The Council of the EU has reached political agreement on the EU Benchmark Regulation (the Regulation). The legislation will impose controls on a range of financial market activity that uses interest rate, currency, commodity and other indices to set prices and contract values. Although not yet finalised the new rules are expected to be published later this year and apply in 2016. The Regulation is expansive in scope, covering not only indices such as LIBOR and the DAX but also many other less obvious ‘benchmarks’. The new rules could lead to the transformation or even disappearance of some benchmarks, presenting a significant implementation challenge. The compliance burden for firms that administer, use and contribute to financial benchmarks will also be substantial and the Regulation will pose special challenges for EU market participants that rely on non-EU benchmarks.

The Regulation is part of the EU’s response to the LIBOR scandal and international developments such as IOSCO’s 2013 report on benchmarks. However, by choosing to regulate a very broad class of benchmarks used in financial instruments, the EU is taking a more radical regulatory approach than some of its important international peers. In some jurisdictions (such as Japan and Singapore) the scope of benchmark regulation is focused on a limited number of specified benchmarks, while the US approach will be to rely on self regulation and robust enforcement rather than the construction of an entirely new supervisory architecture.

The agreement reached by the Council in January was confirmed in early February with publication of the Council’s negotiating mandate text. However, political agreement among EU member states in the Council by no means settles all of the issues. Last month also saw the publication by the European Parliament of hundreds of suggested amendments to the original Commission proposal. There remains considerable scope for change to the detail of the Regulation’s provisions as the “trilogue” negotiation between the Commission, Council and Parliament runs its course. Unless otherwise stated, the analysis in this briefing assesses the Council negotiating mandate text of 6 February.

Impact

Firms will need to identify all indices produced or controlled by them that qualify as benchmarks under the Regulation (including proprietary or customised indices). For EU firms that administer benchmarks, the Regulation will present a significant compliance burden. Many firms will need to overhaul their internal procedures in order to meet exacting standards of control and oversight in the computation of benchmarks. The legislation imposes myriad administrative requirements and the onus will be very much on firms themselves to demonstrate to regulators their compliance. Benchmark administrators bear significant responsibility for “input data” and will need to develop systems and controls to ensure the integrity of data that they receive from third party contributors.

Benchmark administrators that are located outside the EU will need to assess their ability and willingness to operate under the Regulation’s “third country” regime. Although there have been some improvements to the original Commission proposal, both the Council text and many of the Parliament amendments still leave unanswered questions about the practical ability of EU firms to continue using benchmarks that are administered outside the EU (see Third country regime below).

While the most onerous requirements under the Regulation affect benchmark administrators, entities that contribute data to, or that simply use, benchmarks also fall within the Regulation’s perimeter. Firms should begin the exercise now of working out which benchmarks (or possible benchmarks) they contribute to and start planning to institute the systems and controls mandated for contributors, such as sign off processes from senior staff supervising employees acting as “submitters”, record keeping requirements and policies for guiding the use of any discretion or expert judgment in the process of data contribution. Although market participants have already tightened controls in the wake of LIBOR the Regulation’s breadth increases the scope of the internal compliance exercise; the size of the task of identifying all of benchmarks that firms contribute to should not be underestimated.

Firms also need to identify which of their business lines are engaged in activities that may constitute the “use” of a benchmark (for example, when issuing securities or entering into derivatives contracts – see key definitions below) and prepare to comply with the various obligations affecting users, such as the requirement to maintain written contingency plans for coping with situations where a benchmark they use materially changes or ceases to be produced. The latter requirement in particular presents a repapering challenge as well, since firms will be required to reflect these contingency arrangements in contracts with clients. Issuers of securities that reference benchmarks will also need to include information in the prospectus explaining to investors whether the referenced benchmark is provided by a regulated administrator, while simultaneously warning of the risks associated with referencing the particular benchmark.

The Regulation will have an important impact in mortgage and consumer credit markets, for example by introducing requirements to assess the knowledge and experience of consumers who are being sold products that reference a benchmark and to provide information to consumers enabling them to assess the appropriateness of the benchmark linked product.

The Regulation could also have important implications for organizations that publish data or an index (such as international news agencies) which third parties then use in their financial instruments or contracts. Under the Council text, it appears that the Regulation applies to the index producer at the point it becomes aware or ought reasonably to be aware that its data is being used in this way even if the producer did not know or consent to that use. If the provider is in the EU then it may then need to become authorised or registered under the Regulation. Strategies to control unauthorised use of index data may be difficult to implement without completely restricting access to data which is currently published freely.

