interests. Both proposals can be expected to influence companies’ remuneration policy and remuneration report ballot items put forward for shareholder votes at AGMs.

Director Elections

The CSR Directive mandates that companies disclose descriptions of the role of the administrative, management and supervisory bodies with regard to sustainability matters, and of their expertise and skills to fulfil this role, or alternatively, their access to such expertise and skills. This requirement mainly concerns disclosure, and it is yet to be seen how such information will impact shareholder views of what makes a candidate competent to serve on the company’s board.

Currently, listed companies have to produce a corporate governance statement in their management report which includes a description of the diversity policy applied to the company’s administrative, management and supervisory bodies. However, companies have flexibility as to which aspects of diversity to report on. The CSR Directive would require listed companies to always report on their gender diversity policies and their implementation.

The November 2022 Directive on gender balance in company boards (2022/2381) brings about the biggest changes in this area. EU listed companies will have to meet the objectives of having boards on which members of the underrepresented sex hold at least 40 percent of non-executive director positions or at least 33 percent of all director positions by 30 June 2026, and to report to authorities once a year regarding gender representation on their boards.

Board elections are likely to be impacted by all of these factors: expertise regarding sustainability matters, application of diversity policy, and board gender balance. Shareholders will be able to consider the aforementioned factors when evaluating candidate qualifications and board composition as a whole.

Auditors and Audit Committee

The CSR Directive will bring about significant changes in how companies disclose sustainability information. For example, the management report will have to be prepared in accordance with sustainability reporting standards. Furthermore, the requirements relating to sustainability reporting will affect both the use of external auditors in companies as well as the role of the audit committee. The audit committee will oversee the new reporting process and report to management or the supervisory body regarding three key factors: i) the outcome of the assurance of sustainability reporting; ii) the audit committee’s contribution to the integrity of sustainability reporting; and iii) what the role of the audit committee was in the process.

In addition, shareholders may exercise their rights as laid out in the Shareholder Rights Directive to put forward proposals to require that the sustainability reporting is made available to the general meeting of shareholders and that the auditor carrying out the sustainability reporting is not the same one carrying out the statutory audit.

Discharge of Board and Management

The CSDD Directive proposal consists of a combination of sanctions and civil liability. The provisions relating to civil liability and directors’ duties drew some criticism in the public consultation and feedback period. Some of the feedback highlighted that imposing obligations on companies from international law creates an excessive litigation risk for companies. In general, the provisions were considered by some to be vague and unclear, putting both companies and their leadership in an unpredictable position.

Following the criticisms received, both the Parliament’s draft report and the Council’s negotiating position aim to address a number of concerns. For example, the Parliament’s draft report takes the intended scope of the directive further than the Commission’s proposal, envisioning that directors’ oversight regarding due diligence should also include ensuring that the overall business model and strategy of the company is aligned to sustainable transition and limiting global warming to 1.5°C. Also, the Parliament’s position on civil liability covers the entire directive whereas the original Commission proposal only focused on failures to comply with Articles 7 and 8. On the other hand, the Council’s position on civil liability strongly focuses on the need to achieve legal clarity and certainty for companies and to avoid unreasonable interference with Member States’ tort law systems. The negotiating position has also deleted the provision on directors’ duties.

Given the differing views coming from the Parliament and the Council, shareholders should anticipate that the final directive may include a number of kinds of provisions on civil liability and directors’ due diligence obligations. As the result of obligations to comply with due diligence measures found in the CSDD Directive and the sustainability reporting requirements of the CSR Directive, shareholders will likely be presented with multiple additional considerations to be taken into account when assessing the votes on discharge of both the board and management. The additional disclosure requirements are intended to give shareholders the tools to hold company management accountable.

Conclusion

The year 2022 saw significant progress in EU legislation relating to ESG matters with both the CSR Directive and Directive on Gender Balance being formally adopted. With the publication of the Parliament’s draft report and the Council’s negotiation position on the CSDD Directive, there is now much better understanding on what to expect regarding due diligence obligations in the upcoming years.

These legislative and upcoming legislative changes will bring about a combination of disclosure requirements and changes to corporate governance practices in companies. Additionally, companies will be subject to increased transparency of many of their corporate activities and will be held to a higher standard regarding human rights and sustainability practices. Shareholders for their part will have more information to be able to assess the qualifications of candidates to the boards of directors or the supervisory boards, specifically regarding diversity and sustainability expertise. In summary, shareholders are receiving many additional tools that can be used to better understand company practices in these areas and in holding the company and its management accountable.

This post comes to us from Institutional Shareholder Service. It is based on the firm’s article, “EU Legislative Changes: Sustainability Reporting, Sustainability Due Diligence, and Gender Balance on Company Boards: Anticipated Impacts of Selected EU Legislative Initiatives on General Meeting Agendas,” dated March 3, 2023, and available here.

Sky Blog

Sky Blog