The meteoric global rise of ESG investing is increasingly being met with an equally ambitious regulatory disclosure regime, and, targeting greenwashing, policymakers are beginning to bare their teeth. In the latest salvo, on 25 May the US Securities and Exchange Commission (SEC) voted 3:1 to approve two proposals enhancing scrutiny of ESG funds and advisers’ ESG practices. One proposal seeks to expand the rule governing fund naming conventions and the other proposes additional disclosure requirements by funds and investment advisers about ESG investment practices.

Overview of SEC proposals

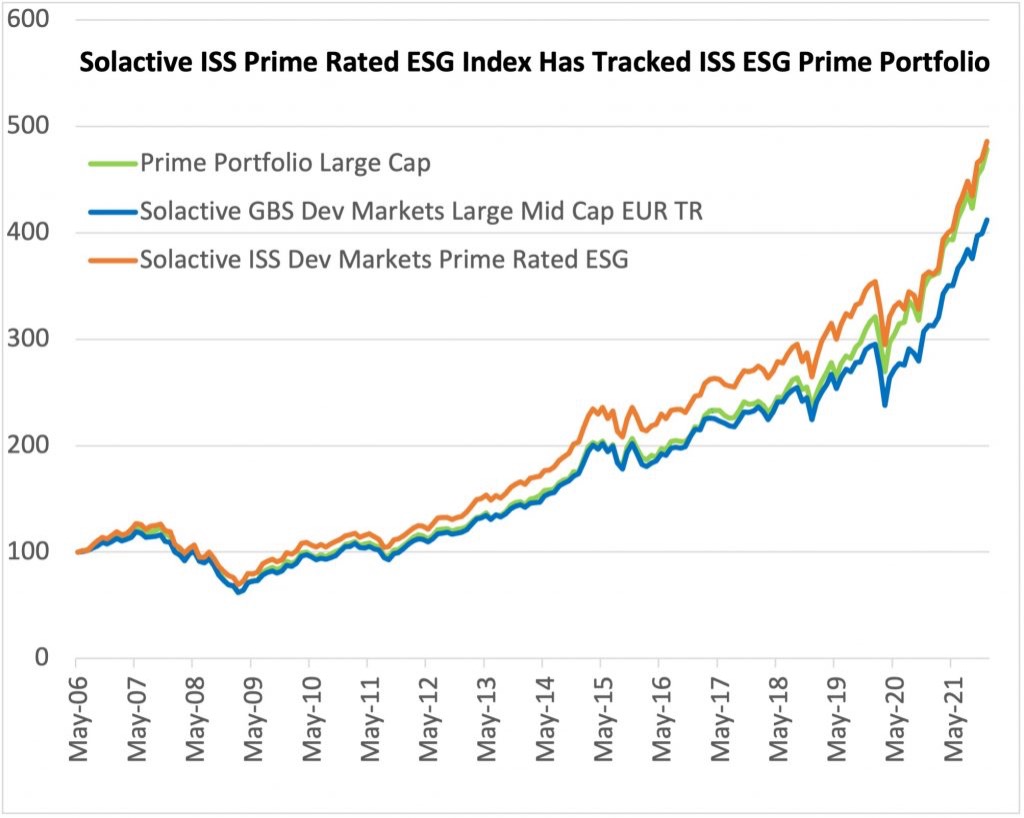

Source: Deutsche Performancemessungs-Gesellschaft (DPG) and ISS ESG. May 31, 2006-Dec 31, 2021

Regulators globally are paying attention, focusing on retail investor protection against greenwashing and mis-selling of ESG products. On the heels of its two companion proposals, the SEC fined BNY Mellon Investment Adviser $1.5 million for misstatements and omissions related to its ESG practices. Just a week later, the German police raided Deutsche Bank’s DWS unit over ESG “greenwashing” claims.

In addition to enforcement, regulators are scrutinizing ESG fund and product disclosure, proposing to enhance existing regulation of fund managers and financial products. The regimes, such as those seen in the EU, UK, Canada and more recently throughout the APAC region, typically address similar issues but take different approaches.

Recently updated Canadian fund guidance

In January 2022, the Canadian Securities Administrators (CSA) published staff guidance on ESG-related investment fund disclosure, raising expectations about the disclosure and marketing practices of funds using ESG objectives or strategies. The guidance is both comprehensive and detailed, covering investment objectives and fund names; investment strategies disclosure; proxy voting and shareholder engagement policies and procedures; risk disclosures; suitability; sales communications; ESG-related changes to existing funds; and ESG-related terminology.

The guidance also lays out disclosure requirements for using ESG ratings, scores, indices, or benchmarks in sales communications. Additionally, funds are encouraged to disclose fund-level ESG ratings, scores, or rankings to provide disclosure from at least 2 different providers. Funds using engagement as an ESG strategy are encouraged to provide greater disclosure of the scope and nature of the engagement along with previous engagements (including goals, monitoring, and success assessment). Finally, the guidance indicates that only funds that reference ESG in their investment objective can use “ESG” in the fund name.