The Regulation imposes direct obligations on users and contributors that are “supervised entities.” Broadly speaking, this term covers a large constituency of different categories of financial institution referred to in EU legislation including banks, investment firms, insurers, reinsurers, clearing houses, hedge funds and regulated funds. However, by simply cross-referring to the definitions under other European legislation the Regulation does not make clear whether the obligations of supervised entities also apply to entities exempted from the scope of that other EU legislation or non-EU entities that meet the definition of the relevant category of financial institution (e.g. the definition of “credit institution” or “investment firm”) but which are not supervised in the EU – although the fact that the restrictions on the “use” by supervised entities of benchmarks apply to use “in the Union” implies some territorial limit on these obligations.

For all entities potentially affected by the legislation it will be important to begin planning as soon as possible. While a final text may be some months away and new rules may not apply until later next year, the current transitional arrangements present a number of implementation challenges. Although transitional arrangements are likely to change during the trilogue negotiations, the current key concern is the inclusion of a “hard stop” implementation deadline that could prevent market participants’ from using existing benchmarks in new contracts where the existing benchmark’s administrator has not obtained authorisation or met the conditions for non-EU administrators by the date the Regulation begins to apply (12 months after the in force date). Also the ability to continue to use EU benchmarks in existing contracts after that date may be of little value unless the EU administrator can continue to produce those benchmarks even if not authorised.

Scope

The scope of the Regulation is extremely broad. It is designed to cover a very wide range of indices including interest rates, currencies, commodities and even factors with no obvious “underlying” (such as weather). The breadth of the definition of “index” has, for example, raised the question as to whether it might extend to commercial banks’ own published lending rates. Investment banks also routinely produce customized “baskets” of reference assets for a wide range of derivatives and other products and these could all be affected by the Regulation. There is an exemption for benchmarks provided by central banks and EU public authorities (e.g. central bank base rates, or publicly administered inflation indices) and the Council appears to intend that this exemption is also available to non-EU central banks.

A key outstanding question for participants in derivatives markets is the extent to which the Regulation affects bilateral OTC trading in derivatives. What is unclear is whether the references to trading venues and systematic internalisers (SIs) in the definition of “financial instrument” mean that the Regulation only applies when trading actually takes place on a trading venue or via an SI, or whether the Regulation also applies to bilateral trading outside a trading venue (and not with an SI) just because the contract happens to be capable of being traded on a trading venue or via an SI. Worryingly, the Council text seems to imply that if there is any trading – however limited in volume – on an MTF or OTF in an OTC derivative contract linked to an EU or a non-EU benchmark in the lead up to the application of the Regulation, then once the Regulation applies, it would (in effect) ban supervised entities from entering into new OTC derivative contracts of that kind on MTFs or OTFs or with Sis and possibly also other bilateral OTC trading in that contract.

Administering benchmarks

Title II of the Regulation (Benchmark Integrity and Reliability) is targeted at the administrative arrangements that benchmark administrators need to have in place. The most important of these fall into four distinct categories: governance and conflict of interest requirements; internal oversight functions; control frameworks; and accountability frameworks. The European Securities and Markets Authority (ESMA) is tasked with developing regulatory technical standards (RTS) to specify the features of these various frameworks and functions. These technical standards will be important in helping firms understand how they can demonstrate compliance with a range of obligations that, whilst legally distinct from one another, appear to overlap to some extent. The essential purpose of these provisions is to establish an organisational foundation within which conflicts of interest are minimized, it is harder for individuals to engage in abusive practices and which makes it easier for regulators to hold firms and senior individuals to account if failings are detected.

The Regulation also requires administrators to keep thorough records relating to the calculation of benchmarks and imposes some restrictions on the outsourcing of important functions connected with the provision of a benchmark. Detailed requirements are laid out relating to the quality of input data and the methodologies employed in benchmark calculation. These include a requirement to publish calculation methodologies and to establish systems and controls that ensure the integrity of input data. Under the Regulation’s governance provisions, administrators are required to develop and maintain a code of conduct for each of their benchmarks, outlining the responsibilities of contributors. Administrators also have to verify that their contributors adhere to the standards set by the relevant code of conduct.

Different types of benchmarks

Regulated data benchmarks

Some of the governance and administrative requirements of the Regulation do not apply to “regulated data benchmarks”. These are benchmarks which are determined by the application of a formula from input data “contributed entirely and directly from” trading venues, approved publication arrangements, approved reporting mechanisms and different types of commodity exchanges. Thus, administrators of the CAC40 or DAX indices would be subject to less extensive requirements under the Regulation than administrators of interbank benchmark such as LIBOR or Euribor.

