On November 3, 2014, the board of directors of Cogent Communications Holdings, Inc., a publicly traded internet-service provider incorporated in Delaware, amended Cogent’s bylaws to include two new provisions. One was a forum-selection provision designating Delaware as the exclusive forum for derivative actions and other claims involving internal corporate matters. The other was a so-called “fee-shifting” bylaw requiring any stockholder who asserts “any claim … against the Corporation and/or any director, officer, [or] employee” and does not obtain a judgment on the merits that “substantially achieves… the full remedy sought” to reimburse any costs the corporation incurred defending the suit (Cogent Communications Holdings, Inc., 8-K, November 5, 2014). After a backlash from its shareholders, however, Cogent rescinded the amendments and restored the company’s bylaws to their pre-amendment state (Cogent Communications Holdings, Inc., 8-K/A, March 30, 2015).

The Delaware Legislature is currently considering an amendment to the Delaware General Corporation Law (DGCL) that would invalidate fee-shifting provisions contained in corporations’ organizational documents and ward off the kind of disputes that took place at Cogent. But according to our analysis, the statutory amendment, even if passed in its proposed form, may not have as wide a peacemaking effect as anticipated.

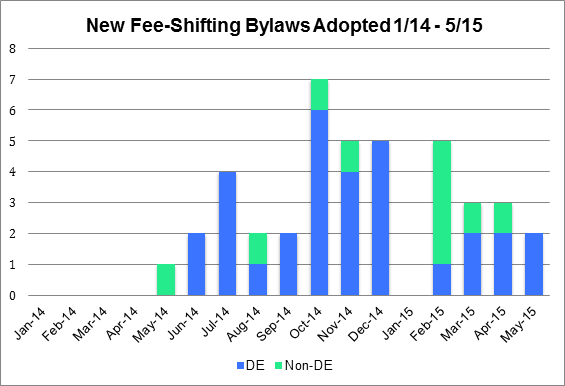

Before June 2014, fee-shifting bylaws were very uncommon; only two publicly held Delaware companies’ bylaws included these provisions. But between June 2014 and May 2015, that number ballooned to 34, when 32 Delaware public companies, including Cogent, adopted bylaws designed to transfer litigation costs to unsuccessful shareholder-plaintiffs. This flood of adoptions was precipitated by a May 2014 decision of the Delaware Supreme Court, holding that fee-shifting bylaws can be “valid and enforceable” in Delaware if adopted for a “proper purpose” (ATP Tour, Inc., et al. v. Deutscher Tennis Bund, et al., 91 A.3d 554 (Del. 2014)(ATP Tour)). Even though ATP Tour involved a non-stock company, most observers understood the decision’s underlying rationale to apply equally to ordinary stock companies. Public companies soon reacted; the first new fee-shifting bylaw was adopted a month later (The LGL Group, Inc., 8-K, June 17, 2014).

Despite the immediate embrace of fee-shifting bylaws among many in the business community, and the bylaws’ vigorous defense by some commentators – UCLA law professor Stephen Bainbridge called them “an appropriate means of addressing” a crisis of “runaway frivolous litigation” (Stephen Bainbridge, The Case for Allowing Fee Shifting Bylaws as a Privately Ordered Solution to the Shareholder Litigation Epidemic, Professorbainbridge.com (Nov. 17, 2014)) – the plaintiffs’ bar expressed concern. A typical argument, voiced by Mark Lebovitch and Jeroen van Kwawegen of Bernstein Litowitz Berger & Grossmann LLP, was that fee-shifting bylaws were “likely to eliminate all stockholder litigation, irrespective of merit” (Mark Lebovitch and Jeroen van Kwawegen, Of Babies and Bathwater: Deterring Frivolous Stockholder Suits Without Closing the Courthouse Doors to Legitimate Claims, available at: http://blogs.reuters.com/alison-frankel/files/2015/03/babiesandbathwater.pdf).

