The debate over asset managers’ potential systemic risk has been ongoing for some years, with little agreement between the industry, US regulators, and global standard setting bodies. US regulators themselves have been divided – the SEC has in particular been skeptical that asset managers or individual funds can be the source of systemic risk of a magnitude akin to that posed by large banks.

Nevertheless, consensus is finally forming on the need to address specific risks of the industry. With the designation of asset managers as systemically important financial institutions (“nonbank SIFIs”) by the Financial Stability Oversight Council (“FSOC”) now off the table for the foreseeable future, the SEC has assumed a more prominent regulatory role in this regard.[1] The SEC is expected to take its first major step this week by proposing enhanced data reporting requirements for investment advisers and funds. As indicated by SEC Chair Mary Jo White, this action will then be followed by additional requirements for asset managers or individual funds around liquidity risk management, the use of derivatives, stress testing, and transition planning.

We expect these requirements to primarily affect traditional mutual funds and their advisers, with the new stress testing rule potentially being very impactful. Such a rule would apply to over a hundred individual US funds with over $10 billion in consolidated assets (in addition to advisers). Exchange-traded funds (“ETFs”) and others will likely also be affected by specific new requirements, e.g., around the use of derivatives.

Meanwhile, outside of the US, the Financial Stability Board (“FSB”) and the International Organization of Securities Commissions (“IOSCO”) continue to move forward with their proposed standards to identify asset managers as global systemically important financial institutions

(“G-SIFIs”). The second iteration of their proposal (issued in March 2015) maintains the first version’s focus on identifying individual funds as systemically important, but adds the asset managers themselves as a new category of entities to be considered for identification (as FSOC once entertained).

In our view, few if any US asset managers or funds will be identified as G-SIFIs by the FSB, and any such identification will not lead to FSOC designation as a nonbank SIFI. Perhaps due to the US’s influence, the second FSB/IOSCO proposal clearly asserts that individual nations are jointly responsible for identifying G-SIFIs with the FSB. Moreover, the proposal requires that global policy tools must be in place for addressing G-SIFI risks before any firms are identified,2 thereby pushing the identification of any firms to 2017 at the earliest (and providing the SEC with more time to finalize new regulations that address the concerns behind any G-SIFI identifications, without FSOC designation).

This post provides our view of the SEC’s upcoming regulations and timeline for SEC action.

Background [2]

FSOC was created under Dodd-Frank to address emerging threats to the US financial system, including identifying nonbank SIFIs for heightened regulation. Although asset managers were not subject to the first round of FSOC designations in June 2013,[3] FSOC turned its focus to the industry shortly thereafter by tasking the Treasury Department’s Office of Financial Research (“OFR”) with providing a report on the potential systemic risks of asset managers. The OFR issued its report in September 2013, highlighting a number of potential threats (e.g., around leverage and run-risk), but stopped short of outlining regulatory remedies. Subsequently, FSOC focused on analyzing two large asset managers for potential SIFI designation.

After its publication, the OFR’s report was widely criticized by the industry and by a bipartisan group of lawmakers and SEC commissioners. Discouraged from designating asset managers, FSOC opted to instead focus on activities and products of the industry that as a whole may pose systemic risk.[4] The industry’s response to FSOC’s subsequent request for public comments on the topic indicates overall favorable views of this policy change among asset managers vis-à-vis the alternative approach of designation (this comment period closed in March 2015).

Concerns regarding the potential systemic risks of asset manager activities are shared by some global authorities, including the FSB, the Bank of International Settlements (“BIS”), and the International Monetary Fund (“IMF”). These authorities are particularly troubled by the potential migration of systemic risk from the traditional circle of supervised banks (and broker-dealers within bank holding companies) to nonbank financial entities, including asset managers.[5] Please see the Appendix for a deeper discussion of this issue.

Among these authorities, the FSB was tasked by the G20 in 2011 to issue standards for identifying and addressing risks posed by asset manager G-SIFIs, and took its first step by jointly proposing methodologies with IOSCO for their identification in January 2014. The 2014 issuance proposed assessing systemic importance at the fund-level (as opposed to the asset manager-level), based on criteria including size, interconnectedness, substitutability, complexity, and cross-jurisdictional presence. The 2014 proposal was followed by a second proposal issued earlier this year that maintains the first proposal’s fund-level assessment methodology, but adds the asset managers themselves as a second group of entities for potential identification.