European Union regulation

The EU Sustainable Finance Disclosure Regulation (SFDR), which came into effect on 10 March 2021, and the EU taxonomy regulation, which helps identify economic activities judged to be “environmentally sustainable” and that became effective 1 January 2022, are core components of EU regulation designed to provide more transparency of investment products, financial advisers and any firm creating investment products.

The SFDR requires these financial market participants to disclose how they integrate and consider both financially material ESG risks as well as adverse sustainability impacts for their complete investment universe. It also specifies three categories of investment products:

- Article 6 products, which integrate ESG considerations or explain why sustainability risk is not relevant;

- Article 8 products, which promote environmental and/or social characteristics but do not include sustainable investing as a core objective; and

- Article 9 products that feature sustainable investment as a core objective.

Detailed templates and a concrete list of ESG principle adverse impact indicators to report on are provided. In addition, SFDR requires extensive disclosures regarding investment strategy, criteria and use of the EU taxonomy for defined categories of products with sustainable investment objectives or ESG characteristics. It also sets a definition for sustainable investment outside of the EU taxonomy.

Changes to two EU directives, Markets in Financial Instruments Directive (MiFID) and Insurance Distribution Directive (IDD), prescribe the three types of products (products with taxonomy-aligned investments; products with sustainable investments under the SFDR definition; and products taking into consideration principle adverse impacts) that are allowed to be offered to clients that voice sustainability preferences as part of the mandatory suitability assessment when giving financial advice.

UK regulation

In the UK, ISS ESG anticipates the Financial Conduct Authority (FCA) will publish draft rules on the Sustainability Disclosure Requirements (SDR) and investment product labels in July 2022, accompanied by Technical Screening Criteria (TSC) for the first two (of six) TSC tranches by the end of 2022.

Based on its 2021 discussion paper and other commentary, the FCA is focusing on consumer-facing product disclosures aimed at retail investors, which would include the sustainable investment strategy pursued, disclosure against the UK’s taxonomy, the approach to investor stewardship, and wider sustainability performance metrics. In addition, it is considering detailed product-level disclosures aimed at institutional investors, featuring additional information on the methodologies used to calculate metrics, and detailed entity-level disclosures to show how risks and opportunities are incorporated into the investment process.

Disclosure of mandatory climate transition plans are also expected to be part of the SDR, requiring investment managers, asset owners and listed companies to publish robust transition plans detailing how they will decarbonize to achieve Net Zero. In April 2022, HM Treasury launched the Transition Plan Taskforce (TPT) to develop a gold standard for such climate transition plans, and the TPT recently put out a call for evidence, seeking public input.

Emerging APAC regulation

Last year, the Securities and Futures Commission (SFC) of Hong Kong issued a circular, effective January 2022, regarding enhanced disclosures for ESG-related funds, requiring new disclosure for periodic assessments and new guidelines for funds with a climate-related focus. The SFC maintains a public register of ESG funds authorized by the SFC. The SFC has also amended the Fund Manager Code of Conduct (FMCC), introducing requirements for asset managers, on a two-tier approach, regarding consideration of climate-related risks. Larger in-scope asset managers have until 20 August 2022 to comply with the “baseline” requirements, and the enhanced standards by 20 November 2022. Other asset managers have until the November date to comply with the baseline requirements.

In May 2022, the Monetary Authority of Singapore (MAS) released its Environmental Risk Management Information Papers, setting out expectations for fund managers, among others, regarding ESG risk assessments across investment portfolios. ISS ESG also expects MAS to take steps to require asset managers to make climate-related financial disclosures and to consider introducing ESG-specific requirements for ESG-advertised retail funds. MAS is looking for evidence of environmental risk integration into asset managers’ investment decisions, focusing on climate change and biodiversity, among other topics. Its Environmental Risk Management Guidelines cover governance and strategy, portfolio construction, portfolio risk management, and disclosure of environmental risk.

Meanwhile, the Australian Sustainable Finance Initiative (ASFI) has announced an expert group to provide technical input on the development of a “green” economy. The industry-led initiative builds on the Australian Securities and Investments Commission (ASIC) review of ESG marketing by superannuation and managed funds.

Conclusion

As global regulators and supervisory bodies prioritize the fight against greenwashing, we can expect the continued rapid evolution of new regulatory requirements and further guidance to clarify existing regulation. Globalized markets will likely face regulatory fragmentation, however, because of the diverging regulatory approach between jurisdictions, posing a challenge for global financial market participants operating across markets. This reality, coupled with the associated legal, financial, and reputational risks, creates a challenging environment for fund managers and advisers.

This post comes to us from Institutional Shareholder Services. It is based on the firm’s memorandum, “Regulatory Solutions: A Global Crackdown on ESG Greenwash,” dated June 9, 2022, and available here.

Sky Blog

Sky Blog