Despite the trillions of dollars spent annually on mergers and acquisitions (M&A)[1], surprisingly little is known about the bidding strategies of potential acquirers and how negotiations unfold. For example, do bidders begin with a low-premium offer and increase it in increments, or do they start bidding with a strong offer? How are these initial bidding strategies related to outcomes such as securing the deal and shareholder value?

In a recent paper, we investigate bidding behavior during the private phase of the M&A process and how it correlates with key outcomes for the winning bidder. The importance of this topic is illustrated by media[2]and academic articles[3] on how acquirers appear to have overpaid for targets’ assets, and thus destroyed shareholder value.

Traditionally, academic work has focused on public-bidding behavior. However, by the time a deal is publicly announced, the bidding and negotiation process has largely concluded, limiting the ability to draw inferences about strategic bidding behavior. To obtain information about the private sales process, we extract information from SEC EDGAR filings related to the merger background for a sample of U.S.-based target firms. From these documents, we collect information on the initiation date, party initiating the sales process, offer values, and number of bidders in each bidding round. Though we cannot observe the identity of all bidders in the takeover contest, we can link the successful acquirer to each bid based on the descriptions in the merger background.

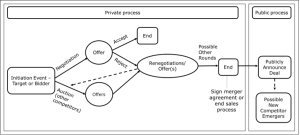

Once either a bidder or target initiates the private sales process, the target firm chooses whether to negotiate with a single bidder or conduct an auction involving multiple bidders. Sales processes beginning as negotiations can eventually result in an auction and vice versa. Both approaches entail multiple rounds of bidding. The figure below illustrates the M&A bidding sequence of both the private and public process.

FIGURE: OVERVIEW OF THE M&A BIDDING SEQUENCE

Each potential bidder has to determine whether to make an offer and the bidding strategy to pursue. Our analyses focus on the initial offer premium because it provides the clearest insight into potential strategic bidding behavior. A bidder could take an aggressive approach by first offering a high price relative to the bidder’s desired final price. A strong initial bid could signal to the target that the bidder is serious, and the target might choose to forestall a full auction. Even if targets still consider other offers initially, they will frequently limit bidding in subsequent rounds to parties that have indicated the highest valuations. Thus, a high bid could increase the likelihood of winning the takeover contest. However, a higher initial bid could also signal the bidder’s eagerness, prompting the target to believe it has greater bargaining power and to negotiate harder to extract an even higher price. Further, if the bidder starts strong, it is more difficult to pull back on the offer in subsequent rounds, potentially leading to overpayment.

We find that higher initial offers, with the first bid serving as a proxy for the expected final premium based, are revised fewer times and are more likely to result in a successful purchase. Despite documenting that higher first offers are associated with higher final premiums, we do not find that they correspond to lower announcement returns for the acquirer. In fact, in target-initiated deals, stronger first offers are associated with higher acquirer announcement returns. These results could suggest that, when targets have shown a greater willingness to sell, a strong first offer could convince them to end an auction process early and not solicit other bids, leading to a more beneficial and smoother process for the bidding party. This decision could also be rational from the perspective of the target, which would avoid a costly and lengthy process and would not have to reveal valuable private information to other parties.

We contend that our evidence is consistent with the bidders’ use of these strategies to mitigate target resistance to the takeover and can encourage them not to run a full auction or can truncate the auction process. We demonstrate that higher initial bids are associated with fewer subsequent price revisions and competing bids, which provides further evidence that bidders make initial offers to persuade targets that they are serious about the deal and will pay a sufficiently high premium.

We further explore the form of the offer. When the bidder makes an initial offer, it can either be precise or imprecise. We define precise offers as those that are not rounded to the nearest dollar or presented as a range of values. More precise first bids correspond to fewer rounds of bidding and have a higher likelihood of being accepted. Interestingly, more precise initial offers are associated with higher final premiums in target-initiated deals but result in lower ultimate premiums if transactions are initiated by the bidder. Moreover, these precise offers correspond to significantly higher bidder returns in auctions, are bidder-initiated, and cash transactions. This evidence suggests that more precise offers could serve as a signal of bidder confidence in correctly valuing targets. As a result, targets are less likely to anticipate future upward bid revisions and might consequently decide not to organize a costly auction process.

Our paper demonstrates that stronger initial bids are associated with less resistance from targets and a smoother deal process. In addition, we do not find that the higher chance of winning the deal comes at the expense of shareholder value. Further, we find that the precision of the first offer serves an additional signal of the first bidder’s diligence and interest and demonstrates that more precise offers help deter bidding competition and convince target shareholders to sell.

Our study illuminates how bidding strategies in the private phase of a deal can significantly smooth the transaction while leading to higher stock prices when it is publicly announced. Therefore, our findings are highly relevant for M&A teams and advisers to both the target and acquiring firms. Finally, our findings illustrate the importance of, and the need for additional research on, the private negotiations process.

ENDNOTES

[1] See, https://www.bain.com/insights/looking-back-m-and-a-report-2024/

[2] https://www.nytimes.com/2014/06/22/your-money/merger-fever-can-be-a-menace-for-shareholders.html

[3] e.g., Moeller, S.B., Schlingemann, F.P. and Stulz, R.M., 2005. Wealth destruction on a massive scale? A study of acquiring‐firm returns in the recent merger wave. The journal of finance, 60(2), pp.757-782.

This post comes to us from Audra L. Boone at Texas Christian University’s M.J. Neeley School of Business, Wouter De Maeseneire at Vlerick Business School, Sebastien Dereeper at IAE Aix-Marseille – CERGAM and Skema Business School, Mathieu Luypaert at Vlerick Business School, and Mai Nguyen Thuy at Vietnamese German University. It is based on their recent paper, “Unravelling Bidding Strategies in M&A Transactions: Evidence from the Private Phase of the Deal Process, “available here.

Sky Blog

Sky Blog