In a new article, I examine how the role of derivatives in the crypto industry compares in terms of sophistication and leverage with their role in traditional finance. Engaging in the first qualitative and empirical analysis of the issue, I conclude that, at their current stage of development, crypto-derivatives do not represent a significant step forward in sophistication but tend to replicate the most basic structures. At the same time, crypto-derivatives are linked to a series of emerging activities in a developing network that I have called crypto shadow banking (see Technology in Financial Markets: Complex Change and Disruption, OUP 2024).

What Are Crypto-Derivatives?

Crypto-derivatives emerged as instruments linked to Bitcoin (BTC), with the first BTC futures contract launched around November 2011 on the ICBIT platform, when BTC traded below $4. This contract provided exposure to the U.S. dollar (USD)/BTC rate, settled in bitcoins, appealing to early crypto traders seeking BTC accumulation and enabling platforms to operate without fiat currency. Derivatives margined and settled in cryptocurrency later became known as “inverse” contracts, marking a departure from fiat-settled commodity-style derivatives; the first BTC derivative would today be classified as an inverse futures contract.

Crypto-derivatives are generally classified as linear or inverse, based on their payoff structure, and derive their value from BTC prices quoted in a reference currency, typically the U.S. dollar or Tether, which is a stablecoin pegged to the U.S. dollar (USDt). Due to price discrepancies across exchanges, settlement prices are usually determined using composite price indices calculated from multiple sources shortly before settlement. Linear contracts exhibit a direct relationship with BTC price movements and may be denominated, margined, and settled in either USD or BTC, depending on contract design. However, quoting contracts in different currencies of the same index can shift payoffs from linear (y = mx) to non-linear (y = 1/x), as seen in USD/BTC futures, which have linear USD payoffs but non-linear BTC payoffs.

Crypto-derivatives are typically highly leveraged, often up to 125 times, and require both initial margin (IM) and maintenance margin (MM). IM is the minimum amount required to open a position and varies inversely with leverage and directly with position size, while MM is proportional to position size and independent of leverage. Exchanges impose risk limits by setting IM, MM, and maximum leverage thresholds according to contract type and position size.

The most widely traded crypto-derivatives are perpetual swaps (or perpetual futures), options, and quantos. Perpetual swaps resemble futures contracts but have no expiration date, allowing indefinite positions and weakening the natural convergence between spot and futures prices. To address this, a funding mechanism transfers payments between long and short positions – typically every eight hours – based on a funding rate composed of interest and premium or discount components. Perpetuals share similarities with currency swaps, rolling spot forex contracts (RSFs), and contracts for difference (CfDs), which allow traders to profit from price movements without maturity. While CfDs and RSFs are prohibited in the U.S. and regulated in the EU and UK due to their high risk, perpetual swaps dominate crypto markets because of low margin requirements and the absence of rollover costs, though these same features amplify risk and potential instability, particularly in inverse contracts.

Crypto-options constitute a more sophisticated class of derivatives, enabling exposure to both price movements and volatility, with pricing determined by the Greeks (delta, gamma, theta, and rho). Most crypto-options are European-style and priced using composite indices. The appropriate pricing model depends on the legal classification of the underlying asset, with FX models such as Garman–Kohlhagen or Dupire applied to currency pairs, and Black–Scholes used for securities or commodities. The absence of a risk-free rate complicates crypto-options pricing, highlighting the need for clearer crypto-asset taxonomy.

Quanto options represent a notable innovation, settling in a currency different from the underlying asset. Direct quantos operate with a fixed conversion rate, while inverse quantos introduce an exotic structure combining inverse payoffs with settlement in another currency. Retail traders often access options through decentralized option vaults (DOVs), which are smart contract-based automated market makers that pool user funds, execute strategies, sell options, and distribute premia to depositors.

Market Trends and Data

An analysis of crypto-derivatives market trends shows a substantial increase in daily trading volumes between 2020, 2022, and 2023, with derivatives clearly dominating the spot market. Market share among exchanges is highly concentrated: Binance leads with nearly 60%, followed by OKX (17.2%) and Bybit (13.2%), while other exchanges play only a marginal role, reflecting broader trends in the crypto economy and fintech.

Direct perpetuals – margined and settled in fiat or stablecoins – are the most popular contracts, offered by 92% of platforms, due to their high leverage, low margin requirements and lack of rollover needs. Inverse perpetuals, margined and settled in the underlying cryptocurrency, are the second most common, available on 49% of platforms. Crypto options, both direct and inverse, are offered by 19% of exchanges; as complex instruments, they may struggle to match the popularity of perpetuals. Other derivatives, such as contracts for difference (CFDs) or customized options, are also offered by 19% of exchanges, with leveraged tokens being the most traded in this category, providing passive leveraged exposure without margin or liquidation risk. Quanto futures are the least available, offered by only 5% of platforms, due to their inherent complexity, including currency risk management and intricate valuation requirements.

Crypto-Derivatives and Crypto Shadow Banking

The traditional shadow banking system is described as a “network of financial instruments and institutions” that serves to connect “commercial and consumer borrowers indirectly to investors in capital markets.” Similarly, Crypto shadow banking functions as a network of financial instruments and institutions within the crypto industry. Comparing its functions with those of traditional shadow banking, it appears that the role of indirectly connecting borrowers to investors for the purpose of providing credit and liquidity transformation may systematically emerge in this context as well. This feature is particularly evident in activities related to crypto lending and the potential development of specialized derivatives and structured products. However, given its early stage of development, crypto shadow banking also serves as a network facilitating access to highly speculative financial instruments within the broader crypto economy.

The Policy Dimension

Understanding crypto-derivatives and their impact on a nascent network goes beyond mere formal categorization. It presents an opportunity for regulators to address emerging concerns by strengthening the regulation of market infrastructures, financial products, and potentially emerging financial conglomerates that may be exposed to new technological risks. Regulators should reconsider past experiences and reassess their responses as a starting point for adapting existing strategies to this new paradigm. Although crypto-derivatives do not necessarily represent an evolution in industry sophistication, they introduce significant risks that may grow alongside the potentially exponential growth of the crypto-economy and decentralized finance (DeFi).

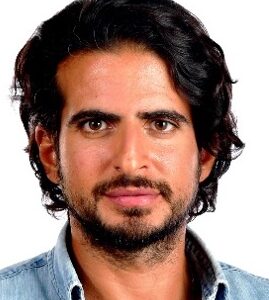

Marco Dell’Erba is a professor of corporate and financial law at the University of Zurich, a research fellow at the Institute for Corporate Governance & Finance at NYU Law School, and a global fellow at the Wilson Center. This post is based on his recent article, “Crypto-Derivatives,” available here.

Sky Blog

Sky Blog