The financial regulatory structure in the U.S. is complex, consisting of multiple agencies with overlapping responsibilities. Regulators have raised concerns that regulatory fragmentation may undermine the stability and efficiency of the U.S. financial system (GAO 2016). In this paper, we suggest that fragmented securities regulation increases information asymmetries and the costs of searching filed documents and thus negatively affects capital markets. Specifically, we examine the consequences of separate disclosure systems due to regulatory fragmentation on stock price efficiency.

Publicly traded banks without a bank holding company (hereinafter stand-alone banks) in the U.S. are exempt from Securities and Exchange Commission (SEC) registration under the Securities Act of 1933 and thus do not submit filings to the SEC through EDGAR. Instead, they file with their federal bank regulator through FDICconnect, a separate filing and dissemination system created by federal bank regulators and administered by the Federal Deposit Insurance Corporation (FDIC). To examine the consequences of the fragmented disclosure system on stock price efficiency, we compare the timeliness of market reactions to Form 4 insider-trading filings on FDICconnect with those on SEC EDGAR, for which prior studies found immediate market reactions (Bolandnazar, Jackson, Jiang, and Mitts 2019; Du 2015; Rogers, Skinner, and Zechman 2016, 2017).

Consequences of the fragmented filing and dissemination system is increasingly important as more bank holding companies consider becoming stand-alone banks due to the increased regulatory burden after the financial crisis. Recently, Zions Bancorp, Bank OZK, BancorpSouth, and Northeast Bancorp dissolved their holding companies. The change in banks’ organizational structure accompanies important changes in requirements for their mandatory disclosure. Publicly traded stand-alone banks file the same Securities Exchange Act filings (e.g., 10-K, 8-K, proxy statement, Form 4) as companies registered with the SEC but to federal bank regulators. This arrangement raises the concern that filings on a separate disclosure system may suffer from lower market awareness and higher search costs, and thus limit the flow of information to financial markets. The SEC expressed concern that filing mandatory disclosures with different regulators “makes it difficult for many investors to know where to find the reports of a particular financial institution” (SEC 1999).

We focus on insider-trading filings to examine the effects of the fragmented disclosure system on stock price efficiency for several reasons. First, whereas other important disclosures such as earnings announcements mostly occur outside market hours, a large subset of Form 4 filings occurs during market hours. Thus, we can observe intra-day market reactions specific to a certain Form 4 filing. Second, Form 4 filings contain useful information in a simple, homogenous format, and thus we compare filings containing similar information on the two different disclosure systems. Third, the information in a Form 4 is not preempted by other sources because it is disclosed first through FDICconnect or SEC EDGAR by regulation. Fourth, sophisticated investors actively trade on information in Form 4 filings.

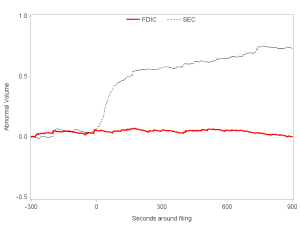

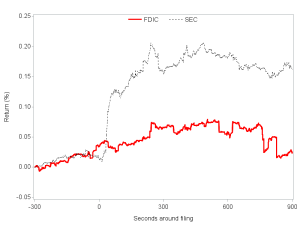

For the main analysis, we match stand-alone banks with bank holding companies consisting of one commercial bank (“single-bank holding companies”) based on year and bank characteristics (the natural log of market capitalization, tier 1 capital, loans as a proportion of assets, and deposits as a proportion of assets). In Figure 1, we plot average percent returns and average percent abnormal volume on a second-by-second basis from five minutes prior to 15 minutes after Form 4 filings of open-market purchases. In the left panel of Figure 1, the average return to filings on FDICconnect (in solid red) shows a small movement after the filing. In contrast, the average return to filings on SEC EDGAR (in dotted black) jumps within seconds of the filing. Similarly, in the right panel of Figure 1, the average abnormal volume to filings on FDICconnect (in solid red) shows a small reaction whereas the average abnormal volume to filings on SEC EDGAR (in dotted bank) immediately increases after the filing. The non-reaction to disclosures containing potentially positive information by stand-alone banks is surprising and notable.

Figure 1: Short-run market reaction to FDICconnect vs. SEC EDGAR filings

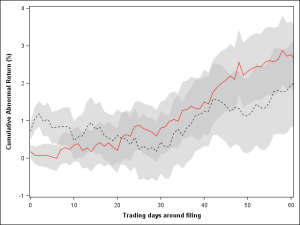

Next, we compare long-term returns to Form 4 filings on FDICconnect and SEC EDGAR. In Figure 2, we generate plots of average cumulative abnormal returns measured from the filing date to the following 63 trading days, approximately three months, for filings on FDICconnect and SEC EDGAR. Cumulative abnormal returns are calculated as raw returns minus the size-decile value-weighted portfolio returns. We find that the cumulative abnormal returns to filings on FDICconnect are smaller than to filings on SEC EDGAR in the first several trading days after filing. However, the mean cumulative abnormal returns of filings on FDICconnect and SEC EDGAR converge at around 10 trading days, approximately two weeks, after filing. Our analysis suggests that returns to filings on FDICconnect and SEC EDGAR are similar in the long run, and thus the short-run difference is not driven by a difference in the information content of the filings.

Figure 2. Long-run abnormal returns to FDICconnect vs. SEC EDGAR filings

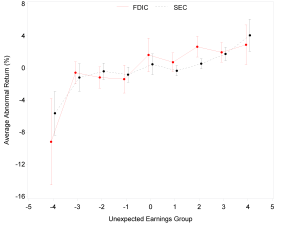

Finally, we run a placebo test using earnings announcements to address concern that the market reaction difference is due to banks’ organization structure rather than the disclosure venues, because the organization structure of a bank solely determines its disclosure venue. In Figure 3, we plot the average two-day abnormal return around the earnings announcement (CAR[0,+1]) for stand-alone banks and bank holding companies by earnings surprise group. Whereas insider-trading activity is first disclosed through a Form 4 filing by regulation, earnings are mostly announced in press releases first and filed on the disclosure system with a significant delay (Bochkay, Markov, Subasi, and Weisbrod 2019). If the market reaction to stand-alone banks’ earnings announcements are delayed as it is for their insider-trading filings, we expect to see smaller negative (positive) reaction for stand-alone banks in the bad (good) news groups compared with bank holding companies. However, we find that the average abnormal returns are not statistically different for most groups and even larger for stand-alone banks in group 2. The placebo test supports our hypothesis that the delayed market reaction to insider-trading filings by stand-alone banks is due to the disclosure venue, FDICconnect, rather than bank organizational structures.

Figure 3. Placebo test: Average earnings announcement returns

Our study finds that the stock market reaction to insider purchases filed on FDICconnect is almost non-existent and significantly smaller than that to the same filings on SEC EDGAR. We also find that the difference in market reactions between filings on FDICconnect and SEC EDGAR persists for several days but disappears eventually. Given that Form 4 filings are easy to interpret and can be traded on, the delayed market response to those filings on FDICconnect is notable. Our empirical tests suggest that these findings are possibly due to lower market awareness about FDICconnect and higher search costs for filings on FDICconnect. As more banks consider removing their holding company structure and filing on FDICconnect instead of on SEC EDGAR, this trend would bring significant consequences on the price efficiency of the stock market.

This post comes to us from professors Sehwa Kim at Columbia Business School and Seil Kim at City University of New York’s Baruch College. It is based on their recent article, “Fragmented Securities Regulation: Neglected Insider Trading in Stand-Alone Banks,” available here.

Sky Blog

Sky Blog