A perennial concern of policy makers around the world is the construction of a framework of financial regulation that is effective, efficient, and—most importantly—conducive to the emergence of deep and liquid financial market. While the channels through which financial development influences economic growth are not yet fully understood, there is broad agreement that developed financial markets are instrumental in fostering economic growth.[1] Thus, the importance of regulatory design for the prosperity of nations can hardly be overestimated.

Essential ingredients of any regulatory regime governing the capital markets are rules mandating the disclosure of financial information, both transaction-specific and ongoing, and liability rules that allow investors to recover losses from those who are responsible for misstatements to the market. Legal institutions requiring, for example, the disclosure of the company’s annual accounts and the publication of an offering prospectus containing particulars of the company and the securities to be offered to the public were formulated, for the first time, in the 19th century. This period saw the transformation of largely agrarian economies to industrial ones, first in Western Europe and then in the United States. With it came the mobilization of capital, expansion of the banking system, and increased use of the capital markets as a means of financing industrial enterprises.[2]

One country was ahead of all other industrialising nations in terms of financial development over the course of the 19th century: Great Britain. The number of joint stock companies incorporated in Britain was seven to eight times higher and their paid-up capital three to four times larger than in the next largest economies on the Continent,[3] and the London Stock Exchange was the leading exchange in the world, with a deeper and more liquid market than anywhere else.[4] The different financial trajectory is particularly astonishing when compared with another European economy that was rapidly growing in the latter half of the 19th century and overtook Britain as the leading industrial powerhouse of Europe by the early 20th century: Germany. In spite of the fact that Germany was home to a considerable number of expanding industrial corporations, available comparative data show consistently that, until the eve of World War I, Germany’s financial markets lagged behind those in Britain in respect of almost every measure of financial development: number of incorporated firms, volume of securities issues, stock market capitalization as a percentage of gross domestic product, and financial assets as a proportion of national assets.[5]

One explanation for these striking differences in financial development, often advanced in the finance and legal literature, is epitomised by the following quote:

“Disclosure legislation by the end of the nineteenth century armed British investors … with the best information possessed by investors anywhere. We consider this to be a reason, possibly a major reason, … why the British capital markets were the world leaders in the same era.”[6]

Thus, a central role in the development of financial markets is attributed to financial regulation and more generally the legal environment. Legal rules that impose comprehensive disclosure requirements on issuers and allow investors to recover losses incurred as a consequence of incorrect market disclosures give the necessary assurances to the public to part with their savings and invest in the capital markets. Since such legal mechanisms were in place in the UK by the end of the 19th century, it is not surprising, so the argument goes, that Britain’s financial system was more diversified and market-oriented than those on the Continent.

However, a detailed legal historical analysis of the regulatory framework in key countries, such as Britain and Germany, which could corroborate or refute the hypothesis that disclosure regulation plays an essential role in financial development, is largely absent from the debate. The period of time when the financial trajectories of Germany and Britain started to diverge, the 19th century, is also what can be called the formative stage of securities regulation. In both countries, modern regulatory concepts such as on-going disclosure in the form of the mandatory drawing up and publication of the company’s accounts, prospectus disclosure, and liability provisions specifically designed to address the dissemination of misstatements in anonymous markets without personal interaction between buyer and seller, initially emerged during this period.

Focussing on the two most important items of disclosure in 19th century regulation, the company’s financial accounts and the offering prospectus, an approach to facilitate comparison between the two countries could analyse the regulatory regime along four dimensions: first, the requirement to disclose the financial accounts on an annual basis; second, the mandatory audit of the accounts; third, the requirement to publish a prospectus before shares can be offered to the public and/or listed on a stock exchange; and fourth, rules providing for a relatively comprehensive list of relevant information to be contained in the prospectus.[7]

In Great Britain, the first act to introduce more than fragmentary disclosure obligations was the Joint Stock Companies Act of 1844,[8] which replaced the concession system with a liberal system of incorporation by registration. The 1844 Act, informed by the conviction of its primary author, William Gladstone, that publicity was “the most effectual remedy” in that it brought “the power of public opinion to bear on the proceedings of joint-stock companies”,[9] required for incorporation only the filing of a list of particulars with the registrar of companies that included information on the name, purpose, and principal place of business of the company, its promoters, officers, and subscribers, and a copy of every prospectus or other statement addressed to the public with a view to issuing and allotting the company’s shares.[10] The latter requirement is noteworthy for its wide scope, applying to any “prospectus or circular, handbill or advertisement, or other such document at any time addressed to the public, or to the subscribers or others, relative to the formation or modification of [the] company”.[11] Thus, the legislator intended to establish control over any form of communication with the public that could potentially influence the investors’ decision to subscribe for securities. These obligations upon the formation of companies were supplemented by detailed, mandatory rules on the drawing-up, auditing, and disclosure of the company’s financial accounts.[12]