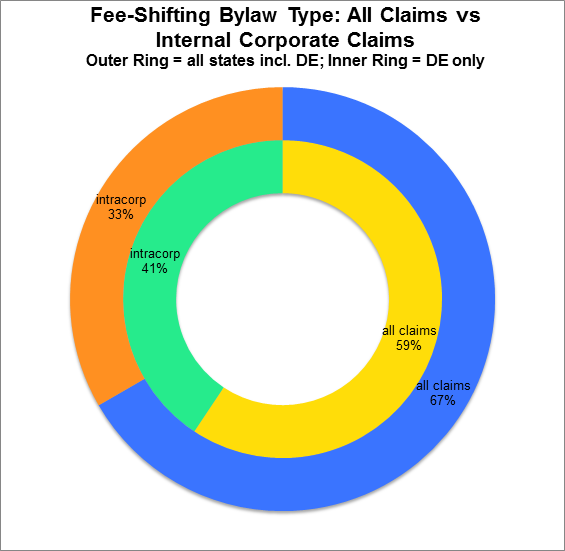

The debate was unique compared to other, relatively non-controversial matters of Delaware statutory law, because it could be seen as pitting the interests of the business community against the interests of the plaintiffs’ bar. In March of this year, the Corporate Law Council of the Delaware Bar Association largely took the latter’s side, proposing amendments to the DGCL that would limit the holding in ATP Tour to non-stock corporations (Practical Law Legal Update, DGCL Amendments Proposed on Fee-shifting, Forum Selection and Appraisal Rights). These amendments, currently embodied in Delaware Senate Bill 75, forbid both bylaws and certificates of incorporation from containing “any provision that would impose liability on a stockholder for the attorneys’ fees or expenses of the corporation … in connection with an internal corporate claim[i].” Internal corporate claims, in turn, would be defined as those brought “in the right of the corporation” – meaning derivative claims, which “belong” to the corporation even though they are brought by shareholders – either alleging a violation of a fiduciary duty by a director or officer or otherwise coming under the statutory jurisdiction of the Court of Chancery (S.B. 75, 148th Gen. Assemb., 1st Reg. Sess. (Del. 2015) (SB 75)). By its own terms, then, the amendment would not invalidate provisions in the bylaws or certificate of incorporation that shift fees for claims not alleging a breach of a fiduciary duty and not under the Chancery Court’s jurisdiction. As noted by Professor John Coffee of Columbia Law School, this means the amendment will not cover federal securities class actions, which must allege a material misstatement or omission, but need not allege a breach of fiduciary duty (John C. Coffee, Jr., Delaware Throws a Curveball, The CLS Blue Sky Blog (Mar. 16, 2015)).

Based on this distinction, our analysis of currently effective fee-shifting bylaws indicates that if SB 75 were passed into law in its currently proposed form, the statute would completely invalidate some of the fee-shifting bylaws adopted since June 2014, but many others would remain largely intact. Consequently, SB 75 is unlikely to completely resolve the tension over fee-shifting bylaws.

“External” Corporate Claims

Many of the fee-shifting bylaws adopted since June reach beyond “internal” corporate claims and cover any claim brought by an equity investor. Bylaws of this type would only be partially invalidated by SB 75. In fact, our survey found that most (67%) of the fee-shifting bylaws adopted since June 1, 2014, including the bylaw adopted and then rescinded by Cogent’s board, apply by their terms to any action brought by a shareholder, including claims alleging violations of the federal securities laws (and, if read strictly, even to actions unrelated to the shareholder’s status as a shareholder).

As noted, SB 75 would not quell all disputes over fee-shifting bylaws, such as the dispute that took place at Cogent. But the potential impact of fee-shifting bylaws on private securities enforcement has not gone unnoticed either. In testimony before the Securities and Exchange Commission, Professor Coffee urged the SEC to take action to curtail the use of fee-shifting bylaws, “or concede the decline of private enforcement” (Fee-Shifting Bylaws: Can They Apply in Federal Court? – The Case For Preemption, Testimony of John C. Coffee, Jr. before the SEC Investor Advisory Committee (Oct. 9, 2014)). SEC Chair Mary Jo White, speaking at Tulane Law School’s Corporate Law Institute, while declining to promise specific action, did put issuers on notice that she is “keeping a very close eye” on developments to ensure that fee-shifting bylaws do not “improperly hinder shareholder’s exercise of their rights” (A Few Observations on Shareholders in 2015, speech by Mary Jo White at the Tulane University Law School 27th Annual Corporate Law Institute (Mar. 19, 2015)).