Interest rate benchmarks

Interest rate benchmarks are also singled out for specific treatment. Annex I of the Regulation lays out distinct requirements that amend and supplement the governance arrangements applicable to other benchmarks. In particular, these require input data for interest rate benchmarks to be taken as far as possible from actual transactions in the underlying market. Administrators of interest rate benchmarks are also required to establish an independent oversight committee tasked with regular scrutiny of calculation methodology, input data and wider governance arrangements. Specific and comprehensive systems and controls requirements are also mandated for firms contributing to interest rate benchmarks. These controls are designed to preserve the integrity of data and to reduce the likelihood of manipulation.

Critical benchmarks

Critical benchmarks are subject to some additional requirements. Notably, regulators are given powers to require firms to make contributions to the benchmark, to determine the form and timing requirements for the submission of input data and to make changes to the code of conduct, calculation methodology or other rules relating to a particular critical benchmark.

The original Commission proposal defined critical benchmarks by reference to a simple quantitative threshold (“a benchmark, the majority of contributors to which are supervised entities and that reference financial instruments having a notional value of at least 500 billion euro”). The criteria set out in the Council text are now more sophisticated and engage qualitative as well as quantitative elements which would mean that the more onerous critical benchmark requirements would apply less bluntly than under the original Commission proposals.

The Regulation recognises that sometimes a benchmark that is critical in one Member State might be administered in another. The Regulation addresses this issue by enabling national regulators of Member States where a particular critical benchmark is important to the Member State economy to participate in a college of competent authorities and to collaborate in the supervision of the relevant administrator.

Commodity benchmarks

Commodity benchmarks are subject to distinct requirements under Annex II of the Council text. As with interest rate benchmarks, these particular requirements mainly affect governance arrangements (including conflicts of interest policies) and calculation methodologies. Administrators of commodities benchmarks are required to specify the criteria that define the physical commodity that is the subject of a particular benchmark. Priority is then given to input data based on concluded and reported transactions as well as data relating to bids and offers, in order to present an accurate picture of the market.

Aside from third countries, commodities is another topic that has generated heated debate during the development of the legislation. While the Council text proposes a special framework for commodities under the Regulation, some of the amendments that have been proposed by the Parliament aim to remove commodity benchmarks from the scope of the Regulation altogether, to be dealt with in a separate piece of legislation instead. Until the trilogue process is complete, the extent of the impact of the Regulation on different commodity benchmarks will be difficult to assess.

Authorisation and supervision of benchmark administrators

Benchmark administrators are required to obtain authorisation from their national regulators. Once authorised under the Regulation, administrators must publish a “benchmark statement” describing the key features of each benchmark or family of benchmarks that they provide as well as the methodology and input data used to calculate the benchmark. Administrators that are supervised entities must apply for registration rather than authorisation but otherwise are mainly subject to the same obligations.

A wide range of supervisory and investigatory powers is given to regulators relating to data access, requiring information, carrying out on-site inspections and requesting the freezing or sequestration of assets. The Regulation also establishes administrative measures and sanctioning powers for regulators including cease and desist orders, profit disgorgement powers, warnings, suspension and withdrawal of authorization, limitations on natural persons performing management functions as well as financial penalties on both natural and legal persons (at least EUR 500,000 or equivalent for natural persons and in certain cases up to 10% of turnover for legal persons).

Third country regime

The Regulation will restrict the use in the EU by supervised entities of benchmarks provided by administrators located in non-EU jurisdictions. For example, this restriction could cause problems for EU managers of ETFs that track an underlying non-EU benchmark. It could also interfere with obtaining hedging in the EU on loans denominated in non-EU currencies or whose repayment terms are linked to non-EU benchmarks.

There are potentially four routes through which EU firms may use non-EU benchmarks under the Regulation.

Equivalence

EU supervised entities can use a “third country” benchmark (i.e. a benchmark whose administrator is outside the EU) where the following requirements have been satisfied:

- The Commission adopts a decision that the third country legal framework and supervisory practice ensures that the administrator complies with binding requirements “equivalent” to EU requirements under the Regulation;

- The administrator is authorised and supervised under the rules of the third country;

- The third country benchmark regulator notifies ESMA that the third country administrator has consented to its benchmarks being used by EU supervised entities and provides ESMA with a list of the relevant benchmarks.