However, the relatively demanding regime started to be dismantled only a few years later with the Joint Stock Companies Act 1847, which repealed the registration requirement for prospectuses because it was “found to be very burdensome to the Promoters”,[13] and the Joint Stock Companies Act 1856, which moved the rules on audited accounts into an appendix to the act laying down model articles that could be disapplied by the incorporators,[14] allowed registration with the most basic information to be filed,[15] and did not undertake to regulate primary market disclosure in any way.

The amendments of 1847 and 1856 were said to have been adopted “in the heyday of laissez-faire”.[16] Both the requirement to register prospectuses and mandatory auditing should not be reinstated until the Companies Act 1900.[17]

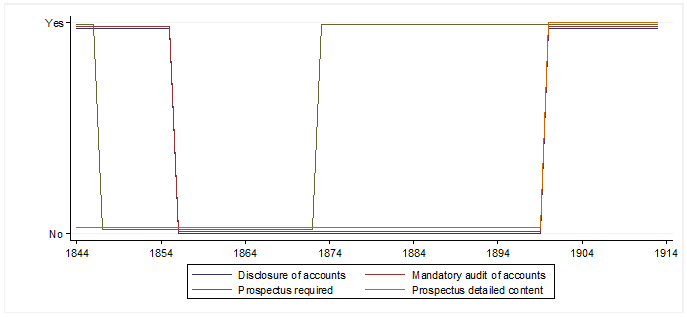

Figure 1 visualizes the legal changes regarding the four dimension of disclosure mentioned above from the Joint Stock Companies Act of 1844 to the Companies Act 1900 in a binary way.

Fig. 1: Evolution of disclosure regulation in Great Britain 1844-1914

In Germany, similar to Great Britain, disclosure requirements were imposed for the first time when the concession system was replaced with a system of incorporation by registration in 1870.[18] As opposed to the British Act of 1844, the Companies Act of 1870, however, only embraced one aspect of disclosure, the periodic publication of the company’s books and accounts.[19] The act also contained some relatively basic provisions on the form of the accounts[20] and criminal sanctions,[21] but prospectus disclosure was not mentioned. This approach was maintained in later company law amendments.

To some extent, the regulatory lacuna was filled by the rules and regulations of the stock exchanges adopted since the 1880s, which required the publication of a prospectus before securities could be admitted to trading and specified in detail the content of the prospectus, distinguishing between type of issuer and security.[22] For example, for shares of domestic industrial corporations the prospectus had to contain information on the articles of association, objects, domicile and duration of the company, legal capital and amount of shares to be issued, rights attached to the shares, including pre-emptive rights and dividend rights, contributions in kind and payments made or other benefits granted in relation to the formation of the company, applicable accounting principles and principles on dividend distribution, and the names of the members of the management and supervisory boards. In addition, the company’s articles and the last annual report had to be appended to the application.[23]

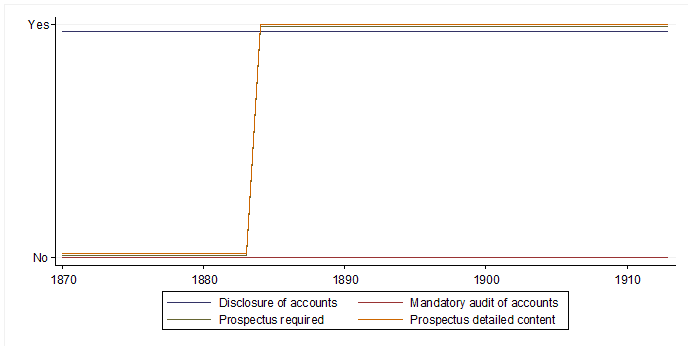

This regulatory framework remained largely unaltered until after World War I. If we visualize the legal situation as before by coding changes in the law in a binary way, we obtain the picture reproduced in Figure 2.