The SEC’s expected actions

As the asset management industry’s primary regulator, the SEC has increased its efforts since last year to develop a regime for addressing potential systemic risks.[6] We expect the SEC’s to continue on this path regardless of the FSB’s future direction, as Congress continues to press regulators to act independently from the FSB process.

The SEC is embracing this role in part due to ongoing pressure from FSOC, and also due to the agency’s own long-standing concerns that pre-date Dodd-Frank. More specifically, the SEC’s announced new rulemaking agenda is aligned with the agency’s pre-existing efforts to update certain areas of the Investment Company Act of 1940 (“’40 Act”), which governs retail funds including mutual funds and most ETFs (“’40 Act funds”), to address new product development and market changes (e.g., the use of derivatives).

Although resource and staffing problems remain at the SEC, a consensus has emerged creating momentum for rulemaking around data reporting, liquidity, stress testing, and transition planning, as discussed below.

Data reporting

Enhanced data reporting for ’40 Act funds is essential to advancing SEC initiatives in other areas, as the agency currently lacks a clear, full view of activities across the asset management industry. Therefore, it comes as no surprise that the SEC has decided to prioritize this area of rulemaking, with the agency set to propose new data reporting requirements on May 20th.

Many existing data reporting requirements for fund and investment advisers are outdated as they were established decades ago based on technologies then available to the industry. Other areas (e.g., use of derivatives) lack clear reporting requirements altogether. As a result, the SEC currently has an asymmetric view of the market, with more timely and relevant risk data on smaller private funds via Form PF than on much larger ’40 Act mutual funds and ETFs.

To address these issues, we expect the SEC’s May 20th proposal (and any future enhancements) to include (a) more comprehensive reporting of basic fund and adviser information, (b) enhanced reporting of fund investments in derivatives, liquidity of holdings, and securities lending practices, and (c) broader information collection from advisers on separately managed accounts.

These measures, in general, seek to bring ’40 Act funds in line with money market funds (“MMFs”) and private funds with respect to data reporting. This action would result in more dynamic data sets that would better align with market practices and allow for data aggregation and disaggregation based on SEC staff needs.

Liquidity

Liquidity concerns primarily relate to mutual funds’ ability to satisfy a large number of redemption requests during market stress. Liquidity management has therefore emerged as a key systemic risk concern for regulators, but existing SEC pronouncements on the topic are relatively outdated, piecemeal, and in the form of informal guidance and no-action letters. As such, the current regulatory framework does not adequately address recent industry developments such as changes portfolio management strategies and the introduction of more complex investment products.

Furthermore, liquidity concerns have increased due to the growing importance of retail funds in certain fixed income markets, where mutual funds may be forced to sell large quantities of less liquid instruments to satisfy redemption requests within seven days (as they are obligated to do), potentially leading to rapid market price reductions.[7] These concerns are further reinforced by bank-centric regulations that have arguably raised the capital cost of holding fixed income inventories and thus decreased available broker-dealer liquidity in some debt markets, according to recent studies produced by the BIS, the IMF, and others. See the Appendix of this paper for further detail of these developments.

To address these concerns, we expect the SEC to propose a new comprehensive approach to liquidity risk management by early 2016, including requirements for (a) baseline liquidity risk management programs for funds and advisers, and (b) more transparent investor disclosures delineating investments’ liquidity risks. However, we do not necessarily expect the SEC to propose stricter limits than the current 15% limit on illiquid investments for long-term mutual funds.

The SEC’s rulemaking efforts will likely be supplemented with examinations, especially for certain classes of mutual funds which have grown significantly in recent years such as bond funds.[8] A stronger examination focus will also likely apply to retail liquid alternative funds, which also have underlying liquidity transformation risks. Since the majority of these liquid alternative funds were created after the 2008 financial crisis, their performance under severe market stresses remains unknown. The SEC’s recent sweep of liquid alt funds was in part driven by regulators’ liquidity concerns, and intended to get a sense of advisers’ implementation of the ’40 Act’s liquidity restrictions.[9]

The use of derivatives

Similar to liquidity, the use of derivatives has raised considerable regulatory concerns, largely around the use of derivatives to achieve synthetic leverage by ’40 Act funds. While traditional cash leverage (i.e., direct borrowing for investment) is clearly prohibited by the ’40 Act, the Act does not address indirect borrowing through the use of derivatives. The SEC has taken a flexible approach to limiting leveraged investments through derivatives by, e.g., requiring the funds to segregate underlying assets or to enter offsetting transactions sufficient to cover potential liabilities associated with these leveraged investments.[10]

As highlighted in some recent comment letters to FSOC from industry, improvements in this area are long overdue, particularly for leveraged ETFs. While ETFs do not have the same redemption risks as open-ended mutual funds, certain leveraged ETFs rely heavily on derivatives, which can magnify volatility in specific markets during times of stress.

