The positive correlation between oil prices and equity markets over the past few years has been discussed extensively in the media as well as by prominent economists, such as Bernanke and Obstfeld, and has brought into question the generally accepted view that lower oil prices are good for the U.S. and the global economy. However, in a recent study, we illustrate that there has been no stable relationship between real oil prices and equity returns over the last 71 years. Nevertheless, we argue that, as in previous episodes of falling oil prices, lower oil prices improve profit opportunities and dividends in the oil importing economies, which is overall good for the world economy.

Taking a relatively long historical perspective (1946-2016), we show the monthly evolution of real oil prices, in 2015 U.S. dollars per barrel, and U.S. real equity prices, as measured by the S&P 500 index. Figure 1 makes clear that there is little evidence of a stable relationship between oil prices and real equity prices. In particular, there are sub-periods where changes in real oil prices and real equity prices are unrelated, as well as sub-periods over which they are negatively and positively correlated.

Therefore, the recent perverse response of equity markets to oil price changes should not be taken as evidence that lower oil prices are no longer beneficial for the U.S. and the world economy. There could be a number of reasons for the recent positive relationship. First, while markets are generally efficient and therefore equity prices reflect the fundamentals, there are also episodes when real equity prices do not reflect the state of the economy. In such periods any evidence of a perverse relationship between real equity and oil prices could be due to the disconnect between equity markets and economic fundamentals and not necessarily any breaks in the relationship between oil prices and the real economy. Second, Sovereign Wealth Funds (SWFs) accumulated large assets during the most recent oil boom (2002-2008) and they have come to play a major role in reserve management of oil revenues. On average 65% of SWF assets are held in public and private equities. During periods of rising oil prices, these funds are topped up with equity purchases. However, when oil prices fall, most major oil exporters withdraw money from the funds in order to maintain other expenditure, such as on welfare. The equity transactions of SWFs in turn induce an unintended positive correlation between oil and equity prices. While it is true that such effects might not be that large, they could trigger larger effects due to known market over-reactions.

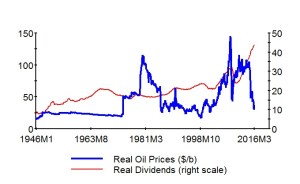

Looking instead at the relationship between real oil prices and real dividends on the S&P 500 as a proxy for economic activity over the last 71 years, we observe that generally lower (higher) oil prices have been associated with higher (lower) dividends, see Figure 2. More important, changes in real oil prices are negatively related to changes in real dividends over the post-2008 period.

To re-examine the effects of low oil prices on the U.S. economy over different sub-periods, we conduct more robust statistical analysis using monthly observations on real oil prices, real equity prices and real dividends. We confirm the perverse positive relationship between oil and equity prices over the period since the 2008 financial crisis highlighted by Bernanke and Obstfeld, but show that this relationship has been unstable when considered over the longer time period of 1946–2016. In contrast, we find a stable negative relationship between oil prices and real dividends (as well as U.S. industrial and manufacturing production indices), which we argue is a better proxy for economic activity (as compared with equity prices) and which does not support the view that lower oil prices have not been good for the U.S. economy since the 2008 financial crisis.

In a separate exercise, and to take into account the feedback effects of oil price changes on global energy demand, interest rates, financial markets and world trade, we use a quarterly multi-country model (known as the GVAR-Oil model), and show that a fall in oil prices tends relatively quickly to lower interest rates and inflation in most countries and increase global real equity prices. The effects on real output are positive, although they take longer to materialize, which supports the results based on monthly data.

As with all markets, lower oil prices will eventually lead to higher demand and lower supplies. The beneficial income effects of lower oil prices will show up in higher oil demand by oil importers including the U.S., while the loss of revenues by oil exporters will act in the opposite direction, but the net effect is likely to be positive. However, due to uncertainties over Brexit, U.S. elections, the threat of terrorism and the surge in financial market volatility, it is likely that there will be a delay in the materialization of any economic benefits of lower oil prices.

This post comes to us from Kamiar Mohaddes, a Senior Lecturer and Fellow in Economics at Girton College, University of Cambridge, and M. Hashem Pesaran, the John Elliot Distinguished Chair and Professor of Economics at the University of Southern California, the director of the USC Dornsife Institute for New Economic Thinking, an Emeritus Professor of Economics at the University of Cambridge and a Fellow of Trinity College, Cambridge. It is based on their article, “Oil Prices and the Global Economy: Is it Different this Time Around?” which is available here.

Sky Blog

Sky Blog