Fig. 2: Evolution of disclosure regulation in Germany 1870-1914

Thus, it is difficult to conclude that one disclosure regime was clearly superior to the other. The German rules were less stringent than their British counterparts in that they did not require the mandatory auditing of annual accounts. In addition, the prospectus requirement was linked to the application for admission to trading on a stock exchange, since it was imposed not by general company legislation, but by the regulations of the stock exchanges. The British legislation, on the other hand, used a wide definition of prospectuses to ensure that the regulation applied to any communication to the public that was intended to attract subscriptions for securities. However, these differences emerged relatively late, in 1900, when the British capital markets were already well developed and leading in the world.

An analysis of the second dimension of disclosure regulation, liability for incorrect statements to the market, also does not indicate that the British regime equipped investors with more effective tools than German law. For most of the 19th century, the courts in both countries grappled with the problem of interpreting common law concepts developed in different contexts (tort of deceit or the Roman-law actio doli) in ways that made them operational in impersonal capital markets. They did so with mixed success. For most purposes plaintiffs had to show intent to deceive or recklessness and reliance on the misstatement, which ruled out recovery in all but the most egregious cases.[24]

Liability provisions specifically designed to address misstatements in prospectuses were adopted in Britain in 1890[25] and in Germany in 1896.[26] Both acts brought certain innovations. The British law provided for a shift of the burden of proof to those responsible for the prospectus, who could exculpate themselves by showing that they had reasonable ground to believe, and did believe, that the information in the prospectus was correct. This provision, which already distinguished between expertized and non-expertized portions of the prospectus, served as a template for Section 11 of the US Securities Act of 1933,[27] and the structure of the 1890 prospectus liability provision can still be discerned in its US counterpart, notably in the due diligence defense of section 11(b)(3) of the 1933 Act.

On the other hand, the 1890 Act continued to require the plaintiff to show reliance and loss causation. Here, the German policy makers displayed remarkable ingenuity. During the reform discussions that led to the adoption of the Stock Exchange Act the government commission preparing the reform expressed the view that “it could be expected that … the offering prospectus, given its function, can and will generate a certain investment mood on the part of the public invited to subscribe to the offering”.[28] Investors were entitled to rely on this “investment mood”, even if they had not read the prospectus and were not familiar with its detailed content, unless they must have been aware of the true circumstances. The courts adopted this approach and held that the necessary causal connection was given if the investor was influenced by the investment mood created by the prospectus to acquire the securities.[29]

This approach bears some resemblance to the US fraud-on-the-market theory, which can be used to establish reliance in Rule 10b-5 actions.[30] Both notions create rebuttable presumptions; both are informed by the consideration that the price of the securities is influenced by the incorrect information and that the investor would not have acquired the securities, at least not at the respective price, if the true facts had been disclosed. The German approach is somewhat crude compared with the fraud-on-the-market theory, because the courts seemed to be prepared to invoke an “investment mood” fairly quickly, without considering whether the market was sufficiently efficient to allow the assumption that misstatements would be priced in quickly. On the other hand, considering that the policy-makers and courts could not benefit from two decades (at the time of Basic, Inc.) of research into market efficiency,[31] it is probably not surprising that the theory was not yet well developed. In spite of its shortcomings, the approach is remarkable for considering the function of information in capital markets at a time when such markets were a relatively new phenomenon in Germany. Thus, both the German and British provisions facilitated recovery in certain respects and continued to place a relatively onerous burden on the plaintiff in others (showing of fault and reliance, respectively).

If it is difficult to identify qualitatively meaningful differences between British and German regulatory strategies during the period of interest, how can we explain the different financing patterns that developed in the two countries over the course of the 19th century? It is clear that various non-legal factors are potentially of greater importance than the legal environment, for example the structure of the banking industry and the ability of small investors to provide equity finance. However, if law does play a role, an area that merits closer attention are the rules on formation of public stock corporations. Here, we find the most striking differences between the British and German legal regimes.

In 1884, in reaction to a large number of financial scandals that occurred after the abolishment of the concession system in 1870, German stock corporation law was fundamentally reformed.[32] Most importantly, the minimum par value of shares was increased to 1,000 Mark,[33] a significant amount at the time, given that 94 percent of taxpayers had an annual income of less than 1,500 marks.[34] This increase was seen as an essential investor protection mechanism and shows the paternalistic nature of the reform. While the policy makers recognized that only the investor’s vigilance could protect effectively against deceit and improvidence, they evidently did not have much faith in the ability of the “small investor” (the “kleine Mann” or “kleine Kapitalist”) to assess the value of an investment opportunity. The legislative memorandum accompanying the 1884 Act explained that the savings of this class of investors, “acquired laboriously and constituting maybe their only assets after long years of work”, should be placed in save investments such as government bonds or interests in cooperatives. The small savers, accordingly, should be prevented from accessing the capital markets altogether.[35]