We expect the SEC to address the use of derivatives and related disclosures for ETFs and other retail funds directly via a proposal in 2016, replacing the current patchwork of indirect rules and firm-specific guidance. The proposal will be informed by the 2011 SEC Concept Release on the use of derivatives by registered investment companies, which has been generally well-received by the industry. The proposal will likely build upon the Concept Release’s framework by setting out new requirements for (a) segregation of derivatives’ underlying assets, (b) permitted amount of leverage, and (c) addressing risks associated with derivatives in fund-level risk management programs.

Stress testing

The SEC is mandated by Dodd-Frank to establish stress testing protocols for its supervised nonbank financial companies with consolidated assets of over $10 billion (as SEC Chair White reminded the industry in a December 2014 speech), but the SEC has thus far lagged bank regulators in this area. Such nonbank financial institutions include broker-dealers, registered investment advisers, and likely over a hundred registered investment companies (i.e., individual funds), thereby making stress testing requirements potentially very impactful. Mandated rules must establish – at a minimum – stress testing methodologies, stress scenarios, and reporting forms including a public summary of test results.

SEC staff has some experience with stress testing (namely with MMFs), but not in the context of the asset management firm itself. Therefore, the work on this rulemaking remains in its early stages. The SEC is working to define potential stress factors (e.g., runs, interest rate fluctuation, and market shocks) and to establish baseline scenarios based on those factors. Given these challenges, we expect stress testing measures to require more discussion within the SEC, which likely will not propose a rule until at least early 2016. Part of the debate may be around whether to adapt stress testing concepts from Europe’s AIFMD[11] in an effort to harmonize the SEC’s approach and ease the industry’s implementation burden.

Transition planning

The need for bank-like resolution planning requirements for asset managers is also subject to strong debate and is unlikely to gain much traction in the near term. Unlike banks and insurers, investment advisors do not own the assets under their management, which are held by third-party custodians, such that the advisor can be replaced without necessarily causing forced asset sales. Also, asset managers are not funded by insured deposits (as banks are) or backed by state insurance guarantees (as insurers often are). Thus, many within the industry and financial regulatory agencies view bank-like resolution planning for asset managers as unnecessary. They also consider establishing comprehensive and detailed resolution planning requirements for asset managers to be impractical, as the activities and business models that must be addressed vary greatly among asset managers.

Nevertheless, concerns remain around restrictions on investors’ ability to move assets away from an adviser during times of market stress, especially in the cases of illiquid assets. To address these concerns, the SEC is likely to propose, under the current compliance rule framework, that firms have reasonable policies and procedures in place to transition managed funds and client accounts.

The SEC is also likely to propose requirements to ensure business continuity in the event of a major disruption in operations (e.g., due to departure of key personnel, dissolution, or natural disasters). We expect these efforts to build upon current business continuity planning requirements for certain registered investment advisers.

Timeline of upcoming actions

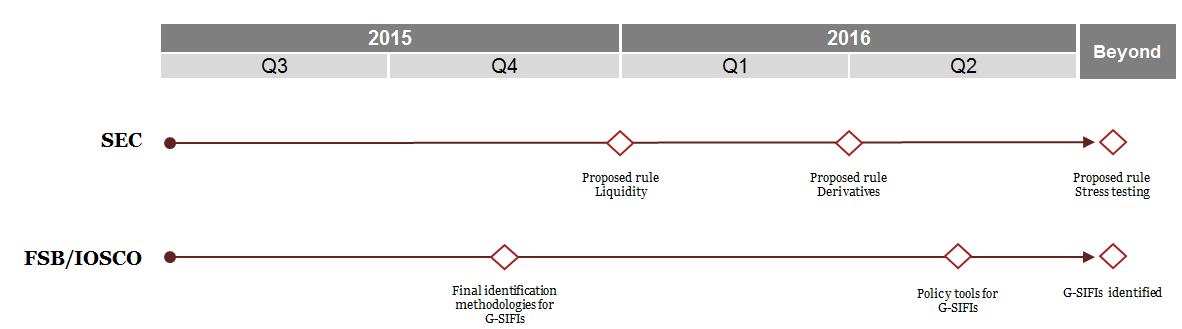

The below timeline synthesizes our views on the timing of the above upcoming SEC actions, and also includes our view regarding the FSB/IOSCO’s next steps:

Appendix: Systemic risk concern – asset managers in fixed income markets

The asset management industry is deeply interconnected with other segments of the economy, mainly as a provider of credit outside of the banking system (through funds and via capital markets). Therefore, bank regulators charged with macro-prudential oversight are concerned that in response to post-crisis regulatory pressure on banks, systemic risk may migrate to others areas of the financial system – e.g., to asset manager activities.