Beyond Delaware

Our survey also found that since ATP Tour, fee-shifting bylaws have been adopted by ten public companies organized in states other than Delaware. Five of these companies are organized in Nevada, but fee-shifting bylaws were also adopted by companies in Colorado, Florida, Maryland, and Utah. None of these states has existing case law regarding the enforceability of fee-shifting bylaws. Indeed, ATP Tour was a case of first impression in Delaware and appears to have been the first in the nation to opine on fee-shifting bylaws. Impossible though it is to predict with certainty how courts in other jurisdictions would treat these provisions, several states have the legal building blocks in place to support the logic of ATP Tour that found board-adopted fee-shifting bylaws binding on shareholders.

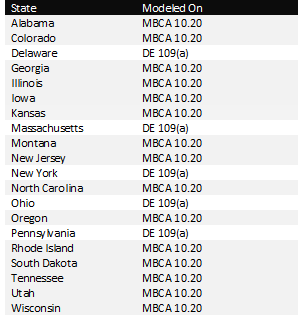

The crux of the holding in ATP Tour rests on two legal concepts that combine to give directors the power to adopt bylaws unilaterally that are binding on shareholders. The first was the statutory grant to the board of limited power to make bylaws unilaterally. Section 109(a) of the DGCL provides that stockholders have the power to adopt and amend bylaws, but adds that that power may be bestowed on the board via the company’s charter (Del. Code Ann. tit. 8, § 109(a) (West 2015)). Section 10.20 of the Model Business Corporation Act – the model statute formulated by the American Bar Association and followed by 24 states – goes further, giving the board power by default to make bylaws unless the charter takes that power away (See 3 William M. Fletcher, Fletcher Corporation Forms Annotated § 18.3 (5th ed. 2015)).

The second foundational concept of ATP Tour was the common law principle that a corporation’s bylaws are tantamount to a “contract among the shareholders” (Airgas, Inc. v. Air Prods. & Chems., Inc., 8 A.3d 1182 (Del. 2010)). This, together with the power of the board to make bylaws, made it possible for the ATP Tour court to rule that directors could adopt a fee-shifting provision that was binding on the (non-stock corporation’s) members.

At least five states, including New York, Massachusetts, and Pennsylvania, have both statutory language resembling DGCL Section 109 and case law treating bylaws as contracts. Another 15 states have case law treating a bylaw as a binding contract and a board-empowering statute patterned after MBCA Section 10.20.

States with Case Law Treating Bylaws as Binding Contracts & Giving Directors Power to Unilaterally Make Bylaws

Although these jurisdictions could provide for more corporate-friendly fee-shifting rules than Delaware once SB 75 is passed, it is hard to imagine that widely held companies will prophylactically change their jurisdiction of incorporation in order to adopt a fee-shifting bylaw. However, our survey of bylaws adopted between June 2014 and May 2015 found that 40% of the companies adopting such provisions were majority-controlled entities also entering into an M&A or reorganization transaction. It is easier to imagine that a majority-controlled company would reincorporate in another jurisdiction in order to insulate a transaction from suit by minority holders.

ENDNOTES

[1] Although the amended statute, as proposed, would permit corporations to include fee-shifting provisions in contractual agreements signed by the shareholders, as a practical matter this is a virtual impossibility for public corporations.

Related Material

Business Law Center EDGAR Search for Fee-Shifting Bylaws

Practical Law Legal Update, Proposal to Limit “ATP Tour” Decision on Fee-shifting By-laws

Mark A. Sargent and Dennis R. Honabach, D&O Liab. Hdbk. § I:13

The preceding post is based on analysis authored by Craig Eastland, Business Law Expert on-Call at Thomson Reuters and Daniel Rubin, Senior Editor, Practical Law at Thomson Reuters. The analysis was published on June 5, 2015 and is available here.

Sky Blog

Sky Blog