Other changes to the law required an external audit for contributions in kind and imposed joint and several liability on all directors and promoters for any shortfall in the company’s capital, for example where a contribution in kind did not constitute fair value. In order to increase its deterrent effect, the liability provision was combined with a presumption of fault. The defendants had to show that they did not know and, employing the care of a diligent and conscientious manager, could not have known that the rules on formation had not been complied with.[36] In contrast, in Great Britain, legal capital was regulated in a lenient way. The law did not prescribe a minimum nominal value for shares or a minimum legal capital. It did not provide for any special requirements concerning contributions in kind, and the courts adopted a laissez-faire approach in dealing with shareholder contributions. For example, in the famous case Re Wragg, the court held that the parties’ valuation of non-cash considerations would be accepted as conclusive unless its inadequacy appeared on the face of the transaction; and there was no requirement for an independent valuation.[37]

Data show that the German industrial economy in the decades after the reform was characterized by increased economic concentration. Banks and industrial corporations became more important as providers of equity capital, the relevance of offerings to the public decreased, and smaller businesses did not use the form of the joint stock corporation, but incorporated as private limited liability companies that were excluded from the stock markets.[38] Thus, the formation regime adopted in 1884, it is submitted, represents the main difference between the German and British regulatory environment in the 19th century. The reforms had far-reaching ramifications for the development of the corporate landscape in Germany that continue to be felt to this day, as a significant section of economic activity continues to be pursued in the form of the limited liability company, and the public stock corporation remains reserved for large, capital intensive undertakings.

ENDNOTES

[1] The first in-depth consideration of the nexus of finance and economic growth is commonly attributed to Joseph Schumpeter, The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle (Harvard University Press, 1911). For two more recent contributions providing empirical evidence see Robert G. King and Ross Levine, Finance and Growth: Schumpeter Might Be Right, 108 Q. J. Econ. 717 (1993); Raghuram G. Rajan and Luigi Zingales, Financial Dependence and Growth. 88 Am. Econ. Rev. 559 (1998).

[2] Caroline Fohlin, Mobilizing Money 15-47 (Cambridge University Press, 2012).

[3] In 1906, 40,995 joint-stock companies with a combined paid-up capital of £2,000 million were incorporated in Britain, compared with 5,061 companies with a paid-up capital of £685 million in Germany (also 1906) and 6,325 companies with a paid-up capital of £540 million in France (1898), see Ranald Michie, Different in name only? The London Stock Exchange and foreign bourses, c. 1850-1914, 30 Business History 46, 52 (1988).

[4] Ranald Michie, The London Stock Exchange: A History 70-73 (Oxford University Press, 2001); Raghuram G. Rajan and Luigi Zingales, The Great Reversals: The Politics of Financial Development in the 20th Century, 69 J. Fin. Econ. 5, 15 (2003).

[5] Deutsche Bundesbank, Deutsches Geld- und Bankwesen in Zahlen, 1876-1975 (Knapp, 1975). Detailed annual information on listings on the London Stock Exchange are contained in Burdett’s Official Intelligence of Securities (Couchman, from 1882), later renamed Stock Exchange Official Intelligence. Secondary sources summarising the data include George W Edwards, The Evolution of Finance Capitalism 392-393, 404-405 (Longmans, 1938); Raymond W Goldsmith, Comparative National Balance Sheets: a Study of Twenty Countries 1688-1978 221-226 (University of Chicago Press, 1985); Alfred Neymarck, La statistique internationale des valeurs mobilières, 56 Journal de la Société Française de Statistique 353, 360-366 (1915).

[6] Richard Sylla and George David Smith, Information and Capital Market Regulation in Anglo-American Finance, in Michael D Bordo and Richard Sylla (eds.), Anglo-American Financial Systems: Institutions and Markets in the Twentieth Century 179 (Irwin, 1995). The studies of Rafael La Porta, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert Vishny (LLSV), who express similar views, are well known, see for example LLSV, Legal determinants of external finance, 52 J. Fin. 1131 (1997).

[7] The following overview of the regulatory regime in place in Britain and Germany in the 19th century is a summary of the detailed analysis from Carsten Gerner-Beuerle, Law and Finance in Emerging Economies: The Case of Germany 1800-1913, available at http://ssrn.com/abstract=2617231.

[8] 7 & 8 Vict., c. 110.

[9] The Economist, April 6, 1844, 655.

