If you have a pet, you may wonder why pet-food prices have increased so much recently, 15.1 percent year-over-year in January 2023, according to the Federal Reserve Bank of Minneapolis.1 A recent complaint filed with the Justice Department suggests one potential reason: interlocking directorates between PetSmart and Chewy, major retailers of pet food in the U.S. whose boards share three members.2

Could interlocking directorates among competing firms lead to coordinated price behavior or other anti-competitive practices? In theory, successful coordination among competitors yields monopolistic profits. Such coordination can, for example, take the form of price-fixing schemes. It could also involve market allocation, in which competing firms each agree to serve a separate product category, geographic area, or demographic group and wield market power there. Such an equilibrium could be difficult to sustain, as it can be optimal for the participating firms to deviate and engage in predatory behaviors. This is where interlocking directorates come in. Interlocking directorates (and board connections in general) could facilitate communication and build trust among competitors, making coordination more stable.

In the U.S., the Clayton Antitrust Act of 1914 has largely prohibited firms with substantial overlap in their activities from sharing directors and officers. However, the regulation might be flawed. First, regulators have limited time and personnel resources. Second and more importantly, in today’s ever-changing and overlapping product market, it is often challenging to define competitors. For example, when Amazon was asked to provide a list of its top 10 competitors, it identified 1,700 companies, including “a discount surgical supply distributor and a beef jerky company.” 3

In a recent paper, we answer two questions. First, how prevalent are board connections among competing U.S. firms? Here we employ the text-based definition of product market peers (Hoberg and Phillips, 20104, 20165) and a broader definition of connections that includes interlocking directors (when one person sits on two boards) and indirect board connections (when two firms are linked via a third intermediate firm). Second, can board connections facilitate anti-competitive practices? To answer this question, we integrate both the validation approach, where we estimate the causal effects of board connections on a firm’s profitability, and the direct approach, where we examine whether there is coordinated pricing following board connections using product market prices from scanner data collected in grocery stores.

We find 1,493 cases of a firm forming new direct connections to product market peers and 4,085 cases of new indirect connections to product market peers via an intermediate firm. Then we construct a treatment-control matched sample where control firms are chosen as the closest ones to the treated firms in terms of firm characteristics. In the three years following a direct connection to a product market peer, we find that a firm’s gross margin, operating margin, and return on assets (ROA) increase by 0.8 percentage points (p.p. henceforth), 1.4 p.p., and 0.9 p.p., respectively, relative to the control firms. The estimates following an indirect connection to a product market peer are 0.4 p.p., 0.8 p.p., and 0.6 p.p., respectively.

These findings do not by themselves prove a causal relationship between board connections and higher profitability. Instead, other, concurrent factors might cause the observed profitability increase. For example, better-performing firms could afford to appoint directors who are experts in their industry and thus are also connected to product market peers. Also, directors of a firm whose prospects are improving may be more valued in the director labor market and hence more likely to be appointed to the board of a product market peer.

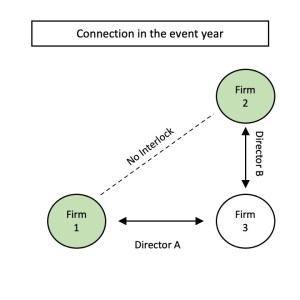

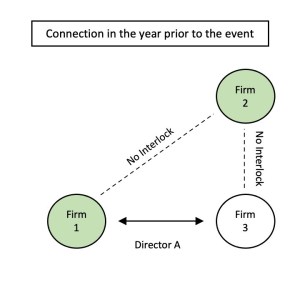

To address these alternative explanations, we examine third party-initiated board connection changes. In particular, we look at a focal firm’s indirect connections to a product market peer that arise because of changes on the board of the intermediate or the peer firm rather than the focal firm itself. The following figure illustrates such cases, where Firm 1 is the focal firm, Firm 2 is its product market peer, and Firm 3 is the intermediate firm that connects them. In the event year, Firm 2 and 3 become interlocked via Director B, and as a result, Firm 1 becomes indirectly connected to Firm 2. As this new connection of Firm 1 does not result from any changes on Firm 1’s own board of directors, it is less likely to be correlated with the future prospects of Firm 1. Hence, it is less likely that concurrent factors could produce a relationship between the board connection of the focal firm and its profitability. Even in these cases, we still find that the board connections are related to higher profitability of the focal firm.

Are these results indicative of anti-competitive practices? We predict benefits from such practices to be greater when the connections are between firms that share common major corporate customers, are more similar in business descriptions, are closer geographically, or are in more competitive industries. Consistent with the interpretation of anti-competition, in the cross-section, we indeed find the estimated effects to be stronger in these scenarios.

To give more direct evidence, we look at the product-level prices in the consumer goods sector. We find that when new board connections form among firms selling in the same product category, the product prices of treated firms rise 0.08 p.p. faster per quarter than those of untreated firms in the same product category, which translates into a 0.32 p.p. annualized difference. We interpret this as direct evidence that board connections could enable anti-competitive practices.

Our research provides a few important policy implications. First, our results indicate the role of directors in anti-competitive practices and provide support for the current ban on interlocking directorates between competing firms. Second, the results suggest that text-based analyses are powerful in identifying competitors in the marketplace and have the potential to aid in the execution of antitrust regulations. In addition, we find that indirect connections via an intermediate firm also positively affect profitability even though their economic magnitudes are smaller than those of direct connections. This argues for going beyond interlocking directorates and putting restraints on indirect board connections between competitors, especially in cases where the detrimental effects of anti-competitive practices on consumer welfare are substantial.

ENDNOTES

Pet food prices are rising. Could it ever get so high you’d give up your pup? https://www.foxbusiness.com/economy/pet-food-prices-rising-ever-get-high-give-pup

PetSmart, Chewy Overlapping Directors Focus of DOJ Complaint. https://www.bloomberg.com/news/articles/2023-03-09/petsmart-chewy-overlapping-directors-focus-of-doj-complaint. We thank one discussant for this interesting example.

Amazon (2020): “Statement by Jeffrey P. Bezos, Founder & Chief Executive Officer, Amazon before the U.S. House of Representatives, Committee on the Judiciary, Subcommittee on Antitrust, Commercial, and Administrative Law,” House Committee on the Judiciary, available at https://docs.house.gov/meetings/JU/JU05/20200729/110883/HHRG-116-JU05-Wstate-B ezosJ-20200729.pdf.

Hoberg, G. and G. Phillips (2010): “Product Market Synergies and Competition in Mergers and Acquisitions: A Text-Based Analysis,” The Review of Financial Studies, 23, 3773–3811.

Hoberg, G. and G. Phillips (2016): “Text-Based Network Industries and Endogenous Product Differentiation,” Journal of Political Economy, 124, 1423–1465.

This post comes to us from Renping Li, a PhD candidate at Washington University in St. Louis, and Alminas Žaldokas, associate professor of finance and Lee Heng Fellow at Hong Kong University of Science & Technology. It is based on their recent paper, with Radhakrishnan Gopalan, “Do Board Connections between Product Market Peers Impede Competition?” available here.

Sky Blog

Sky Blog