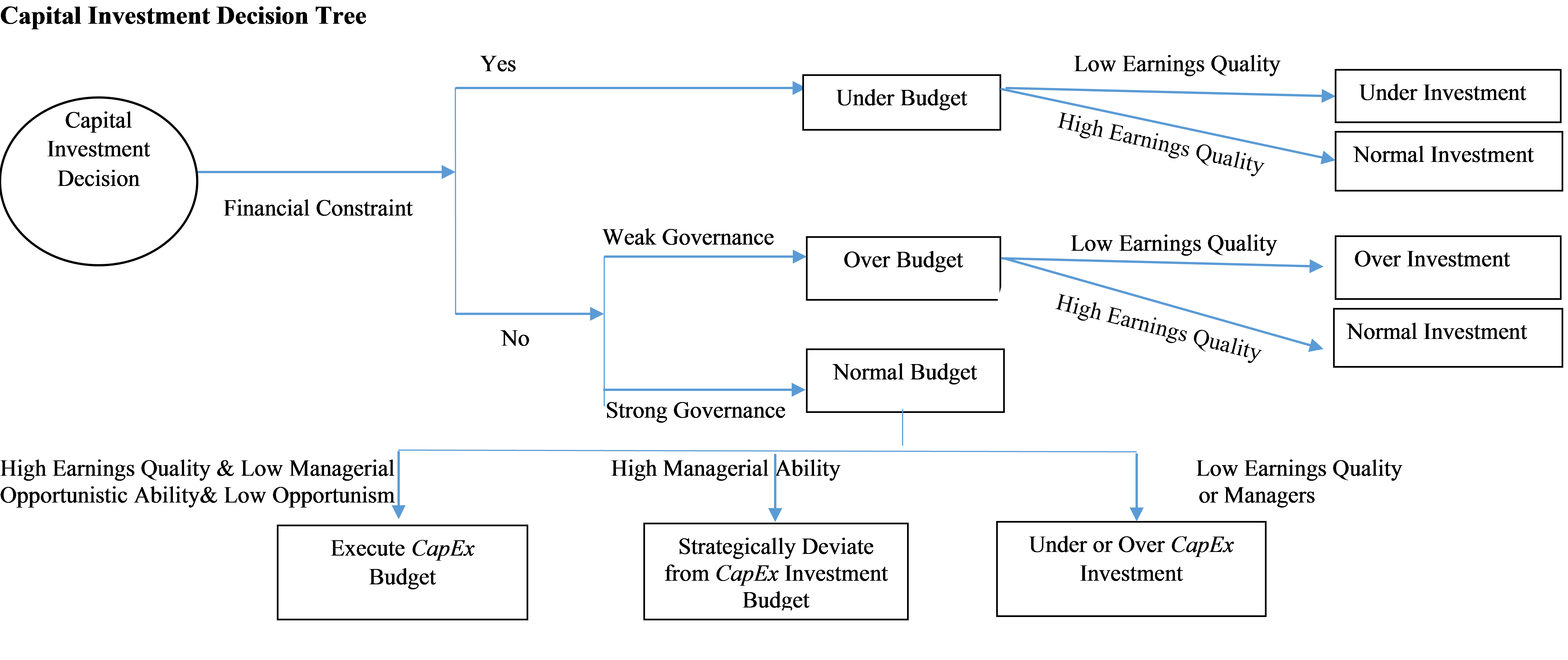

In spite of intensive academic research on capital expenditure efficiency, how firms make investment decisions remains largely a black box. We analyze that process by dividing it into two stages: budgeting of capital expenditures (CapEx) and execution of the budget. We find that these two stages have different effects on investment efficiency, and are in turn affected differently by accounting quality and governance. Further, while opportunistic managers massively exceed investment budgets, managers with high ability strategically find a level of execution errors that optimizes their compensation while remaining undetected by boards. These strategic execution deviations entail significant costs for their employers.

Prior academic literature (e.g., Biddle and Hilary 2006; Biddle, Hilary and Verdi 2009) suggests that higher accounting quality and better governance improve corporate investment efficiency. Specifically, these studies show that firms with high accounting quality are less likely to experience under-investment induced by financial constraints, and that high accounting quality and strong governance both mitigate over-investment. A variety of studies using numerous alternative settings and proxies have confirmed these basic findings. However, these different studies all focus on the outcome of the capital investment process, namely the realized level of capital investment. Thus, it is difficult to understand exactly how firms reach their realized level of capital investment.

