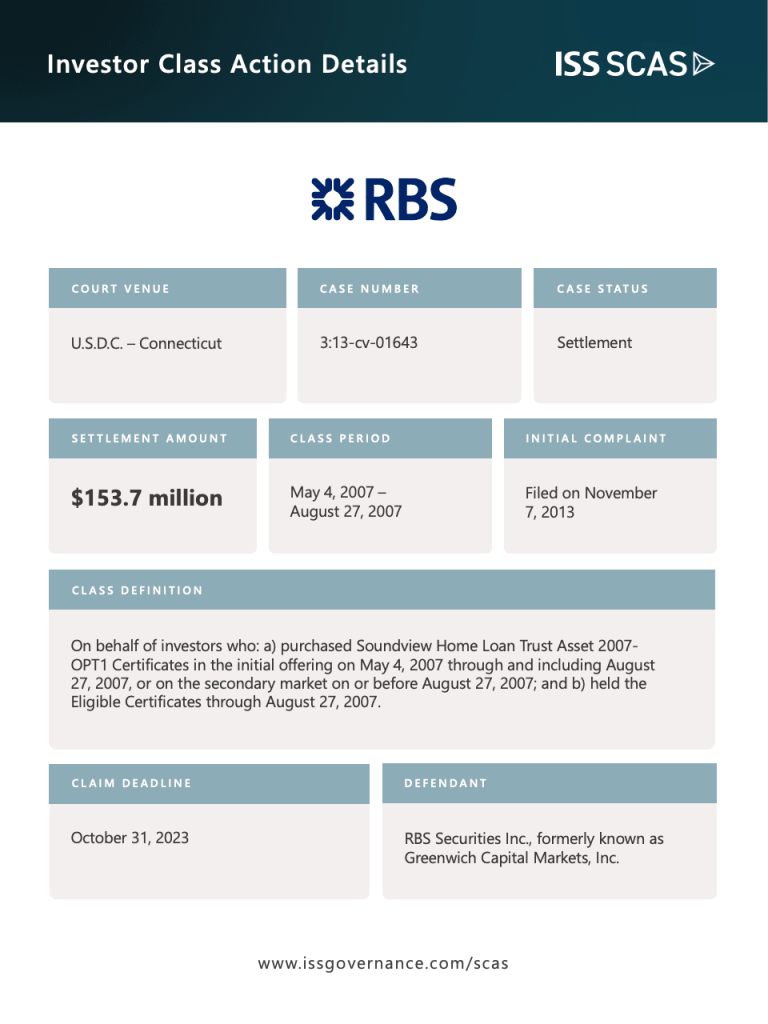

Investors of RBS Securities Inc.’s multi-billion 2007 subprime mortgage-backed security offering – Soundview Home Loan Trust 2007-OPT1 – will soon be eligible to receive payment from the SEC’s $153.7 million fair fund.

The SEC first commenced its case in 2013 alleging RBS – a subsidiary of the Royal Bank of Scotland plc – misled investors by claiming that the loans backing the $2.2 billion security offering were generally in compliance with the lender’s underwriting guidelines. The loans allegedly deviated so much from RBS’s underwriting guidelines that about 30% should have been excluded from the mortgage-backed security offering entirely.

When RBS purchased the more than 11,000 mortgages in subprime mortgage pools from an H&R Block Inc. subsidiary, it was under “acute pressure” to package and sell off the mortgages into securities quickly – before the closing date of April 30, 2017. In a rush to meet the seller’s deadline, RBS is alleged to have quickly reviewed only a fraction of the mortgage loans, even after finding significant deficiencies during diligence.

The SEC fair fund punishes RBS for its alleged misconduct and secures more than $150 million in relief for those harmed by the “shoddy securitization.” RBS consented to an entry of judgment in November 2013, agreeing to disgorge $80.3 million, plus prejudgment interest of $25.2 million, and pay a civil penalty of $48.2 million. The court approved the SEC’s plan to distribute the funds in May 2023, more than nine years later.

This fair fund is by far the largest with a claim filing deadline of this year – more than double the Kraft Heinz $62 million fair fund created by the SEC.

SEC Fair Funds like the Soundview Home Loan represent significant recovery opportunities for investors – as they represent about 10% of the total value of investors’ securities-related claims, according to ISS SCAS research.These “Fair Funds” – established by the Sarbanes–Oxley Act of 2002 to disgorge profits unlawfully obtained by corporations – operate differently than securities class actions and may impose additional claim filing requirements on investors. For example, recent SEC plans of distributions specifically prohibit fees to “third-party filers” from being paid or deducted from the distribution payment. While this may prevent some of SCAS’ competitors from servicing fair funds in the future, SCAS has the capacity and flexibility in its offerings to continue to fully file for fair funds, ensuring SCAS clients can recover what they are entitled to.ISS Securities Class Action Services will continue to monitor and file fair fund claims for this high-profile action and others.This post comes to us from Institutional Shareholder Services. It is based on the firm’s article, “Investors to Receive $153 Million in SEC Fair Fund Over Mortgage-Backed Security Offering,” dated August 9, 2023, and available here.

SEC Fair Funds like the Soundview Home Loan represent significant recovery opportunities for investors – as they represent about 10% of the total value of investors’ securities-related claims, according to ISS SCAS research.These “Fair Funds” – established by the Sarbanes–Oxley Act of 2002 to disgorge profits unlawfully obtained by corporations – operate differently than securities class actions and may impose additional claim filing requirements on investors. For example, recent SEC plans of distributions specifically prohibit fees to “third-party filers” from being paid or deducted from the distribution payment. While this may prevent some of SCAS’ competitors from servicing fair funds in the future, SCAS has the capacity and flexibility in its offerings to continue to fully file for fair funds, ensuring SCAS clients can recover what they are entitled to.ISS Securities Class Action Services will continue to monitor and file fair fund claims for this high-profile action and others.This post comes to us from Institutional Shareholder Services. It is based on the firm’s article, “Investors to Receive $153 Million in SEC Fair Fund Over Mortgage-Backed Security Offering,” dated August 9, 2023, and available here.  Sky Blog

Sky Blog