- The administrator is registered by ESMA; and

- ESMA establishes and operates cooperation arrangements with third country authorities.

The above requirements are cumulative. Although the first requirement effectively requires third countries to have equivalent legal and regulatory frameworks to that established by the Regulation, at least there is no reciprocity requirement. Nevertheless, it seems unlikely that many third country benchmarks could qualify under this regime soon, given the different approaches taken to regulation in other jurisdictions.

Recognition

Pending a Commission equivalence determination, the Council text proposes an alternative framework that is intended to allow EU supervised entities to use third country benchmarks provided that the third country administrator obtains “recognition” from the national regulator in the EU Member State “of reference”. Under this recognition regime, the non-EU administrator has to comply with most of the obligations applicable to EU administrators while also appointing an EU representative.

Non-EU administrators may face practical difficulty in determining which Member State is the appropriate “reference” country because the data that would enable the administrator to make this judgment (e.g. data identifying where most trade activity is occurring) may not be available to it (or anyone else) at the time of seeking recognition. Moreover, the burden of compliance with the recognition regime could dissuade non-EU administrators from seeking recognition. Unless a non-EU benchmark administrator derives significant payments from EU users of its benchmarks (and in some cases EU users can use non-EU benchmarks free of charge) then it is hard to see what incentive the non-EU administrator has to obtain recognition.

Endorsement

The Regulation’s “endorsement” regime is primarily intended to allow EU administrators to endorse non-EU benchmarks that are produced by their non-EU affiliates for use in the EU for a period up to five years following the entry into force of the Regulation. The EU administrator would need to apply to its national regulator to be allowed to endorse benchmarks provided by its non-EU affiliate. Crucially, among other conditions, the applicant firm has to be able to demonstrate on an ongoing basis that the non-EU benchmark fulfils requirements at least as stringent as those set by the Regulation.

Transitional arrangements

Apart from the equivalence, recognition or endorsement regimes, the Regulation’s transitional arrangements would only permit unrestricted use of non-EU benchmarks for 12 months after the Regulation enters into force. As already noted, after that, there would be a “hard stop” on supervised entities using non-EU benchmarks in new “in scope” financial instruments and contracts, although some use in existing contracts would be permitted. There will need to be further work on these transitional provisions in trilogue if significant disruptions are to be avoided.

Timing

Next steps

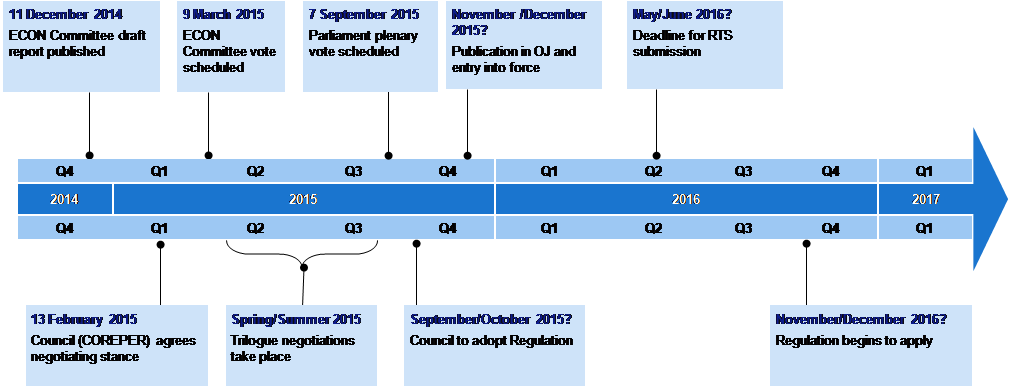

The agreement reached by the Council in January marks a significant milestone in finalizing the Regulation. However, the Council text simply reflects its negotiating position as it enters trilogue with the Commission and Parliament. The legislation is not yet cast in stone. At the Parliament meetings between the rapporteur and shadow rapporteur are underway and the ECON Committee is scheduled to vote on the draft Parliament report in early March, although continuing political controversies around the treatment of commodity benchmarks could delay Parliament’s plenary vote on the Regulation.

As the legislative process nears its conclusion, questions around the third country regime and the treatment of commodity benchmarks look set to continue to dominate the debate. However these questions are ultimately addressed, it seems clear that by year end the EU will have taken a much more radical step forward in the regulation of benchmarks than other jurisdictions.

The full and original memorandum was published by Clifford Chance on February 25, 2015, and is available here.

Sky Blog

Sky Blog