We recently published a study (“2015 Investor Survey: Deconstructing Proxy Statements”) in collaboration with RR Donnelley and Equilar that examines how institutional investors use the information in corporate proxies to make voting and investment decisions. Full results are available here.[1]

We find that institutional investors are highly dissatisfied with the quality of information that they receive about corporate governance policies and practices in the annual proxy. Across the board, investors want proxies to be shorter, more concise, more candid, and less legal. Fifty-five percent of investors believe that the typical proxy statement is too long. Forty-eight percent believe that it is difficult to read and understand. Investors claim to read only 32 percent of a typical proxy, on average. They report that the ideal length of a proxy is 25 pages, compared with an actual average of 80 pages among companies in the Russell 3000.

The fundamental complaint about proxies is rooted in a perception that companies are not communicating candidly with owners. Shareholders want corporations to explain information rather than disclose it. Investors view corporations as using the proxy as a vehicle to meet disclosure obligations without a willingness to provide information in a format that is clear and understandable to a typical—or even sophisticated—owner.

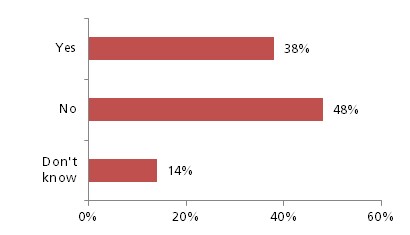

The largest complaint involves executive compensation and the inability of investors to read the information that companies disclose and determine whether senior management is paid appropriately. According to the survey above, less than half (38 percent) of institutional investors believe that executive compensation is clearly and effectively disclosed in the proxy (see Figure 1).

“Do you believe information about executive compensation is clearly and effectively disclosed in proxy statements?”

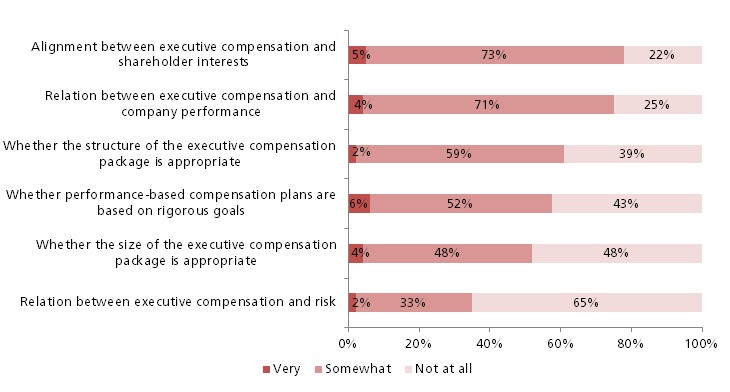

Responses are consistently negative across all elements of compensation disclosure. Sixty-five percent say that the relation between compensation and risk is “not at all” clear. Forty-eight percent say that it is “not at all” clear that the size of compensation is appropriate. Forty-three percent believe that it is “not at all” clear whether performance-based compensation plans are based on rigorous goals. Significant minorities cannot determine whether the structure of executive compensation is appropriate (39 percent), cannot understand the relation between compensation and performance (25 percent), and cannot determine whether compensation is well-aligned with shareholder interests (22 percent – see Figure 2).

Figure 2

“How clear and effective are proxy statements in helping you understand the following?”

Investors also express considerable dissatisfaction with the disclosure of potential payouts to executives under long-term performance plans.

Inadequate disclosure negatively impacts the voting process. Only half (54 percent) believe that the proxy allows them to make an informed decision regarding “say on pay.”

The challenge that corporations face is to find a solution that satisfies investor demands for clarity while at the same time satisfying numerous regulatory requirements for the disclosure of specific elements. Based on the feedback of major institutional asset owners and asset managers, the ideal proxy would include the following:

Context. Investors believe that proxies, as written today, lack context. They want to know how the company’s governance choices are informed by its strategic goals, in particular its choices relating to board composition, shareholder rights, financial targets, performance measurement, and executive compensation. Investors want companies to avoid the use of boilerplate, legal, and compliance-oriented language and instead to describe the context for corporate decision-making in simple and direct language. Preferably, this information would come from the independent chairman or lead director.

Board Composition. Investors want a better understanding of why each director is on the board and how they contribute to the corporate strategy and governance of the firm. This information could take the form of a skills matrix that maps director qualifications to the needs of the organization. Shareholders would be able to make decisions about director reelection based on their assessment of the company’s performance in each of these areas. Investors also want to understand the process for committee assignments, director evaluation, and refreshing the board over time, including some information about board succession planning. In addition, the proxy should continue to summarize the company’s ownership guidelines and provide a table on director compensation and ownership levels.

Compensation. The compensation section of the proxy could be improved through a more concise presentation of data and clearer description of how compensation is tied to long-term strategy, financial metrics, and risk. According to one investor, the compensation section of the proxy would benefit from context: “A big sticking point for us is that we want to see better disclosure, not more disclosure.” According to another, investors need better information to help them determine whether pay levels are appropriate: “Pay can be perfectly aligned with performance, yet still be too high.” To improve their understanding of these issues, investors would like to see the following:

- The value of compensation granted, realized, and realizable by named executives during the year.

- Comparable data among peers or industry averages.

- Metrics, targets, and weightings used to award performance-based awards.

- The company’s actual performance relative to targets.

- Outstanding awards and the conditions under which they can be realized.

- A justification for discretionary payments.

- Ownership guidelines and ownership levels.

Shareholder Rights. Investors want a concise summary of charter and bylaw provisions that spells out their rights to influence the corporation, including changes made in recent years and an explanation of why those changes were made. They want plain-language statements of company opposition to shareholder-sponsored proposals, and an explanation of the process the board will take in response to shareholder engagement.

Ironically, the ideal proxy statement today in many ways resembles proxy statements as written over fifty years ago. Then, a typical proxy was less than 10 pages in length, was simple in design and language, and contained a specificity of disclosure consistent with what investors are requesting today.

Regulatory requirements and investor demands for information make a return to historical proxy formats unlikely. Still, one approach that suggests itself from the research above is to make expanded use of a summary section at the beginning of proxies for increased clarity, while retaining detail in the body. Investors express considerable preference for summarized data, and respondents to the survey above claim that they are most likely to read the summary section first. This is consistent with the practice of including a summary prospectus in the event of a merger or acquisition.

ENDNOTES

[1] Link to: http://www.gsb.stanford.edu/faculty-research/publications/2015-investor-survey-deconstructing-proxy-statements-what-matters.

This post comes to us from Professor David Larcker, the James Irvin Miller Professor of Accounting and Senior Faculty at the Rock Center for Corporate Governance at Stanford University, and Brian Tayan, a researcher in the center. The post is based on their recent article entitled “The Ideal Proxy Statement” and available here. They are co-authors of the book A Real Look at Real World Corporate Governance.

Sky Blog

Sky Blog