Fixed income funds (including mutual funds and ETFs) have been particularly highlighted by regulators as such a systemic risk concern. As lower bond inventories are held by banks and their broker-dealers, these funds have stepped in to fill the resulting financing gaps.

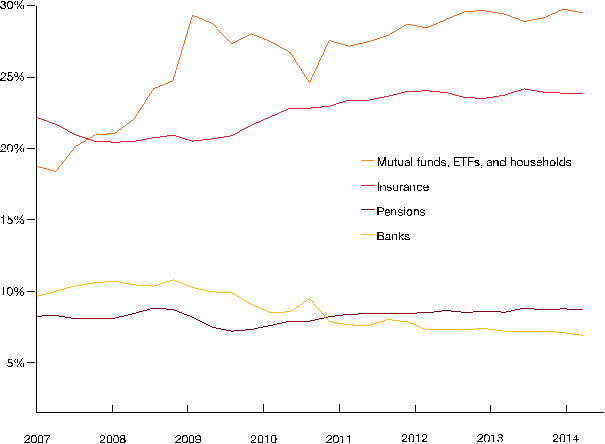

According to the IMF, this dynamic is evidenced in the US by the drop in banks’ bond inventories from a peak of over 10% of total US corporate and foreign bond holdings in 2008 to around 7% in 2014. Over the same period, mutual funds, ETFs, and households increased their share of bond holdings from about 20% to 30%. Please see the following graph:

| US Corporate and Foreign Bond Holdings (percent share of total holdings, by holder-type) |