[10] Joint Stock Companies Act 1844, s. 4.

[11] Ibid. s. 4, no. 8.

[12] Ibid., ss. 34-43.

[13] 10 & 11 Vict., c. 78, s. 4.

[14] 19 & 20 Vict., c. 47, s. 9 and Table B.

[15] Ibid., ss. 5, 12.

[16] Laurence C.B. Gower, The Principles of Modern Company Law 49 (3rd ed., Stevens 1969).

[17] Companies Act 1900, 63 & 64 Vict., c. 48, ss. 9-10, 21-23. The requirement to publish audited accounts was reinstated earlier for banking corporations, Companies Act 1879, 42 & 43 Vict., c. 76, s. 7.

[18] The new system was introduced for the states of the North German Confederation, which included Prussia, in Art. 211 Allgemeines Deutsches Handelsgesetzbuch (ADHGB) [General German Commercial Code], as amended by Gesetz, betreffend die Kommanditgesellschaften auf Aktien und die Aktiengesellschaften [Act concerning limited partnerships by shares and joint stock corporations], BGBl. Norddt. Bund [Federal Law Gazette of the North German Confederation] 1870, p. 375.

[19] Ibid. art. 239.

[20] Ibid. art. 239a.

[21] Ibid. art. 249.

[22] See, for example, the regulations of the Berlin Stock Exchange of 1884, reproduced in Bericht der Börsen-Enquete-Kommission [Report of the Stock Exchange Commission of Inquiry] (1893), 47-51.

[23] Report of the Stock Exchange Commission of Inquiry, ibid. 51.

[24] A well-known British case illustrating this point is Derry v Peek (1889) LR 14 App Cas 337. For a detailed analysis see Gerner-Beuerle, supra n 7, 18-27, 36-37.

[25] Directors Liability Act 1890, 53 & 54 Vict., c. 64.

[26] Stock Exchange Act 1896, RGBl. 1896, p. 157, s. 43.

[27] See the account of James M. Landis, member and second chairman of the SEC and one of the drafters of the Securities Act of 1933, Legislative History of the Securities Act of 1933, 28 Geo. Wash. L. Rev. 29, 34 (1959-1960).

[28] Report of the Stock Exchange Commission of Inquiry, supra n 22, 70.

[29] See, for example, Imperial Court, decision of 11 October 1912, RGZ 80, 196, 204.

[30] Basic Inc. v. Levinson, 485 U.S. 224 (1988).

[31] The first theorems and empirical evidence concerning market efficiency appeared in the 1960s, see Andrei Shleifer, Inefficient Markets: An Introduction to Behavioural Finance 1-10 (Oxford University Press, 2000).

[32] Gesetz, betreffend die Kommanditgesellschaften auf Aktien und die Aktiengesellschaften [Act concerning limited partnerships by shares and joint stock corporations], RGBl. 1884, p. 123.

[33] General German Commercial Code, as amended, art 207a.

[34] Ernst Engel, Der Werth des Menschen, Volkswirthschaftliche Zeitfragen, vol. 5, issue 37, 16 (1883).

[35] Stenographische Berichte über die Verhandlungen des Reichstages, 5. Legislatur-Periode, IV. Session 1884 [Stenographic protocols of the proceedings of the Reichstag, 5th parliamentary term, session IV 1884], vol. 3, document no. 21, p. 248.

[36] For a detailed analysis of these reforms see Gerner-Beuerle, supra n 7, 64-75.

[37] In Re Wragg, Ltd. [1897] 1 Ch. 796.

[38] See the figures by Michie, supra n 3, 52 (1988) (showing that the number of joint stock companies incorporated in Germany was relatively low, around 5,000 at the turn of the century with an aggregate paid-up capital of 685 million pounds sterling, compared with more than 40,000 in Great Britain with an aggregate capital of 2,000 million pounds sterling; on the other hand, the average capital of a German corporation was almost three times higher than that of British companies, amounting to 135,349 pounds sterling, compared with 48,786 pounds sterling for British joint stock companies).

The preceding post comes to us from Carsten Gerner-Beuerle, Associate Professor of Law at the London School of Economics and Political Science. The post is based on his article, which is entitled “Law and Finance in Emerging Economies: The Case of Germany 1800-1913” and available here.

Sky Blog

Sky Blog

Great post! Could it be that the greater experience of the british public with public corporations would have allowed for a less paternalistic approach by the legislator? Britons held shares of the East India Company and some others through the XVIII century, and germans didn’t