Dividing the capital investment process into two stages allows us to examine several important research questions about capital investment. For example, we know little about the degree of autonomy that managers enjoy in the execution of corporate budgets and the consequences of this autonomy on firm value and performance, if any. We know little about how boards are involved in capital expenditure decisions. Further, although we know that both accounting quality and corporate governance affect investment efficiency, their specific roles and interactions remain under-studied.

In exploring these questions, we use a manually collected dataset of annual capital budgets from corporate annual financial reports. First, we document significant variation in the efficiencies of both CapEx budgeting and execution. Managers do not strictly follow the CapEx budgets. On average, the budgeted CapEx is lower than the realized level, but deviations exist on both sides. Large under-investment is mainly the result of under-budgeting rather than inefficient budget execution. In contrast, although both budgeting and execution contribute to large over-investment, the latter plays a more important role in determining over-investment than the former.

Second, we examine the determinants of CapEx budgeting efficiency. Unsurprisingly, firms that are financially constrained budget a low level of CapEx. Further, high accounting quality mitigates under-budgeting. Strong board independence does not play a significant role in the budgeting of constrained firms, but unconstrained firms over-budget if their boards lack independence. Accounting quality does not significantly mitigate over-budgeting. Financially unconstrained firms with a more independent board are more likely to have a budgeted level of CapEx that is close to the expected – or “normal” – level, given the firm’s environment.

Third, we analyze the efficiency of the budget execution stage. We find that accounting quality plays a more important role in determining execution efficiency than does board independence. Firms with high accounting quality compensate for inefficiencies in their budgets during the execution stage. Specifically, high accounting quality increases the probability that a firm that under-budgets or over-budgets will eventually invest a normal level of realized CapEx. In the sample of firms with normal budgets, high accounting quality also improves the efficiency of the execution. It reduces both execution deviation (defined as the difference between realized and budgeted CapEx) and the probability of substantial over- or under-investment. However, board independence does not affect execution efficiency, regardless of budget efficiency.

Finally, we consider managerial characteristics. We document a new type of inefficient investment behavior and identify an interesting interplay between managerial ability, budget execution, and board monitoring. Prior literature on managerial empire building suggests that opportunistic managers grow the firm beyond its optimal size to benefit themselves. Although this tendency may exist for all executives, it is greater for some. We find that these more opportunistic managers are more likely to over-invest massively by exceeding their budgets. Interestingly, in the sample without large over- or under-investment, we observe a significant portion of firms that strategically deviate from their budgets and exhibit “moderate” over- or under-investments. Compared with large inefficient investments, such strategic deviations do not result in materially abnormal realized investments and thus may attract less scrutiny from the board. Indeed, we find that these strategic deviations increase management compensation but not CEO turnover. In contrast, large inefficient investments do not affect managerial compensation but lead to greater CEO turnover. Importantly, we find that strategic deviations and massive over- or under-investments entail similar significant costs for their employers. Interestingly, high managerial ability is positively associated with strategic deviations but not with large inefficient investments. These findings suggest that a skilled manager finds the optimal level of execution deviation that optimizes their compensation while remaining undetected by boards.

Our study contributes to our understanding of governance issues in several ways. First, we clarify what boards do in the capital investment process. Our study finds that they affect the approval of budgets and monitor managers of firms with large under- or over-investments. However, boards appear to play a greater role in monitoring CapEx budgeting than in executing it, even though deviations from the budget can entail significant costs for their firms. Although investigating this possibility is beyond the scope of this study, investors may be better off when firms deploy policies to limit managers’ discretion over the execution stage, particularly when accounting quality is low. Second, our findings suggest that accounting quality and board independence play different roles at different stages of the process. The effect of board monitoring concentrates in the budgeting stage while high accounting quality mainly improves the efficiency of budget execution. Finally, while prior studies have investigated large over- or under- investments, we document a new type of investment inefficiency, strategic deviations. Such strategic deviations are costly but difficult to detect, thus resulting in significant agency costs.

This post comes to us from professors Gilles Hilary at Georgetown University and Mark (Shuai) Ma at American University, and Wenjia Yan, who is a PhD candidate at the University of Hong Kong. It is based on their recent article, “Opening the Black Box of Capital Investment: The Roles of Capital Expenditure Budget and Execution,” available here.

Sky Blog

Sky Blog