|

| Sources: IMF[12] and Federal Reserve |

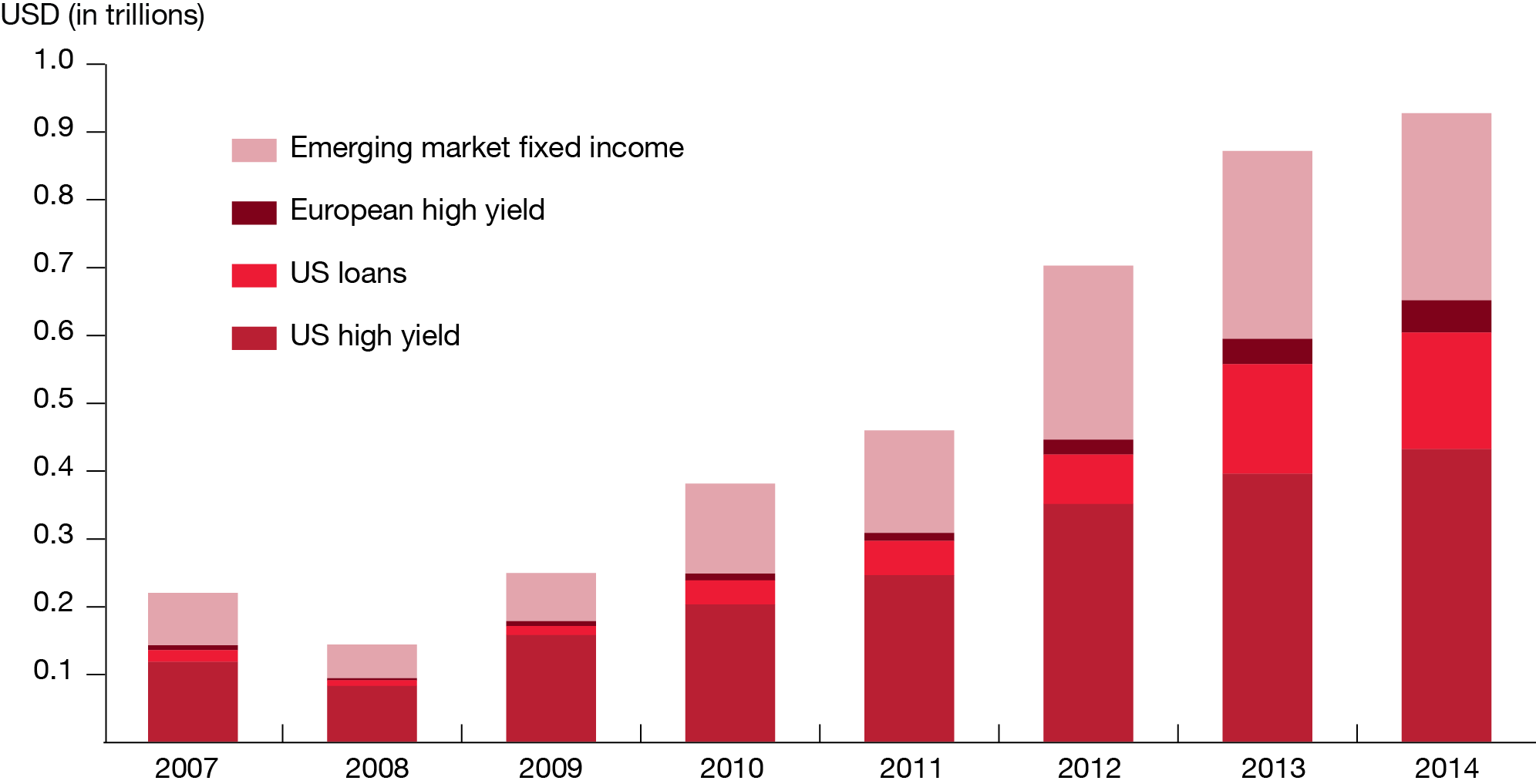

In addition, a large portion of these bond holdings by mutual funds and ETFs is made up of less liquid assets (e.g., emerging market fixed income). The holdings have increased at these funds from approximately $150 billion to nearly $1 trillion between 2008 and 2014:

| Less Liquid Assets at Mutual Funds and ETFs |

|

| Sources: IMF[13] and EPFR Global |

As a consequence, capital markets are increasingly reliant on liquidity provided by funds, rather than banks and their broker-dealers, which has raised the question of if these funds can meet short-term redemption requests during times of stress without introducing fire-sales.

ENDNOTES

[1] See PwC’s Regulatory brief, Asset managers: FSOC stands down, SEC stands up (November 2014).

[2] This measure was perhaps introduced in response to criticism levied on the FSB after it identified G-SIFI insurers, without having developed policy tools applicable to them to mitigate their systemic risk. See PwC’s Regulatory brief, Systemically important insurers: Global follows US lead (July 2013).

[3] See PwC’s Regulatory brief, Nonbank SIFIs: FSOC proposes initial designations – more names to follow (June 2013).

[4] Other challenges to FSOC’s designation authority may have also contributed to this change of policy approach, particularly MetLife’s on-going legal challenge to its August 2014 designation and Congressional calls for increased FSOC transparency.

[5] These concerns in part result from recent studies (e.g., by the IMF) showing that fixed income markets are becoming increasingly reliant on financing provided by fund vehicles.

[6] See note 1.

[7] Although the ’40 Act limits the amount of illiquid assets held by open-ended mutual funds to no more than 15% of their net assets, the Act’s definition of these assets is vague and based on asset liquidity under normal market conditions.

[8] To that end, the SEC’s Office of Compliance Inspections and Examinations is already scrutinizing certain fixed income funds via a national sweep.

[9] See PwC’s Regulatory brief, SEC sweep: Liquid alternative funds (June 2014).

[10] This approach has been further relaxed since 2005 by the SEC informally permitting funds (but only for cash-settled derivatives) to segregate only daily mark-to-market margins, instead of full notional amount of derivatives positions. This has allowed funds to segregate fewer assets and invest more in derivatives.

[11] AIFMD is an EU-wide regulation currently in place that aims to address industry risks by establishing capital and liquidity requirements on alternative fund managers, including stress testing. See PwC’s Regulatory brief, EU’s AIFMD: Impact on US Asset Managers (June 2013). The FSB is also likely to seek harmonization of its approach with AIFMD as part of its policy tools, and will likely similarly encourage the SEC to do so.

[12] International Monetary Fund, Global financial stability report: Risk taking, liquidity, and shadow banking – Curbing excess while promoting growth (October 2014).

[13] See note 12.

The preceding post is based on a memorandum prepared by PwC in May 2015, which is available here.

Sky Blog

Sky Blog